- myFICO® Forums

- Types of Credit

- Credit Cards

- Re: US Bank Altitude News: Added Category for AR &...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

US Bank Altitude News: Added Category for AR & Two New Altitude-Branded Cards Coming Soon

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: US Bank Altitude News: Added Category for AR & Two New Altitude-Branded Cards Coming Soon

@Shadowfactor wrote:I pushed it a little too hard man!

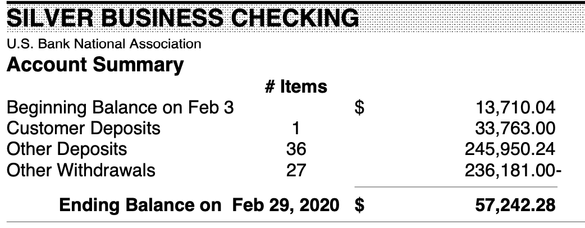

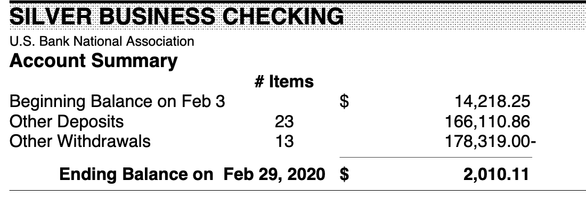

Was spending around 60-120K a month on 3X Mobile wallet. mainly BBY for Business and Microcenter. Coupled with the high bank deposits I think they finally got mad.

Thats just in USB. I use several other banks too.

Will miss the bittersweet amount of points I earned each month from that card.

And umm yes thats all from that pesky topic I'm not allowed to bring up here.

I can just about see where that might have caught their attention!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: US Bank Altitude News: Added Category for AR & Two New Altitude-Branded Cards Coming Soon

@longtimelurker wrote:

@Shadowfactor wrote:I pushed it a little too hard man!

Was spending aroundj 60-120K a month on 3X Mobile wallet. mainly BBY for Business and Microcenter. Coupled with the high bank deposits I think they finally got mad.

Thats just in USB. I use several other banks too.

Will miss the bittersweet amount of points I earned each month from that card.

And umm yes thats all from that pesky topic I'm not allowed to bring up here.

I can just about see where that might have caught their attention!

Heh, I was just looking at the numbers thinking: add them together and you are at the nominal value of my LA condo.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: US Bank Altitude News: Added Category for AR & Two New Altitude-Branded Cards Coming Soon

Well this is really not cool! What gives USB? I'd cancel.

BUSINESS; Amex | Citi

F8 Current F8s ~750 Best Ever F8s ~775

TOTAL PERSONAL CL > $350k and TCL > $365k

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: US Bank Altitude News: Added Category for AR & Two New Altitude-Branded Cards Coming Soon

I was planning on applying for the AR tomorrow... Mostly for the 4.5x redemption on mobile purchases. Might just get the cash+ move on.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: US Bank Altitude News: Added Category for AR & Two New Altitude-Branded Cards Coming Soon

So according to DOC, its really looking like RTR and Portal redemptions will be dropped down to 1c a point. Leaving it at 1.5c seems too good to be true. Im hoping the points are tiered depending on the card you have like AR=1.5c, AC/AG=1c. Otherwise the point earnings seem way to generous on the lower AF cards.

This below is pasted directly from DOC.

Altitude Go – No Annual Fee

- Card has no annual fee

- Card earns the following rates:

- 4x on Dining and Takeout

- 2x on Grocery, Gas Stations, and Streaming Services

- (?) I assume 1x everywhere else

- “$15 Free month of streaming for annual streaming services”. I interpret this to mean that it has one $15 annual streaming services credit, but (likely) that you need to use the $15 in one shot – that’s my interpretation.

0% intro APR for 12 months on purchases and balances transfers

Altitude Connect – $95 Annual Fee

- Card has $95 annual fee, fee is waived the first year

- Card earns the following rates:

- 5x on prepaid hotel and car rentals when booked with the Altitude Rewards Center

- 4x on Travel and at Gas Stations

- 2x on Dining, Takeout, Groceries, and Streaming Services

- (?) I assume 1x everywhere else

- “$30 Free month of streaming for annual streaming services”. I interpret this to mean that it has one $30 annual streaming services credit, but (likely) that you need to use the $30 in one shot – that’s my interpretation.

If I had to guess, AR annual fee will be raised and travel will at the minimum be bumped up to atleast 4x. Otherwise, the Altitude Connect card looks like the better travel card as it is right now.

I see AR possibly ending up with:

5x Prepaid hotel and rental

4x Travel

3x Mobile Wallet

1x Everything else

Ill have to wait to see the final changes to AR before I make my decision on whether im going to renew or perhaps downgrade to one of these new cards. Hopefully, US Bank at least bumps mobile wallet to 4x to give the AR the edge over the other 2 in earning potential but who knows.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: US Bank Altitude News: Added Category for AR & Two New Altitude-Branded Cards Coming Soon

@Anonymous wrote:So according to DOC, its really looking like RTR and Portal redemptions will be dropped down to 1c a point. Leaving it at 1.5c seems too good to be true. Im hoping the points are tiered depending on the card you have like AR=1.5c, AC/AG=1c. Otherwise the point earnings seem way to generous on the lower AF cards.

This below is pasted directly from DOC.

