- myFICO® Forums

- Types of Credit

- Credit Cards

- Re: What card(s) should be in my goals?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

What card(s) should be in my goals?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What card(s) should be in my goals?

@Anonymous wrote:

Correct about the Citi Dividend, you must PC to it.

Do you know how long it is before you can PC? Honestly it’s a good idea to get my foot in the door with Citi so maybe I’ll put a DC on my late 2020 radar (I want my BK gone before I gamble on Citi).

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What card(s) should be in my goals?

Found the card for you !

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What card(s) should be in my goals?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What card(s) should be in my goals?

@Kforce wrote:Found the card for you !

I am definitely on track to be one of the worst gardeners, I have to reset my seedling again if US Bank’s letters for checking and Cash+ are because they tried to pull Experian (didn’t realize they did EX in CO) and not because I burned them in 2010. I already reset it twice in December and once in January lol.

But you spelled my name wrong so the card is invalid. 🤣

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What card(s) should be in my goals?

@Anonymous wrote:

But you spelled my name wrong so the card is invalid. 🤣

Sorry Saeren;

Drinking and Photoline don't mix !! ![]()

Still drinking but it was "Photoline" not "Photoshop".

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What card(s) should be in my goals?

@Kforce wrote:

@Anonymous wrote:

But you spelled my name wrong so the card is invalid. 🤣

Sorry Saeren;

Drinking and Photoline don't mix !!

Still drinking but it was "Photoline" not "Photoshop".

Lol it’s all good, only a few people spell it right.

I actually will garden for awhile but if I get the encouragement of a letter saying that my denials with US Bank were not automatically done based on past relationship, as soon as I get my repo and 120 lates off my EX in April, I’m going to go for the Cash+. The most expensive bill I have is my Comcast bill which makes the Cash+ a no-brainer card. I may get the Nusenda and then the only thing left is a card from Citi and a card from Chase to get those relationships started. That’s a 2020 goal and unless 5/24 rules change in the meantime, I can get 4 cards in the middle and still get Chase in 12/2020.

1) Cash+

2) Nusenda (and I still need to really evaluate how much value I’ll get out of this card but for now it’s on the list)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What card(s) should be in my goals?

USB-Cash+ has been a great card for me.

Recomed it when you can get back in with them.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What card(s) should be in my goals?

@Kforce wrote:USB-Cash+ has been a great card for me.

Recomed it when you can get back in with them.

It accomplishes two goals - get back in with US Bank and cut down how much I pay for Comcast so I’m definitely going to push for that one if I’m not blacklisted. If I am, I’ll just garden unless I come across another pick-your-category spend card that’s over 3%.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What card(s) should be in my goals?

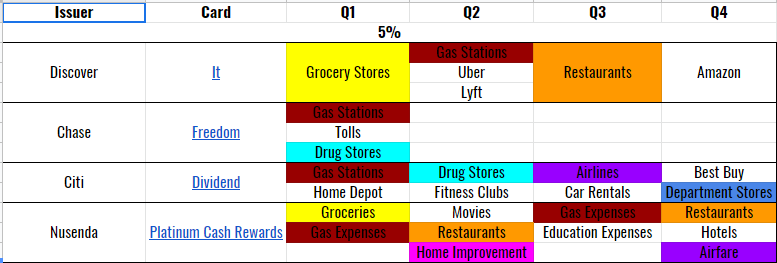

I forgot I had this little spreadsheet of the 5% category quarters lying around.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What card(s) should be in my goals?

@Anonymous wrote:I forgot I had this little spreadsheet of the 5% category quarters lying around.

That Nusenda card would be a nice addition to my Disco. Does Nusenda code delivery and fast food as restaurants?

I haven’t seen many DPs of people under 800 getting that card so I’m definitely not going to apply with a 662 EX but I might try when I get EE from EX and get that score over 700 in April if US Bank is off the table. I am also going to be going from AZE4 to AZEO on the 22nd and my highest utilization will go from 31% to 27% so I should see some upward score movement next month. I seem to lose about 6 points per card with a balance on average.