- myFICO® Forums

- Types of Credit

- Credit Cards

- This is how I monitor my CC's

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

This is how I monitor my CC's

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- « Previous

- Next »

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: This is how I monitor my CC's

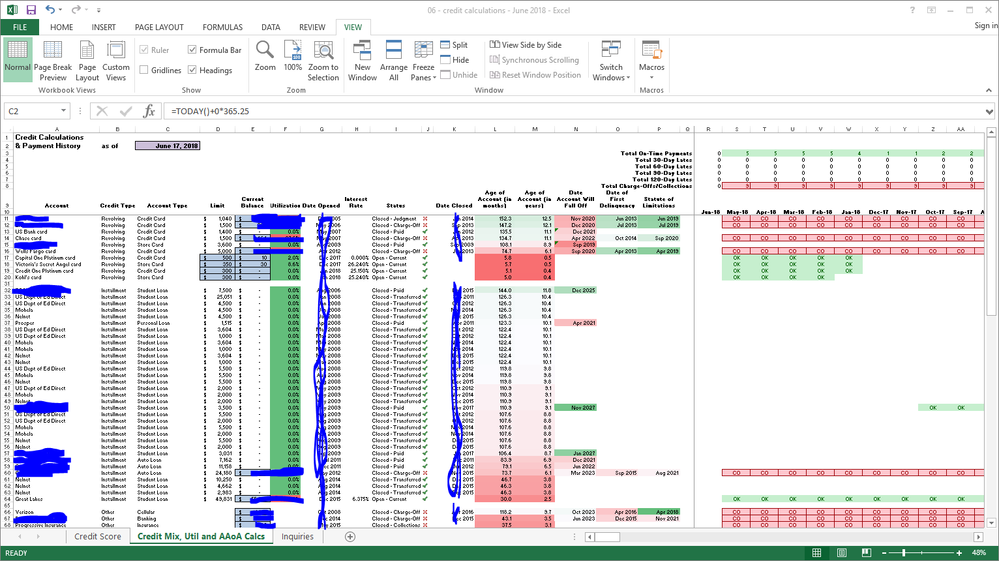

I constructed a spreadsheet that I use to manage my cards and rebuild, particularly since I have a looonnng report (50+ pages) and want to easily see when certain lates and derogatory accounts will fall off (and TBH I just like making spreadsheets, haha). I basically reconstructed my payment history and DOFD in Excel using past credit reports. (Thankfully, even though I put my head in the sand about my credit I had the presence of mind to pull some free reports even though at the time I had no idea how important it would be.) This spreadsheet only monitors stuff related to my credit report (utilization %, AAoA, payment history, default status, etc) - stuff like due dates I manage in my paper calendar. (Though when I get a new computer I will start using Banktivity for that so I can also monitor my actual budget and spending.)

Lots of formulas, drop-down menus, and conditional formatting went into the creation of this spreadsheet, LOL.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: This is how I monitor my CC's

I like the fact that those who mentioned their payment dates all gave dates 5, 7, or more days in advance of the due dates. Too many bad stories have appeared on this board because folk wait until the actual due date (or sometimes the statement closing date) to make their monthly payments, and then they have no time to react to unexpected payment difficulties.

Sock Drawer: PenFed Promise • NFCU cashRewards • Chase Sapphire Preferred • Chase Freedom Unlimited • United Explorer • UNFCU Azure

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: This is how I monitor my CC's

@beutiful5678 wrote:

@Anonymous wrote:

@jamesdwi wrote:is any of this data auto-populated from perhaps an on-line source? Quicken? or is it all entered manually?

The only two columns that are manually entered are age and balance every month; Rest is auto-calculated or entered only once because they are constants.

You should be able to auto-calculate age using the following Excel formula:

=(TODAY()-E2)/30Change the E2 reference for each line of code. (I'm assuming your Discover card starts on Row 2.)

Thanks for this; Just made changes my sheets ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: This is how I monitor my CC's

@UpperNwGuy wrote:I like the fact that those who mentioned their payment dates all gave dates 5, 7, or more days in advance of the due dates. Too many bad stories have appeared on this board because folk wait until the actual due date (or sometimes the statement closing date) to make their monthly payments, and then they have no time to react to unexpected payment difficulties.

haha, well its better to be early than sorry. ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: This is how I monitor my CC's

@beutiful5678 wrote:I constructed a spreadsheet that I use to manage my cards and rebuild, particularly since I have a looonnng report (50+ pages) and want to easily see when certain lates and derogatory accounts will fall off (and TBH I just like making spreadsheets, haha). I basically reconstructed my payment history and DOFD in Excel using past credit reports. (Thankfully, even though I put my head in the sand about my credit I had the presence of mind to pull some free reports even though at the time I had no idea how important it would be.) This spreadsheet only monitors stuff related to my credit report (utilization %, AAoA, payment history, default status, etc) - stuff like due dates I manage in my paper calendar. (Though when I get a new computer I will start using Banktivity for that so I can also monitor my actual budget and spending.)