Altitude Go – No Annual Fee

- Card has no annual fee

- Card earns the following rates:

- 4x on Dining and Takeout

- 2x on Grocery, Gas Stations, and Streaming Services

- (?) I assume 1x everywhere else

- “$15 Free month of streaming for annual streaming services”. I interpret this to mean that it has one $15 annual streaming services credit, but (likely) that you need to use the $15 in one shot – that’s my interpretation.

0% intro APR for 12 months on purchases and balances transfers

Altitude Connect – $95 Annual Fee

- Card has $95 annual fee, fee is waived the first year

- Card earns the following rates:

- 5x on prepaid hotel and car rentals when booked with the Altitude Rewards Center

- 4x on Travel and at Gas Stations

- 2x on Dining, Takeout, Groceries, and Streaming Services

- (?) I assume 1x everywhere else

- “$30 Free month of streaming for annual streaming services”. I interpret this to mean that it has one $30 annual streaming services credit, but (likely) that you need to use the $30 in one shot – that’s my interpretation.

If I had to guess, AR annual fee will be raised and travel will at the minimum be bumped up to atleast 4x. Otherwise, the Altitude Connect card looks like the better travel card as it is right now.

I see AR possibly ending up with:

5x Prepaid hotel and rental

4x Travel

3x Mobile Wallet

1x Everything else

Ill have to wait to see the final changes to AR before I make my decision on whether im going to renew or perhaps downgrade to one of these new cards. Hopefully, US Bank at least bumps mobile wallet to 4x to give the AR the edge over the other 2 in earning potential but who knows.

4x mobile wallet sounds a little too generous, as in some areas it applies to practically every purchase. I guess if they reduce even portal redemption to 1x it might be OK, but 4% is still a lot.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: US Bank Altitude News: Added Category for AR & Two New Altitude-Branded Cards Coming Soon

Honestly, they should have did this along time ago when the Altitude first launched, idk why they're doing it backwards. If they allow to PC to the no AF then I would get it, other than that I don't see too much of a use when I could get restaurant and groceries at 3% but then it's good to see they have a new lineup since the AR launched. Hopefully, it will be their flagship and in-house going forward.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: US Bank Altitude News: Added Category for AR & Two New Altitude-Branded Cards Coming Soon

They must be lowering the ultimate value of the points because the $95 AF card looks just as good or even better than the current Reserve product with a much higher AF, if points are worth 1.5c. So I'd think they are bumping up the earn rates, but lowering the redemption rates, since most consumers will be enticed by the earn and not notice the redemption rate being lowered.

At 1cpp, the rates are solid, but just really another option among many at this point.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: US Bank Altitude News: Added Category for AR & Two New Altitude-Branded Cards Coming Soon

@longtimelurker wrote:

@Anonymous wrote:So according to DOC, its really looking like RTR and Portal redemptions will be dropped down to 1c a point. Leaving it at 1.5c seems too good to be true. Im hoping the points are tiered depending on the card you have like AR=1.5c, AC/AG=1c. Otherwise the point earnings seem way to generous on the lower AF cards.

This below is pasted directly from DOC.

Altitude Go – No Annual Fee

- Card has no annual fee

- Card earns the following rates:

- 4x on Dining and Takeout

- 2x on Grocery, Gas Stations, and Streaming Services

- (?) I assume 1x everywhere else

- “$15 Free month of streaming for annual streaming services”. I interpret this to mean that it has one $15 annual streaming services credit, but (likely) that you need to use the $15 in one shot – that’s my interpretation.

0% intro APR for 12 months on purchases and balances transfers

Altitude Connect – $95 Annual Fee

- Card has $95 annual fee, fee is waived the first year

- Card earns the following rates:

- 5x on prepaid hotel and car rentals when booked with the Altitude Rewards Center

- 4x on Travel and at Gas Stations

- 2x on Dining, Takeout, Groceries, and Streaming Services

- (?) I assume 1x everywhere else

- “$30 Free month of streaming for annual streaming services”. I interpret this to mean that it has one $30 annual streaming services credit, but (likely) that you need to use the $30 in one shot – that’s my interpretation.

If I had to guess, AR annual fee will be raised and travel will at the minimum be bumped up to atleast 4x. Otherwise, the Altitude Connect card looks like the better travel card as it is right now.

I see AR possibly ending up with:

5x Prepaid hotel and rental

4x Travel

3x Mobile Wallet

1x Everything else

Ill have to wait to see the final changes to AR before I make my decision on whether im going to renew or perhaps downgrade to one of these new cards. Hopefully, US Bank at least bumps mobile wallet to 4x to give the AR the edge over the other 2 in earning potential but who knows.

4x mobile wallet sounds a little too generous, as in some areas it applies to practically every purchase. I guess if they reduce even portal redemption to 1x it might be OK, but 4% is still a lot.

Well If the point value is dropped to 1c a point as I expect, it would be 4% compared to the 4.5% back u currently get back with it. It seems like a fair trade off to me. Anyways I doubt it happens without an increased annual fee.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: US Bank Altitude News: Added Category for AR & Two New Altitude-Branded Cards Coming Soon

I'm just hoping they mimic Chase's program somewhat and keep redemptions for AR at 1.5x while lowering the value for the other 2 Altitude cards. I also hope that if USB plans to make significant changes to the value and benefits of AR, they also give some type of notice so people can decide what to do with their points at current value.

Maybe I'm just hoping for too much...