- myFICO® Forums

- Types of Credit

- Credit Cards

- Re: What would be next best credit card for me?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

What would be next best credit card for me?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What would be next best credit card for me?

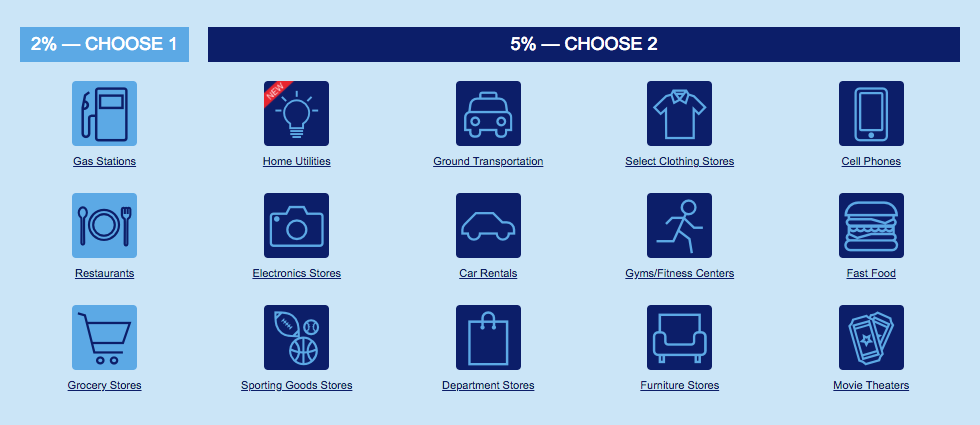

If you Google the US Bank Cash+ rewards categories, you can find this on AwardWallet.

The 5% catories are quarterly rotating just like Discover and Chase Freedom, however, you get 2x 5% categories!

So, like I say, if your other categories are covered by other cards, this is perfect for Utilities and Cell Phone. And of course, there's the 2% category, should you need it.

Sock Drawered

On Deck: No Plans Currently

On Deck: No Plans Currently

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What would be next best credit card for me?

Do you know if it is allowed to repeat the same categories every quarter or do you have to switch? Any idea if cable is included in utilities? If so, I could probably get close the the max $100 per quarter (5% of $2k). I'd get the card just for those categories and probably not use it for anything else.

AoOA: closed: 36 years, open: 25 years; AAoA: 11.8 years

Amex Gold, Amex Green, Amex Blue, Amex ED, Amex Delta Gold, Amex Hilton Surpass, BoA Platinum Plus, Chase Freedom Unlimited, Chase Amazon, Chase CSP, Chase United Explorer, Citi AA Plat, Sync Lowes, Sync JC Penney - total CL 145k

Loans: Chase car loan (35k/6yrs 0.9%)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What would be next best credit card for me?

You can keep the same 5% categories year-round if you choose to do so. But if you want to change them for any reason, you have to do it quarterly. I'm not sure if the utilities include cable.....I checked the terms of condition on the US Bank site and it makes no mention of it. I'm sure you could call US Bank to get clarification.

Added note: I know for me, my internet is AT&T and satelite DirecTV, which are now linked together, so I have them bundled. AT&T/DirecTV accepts credit card payments, however they charge a fee to do so. Can't remember the fee off-hand, but ultimately it would offset any cashback you gained, so I've never payed via CC. (My power company does the same thing which really sucks) Just something to for you to check out first....

This info could be useful to the OP and others as well, so I don't think it's going off-topic too much.

Sock Drawered

On Deck: No Plans Currently

On Deck: No Plans Currently

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What would be next best credit card for me?

@Taurus22 wrote:

The 5% catories are quarterly rotating just like Discover and Chase Freedom, however, you get 2x 5% categories!

So, like I say, if your other categories are covered by other cards, this is perfect for Utilities and Cell Phone. And of course, there's the 2% category, should you need it.

