- myFICO® Forums

- Types of Credit

- Credit Cards

- U.S. Bank Altitude Reserve Eligibility Question g

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

U.S. Bank Altitude Reserve Eligibility Question g

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: U.S. Bank Altitude Reserve Eligibility Question g

Forgive me, it has taken a while to type this as I have been running back and forth between the computer and be envolved with my 👪 family.

@Remedios wrote:

@GrandBaker wrote:Since you are outside of their footprint and an established relationship is a requirement for this card it leaves you with these options:

1. Auto loan (refi or new)

2. Home loan (refi or new)

3. Apply for one of their other credit cards, wait a couple months and then apply for the AR card.

All 3 require a wait time but IMO option 3 is the easiest.

How so? Add a card, risk possible denial for too many accounts in the past 12 months doesn't exactly sound like "safe option" to me.

Before anyone goes "profile specific", yup true, but does one want a card or does one wants to be a DP

... well, he said ,..."option 3 is the easiest."

I'd agree it is not necessarily a safe option due to #/12 inquiries.

Particularly i am looking for a travel card with and or another CC for additional benefits. As an example, a 3x card or better for everyday use. Hence my interest in U.S. Bank Altitude Reserve, AOD Visa Signature or others

At the same time, through out the year I tend to have tens of thousands of dollars in non-categorized spend to which I would like to capture an increased return on. A return greater than 2%. I am setting aside any BofA relationship/application or asset management for much further into the future, so I have ruled them out and off my list for 2021and possibly 2022.

Specifically, I think Cash+ will not add then benefit I have been looking for over the past year. I have been lightly contemplating this since May of last year (during the Anniston Tidal Wave) but this is while juggling a dirty profile and not only that, IMO 4 freshly minted apps/inquiries (May '19-through Aug '19) but also combined with older inquiries that were still on my reports, which have fallen off at this point.

So I guess I here I will share some of my story...

My oldest open revolver is 36 months old

My two youngest are about 21 months

Currently I have 6 CCs and I can not stress enough that I wish to have a thin-ish wallet compared to other Myficoers, not 15 plus 😒 CCs.

I really do not want to add more than 3 or 4 additional cards to keep as a credit revolving base for the remainder of my credit life.

So I am attempting to choose wisely.

2 possible travel/hotel cards

+ up to 2 additional cards.

Beyond that point if I continue to feel a need to spend a great deal of time hoarding over credit information then other cards would be opened and closed/PC/combined a few years later, for the SUBs or specific niches uses.

When I first began lurking/reading these threads and formulating my plans in 2017 the AR was at the top of my list, or whenever it was introduced, for its duality as both a travel card as well as a 3x catch-all through mobile wallet purchases.

I had envisioned desires and uses for the following as a base of credit cards:

1. Altitude Reserve - at least for 3x back on non-categorized purchases

2. CSR & or Ritz Carlton - hotels (its other benefits), currently have a family of 4

3. Chase Freedom - 5x categories & their UR value when transferred

4. Discover - 5x categories and utilization padding, maybe a 2nd one & later combine limits

5. Credit Union CC #1 - 2x cash back & $0 BT fee if needed

6. Credit Union CC #2 - low APR if carrying a balance $0 BT fee

7. Credit Union CC #3 - low APR, $0 BT fee and utilization padding

8. A PLOC - for credit mix and access to additional funds if so desired

In the order applied for, currently my lineup consist of:

PSECU Founders (10K) 2% cash back; 1st CC - I wanted to avoid toy limits so went with a CU

Chase Freedom (9.6K) 5x rotating categories

Navy CLOC (13K) serve as a PLOC and overdraft protection

Navy Flagship (30K) 3x travel & spare 2x return on spend

Discover (20.9K) 5% rotating categories, 0% purchases & BT when offered

PSECU Classic (20K) lower APR if carrying a balance and $0 BT fee @ a 2.99% rat

Navy Platinum MC (23.1K) low APR if carrying a balance and $0

Additional information is in the signature below.

The remainder of my inquiries will drop-off in the months as follows:

Mid-May; end of June; and 2 in the 2nd half of August.

Ideally I have hopes of only adding up to 2 additional personal CC this year then begin to apply for Business credit in the month of September.

Opinions about my thinking are welcome!

Recommendations on courses of action is preferred (whether or not it includes the Altitude Reserve).

