- myFICO® Forums

- Types of Credit

- Credit Cards

- Why is JCB Murakai not popular?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Why is JCB Murakai not popular?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why is JCB Murakai not popular?

I see that 3% cash back, only a $35 AF(annual fee plus membership fee), only 13.9% APR, and a Discover card. To me, that seems better than Citi DC at 2%, CapOne QS at 1.5%. There has to be something that I'm not realizing, anyone have any thoughts on this card?

I personally think it looks a little ugly, but it seems like it does give a lot of cash back.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Why is JCB Murakai not popular?

@ray8806 wrote:

Is there a catch or something that I don't see?

I see that 3% cash back, only a $35 AF(annual fee plus membership fee), only 13.9% APR, and a Discover card. To me, that seems better than Citi DC at 2%, CapOne QS at 1.5%. There has to be something that I'm not realizing, anyone have any thoughts on this card?

I personally think it looks a little ugly, but it seems like it does give a lot of cash back.

Ahhh the prized card from Japan Credit Bank it is a great to get in with them since they are a Prime bank but they are a strict conservative lender with limted acceptance in the US. But if you hold their card thats awesome!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Why is JCB Murakai not popular?

They are also very very conservative. Application method is also very traditional. You fill up an app manually, send it in, and an underwriter will look at it. There's no automated computer approvals.

It's on the discover network, which means acceptance is limited. Out of all the 4 major payment networks, this is the least accepted.

Rewards redemption cannot be done online. You have to call in.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Why is JCB Murakai not popular?

@joedtx wrote:

@ray8806 wrote:

Is there a catch or something that I don't see?

I see that 3% cash back, only a $35 AF(annual fee plus membership fee), only 13.9% APR, and a Discover card. To me, that seems better than Citi DC at 2%, CapOne QS at 1.5%. There has to be something that I'm not realizing, anyone have any thoughts on this card?

I personally think it looks a little ugly, but it seems like it does give a lot of cash back.Ahhh the prized card from Japan Credit Bank it is a great to get in with them since they are a Prime bank but they are a strict conservative lender with limted acceptance in the US. But if you hold their card thats awesome!

+1

The geographical restrictions are pretty much the reason. As per their application disclosure...Currently, JCBUSA has licenses and/or permissions to issue credit cards to U.S. residents in the States of California, Hawaii, Illinois, New Jersey, and New York.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Why is JCB Murakai not popular?

@enharu wrote:

Few reasons. You have to be a resident of either California or Hawaii to qualify. Not sure if they opened up to more states.

They are also very very conservative. Application method is also very traditional. You fill up an app manually, send it in, and an underwriter will look at it. There's no automated computer approvals.

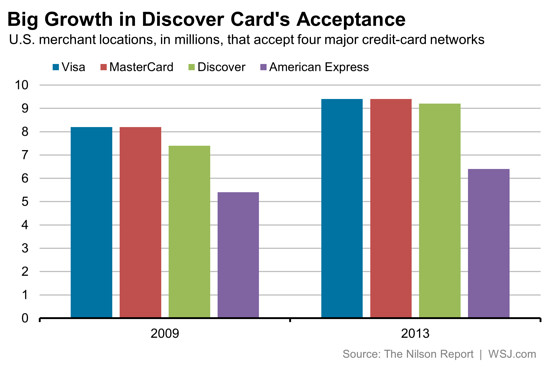

It's on the discover network, which means acceptance is limited. Out of all the 4 major payment networks, this is the least accepted.

Rewards redemption cannot be done online. You have to call in.

Their website says applicants must be a resident of the state of California, Nevada, Oregon or Washington

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Why is JCB Murakai not popular?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Why is JCB Murakai not popular?

@joedtx wrote:

@ray8806 wrote:

Is there a catch or something that I don't see?

I see that 3% cash back, only a $35 AF(annual fee plus membership fee), only 13.9% APR, and a Discover card. To me, that seems better than Citi DC at 2%, CapOne QS at 1.5%. There has to be something that I'm not realizing, anyone have any thoughts on this card?

I personally think it looks a little ugly, but it seems like it does give a lot of cash back.Ahhh the prized card from Japan Credit Bank it is a great to get in with them since they are a Prime bank but they are a strict conservative lender with limted acceptance in the US. But if you hold their card thats awesome!

Mostly because it's limited in issuing, geographically.

If I lived in Hawaii, I'd get this one, lol.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Why is JCB Murakai not popular?

@enharu wrote:

Few reasons. You have to be a resident of either California or Hawaii to qualify. Not sure if they opened up to more states.

They are also very very conservative. Application method is also very traditional. You fill up an app manually, send it in, and an underwriter will look at it. There's no automated computer approvals.

It's on the discover network, which means acceptance is limited. Out of all the 4 major payment networks, this is the least accepted.

Rewards redemption cannot be done online. You have to call in.

In the US, Amex is the least accepted of the 4, discover is close to V/MC. See, from http://blogs.wsj.com/totalreturn/2014/08/28/discover-credit-card-has-risen-in-rankings-and-acceptanc...

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Why is JCB Murakai not popular?

Simple. Because the cashback is "up to" 3%, not flat 3%. It's 1% on spends up to $1K, 2% on spends between 1K and 3K and 3% above 3K.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Why is JCB Murakai not popular?

@yfan wrote:Simple. Because the cashback is "up to" 3%, not flat 3%. It's 1% on spends up to $1K, 2% on spends between 1K and 3K and 3% above 3K.

I would respectfully disagree with this answer. To some people 3k is a single purchase. I would think the general reasons have all been listed by now that are more applicable/probable.