- myFICO® Forums

- Types of Credit

- Credit Cards

- Re: Upgrade Visa - My Experience So Far

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Upgrade Visa - My Experience So Far

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Upgrade Visa - My Experience So Far

Hello all! There has been quite a bit of talk about the Upgrade Visa on here recently. After checking their site for a pre-qualified offer, I was offered $15k at 23.95%. My score on TU wasn't great at the time I checked, but I decided to give it a try so I could consolidate some credit card balances. The version I got was the non-rewards one. They do offer several versions with rewards, including an interesting one I saw on Credit Karma called Elite Cash Rewards offering 2.2% flat rate cash back. Anyway, I'll break down what I have expoerienced with it so far down below.

Approval Process: They soft pulled my TransUnion and I accepted their offer. I didn't have to do anything else after that, but it did take a day or two before my account was setup online. I know some people have said the approval process was slow and annoying, but I guess I got lucky because I didn't have that problem.

The Card: Once you login, they give you a virtual card you can use right away (after approval and account setup). I got the actual card about about 10 days later in the mail. It is a Visa Signature, but I doubt I'll ever be swiping it. I am not sure you can make a charge and pay it off to avoid interest charges. It probably says so somewhere in the mountain of documents they sent me, but I am unsure at this point.

Draws: You can take fee-free cash advances that are direct deposited into you bank account. They give you a payment term and amount before you take the money, so you'll know what the payment is before borrowing. I took out the full amount ($15k) and my payment is $595 for 36 months. The money was direct deposited into my checking account in about 2-3 days. You can pay the balance off early to avoid interest (which I plan to do). Interestingly., they also send you a new truth in lending disclosure each month, so I guess if you ran it back up or added new charges, the payment amount and interest amount would change. I also read somewhere in the paperwork that this account automatically closes for new transactions after 5 years, so it is not a long term, keeper product. I also do not think you will ever get a change in the credit line or in the interest rate without openeing a new account.

Payments: They seem to prefer autopay. I think they mentioned something about a discount if you agree to it. It is withdrawn on the same day each month.

