- myFICO® Forums

- Types of Credit

- Credit Cards

- Re: Why do you love your Cash+?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Why do you love your Cash+?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Why do you love your Cash+?

I've had my cash+ for a year and 4 months and made $800.00+ in that time just paying the household bills. Every thing is set in autopay. The CL has doubled in that time frame too. I like it and US Bank has been very easy to deal with.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Why do you love your Cash+?

The people who like it, like it for much the same reason that people like any cashback card. If the categories work for you, the big advantages over many are a) you get to pick, unlike say Freedom and Discover, where they do the picking, and b) higher 5% caps, you get 5% on $2000 per quarter, whereas Freedom/Discover you get $1500 a quarter.

So, if you maxed out, you get $400 a year for no AF, whereas the much loved BCP, before adding streaming, maxed out at $360 with a $95 AF

But that is also the issue, some people don't find the Cash+ categories that useful as say groceries. But cell phone and utilities are pretty easy to use. My utilities charge a fee for CC use, but as the reward is 5%, it's still worth it.

And the ability to pick really can be very useful. If you know that you are going to buy a gym membership in Q1 and furniture in Q2, you can adjust appropriately

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Why do you love your Cash+?

Admittedly, I don't use my two Cash+ cards as much as I used to, particularly once the "bookstores" category (aka Amazon.com) went away, but I still like the product for its versatility. The Cash+ also led to the closure of my few remaining store cards by offering 5% at department stores (Macy's/JCP). I'd have to say department stores, electronics stores (Best Buy/Newegg), streaming/internet, and utilities are primarily what I use the Cash+ for nowadays.

I would definitely devote one of the categories to cell phone providers if I didn't have another card already offering 5% in that category, however; and it's unfortunate that 5% dining is restricted to fast food.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Why do you love your Cash+?

Well for me it's really simple.... About $400/month on wireless, internet and TV yields about $20 in CB. That's $240 a year for just using my Cash+ to pay for those bills. You tell me if there's a better deal out there!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Why do you love your Cash+?

Have categories other 5% card don't gave, and can pick same catagories every quarter.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Why do you love your Cash+?

What makes the Cash+ card unique is every quarter you pick 2 -5% catagories and 1- 2% catagory. I have had the card for ten years or so. I use the 5% and 2% catagories to my advantage some times that means thinking ahead. US Bank also keeps watch for any potential fraudualent transactions and they will deny a transaction they think is fraud. If I am going to make large purchase and plan on using the Cash+ card I will call and warn of a large purchase. Same is true with travel. I have nothing but good things to say about US Bank. I banked with them for 10 years or so.

Yes calling them at times is a pain, But it is better than finding a $650.00 fruadulent transaction on your monthly statement. I had this happen with another bank credit card. Problem was resolved on the first call and they told me about two or three other charges that I could not see.

Discover 09/90 19,000, JCPenney 10/2008 4,700 US Bank Cash 12,000 Citibank Custom Cash 5/2015 11,100 State Dept. FCU 15,000 06/2023 , 02/2024 Redstone FCU Signature VISA 10,000 Banking: Ally Bank Credit Unions: Lafayette FCU Fortera FCU State Department FCU Pelican CU

Pelican State CU Redstone FCU

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Why do you love your Cash+?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Why do you love your Cash+?

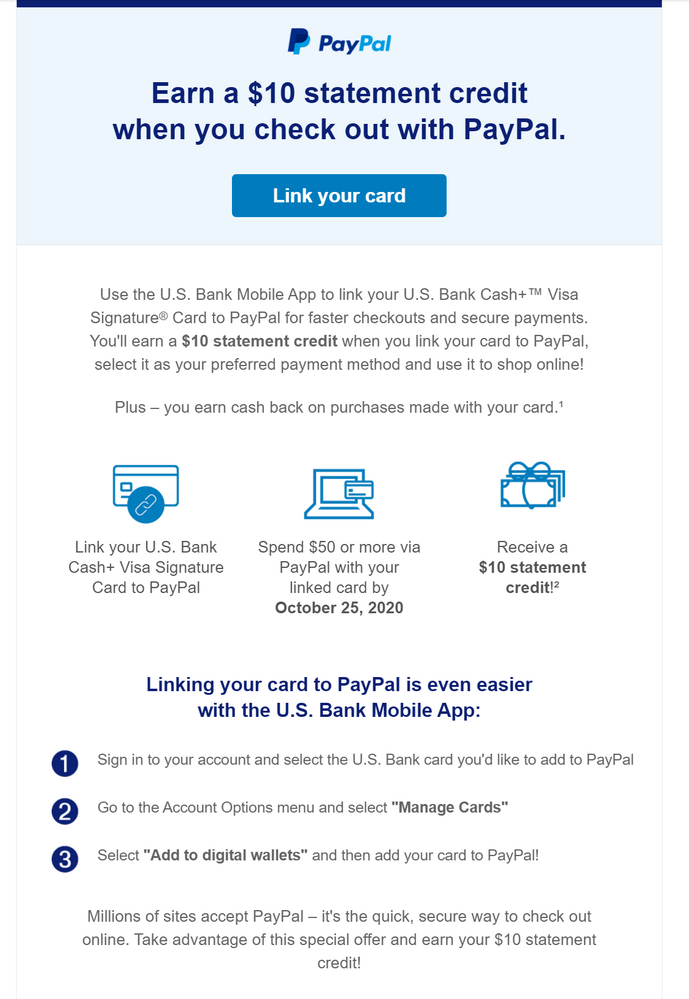

Not quite enough to make me "love" the card, but new offer. Add Cash+ to paypal, make it the preferred payment method, spend $50 and get $10 back. You can presumably then remove it as preferred.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Why do you love your Cash+?

Like any other cash back card you just need to run the numbers for your spend in the given categories and decide if the incremental gain vs your existing cards is worth managing another account.

Nobody is getting life changing money out of this so it's just about how much you want to manage in exchange for a handful more dollars a month.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Why do you love your Cash+?

I use mine for internet/best buy and my second one for Fast-food/mall (department store) purchases. Gotten me tins of cashback.