I am sure there are many members here with abwider knowledge base and greater experience than I have.

Edit to add:

I will catch up on this thread in about an hour. We are taking the munchkins out for a walk.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: U.S. Bank Altitude Reserve Eligibility Question g

Since a previous relationship is a requirement for AR, then it seems you'll need to either open a desposit accoint of apply for a card to prep for eventuall AR app. As for the Auto Loan and choosing USB, usually people go with a specific bank because they bank their or it offerd teh better rate. So if you are interested in buying a new car or refi I guess you could take that route but it's amost the same as just apping for one of their cards.

Either approach seems to have a common theme which is a wait time to acquire it. If you really want the AR it appears as if some work/patience on your part is necessary, apping a card with them and then getting INQ down to an acceptable level with USB before going for AR.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: U.S. Bank Altitude Reserve Eligibility Question g

@Remedios wrote:

@GrandBaker wrote:

@Remedios wrote:

@GrandBaker wrote:Since you are outside of their footprint and an established relationship is a requirement for this card it leaves you with these options:

1. Auto loan (refi or new)

2. Home loan (refi or new)

3. Apply for one of their other credit cards, wait a couple months and then apply for the AR card.

All 3 require a wait time but IMO option 3 is the easiest.

How so? Add a card, risk possible denial for too many accounts in the past 12 months doesn't exactly sound like "safe option" to me.

Before anyone goes "profile specific", yup true, but does one want a card or does one wants to be a DP

I said it was the easiest option

as I didn't want to assume the OP is in the market for a refi on their car/house and double assuming they have one (hello, downtown warriors!)

Even though their question was specifically about auto loan?

Yes, I did specifically mention an auto loan because I know I will apply for one this year.

A co-work with all model Fico scores above 760 informed me that U.S. Bank beat out all other institutions for him, including CUs and he had no prior relationship with U.S. Bank... (something I noticed, not my co-worker, he was not even aware of the fact that) our W2 paychecks are drawn on this particular bank.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: U.S. Bank Altitude Reserve Eligibility Question g

@Anonymous wrote:Since a previous relationship is a requirement for AR, then it seems you'll need to either open a desposit accoint of apply for a card to prep for eventuall AR app. As for the Auto Loan and choosing USB, usually people go with a specific bank because they bank their or it offerd teh better rate. So if you are interested in buying a new car or refi I guess you could take that route but it's amost the same as just apping for one of their cards.

Either approach seems to have a common theme which is a wait time to acquire it. If you really want the AR it appears as if some work/patience on your part is necessary, apping a card with them and then getting INQ down to an acceptable level with USB before going for AR.

You are right

A decision, some work and patience are required!

Thanks! @Anonymous

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: U.S. Bank Altitude Reserve Eligibility Question g

I made eligibility through the basic checking account. However have heard some have opened a self-directed brokerage account. Not sure if this actually works but might be worth looking into.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: U.S. Bank Altitude Reserve Eligibility Question g

@Credit4Growth wrote:Forgive me, it has taken a while to type this as I have been running back and forth between the computer and be envolved with my 👪 family.

@Remedios wrote:

@GrandBaker wrote:Since you are outside of their footprint and an established relationship is a requirement for this card it leaves you with these options:

1. Auto loan (refi or new)

2. Home loan (refi or new)

3. Apply for one of their other credit cards, wait a couple months and then apply for the AR card.

All 3 require a wait time but IMO option 3 is the easiest.

How so? Add a card, risk possible denial for too many accounts in the past 12 months doesn't exactly sound like "safe option" to me.

Before anyone goes "profile specific", yup true, but does one want a card or does one wants to be a DP

... well, he said ,..."option 3 is the easiest."

I'd agree it is not necessarily a safe option due to #/12 inquiries.

Particularly i am looking for a travel card with and or another CC for additional benefits. As an example, a 3x card or better for everyday use. Hence my interest in U.S. Bank Altitude Reserve, AOD Visa Signature or others

At the same time, through out the year I tend to have tens of thousands of dollars in non-categorized spend to which I would like to capture an increased return on. A return greater than 2%. I am setting aside any BofA relationship/application or asset management for much further into the future, so I have ruled them out and off my list for 2021and possibly 2022.