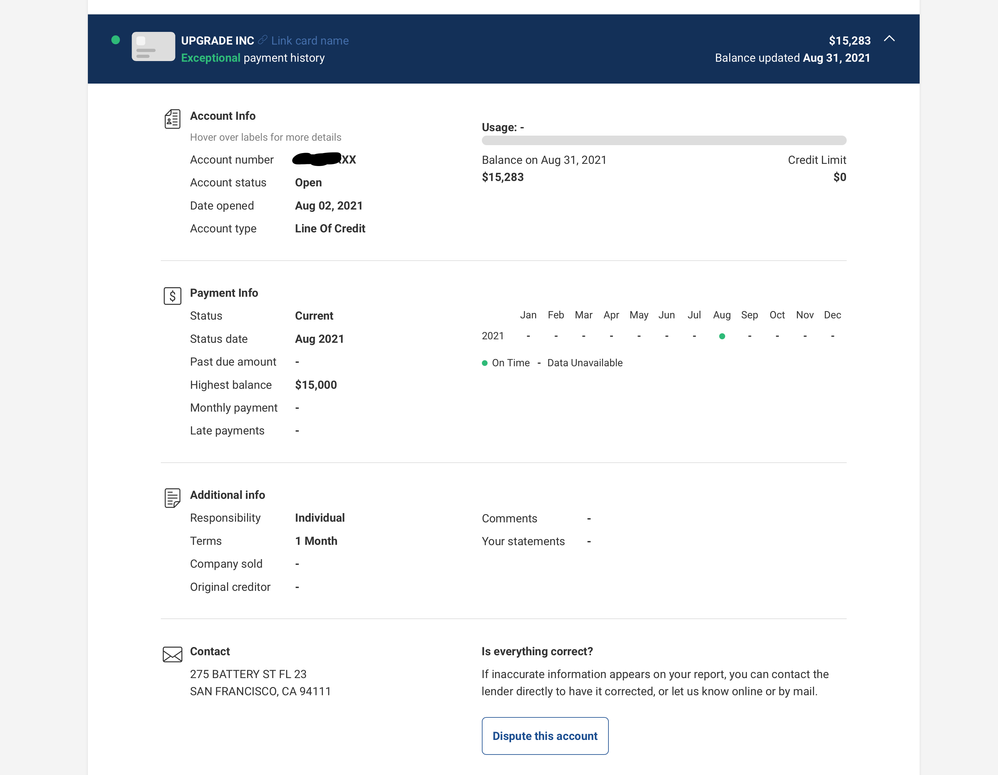

Credit Reporting: After the second statement cut, they began credit reporting. Unfortunately, it does not show up as some have speculated. Ithought this was going to report as an installment loan, but it actualy reports as a line of credit account. The terms section shows 1 month, so I guess they update it with the new balance each month. Mine is showing overlimit for the first month because they calculated in interest charges on top of the balance. Confusingly, there is a high balance, but the credit limit is listed as $0. My Experian FICO stayed the same after it reported 674, so I don't think it is affecting my revolving utilization. I will post a screen shot below from my Experian report.

Conclusion: This is a strange product. I think credit unions and regional banks used to offer lines of credit like this that were to be used for a certain amount of time. I think it doesn't make much sense to use this as a credit card, unless you are using it to finance a project like home remodeling or if you are using it to consolidate debt. Overall, I think it's fine and I haven;t had any problems with it, but I think this is meant for some very specific use cases. The jury is still out on whether you can PIF to avoid interest.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Upgrade Visa - My Experience So Far

Thanks for sharing the information and your experience with us. I was going to apply for this card but later I decided to pass it. I just feel it is too much head ache to keep tracking of things. I have Grain for small amounts to draw. If I need large LOC I should goto a local CU and ask them for an instalment loan. Probably interest rate would low also.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Upgrade Visa - My Experience So Far

I don't recall banks or CUs (unless there are/were some obscure ones out there) that offered any products similar to this. There were some that offered NRLOCs, but the APRs were never this astronomical. Most of the repayment terms would depend on the amount of the draws from such product. PLOCs are what most banks/CUs offer these days.

My understanding, unless you've read the T&Cs that were provided when you submitted the application (or the mountain of paperwork that you received via snail mail) was that there was no grace period on transactions?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Upgrade Visa - My Experience So Far

@FinStar wrote:I don't recall banks or CUs (unless there are/were some obscure ones out there) that offered any products similar to this. There were some that offered NRLOCs, but the APRs were never this astronomical. Most of the repayment terms would depend on the amount of the draws from such product. PLOCs are what most banks/CUs offer these days.

My understanding, unless you've read the T&Cs that were provided when you submitted the application (or the mountain of paperwork that you received via snail mail) was that there was no grace period on transactions?

As best I can tell, I think you will accrue interest from the date you take a cash advance draw or use the card. I am not sure it can be avoided. It seems silly that they are hyping all of their different rewards when the interest charges will likely be more that the rewards, even over the course of one month.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Upgrade Visa - My Experience So Far

@RehabbingANDBlabbing wrote:

@FinStar wrote:I don't recall banks or CUs (unless there are/were some obscure ones out there) that offered any products similar to this. There were some that offered NRLOCs, but the APRs were never this astronomical. Most of the repayment terms would depend on the amount of the draws from such product. PLOCs are what most banks/CUs offer these days.

My understanding, unless you've read the T&Cs that were provided when you submitted the application (or the mountain of paperwork that you received via snail mail) was that there was no grace period on transactions?

As best I can tell, I think you will accrue interest from the date you take a cash advance draw or use the card. I am not sure it can be avoided. It seems silly that they are hyping all of their different rewards when the interest charges will likely be more that the rewards, even over the course of one month.

Yikes. That will be a huge finance charge on your $15,000 draw, even if it is just for a few days and not the whole month 😳. I guess I can see if the APR was a lot lower and someone needed emergency funds, but then again, CUs offer a much better alternative.

Do you know how much cow (steak) can buy you with that much accrued interest? 😬

I would assume the rewards versions function relatively similar so any rewards would be eaten up by any accrued finance charges. The card should be renamed Downgrade Visa -- given what I've seen so far.

Hopefully, it works for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Upgrade Visa - My Experience So Far

The fact that it reported over limit is a huge problem if it's viewed as a revolving line of credit. Some banks and credit unions (Discover, NFCU) keep track of those things and it would impede new apps or increases.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Upgrade Visa - My Experience So Far

@FinStar wrote:

@RehabbingANDBlabbing wrote:

@FinStar wrote:I don't recall banks or CUs (unless there are/were some obscure ones out there) that offered any products similar to this. There were some that offered NRLOCs, but the APRs were never this astronomical. Most of the repayment terms would depend on the amount of the draws from such product. PLOCs are what most banks/CUs offer these days.

