- myFICO® Forums

- Types of Credit

- Credit Cards

- Re: CCs that still have Cell Phone Protection?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

UPDATE: CCs that still have Cell Phone Protection?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: CCs that still have Cell Phone Protection?

@wasCB14 wrote:

@lhcole77 wrote:FYI-

World Elite Mastercards come with cellphone protection:

Coverage for a Stolen or damaged Eligible Cellular Wireless

Telephone is subject to the terms, conditions, exclusions, and

limits of liability of this benefit. The maximum liability is $600

per claim for World Mastercard, and $1,000 per Covered

Card per 12 month period. Each claim is subject to a $50

deductible. Coverage is limited to two (2) claims per Covered

Card per 12 month period.Some do, not all. To check a card:

https://us.mycardbenefits.com/Home/AboutCellPhoneProtection?cd=en&prog=CPP&CardType=MC

Right, I would guess that "most" do not!

On cards that do: The REI WEMC (from US Bank) offers $800 with a $50 deductible, up to $1000 in 12 months.

Note that asking about cell phone protection is a little like asking "which credit cards offer rewards?" in that there is a lot of variation. Some cards offer $250 protection, which, while better than nothing, is obviously not as good as $800. And then you need to consider the usual rewards of the cards, if you are getting 1% back (as with REI) there better be a lot of protection. Having $250 coverage may not be worth giving up 5X on your cellphone bill for a card without protection

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: CCs that still have Cell Phone Protection?

@longtimelurker wrote:

@wasCB14 wrote:

@lhcole77 wrote:FYI-

World Elite Mastercards come with cellphone protection:

Coverage for a Stolen or damaged Eligible Cellular Wireless

Telephone is subject to the terms, conditions, exclusions, and

limits of liability of this benefit. The maximum liability is $600

per claim for World Mastercard, and $1,000 per Covered

Card per 12 month period. Each claim is subject to a $50

deductible. Coverage is limited to two (2) claims per Covered

Card per 12 month period.Some do, not all. To check a card:

https://us.mycardbenefits.com/Home/AboutCellPhoneProtection?cd=en&prog=CPP&CardType=MC

Right, I would guess that "most" do not!

On cards that do: The REI WEMC (from US Bank) offers $800 with a $50 deductible, up to $1000 in 12 months.

Note that asking about cell phone protection is a little like asking "which credit cards offer rewards?" in that there is a lot of variation. Some cards offer $250 protection, which, while better than nothing, is obviously not as good as $800. And then you need to consider the usual rewards of the cards, if you are getting 1% back (as with REI) there better be a lot of protection. Having $250 coverage may not be worth giving up 5X on your cellphone bill for a card without protection

When I checked about a year ago, Aviator Red was eligible. Savor and Double Cash were not.

For the REI card: https://www.reimastercard.com/credit/cellProtection.do?redirect=phone&lang=en&exp=

Here are some examples of what is not covered:

- Cellphone accessories other than the standard battery and/or standard antenna provided by the manufacturer.

- Cellphones purchased for resale or for professional or commercial use.

- Eligible cellphones that are lost or "Mysteriously Disappear".

- Cellphones under the care and control of a common carrier, including, but not limited to, the U.S. Postal Service, airplanes or delivery service.

- Cellphones stolen from baggage unless hand-carried and under the Eligible Person's supervision or under the supervision of the Eligible Person's traveling companion who is previously known to the Eligible Person.

- Cellphones stolen from a construction site.

- Cellphones that are not received as a part of a recurring monthly plan from a cellular provider.

- Cosmetic damage to the Eligible Cellphone or damage that does not impact the Eligible Cellphone's ability to make or receive phone calls.

- Damage or theft resulting from abuse, intentional acts, fraud, hostilities of any kind (including, but not limited to, war, invasion, rebellion or insurrection), confiscation by the authorities, risks of contraband, illegal activities, normal wear and tear, flood, earthquake, radioactive contamination, or damage from inherent product defects or vermin.

- Damage or theft resulting from mis-delivery or voluntary parting from the Eligible Cellphone.

- Replacement Cellphone(s) purchased from other than a cellular service provider's retail or internet store; or Taxes, delivery or transportation charges or any fees associated with the service provided.

Emphasis mine. Those are major exclusions.

Business use: Amex Bus. Plat., BBP, Lowes Amex AU, CFU AU

Perks: Delta Plat., United Explorer, IHG49, Hyatt, "Old SPG"

Mostly SD: Freedom Flex, Freedom, Arrival

Upgrade/Downgrade games: ED, BCE

SUB chasing: AA Platinum Select

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: CCs that still have Cell Phone Protection?

Oooh, good feedback peeps. My WEMC has the coverage and I assumed all WEMCs came with it. Thanks for that clarification.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: CCs that still have Cell Phone Protection?