Specifically, I think Cash+ will not add then benefit I have been looking for over the past year. I have been lightly contemplating this since May of last year (during the Anniston Tidal Wave) but this is while juggling a dirty profile and not only that, IMO 4 freshly minted apps/inquiries (May '19-through Aug '19) but also combined with older inquiries that were still on my reports, which have fallen off at this point.

So I guess I here I will share some of my story...

My oldest open revolver is 36 months old

My two youngest are about 21 months

Currently I have 6 CCs and I can not stress enough that I wish to have a thin-ish wallet compared to other Myficoers, not 15 plus 😒 CCs.

I really do not want to add more than 3 or 4 additional cards to keep as a credit revolving base for the remainder of my credit life.

So I am attempting to choose wisely.

2 possible travel/hotel cards

+ up to 2 additional cards.

Beyond that point if I continue to feel a need to spend a great deal of time hoarding over credit information then other cards would be opened and closed/PC/combined a few years later, for the SUBs or specific niches uses.

When I first began lurking/reading these threads and formulating my plans in 2017 the AR was at the top of my list, or whenever it was introduced, for its duality as both a travel card as well as a 3x catch-all through mobile wallet purchases.

I had envisioned desires and uses for the following as a base of credit cards:

1. Altitude Reserve - at least for 3x back on non-categorized purchases

2. CSR & or Ritz Carlton - hotels (its other benefits), currently have a family of 4

3. Chase Freedom - 5x categories & their UR value when transferred

4. Discover - 5x categories and utilization padding, maybe a 2nd one & later combine limits

5. Credit Union CC #1 - 2x cash back & $0 BT fee if needed

6. Credit Union CC #2 - low APR if carrying a balance $0 BT fee

7. Credit Union CC #3 - low APR, $0 BT fee and utilization padding

8. A PLOC - for credit mix and access to additional funds if so desired

In the order applied for, currently my lineup consist of:

PSECU Founders (10K) 2% cash back; 1st CC - I wanted to avoid toy limits so went with a CU

Chase Freedom (9.6K) 5x rotating categories

Navy CLOC (13K) serve as a PLOC and overdraft protection

Navy Flagship (30K) 3x travel & spare 2x return on spend

Discover (20.9K) 5% rotating categories, 0% purchases & BT when offered

PSECU Classic (20K) lower APR if carrying a balance and $0 BT fee @ a 2.99% rat

Navy Platinum MC (23.1K) low APR if carrying a balance and $0

Additional information is in the signature below.

The remainder of my inquiries will drop-off in the months as follows:

Mid-May; end of June; and 2 in the 2nd half of August.

Ideally I have hopes of only adding up to 2 additional personal CC this year then begin to apply for Business credit in the month of September.

Opinions about my thinking are welcome!

Recommendations on courses of action is preferred (whether or not it includes the Altitude Reserve).

I am sure there are many members here with abwider knowledge base and greater experience than I have.

Edit to add:

I will catch up on this thread in about an hour. We are taking the munchkins out for a walk.

One really important clarification is that 3x is only if you can use mobile wallet, limited travel, or dining through 6/30. If it's a spend that can't be paid for with mobile wallet then it is only 1x.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: U.S. Bank Altitude Reserve Eligibility Question g

When using mobile wallet, is PayPal or other services consider as mobile wallet - at least from time to time?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: U.S. Bank Altitude Reserve Eligibility Question g

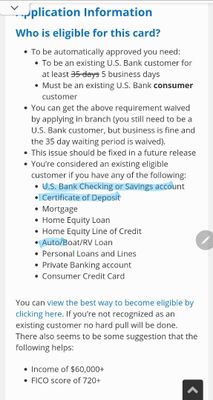

@summerterrace wrote:I made eligibility through the basic checking account. However have heard some have opened a self-directed brokerage account. Not sure if this actually works but might be worth looking into.

Thanks!

Here is a list that I recently read...

I will come with something from this

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: U.S. Bank Altitude Reserve Eligibility Question g

@Credit4Growth wrote:When using mobile wallet, is PayPal or other services consider as mobile wallet - at least from time to time?

Not for me so far, I can only use mobile wallet for stores that show Apple Pay as an option online. Or at stores that allow. Stores that don't allow mobile wallet Kroger, Lowe's, Home Depot, WalMart, Sams Club, Hobby Lobby..

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: U.S. Bank Altitude Reserve Eligibility Question g

One can use Samsung pay in all those stores as long as phone isn't S21.