- myFICO® Forums

- Types of Credit

- Credit Cards

- Why SO MANY Credit Cards?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Why SO MANY Credit Cards?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- « Previous

- Next »

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Why SO MANY Credit Cards?

@Anonymous wrote:I just place credit hoarders in the same category as people who hoard other items, it's a sickness, an addiction and a disease, and I don't encourage it. On a personal level I can see better things to do with my money than having 20 cards, like sticking the money that would go toward credit card balances and putting it toward an emergency fund or a brokerage account so you might have the means to pay those cards when things hit the fan. I have seen people in my own family get in serious trouble with credit hoarding, and they wound up in bankruptcy court or consumer credit counseling. I'm not going to be that guy, and I'm not going to be the one to encourage someone who is brand new to credit, as most new posters on these boards are, to go ahead and apply for 20 accounts they can't afford, to buy things they don't need, to impress people they don't even know.

In 2008 I used to net 700k, and had a biz with employees...I never dealt with good credit habits, I always had enough money on my debit cards. In 2012, when my biz ran into tough times, I had to get rid of people, and shrink my business goals. If I had established my credit, to match my 700k income, I could have survived my short lived jam, without getting rid of good people.

I'm glad you place people who enjoy doing something, which makes them happy and content, regardless of method and madness, as a disease. I usually place people in categories, who are bothered by others, especially when they have no control over the actions taken by friendly, suportive, and respectful people.

Simply put, why does it bother you so much that people collect 40+ cards???

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Why SO MANY Credit Cards?

Don't forget this is a "FICO" forum. We build FICO scores here (not card collections or debt).

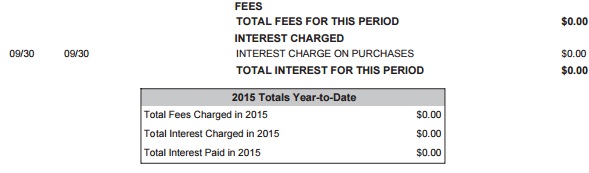

Most of us have MANY of these...

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Why SO MANY Credit Cards?

@Anonymous wrote:

@Anonymous wrote:I just place credit hoarders in the same category as people who hoard other items, it's a sickness, an addiction and a disease, and I don't encourage it. On a personal level I can see better things to do with my money than having 20 cards, like sticking the money that would go toward credit card balances and putting it toward an emergency fund or a brokerage account so you might have the means to pay those cards when things hit the fan. I have seen people in my own family get in serious trouble with credit hoarding, and they wound up in bankruptcy court or consumer credit counseling. I'm not going to be that guy, and I'm not going to be the one to encourage someone who is brand new to credit, as most new posters on these boards are, to go ahead and apply for 20 accounts they can't afford, to buy things they don't need, to impress people they don't even know.

I think there's a fine line between having numerous credit cards to:

A) Build a robust credit file that can withstand future AAOA dings

B) Collect sign up bonuses/maximize cashback

C) Cultivate a banking relationship with a wide array of lenders

D) [Insert other valid personal reason here]

and encouraging people to apply for 20 accounts and using them to buy things they can't afford. To be fair, some people with 10+ accounts are true credit addicts, some are not, and while denouncing the harm in addiction is perfectly reasonable, your original comment made a very wide generalization about people who have 10+ accounts and your second comment conflates their experiences with those of "credit hoarders" and people who can't successfully manage their money. I think that, more than the FSR component, is what got people's feathers ruffled.

Could it be that the 20+ accounts segment has _proportionally_ more people with unresolved issues?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Why SO MANY Credit Cards?

@Anonymous wrote:My question is...why?! Is there a benefit to have that many cards?

This is a VERY common topic so don't overlook all the prior number of cards and total limits threads.

The tl;dr anser for me is to maximize rewards on my spend. However, a few cards do have balances with 0% offers parked on them. I also have some older cards that are generally not used but have grown with me and have high limits so I keep them around for utilization padding and their age.

There are many different reasons that people have the number of cards that they have. However, you need to select cards based on your own needs/wants/priorities etc while also considering what your credit profile can support and what you can reasonably manage. Number of cards in and of itself really isn't important aside from the general recommendation of "at least 2-3 for scoring purposes".

@Anonymous wrote:Personally, enough for me is 3 cards, MAYBE as much as 6. Anyone with more than 10 or 20 has some unresolved issues.

...and that's a very common and flawed assumption. "For me" and "for others" is not the same thing. You cannot assume that what works best for you works best for everyone no matter what the topic. X cards is just X cards. Someone with X cards could have a problem. Someone with X cards might not have a problem. X by itself doesn't tell you that despite your assumption based on anecdotal evidence (also a trap that many fall into). A more careful analysis of the individual is required to determine that.

Certainly do what works for you but don't use that as a basis to judge others or else you're just the pot calling the kettle black.

@Anonymous wrote:I just place credit hoarders in the same category as people who hoard other items, it's a sickness, an addiction and a disease, and I don't encourage it.

You can discourage credit hoarding without assuming that everyone with more cards than you is a credit hoarder. Again, you cannot simply assume that those that do not do things as you do (on any topic -- not just credit cards) have a sickness or a problem which is what your posts are stating. It's possible that your posts aren't conveying your exact thoughts but that is how they come across and all we have to go on.

@Anonymous wrote:On a personal level I can see better things to do with my money than having 20 cards, like sticking the money that would go toward credit card balances and putting it toward an emergency fund or a brokerage account so you might have the means to pay those cards when things hit the fan. I have seen people in my own family get in serious trouble with credit hoarding, and they wound up in bankruptcy court or consumer credit counseling. I'm not going to be that guy, and I'm not going to be the one to encourage someone who is brand new to credit, as most new posters on these boards are, to go ahead and apply for 20 accounts they can't afford, to buy things they don't need, to impress people they don't even know.

You're conflating many things and assuming. X cards doesn't indicate that someone is in debt. X cards doesn't mean that someone is buying what they cannot afford. X cards doesn't mean that someone is buying things to impress others. You're assuming those to all be the same. It is certainly possible for someone to be all those things but, again, X cards in and of itself does not tell you such things and more careful consideration is needed to determine such things.

Additionally, "I have seen" is not stastically meaningful and it is anecdotal evidence so you cannot extrapolate broad trends from such limited sample data. Granted, we all generally operate based on what we have experienced but we need to understand the limitations and drawbacks of only relying on that. If your experience with those with a large number of cards has only been with those who cannot budget, manage that numner of cards, etc it's no wonder you've reached that conclusion. However, that doesn't mean that all people with cards over a certain number that you've selected are like that. It just indicates the limitations of your experiences.

@Anonymous-own-fico wrote:Could it be that the 20+ accounts segment has _proportionally_ more people with unresolved issues?

No telling without a proper study and making generalizations based on any discussion forum's posts is not a proper analysis. "Unresolved issues" would probably not make a large of accounts sustainable in the long run IMO.

@elim wrote:Don't forget this is a "FICO" forum. We build FICO scores here (not card collections or debt).

Even myFICO users vary. There are certainly those that are collecting and/or caught of with the thrill of applying.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Why SO MANY Credit Cards?

Thread is now closed to further comments and under moderator review. Those who have violated our policies will be notified via PM.

gdale6

myFico Moderator