My understanding, unless you've read the T&Cs that were provided when you submitted the application (or the mountain of paperwork that you received via snail mail) was that there was no grace period on transactions?

As best I can tell, I think you will accrue interest from the date you take a cash advance draw or use the card. I am not sure it can be avoided. It seems silly that they are hyping all of their different rewards when the interest charges will likely be more that the rewards, even over the course of one month.

Yikes. That will be a huge finance charge on your $15,000 draw, even if it is just for a few days and not the whole month 😳. I guess I can see if the APR was a lot lower and someone needed emergency funds, but then again, CUs offer a much better alternative.

Do you know how much cow (steak) can buy you with that much accrued interest? 😬

I would assume the rewards versions function relatively similar so any rewards would be eaten up by any accrued finance charges. The card should be renamed Downgrade Visa -- given what I've seen so far.

Hopefully, it works for you.

Yeah, I am just using this a bridge loan to consolidate some credit card debt for a few months. I think it would be insane to keep a balance on an account like this for any extended period of time. I think the most positive thing I can say about this product is that it was extremely easy to obtain, compared to some other options out there, so if someone needs some emergency money, this could be an option. I am unsure if this would be good for rebuilders because it doesn't seem to affect revolving utilization and it would cost money to keep it going. It's something that will report a positive history, but that's about it!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Upgrade Visa - My Experience So Far

@Brian_Earl_Spilner wrote:The fact that it reported over limit is a huge problem if it's viewed as a revolving line of credit. Some banks and credit unions (Discover, NFCU) keep track of those things and it would impede new apps or increases.

I don't think it is affecting revlving utilization. If you look at how it's reporting, it shows the credit limit as $0. It only shows a high balance, which is lower than the current balance (techinically inaccurate). My score didn't change at all after this reported, and I think it would drop significantly if a $15k maxed out credit line was being factored in. I just got about 5 points of an increase after I paid one of my cards down too.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Upgrade Visa - My Experience So Far

@RehabbingANDBlabbing wrote:

@Brian_Earl_Spilner wrote:The fact that it reported over limit is a huge problem if it's viewed as a revolving line of credit. Some banks and credit unions (Discover, NFCU) keep track of those things and it would impede new apps or increases.

I don't think it is affecting revlving utilization. If you look at how it's reporting, it shows the credit limit as $0. It only shows a high balance, which is lower than the current balance (techinically inaccurate). My score didn't change at all after this reported, and I think it would drop significantly if a $15k maxed out credit line was being factored in. I just got about 5 points of an increase after I paid one of my cards down too.

I think the reason it's not impacting your revolving utilization is because it is technically considered a non-revolving line of credit. I assume there's a time period where once some funds are replenished, you can elect to make additional draws.

The terms show = 1 month (time period for your initial draw). Once draws are made, then the repayment terms are calculated (almost like a loan) based on the expected accrued finance charges amortized over the time period it would take to repay the full amount.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Upgrade Visa - My Experience So Far

@FinStar wrote:

@RehabbingANDBlabbing wrote:

@Brian_Earl_Spilner wrote:The fact that it reported over limit is a huge problem if it's viewed as a revolving line of credit. Some banks and credit unions (Discover, NFCU) keep track of those things and it would impede new apps or increases.

I don't think it is affecting revlving utilization. If you look at how it's reporting, it shows the credit limit as $0. It only shows a high balance, which is lower than the current balance (techinically inaccurate). My score didn't change at all after this reported, and I think it would drop significantly if a $15k maxed out credit line was being factored in. I just got about 5 points of an increase after I paid one of my cards down too.

I think the reason it's not impacting your revolving utilization is because it is technically considered a non-revolving line of credit. I assume there's a time period where once some funds are replenished, you can elect to make additional draws.

The terms show = 1 month (time period for your initial draw). Once draws are made, then the repayment terms are calculated (almost like a loan) based on the expected accrued finance charges amortized over the time period it would take to repay the full amount.

I'm just not sure at this point. Technically, I took out the total of $15k in 2 separate draws with different payment amounts, but they were both for 36 months and compounded together after the first statement printed. I think there's a good chance it may just continue reporting this way. I also noted that there is no monthly payment amount reported, which they would have known after the first statment printed. I'll definitely update this thread next month with the next time it reports. It just showed up a couple of days ago and I've had it for 2 billing cycles.