- myFICO® Forums

- Types of Credit

- Credit Cards

- Thoughts on Apple Card - Maybe?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Thoughts on Apple Card - Maybe?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Thoughts on Apple Card - Maybe?

In expanding my wallet a bit this year, I'm giving some thought to the Goldman Sachs Apple MasterCard. Credit Karma is putting it at the top of my recommended list along with high approval odds, but I figure we all know to take such suggestions with a BIG grain of salt...

Honestly, it just seems a bit too Apple and mobile-centric for my spending and lifestyle. Is it really worth the hype? I understand their rewards structure is based not only on where you shop, but also HOW you pay. (Which strikes me as odd.) I've never tried paying for anything with a cell phone before, I'm not spending hundreds or thousands of dollars per month or per year on Apple stuff, I'm not glued to my iPhone 24/7... Can I even get paper statements (if I wanted to)?

Seems as though targeting Capital One Venture (also suggested highly by Credit Karma) or something in the AmEx suite (paying them shortly in order to get back in) would be much more prudent for 2023.

Or am I totally off-base?

I Am Not My Credit Score - it's just a made-up number that we all have to live with.

NOW HIRING - senior credit analyst, account manager, or high-end specialist from American Express National Bank.

Travel Cards: Cashback Rewards Cards:

Still Active, Less Used: Banks and Credit Unions:

Former Accounts, Closed Cards, RIP:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Thoughts on Apple Card - Maybe?

Pretty much, if you don't think the Apple Card would make sense for you, it likely won't.

As to paper statements… sort of. The monthly statements are available to download in PDF format.

I used to think paying with my phone or watch was just a novelty. Until COVID struck and one shop decided to "sanitize" my card with alcohol and wiped off my signature and the mag stripe. Sigh. That pushed me to start using my phone for contactless payment and I've pretty much stuck with that since. The Apple Card does have uncapped 2% when using Apple Pay, so it covers a lot of small purchases, such as convenience stores, that aren't in higher reward categories and as a decent fallback when I hit a quarterly spend limit on another card.

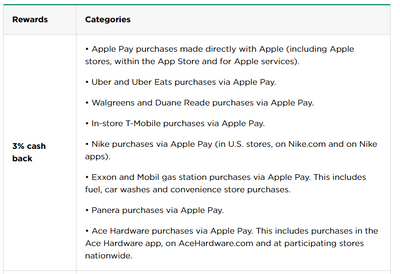

I upgraded my iPhone through one of T-Mobile's "on us" deals so didn't finance it through Apple or the AC. Even so, T-Mobile is one of the 3% categories and I just set up auto-pay using Apple Pay for my monthly service.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Thoughts on Apple Card - Maybe?

My answer is a firm no.

It had a lot of hype from beginning just because it has Apple logo and from Goldman. But the reward is very light.

I had this card because I heard this card won't have HP or would not report to CB or some other false comments. But that is not true. It still counts as a new card.

I've only used this card twice. Both time just to keep it active. I've spent more than $20,000 over the past holiday shopping at local Apple store. But I found I'd much better off not using Apple card with Apple purchases.

The more Apple products I buy, the less I like it with the way Apple does business. Anti competitive. Privacy invasion. And incompetent customer support.

I do not go with any hype, or the fancy colors of Apple card. I like $$ and the rewards.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Thoughts on Apple Card - Maybe?

@SKBirdmind wrote:In expanding my wallet a bit this year, I'm giving some thought to the Goldman Sachs Apple MasterCard. Credit Karma is putting it at the top of my recommended list along with high approval odds, but I figure we all know to take such suggestions with a BIG grain of salt...

Honestly, it just seems a bit too Apple and mobile-centric for my spending and lifestyle. Is it really worth the hype? I understand their rewards structure is based not only on where you shop, but also HOW you pay. (Which strikes me as odd.) I've never tried paying for anything with a cell phone before, I'm not spending hundreds or thousands of dollars per month or per year on Apple stuff, I'm not glued to my iPhone 24/7... Can I even get paper statements (if I wanted to)?

Seems as though targeting Capital One Venture (also suggested highly by Credit Karma) or something in the AmEx suite (paying them shortly in order to get back in) would be much more prudent for 2023.

Or am I totally off-base?

If the bolded statement goes against your ordinary methods for using a CC, spending habits or your current lifestyle, then the Apple Card will likely not be a good fit.

My advice, while Credit Karma is well-known for peddling CCs to all types of profiles, simply do some research outside of CK (and any other CMS platforms) to determine what may be more suitable CC-wise for your needs.

ETA - since you were recently approved for Costco Visa + Hawaiian Airlines MC, perhaps consider closing any rebuilding CCs such as First Progress + Merrick that have annual fees and eventually consider the same for Credit One.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Thoughts on Apple Card - Maybe?

The Apple Card was great when I started out. I use Apple Pay wherever possible even back when I paid for everything with my debit card so the 2% back with Apple Pay was excellent for a starter card. Since I now have so many other cards that can earn 3% to 5% in many categories, the Apple Card doesn't see as much use but is still good to have. The card isn't great if you don't intend to use Apple Pay so unless you plan to start using Apple Pay then I would pass.

