- myFICO® Forums

- Types of Credit

- Credit Cards

- Re: US Bank Altitude Reserve: inqs

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

US Bank Altitude Reserve: inqs

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: US Bank Altitude Reserve: inqs

In all seriousness though, USB has been a great bank and I’ve been very happy with them.

They approved me with a co-signer for 4K on a FlexPerks when my credit was in the dumps. I think around 600 FICO. Only had the USB secured card for 3 months too.

It’s been a pleasant relationship ever since.

AR is a fantastic card, but it’s not a good card as a joint account. The travel credit and WiFi passes far exceed the AF so anything after that is pure gravy. Especially for international travel in developed countries that accept mobile pay.

Total Revolving Limits $254,800

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: US Bank Altitude Reserve: inqs

@imaximous wrote:

@longtimelurker wrote:Looking at my daughter getting this. Issue is that she isn't currently a US Bank customer. The print says you need to have an open account at least 5 business days before applying, so that wouldn't be difficult, but as checking isn't available in her area, she would have to get a card.

She just got the Paypal card, but that's her only new account in the last 12 months. But, if she gets a throwaway US Bank credit card, and then applies for the Altitude Reserve, is that going to be too many inqs? Alternatively, would making her an AU on one of my US Bank cards make her enough of a customer for the Altitude? (Guessing not, but...!)

How much time does she have to get the AR till her upcoming trip? If it's a few months away, then it shouldn't be a problem.

If it happens its two or three months, but the issue is she will been going from a very well paid tech worker to an almost unpaid grad student in another country, so obviously she would want to apply while still employed here! I didn't suggest the cash plus because of the FTF, so was thinking of one of the no AF cards as the "make me a customer" card.

Are the travel rewards unrestricted? I seem to remember some system where flights had to start (or end or both?) in the US

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: US Bank Altitude Reserve: inqs

I applied for Cash+ (first product with them) while lol/24. It was not instant but was approved in less that 2 hrs for $4.5k which was reasonable given my profile at the time.

I opened checking within a week and had both for 6 months.

Fast forward 6 months and I’m even more LOL/24. Applied for Altitude and was approved for $9k in less than 24 hrs.

1 month later I got an auto increase on Cash+ bringing me up $6.5k and $15.5k exposure. US Bank has been nothing but generous to me and a joy to work with.

It’s certainly YMMV as new accts and inqs were never a speed bump, let alone road block, for me

BUSINESS; Amex | Citi

F8 Current F8s ~750 Best Ever F8s ~775

TOTAL PERSONAL CL > $350k and TCL > $365k

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: US Bank Altitude Reserve: inqs

@longtimelurker wrote:

Are the travel rewards unrestricted? I seem to remember some system where flights had to start (or end or both?) in the US

I could be mistaken, but I think the restrictions you're thinking of may have been what triggers the airline credit on Bank of America Premium Rewards? As long as the charge codes as a travel category, it should be fine. My annual credit was used for paid Delta F upgrades, and I've used RTR for Delta flights booked directly with Delta, and the credit appeared immediately even though the charges took a few days to settle so I actually had a negative account balance for a few days. I thought I had a KLM example to report for you, but now that I look, that was actually Amex.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: US Bank Altitude Reserve: inqs

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: US Bank Altitude Reserve: inqs

@K-in-Boston wrote:

@longtimelurker wrote:

Are the travel rewards unrestricted? I seem to remember some system where flights had to start (or end or both?) in the USI could be mistaken, but I think the restrictions you're thinking of may have been what triggers the airline credit on Bank of America Premium Rewards? As long as the charge codes as a travel category, it should be fine. My annual credit was used for paid Delta F upgrades, and I've used RTR for Delta flights booked directly with Delta, and the credit appeared immediately even though the charges took a few days to settle so I actually had a negative account balance for a few days. I thought I had a KLM example to report for you, but now that I look, that was actually Amex.

Sorry, I meant travel redemptions. I assume the booking system is pretty standard but wanted to check!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: US Bank Altitude Reserve: inqs

@longtimelurker wrote:

@K-in-Boston wrote:

@longtimelurker wrote:

Are the travel rewards unrestricted? I seem to remember some system where flights had to start (or end or both?) in the USI could be mistaken, but I think the restrictions you're thinking of may have been what triggers the airline credit on Bank of America Premium Rewards? As long as the charge codes as a travel category, it should be fine. My annual credit was used for paid Delta F upgrades, and I've used RTR for Delta flights booked directly with Delta, and the credit appeared immediately even though the charges took a few days to settle so I actually had a negative account balance for a few days. I thought I had a KLM example to report for you, but now that I look, that was actually Amex.

Sorry, I meant travel redemptions. I assume the booking system is pretty standard but wanted to check!

For redemptions using the USB travel portal, you can use the points for anything there. For Real-Time Rewards (RTR), there are some rules. The more restrictive ones are $500 minimum for hotels and $250 for car rentals. More importantly, for RTR to trigger, the purchase must be at a US merchant. For instance, if you have a hotel stay in a foreign country that meets the $500 minimum, you won't get the text message.

There's also no partial redemptions for RTR. You have to have enough points to cover the entire purchase or RTR won't trigger.

On the portal, you can use partial points if you don't have enough.

But, I'd still try to stay away from booking on the portal and redeem using RTR.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: US Bank Altitude Reserve: inqs

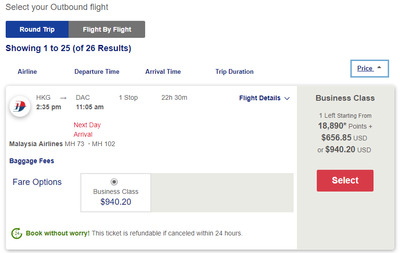

I can't say for sure on RTR, but at least in the travel portal international itineraries are widely available. (Also that's a nice round-trip price for J from Hong Kong to Dhaka via Kuala Lumpur!)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: US Bank Altitude Reserve: inqs

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: US Bank Altitude Reserve: inqs

I don't think the number of inquiries is going to be a problem. I was approved for the Altitude Reserve last year with 3 new accounts in 6 months. I applied at my branch and was sent for a manual review (which seems to be normal business practice for this card). She contacted me later in the day with the approval for $5k. I called UW the next day and requested an increase to $10k and was approved within minutes.

At the time I had been a banking customer for over 18 years.

FICO 9 EX 780

AMEX - Platinum, BCP, Delta Platinum, Simply Cash Plus, Blue Business Cash (Business)

Barclay - Arrival Plus, AAdvantage Aviator

Capital One - Venture, Sparks (Business)

Chase - FU, CSP

Citi - Premier, PLOC

Discover It Miles

TD Cash Visa

US Bank Altitude Reserve

Wells Fargo Propel AMEX

PNC Points Visa

FNBO Evergreen Visa