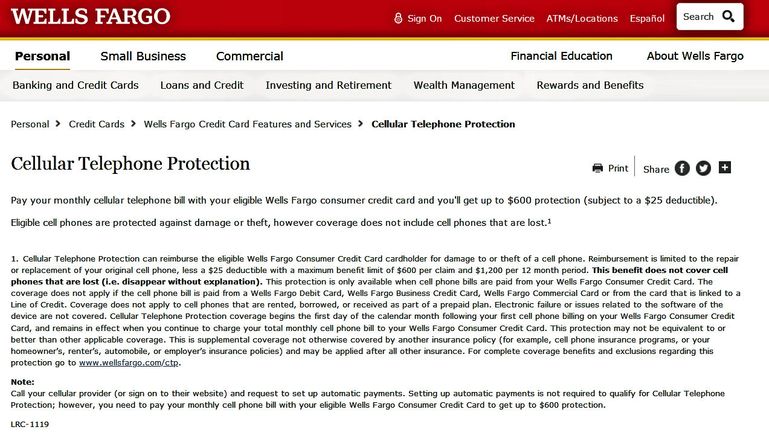

As mentioned upthread, Wells Fargo still has Cellphone protection on multiple cards. It's available on my new Cash Wise card I just opened but also others. $600 per claim less $25 deductible, limit $1200 per year. Recurring monthly charges have to be billed to your card. Doesn't cover unexplained "loss." ![]() The Cash Wise would give you the $600 protection with somewhat unremarkable 1.5% cash back rewards, so that would be the trade-off there.

The Cash Wise would give you the $600 protection with somewhat unremarkable 1.5% cash back rewards, so that would be the trade-off there.

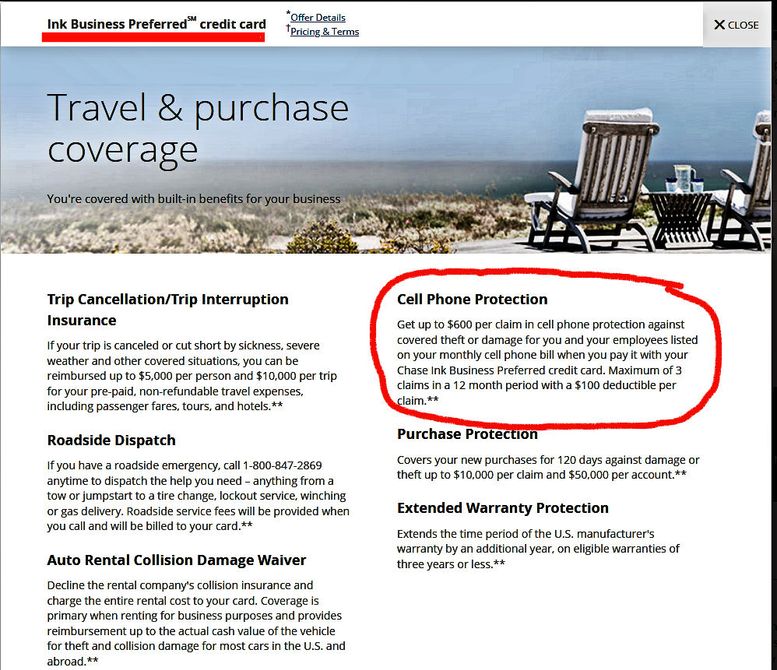

The Chase INK Business Preferred card ($95 AF) covers cell phones. $600 per claim less $100 deductible, limit 3 claims per year. Recurring monthly charges have to be billed to your card. That's not a bad deal if you're also able to take advantage of the other card benefits to justify the $95 AF.

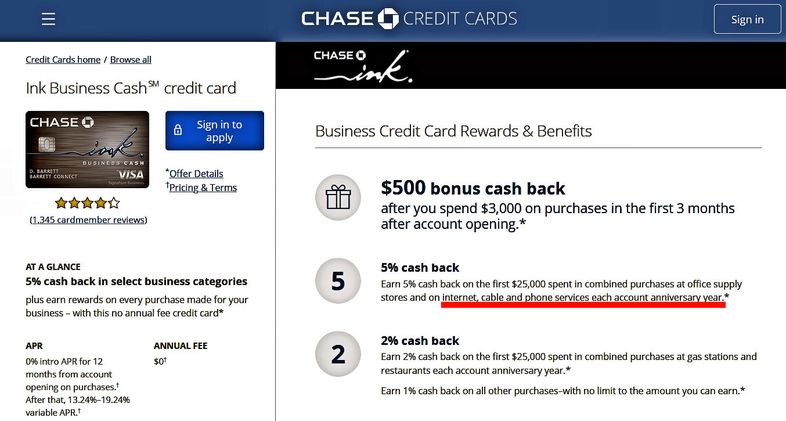

I had the Chase INK Business Preferred but downgraded it to the Chase INK Business Cash. It has no AF and has a high rewards payout on my (home-business) cable tv- internet - cellphone plus on office supplies. (5% cash back on up to $25K per year) After I roll the UR points over to my CSR, I get 7.5% in UR travel rewards redemption on my cellphone bill. One of the best deals going and adds a lot of value to my CSR, but it doesn't include cell phone protection.