Lots of formulas, drop-down menus, and conditional formatting went into the creation of this spreadsheet, LOL.

WOW. Impressive detailed micromanaging and thanks again for auto age formula. ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: This is how I monitor my CC's

I use Mint, which is backed by Intuit, who have been making accounting software forever. It is online (although they do have a phone app) and you setup your accounts in it and then it automatically pulls the data from each source and presents it to you. I can't recommend it enough. It is not just credit cards, I have my checking, savings, investment and assets (house/cars) in there.

It is free, but only because they have a few adds and they mine the hell out of your data. I'm OK with that setup, would rather have it this way then pay a monthly fee for the service.

You get a total view of your financial status, of which credit cards are a part. I'd recommend people to at least give it a try, it is pretty sweet software and really changed my financial outlook for the better.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: This is how I monitor my CC's

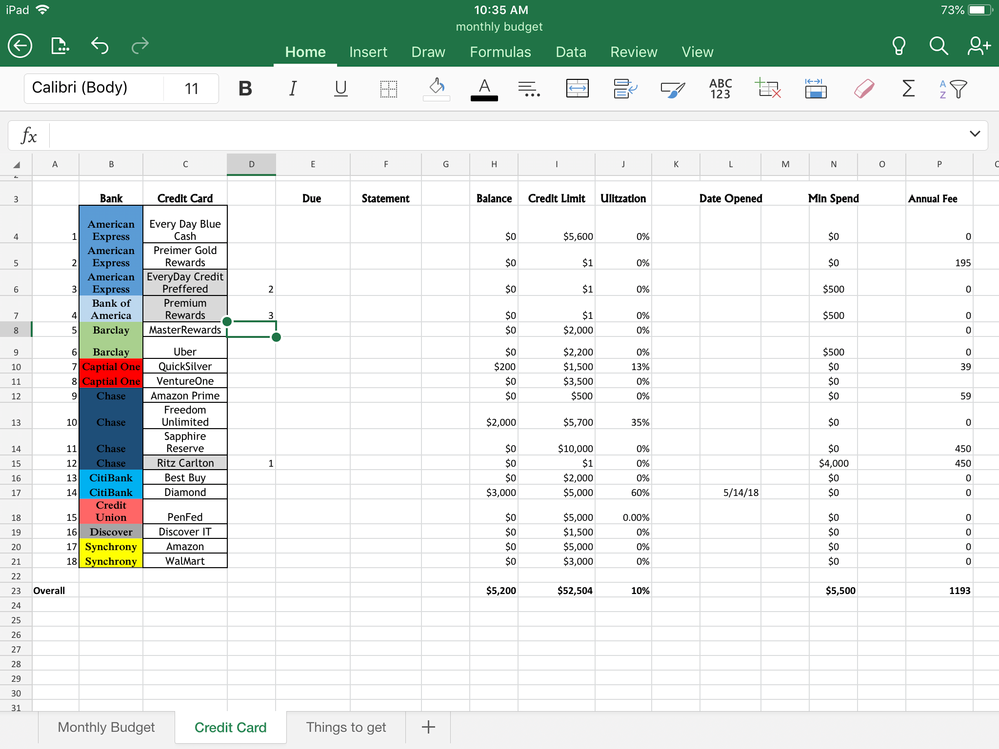

I have 15 card for now and I use two methods :

1. Mint which is very secured application for any platform (ios, Android ,etc)

2. A spreadsheet I created with the custom cells ( I haven’t updated the info)![]()

The 3 cards I have left to obtain Which has $1 limit and greyed out.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

e: This is how I monitor my CC's

I use a spreadsheet in Excel and it works just fine. ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: This is how I monitor my CC's

Preferred is misspelled in your spreadsheet.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: This is how I monitor my CC's

I have a growing number of total accounts (only 1 credit card).

I've tried using Mint and Prism, but DCU and MACU both provide the same Money Management feature and I tend to use DCU's. Doesn't have a "due date" feature like Prism does, but there are no ads (Mint!), emails (Mint!), convoluted interface (Mint!), or funky issues (Prism!) so it's really quick and easy to log in once a day at work to see all my accounts or even transaction history.

Starting Scores: No Scores (03/2018)

Starting Scores: No Scores (03/2018)Current Scores: 779 - 789 (08/2023)

Goal Scores: 780 across the board

Current Total Credit Limit: $109,900 (08/2023)

Take the myFICO Fitness Challenge