You explained more in a later post. but I wouldn't use that terminology. Discover/Freedom rotate whether you like it or not, whereas Cash+ categories are generally available all quarters (except when discontinued). But yes, you have to select each quarter so that bit is the same.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What would be next best credit card for me?

Fico credit score source Bofa and discover

Transunion and equifax source

Credit Karma, wallet hub, capital one credit wise

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What would be next best credit card for me?

Credit Karma, Wallet Hub, and Credit Wise provide Vantage Scores. No lender uses them, so they can be disregarded. All three sites provide nice report information, though.

Discover can provide you with two FICOs. A Transunion FICO is available within your account. And an Experian FICO is available through Discover Credit Scorecard, which is available whether one has a Discover card or not.

No matter, though. We can tell where you're at via the details in your original post. The only cause for concern right now is your new accounts. Let those age, and you'll be in a great position for your next card.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What would be next best credit card for me?

@Taurus22 wrote:You can keep the same 5% categories year-round if you choose to do so. But if you want to change them for any reason, you have to do it quarterly. I'm not sure if the utilities include cable.....I checked the terms of condition on the US Bank site and it makes no mention of it. I'm sure you could call US Bank to get clarification.

Added note: I know for me, my internet is AT&T and satelite DirecTV, which are now linked together, so I have them bundled. AT&T/DirecTV accepts credit card payments, however they charge a fee to do so. Can't remember the fee off-hand, but ultimately it would offset any cashback you gained, so I've never payed via CC. (My power company does the same thing which really sucks) Just something to for you to check out first....

Thanks, I did some digging and found this page:

https://cashplus.usbank.com/merchants/index

Cable/internet are explicitly excluded from utilities. I'll have to check but if I can pay power, water, and cell without fees I can still average $500 to $600 per month in those two 5% categories, which would be worth doing. I'll need to hold off a little though because there's a Chase card I want to get before I go over 5/24, but in a couple of months I'll probably get this.

AoOA: closed: 36 years, open: 25 years; AAoA: 11.8 years

Amex Gold, Amex Green, Amex Blue, Amex ED, Amex Delta Gold, Amex Hilton Surpass, BoA Platinum Plus, Chase Freedom Unlimited, Chase Amazon, Chase CSP, Chase United Explorer, Citi AA Plat, Sync Lowes, Sync JC Penney - total CL 145k

Loans: Chase car loan (35k/6yrs 0.9%)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What would be next best credit card for me?

@FlaDude wrote:

@Taurus22 wrote:You can keep the same 5% categories year-round if you choose to do so. But if you want to change them for any reason, you have to do it quarterly. I'm not sure if the utilities include cable.....I checked the terms of condition on the US Bank site and it makes no mention of it. I'm sure you could call US Bank to get clarification.

Added note: I know for me, my internet is AT&T and satelite DirecTV, which are now linked together, so I have them bundled. AT&T/DirecTV accepts credit card payments, however they charge a fee to do so. Can't remember the fee off-hand, but ultimately it would offset any cashback you gained, so I've never payed via CC. (My power company does the same thing which really sucks) Just something to for you to check out first....

Thanks, I did some digging and found this page:

https://cashplus.usbank.com/merchants/index

Cable/internet are explicitly excluded from utilities. I'll have to check but if I can pay power, water, and cell without fees I can still average $500 to $600 per month in those two 5% categories, which would be worth doing. I'll need to hold off a little though because there's a Chase card I want to get before I go over 5/24, but in a couple of months I'll probably get this.

Thanks for digging that up, you just axed my interest in getting this card entirely and saved me some major disappointment.

Sorry OP, you’re getting fantastic advice and I don’t have anything else to add.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What would be next best credit card for me?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What would be next best credit card for me?

@Remedios wrote:https://cashplus.usbank.com/offer/all

Ugh! I have read this multiple times here and I keep spacing it anyway. Thanks for the reminder!

Guess I’ll be hopping that garden fence again after all.