Business Cards

Length of Credit > 40 years; Total Credit Limits >$898K

Top Lender TCL - Chase 156.4 - BofA 99.7 - AMEX 95.0 - CITI 94.5 - NFCU 80.0

AoOA > 30 years (Jun 1993); AoYA (Feb 2024)

* Hover cursor over cards to see name & CL, or press & hold on mobile app.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: CCs that still have Cell Phone Protection?

@lhcole77 wrote:Oooh, good feedback peeps. My WEMC has the coverage and I assumed all WEMCs came with it. Thanks for that clarification.

Why would you assume that? Oh, perhaps because the WEMC page says:

Enjoy the exciting new benefits that come with every World Elite Mastercard

in large font!

And only in much smaller font:

Please note: Benefits referenced on this site may not always be available on your card product. Selection of benefits on your Mastercard card may vary by card issuer. Please refer to your issuing financial institution for more details. Submission of a claim does not guarantee coverage.

Which suggests an unusual meaning of "every" in "every World Elite Mastercard"!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: CCs that still have Cell Phone Protection?

Looking at the Wells Fargo benefit...

Covered:

Stolen phones

- if you file a police report

- and it is secondary to any homeowner's/renter's or similar policy

Not covered:

"Cell phones purchased for resale, professional, or commercial use" (so little to no business use)

Lost phones

"Electronic issues, such as inability to charge, mechanical or battery failure, where there is no evidence of physical damage"

"Cosmetic damage to the cell phone or damage that does not impact the cell phone’s capabilities and functionalities" (vague as to which capabilities/functionalities are covered. Phone calls? GPS? Camera lens?)

Business use: Amex Bus. Plat., BBP, Lowes Amex AU, CFU AU

Perks: Delta Plat., United Explorer, IHG49, Hyatt, "Old SPG"

Mostly SD: Freedom Flex, Freedom, Arrival

Upgrade/Downgrade games: ED, BCE

SUB chasing: AA Platinum Select

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: CCs that still have Cell Phone Protection?

I am using Huntington Voice now after Citi killed all their coverage.

My bill is so small ($28 for two phones 2gb shared a month) with Spectrum Mobile it doesn't matter much that I am getting 1%, I just want the phone protection since I bought unlocked pixel phones.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: CCs that still have Cell Phone Protection?

@longtimelurker wrote:

@lhcole77 wrote:Oooh, good feedback peeps. My WEMC has the coverage and I assumed all WEMCs came with it. Thanks for that clarification.

Why would you assume that? Oh, perhaps because the WEMC page says:

Enjoy the exciting new benefits that come with every World Elite Mastercard

in large font!

And only in much smaller font:

Please note: Benefits referenced on this site may not always be available on your card product. Selection of benefits on your Mastercard card may vary by card issuer. Please refer to your issuing financial institution for more details. Submission of a claim does not guarantee coverage.

Which suggests an unusual meaning of "every" in "every World Elite Mastercard"!

I am going to start using their theory of the word "every" in my daily life.

When I miss a deadline at work, I will tell my boss "I got everything done on time..." ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: CCs that still have Cell Phone Protection?

I did some heavy research into this very topic a few months ago. The caveat about having a CC with phone protection, is that you will rarely find anything that also includes high CB levels. you pretty much have to choose if the CB or phone protection is more important. For me, it was the phone protection hands down.

After my research, the best i found was NFCU Cash Rewards (MC version). $600 per claim/$1000 yr max. So if you have to claim twice in one year the second will only cover $400. However, you get 1.5% CB with the card so it reduces your phone bill while giving you the coverage.

I personally haven't been able to find anything above 1.5% CB along with solid protection coverage. I currently use Uber (since they nerfed it and I have no other use for the card, this keeps the card active and builds up Uber points that I will probably never use) I just couldn't justify applying for NFCU for that nominal amount of CB. If I had already been an NFCU member and had the card, I obviously would be using that over Uber.

Sock Drawered

On Deck: No Plans Currently

On Deck: No Plans Currently

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: CCs that still have Cell Phone Protection?

@Taurus22 wrote:I did some heavy research into this very topic a few months ago. The caveat about having a CC with phone protection, is that you will rarely find anything that also includes high CB levels. you pretty much have to choose if the CB or phone protection is more important. For me, it was the phone protection hands down.

After my research, the best i found was NFCU Cash Rewards (MC version). $600 per claim/$1000 yr max. So if you have to claim twice in one year the second will only cover $400. However, you get 1.5% CB with the card so it reduces your phone bill while giving you the coverage.

I personally haven't been able to find anything above 1.5% CB along with solid protection coverage. I currently use Uber (since they nerfed it and I have no other use for the card, this keeps the card active and builds up Uber points that I will probably never use) I just couldn't justify applying for NFCU for that nominal amount of CB. If I had already been an NFCU member and had the card, I obviously would be using that over Uber.

As a slight improvement, I use Citizen's Bank which has the standard $600 coverage, but gives 1.8% CB (and it had a promotional 5% CB that has expired)