Current FICO 8 | 9 (April 2024):

Credit Age:

Inquiries (6/12/24):

Banks & CUs:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Thoughts on Apple Card - Maybe?

My watch is for telling the time using an hour, minute, and second hand - plus the date via a small box with a number in it... Nothing else! ![]()

Sure hope that shop got in trouble for wiping out people's signatures and magnetic stripes, SeaProbe - thinking they were doing some sort of favor! I sign the back of mine with an ultra-fine Sharpie which seems to take the abuse much better. What really made me crazy during that era were drive-thru attendants awkwardly handing you a payment terminal, to fumble around with trying to swipe or use an EMV chip. I mouthed off at a guy for doing that once...

Apple DOES seem to be going downhill steadily, BronzeTrader - honestly, I lost most of my faith in them after they killed off iOS 6 about a decade ago. I think there's a lot to be said over privacy concerns relating to facial recognition, tracking personal details, and so on. Ethics sound pretty sketchy if they boast things like no credit approvals, then do an inquiry anyways! By "not using an Apple card for Apple purchases," do you mean to say that rewards (et al) were more beneficial elsewhere?

As for determining what's more suitable - Capital One has always taken very good care of me since I began rebuilding post-Ch 7. I just got my foot in the door with CitiBank also, as mentioned in other threads. Not certain what else, just yet...it would be cool to start 2023 out with a trifecta of cards that would have been unattainable for me at this time in 2020.

I Am Not My Credit Score - it's just a made-up number that we all have to live with.

NOW HIRING - senior credit analyst, account manager, or high-end specialist from American Express National Bank.

Travel Cards: Cashback Rewards Cards:

Still Active, Less Used: Banks and Credit Unions:

Former Accounts, Closed Cards, RIP:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Thoughts on Apple Card - Maybe?

Well, I'm a bit anti-Apple, but I will say that if you can transition yourself to using Digital Wallet more often then not you will be doing yourself a favor.

Not having a physical card you can have stolen, lost, or just forgotten somewhere is amazing (seeing as you can jump online or any other phone and disconnect anything you're truly concerned about if you feel compromised for whatever reason... including a lost or stolen phone, is much much much better than dealing with trying to get through to multiple CC issuers to freeze things). Having access to all your various methods of payment at any given time allows you to be able to min-max categories on the fly... or use that debit card for a withdrawal without having to haul it around useless 90% of the time. Your watch may be for telling time... for now... but going for a run and not having to carry your wallet "just in case" is a glorious thing.

I can see that you, OP, don't have a ton of cards like some of us, and so it might be no problem for you to carry 6ish cards in your wallet. But I feel that this the direction the payment world is taking, and it's better to ease yourself into the technology now (which is designed to make your life easier) while it's still in the training-wheels phase before we all get our wrist implants! 😁

Biz -

Biz -

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Thoughts on Apple Card - Maybe?

I get the US Bank Altitute Reserve. All mobile wallet is solid 3x or 4.5% if used for travel. How much does Apple card earns?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Thoughts on Apple Card - Maybe?

@BronzeTrader wrote:I get the US Bank Altitute Reserve. All mobile wallet is solid 3x or 4.5% if used for travel. How much does Apple card earns?

Yes, this is really the card for people heavily into mobile pay. Apple's 2% seemed a bit weak as there are a number of flat 2% everywhere cards. They have now added a little more value by increasing the 3% categories.

AR really comes into its own in places where mobile pay is much more universal than here, for me the UK. Vet bill for 3,300 GBP? Just pay it with the phone with no issue. Same with much smaller purchases, such as transit ticket, restaurants, hotels. Quickly justifies the effective $75 AF.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Thoughts on Apple Card - Maybe?

@longtimelurker wrote:

@BronzeTrader wrote:I get the US Bank Altitute Reserve. All mobile wallet is solid 3x or 4.5% if used for travel. How much does Apple card earns?

Yes, this is really the card for people heavily into mobile pay. Apple's 2% seemed a bit weak as there are a number of flat 2% everywhere cards. They have now added a little more value by increasing the 3% categories.

AR really comes into its own in places where mobile pay is much more universal than here, for me the UK. Vet bill for 3,300 GBP? Just pay it with the phone with no issue. Same with much smaller purchases, such as transit ticket, restaurants, hotels. Quickly justifies the effective $75 AF.

When I look at Apple rewards, I can't stop shaking my head.

As nation's one of the most suscessful companies and one of the most popular device makers, I would expect no less than 5% straight for any thing Apple related. From Apple stores, to Apple App store and all the Apple subscriptions. That is how Apple should promote its own brand.

Why in the world would Apple want to promote Uber, Walgreesn, Duane Reade, T-Mobile, Nike, Exxon, Penera and Ace Hardware? This is even worse than AmEx Platinum "benefits". When a lot of Apple loyalists would want to shop at Duane Reade and Ace Hardware?

It look like the typical Tim Cook style of "fine tune" those small things.

Anyhow. If this card can't reach 5% range, it will continue to linger. Not many are dumb enough to use this card to get 1% out of it.