- myFICO® Forums

- Types of Credit

- Credit Cards

- USAlliance: News?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

USAlliance: News?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: USAlliance: News?

I need to dig but does anyone remember if we needed to keep a specific amount of money in the savings account to avoid fees?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: USAlliance: News?

@JamP wrote:Well, I hope some of you make it then..

My card is probably going to be closed.

No need for another 2% Visa.

Here's to your good luck.

Thank you, I also hope it survives, but my luck is never that good

More likely just a month or two delay.

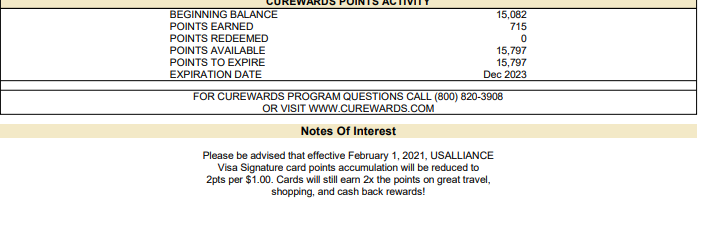

Will need to examine every statement for "Notes of Interest"

Will close after it becomes a 2%, I also don't need another 2% card.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: USAlliance: News?

Yes, I doubt if @Kforce and I will lucky long, I wonder if the fact it isn't on our statements is just an error. Looking at the infamous language:

Please be advised that effective February 1, 2021, USALLIANCE Visa Signature card points accumulation will be reduced to 2pts per $1.00. Cards will still earn 2x the points on great travel, shopping, and cash back rewards!

If it varied by user, I would expect more "...2021, your USALLIANCE Visa Signature card points accumulation will be reduced to 2pts"

But who knows! (Well, probably some people at USAlliance do but they are not telling...) If nothing appears on my Jan 28th statement, I will spend carefully in Feb and see what points are awarded.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: USAlliance: News?

@JamP wrote:I need to dig but does anyone remember if we needed to keep a specific amount of money in the savings account to avoid fees?

I don't think so (beyond the minimum needed for membership). I have $500 because when I started the interest rate was pretty good up to that point, probably should check now!

ETA: Yes, 1.9+% So I am getting over 80c EVERY month! Free money!

(I just had an IRA cert renew, was 2.2%, now 0.55%, rates are low...)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: USAlliance: News?

Going to pull all but rewards out of the USAlliance savings and throw it back into my Alliant CU savings.

Can't wait until these savings accounts go back up to 1% or more if that ever happens again.

I tend to move money around so I can get the best interest rate. Good point on the $500 I almost forgot.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: USAlliance: News?

@JamP wrote:

I tend to move money around so I can get the best interest rate. Good point on the $500 I almost forgot.

Me too.

OT: I am looking for new places for some IRA CDs (having sold off some appreciated stock funds). Very little issue opening accounts at far flung CUs, whereas some local banks (with good rates as it happens!) require an in person visit to open an account. As a) not THAT local, and b) COVID, not doing that. Is that common, banks want to see you, whereas CUs as more flexible?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: USAlliance: News?

Spent a long time on the phone today, many people , finally got someone who seemed to have an answer.

The 3 points is becoming 2 points for "ALL".

I will be shifting spend Feb 1.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: USAlliance: News?

@Kforce wrote:Spent a long time on the phone today, many people , finally got someone who seemed to have an answer.

The 3 points is becoming 2 points for "ALL".

I will be shifting spend Feb 1.

That's what I expected but hoped wasn't the case. Maybe our Jan statements will tell us that (a few days notice!).

One unrelated thing about this CU: pursuing my quest for IRA CDs, the specialist said: "I need to be upfront... There is a $3 monthly fee for a certificate" I guess that's because CDs need so much attention! At least she knew it was strange (none of my other CUs or banks charge fees) So maybe that's how they were able to do 3% for a while!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: USAlliance: News?

Chatted with someone today through the app and they had no idea 3% was going to 2% so she checked and stated it will be everyone. She was very surprised their site still shows 3%.

I pulled most of the money out of the savings not thinking about the $500 sweet spot so I was trying to get her to add my main bank account as a transfer account and she said she could not do that. I canceled my auto-deposit on the account and decided I wanted to start it back up again. I guess I will have to push it from my bank instead.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: USAlliance: News?

@JamP wrote:I applied the first week it was out. March 18th I received the email that said the card will arrive in 7-10 days.

Sonofa..... @longtimelurker

You guys were right, another 2% card..... It was a good ride, this will be my third 2% card now lolThat "Notes of Interest" as the points are being reduced from 3 to 2, however points are worth twice for cashback.

I read that "Notes of Interest" as points from 3 to 2, however 2x points for cashback.

100 = 2 points, 2 points times 2 = 4c per dollar.

Not going to close it yet.

Not going to put anything where I can get more than 2c for Feb

AOD users will be switching if it ends up 4c

Still a wait and see.

Strange wording in those "Notes of Interest"