- myFICO® Forums

- Types of Credit

- Credit Cards

- Re: US Bank & third party bureaus.

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

US Bank & third party bureaus.

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

US Bank & third party bureaus.

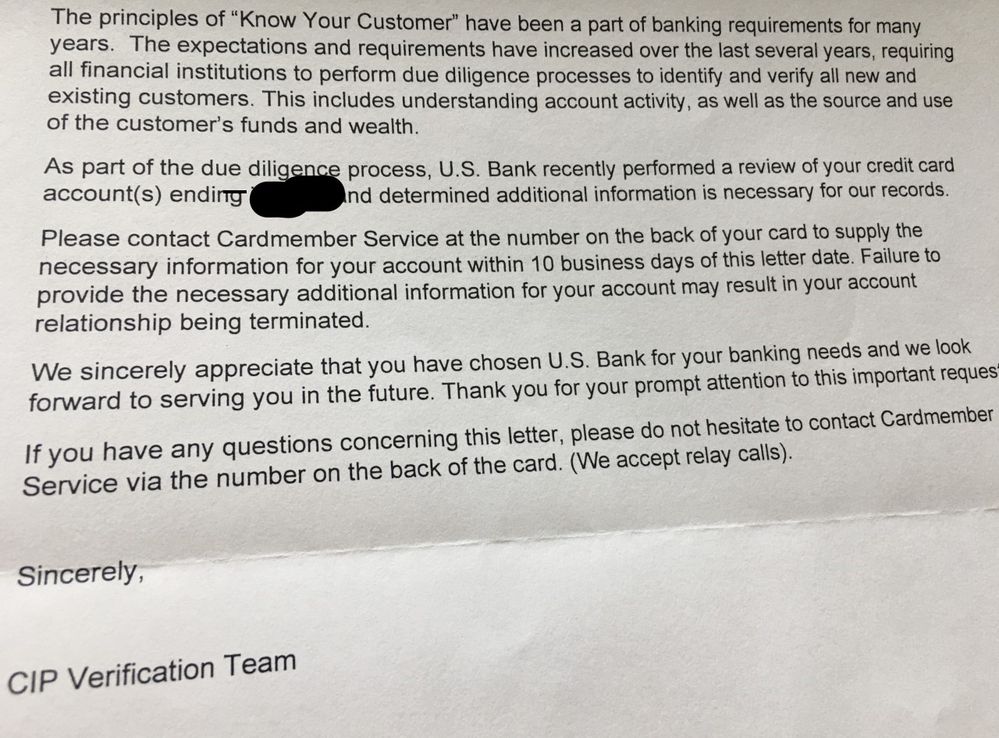

The eye in the sky starting their trouble;

Called USB customer service to see what kind of interrogation. They asked me to verify my address, which has been the same for 15+ years. That was it and accounts were reopened

I am assuming either Lexi, EWS, Innovis, etc, was the cause because nothing new on all three major credit reports for address.

Anyone else get one of these letters?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: US Bank & third party bureaus.

I think they use Sagestream if my memory serves me correct.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: US Bank & third party bureaus.

Many months ago (can't tell time anymore with 1.5 year old) Bank of America insisted that I visit a branch in person to verify my ancient account. It does not appear to have been triggered by anything I did. The rep checked 2 forms of ID and that was the end of it.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: US Bank & third party bureaus.

Since the letter was from the CIP verification team, my guess is that the Apt # was the issue and you should be fine going forward.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: US Bank & third party bureaus.

So an update;

Everything had been ok after updating, until today and all accounts closed.

It seems US Bank is tightening up the Patriot Act rules and now must have an actual physical residential home address on file, not just a street address like before, which could have been a mail center, UPS store, or mailbox store being used for an address. It will flag your account as a commercial address.

I questioned what about the folks who are RV lifers on the road or vacation for months at a time with relatives/friends, and don't have a permanent home address. They said you can use your current address where you are at today, then call in if you are going to travel and just let them know and they will make the adjustments as needed?

Hmmm, seems like a long stress filled issue, especially if you move a lot. Wonder what the homeless folks do?

Anyhow, gave them a home address for their files, told them to continue mailing my statements to my mailing address which has been the same for YEARS, and all accounts have been restored again,

at least for now....

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: US Bank & third party bureaus.

The Patriot Act requires banking institutions to do due diligence to verify customers' information, including their physical address. Mail drop locations are a huge red flag because they are often used for mail fraud and identity theft. Literally half of my LexisNexis report is warning about a Mailboxes Etc. address I used decades ago before the age of 18 being a possible mail drop location. While they can be used for mailing addresses, listing them as your permanent place of residence is untruthful.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: US Bank & third party bureaus.

@K-in-Boston wrote:While they can be used for mailing addresses, listing them as your permanent place of residence is untruthful.

If you don't really have a permanent address, how is it untruthful?

When I sold my house/retired years ago, I traveled a lot, months & even a year at a time. I had to get mail somewhere reputable and secure, and that was a mail center. I still travel although not as much, but I keep my apt lease on month to month basis for that reason and still use same mailbox number at mail center continuously for years, no lapse whatsoever.

Even the rep I spoke with said they have ran into a lot of customers lately who are living full time out of their RVs and having same issue for address verifications and they have to use relatives, parents address, etc.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: US Bank & third party bureaus.

@Benzman wrote:

@K-in-Boston wrote:While they can be used for mailing addresses, listing them as your permanent place of residence is untruthful.

If you don't really have a permanent address, how is it untruthful?

Because it is zoned commercially and is not a residence. You will see similar warnings on the other consumer reporting agencies' reports if an address is also flagged as possibly being a business address. A mailbox is not a permanent physical address.

U.S. Bank is only following the law. If you feel that it unfairly impacts transient persons, you should contact your Representative to discuss having The Patriot Act amended.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: US Bank & third party bureaus.

Banker here. This looks like your account was audited and they followed up with the letter.

Banks get internally and externally audited several times per year. We also have the OCC audit.

Blame the Patriot Act, not the bank.