- myFICO® Forums

- Types of Credit

- Credit Cards

- Walmart randomly closed?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Walmart randomly closed?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

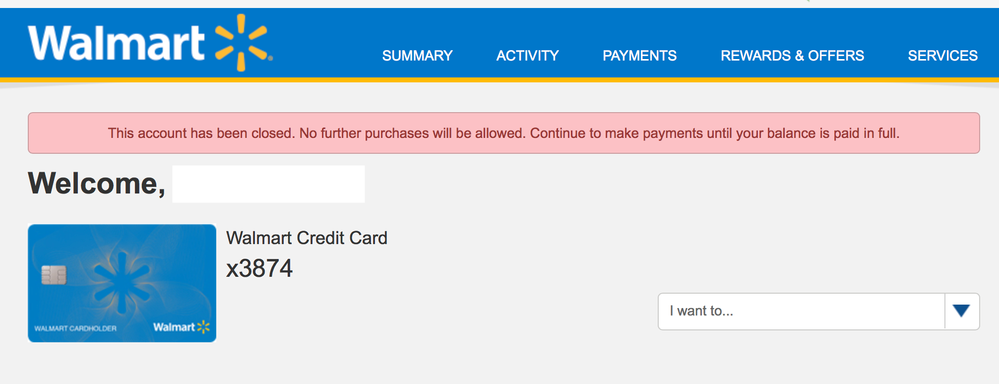

Walmart randomly closed?

Built this from $300 to $4k limit. Always paid more than the minimum and never late. I ran up this month, but so what? What the heck?

The online agent said it cannot be reopened, but if I'd like to reapply I can. I've put through and paid off at least $5k on this in under a year.

What the f.

Anyone know if it's at all possible to get this re-opened? I can pay the balance off if I have to. Insane!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Walmart randomly closed?

Randomly?

I don't think so. You must have done something to spook the Synchrony.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Walmart randomly closed?

Well, yes. They said based on credit report activity. The only negative activity there has been utilization going up, but who cares?

I've been good to Walmart and never had an issue. My Dick's, Amazon, and Lowe's cards are all fine.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Walmart randomly closed?

What's your utilization?

Sock Drawer: PenFed Promise • NFCU cashRewards • Chase Sapphire Preferred • Chase Freedom Unlimited • United Explorer • UNFCU Azure

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Walmart randomly closed?

Was below 30, now 67.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Walmart randomly closed?

Actually, increased utilization is not the only negative activity. You also said "Always paid more than the minimum" which is not the same as paying off what you owed promptly. So Synchrony reviewd your account and decided you're not worth the risk. What's the utilization on your other cards? Are there any baddies on your credit report?

@SirCreditwrote:Well, yes. They said based on credit report activity. The only negative activity there has been utilization going up, but who cares?

I've been good to Walmart and never had an issue. My Dick's, Amazon, and Lowe's cards are all fine.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Walmart randomly closed?

So, instead of paying the $30 minimum on $1k I paid $500... not like I paid $40. Give me a break. Most of the time I pay the balance in full.

I have a few cards in the 70's, most below 67, and a bunch at 0. Nothing maxed.

I suppose it's in their right to do whatever they want, but f them. They don't need me, I don't need them. Won't reapply.

I guess that just means Amazon will be getting more of my money now. Walmart's loss.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Walmart randomly closed?

The credit reporting agencies consider 89 percent utilization as maximum so you're much closer to maximum on your other cards than you think. That's another reason Synchrony might have closed you account.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Walmart randomly closed?

Sure. I get all that.

I think the better way to go about it, with a good year-long customer would have been to say -- "Hey, we've noticed that your utilization is going up on your reports and we're concerned. Are you able to pay x amount to us, or pay the balance off by this date to avoid having your account closed?" Or, "Can you get your overall utilization to x% by y date to avoid account closure?"

I just think they could have handled it better, but again realize they can do whatever they want. I just think to myself -- I've been good to them, and this is how they treat me? Had they reached out I would have done whatever necessary to keep the account open. Folks like that don't get any future business from me.

/rant.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Walmart randomly closed?

@SirCreditwrote:Well, yes. They said based on credit report activity. The only negative activity there has been utilization going up, but who cares?

I've been good to Walmart and never had an issue. My Dick's, Amazon, and Lowe's cards are all fine.

Hi OP,

Sucks you're having to deal with this but to answer your question as to who cares about increased utilization, the short answer is, lenders. They care because since they don't know us personally and we don't know them, they have to rely on credit reports, algorithms, and I'm sure lots of other factors to determine and mitigate risk.

You mentioned that your utilization has increased from 30 to 67 and that *could* be the reason for said closure. You won't know the exact reason until you receive notification by mail. While you may very well have it under control and have a plan to take care of such, lenders aren't privy to what's going on in your financial life or what's going on in our heads for that matter as it relates to repayment of debt.