- myFICO® Forums

- Types of Credit

- Credit Cards

- Why is JCB Murakai not popular?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Why is JCB Murakai not popular?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Why is JCB Murakai not popular?

@yfan wrote:

@FinStar wrote:You cannot have two Chase Amazon CCs (for the same individual). So realistically, not for Amazon Visa. Others, yes...but what is the realistic expectation that most individuals (forum members excluded) are going to miximize this 3%+ benefit since the greater of the population isn't going to seek 2 SallieMaes, 2 Discovers, 2 Cash+ Ccs? JCB has its niche in the marketplace and works for its limited US-domestic footprint and demographics. You don't see a whole lot of posts with folks maximizing or boasting the JCB rewards or trend value.

Right, you cannot have more than one Chase Amazon Visas for the same individual, but that's irrelevant, because the only reason you would want more than one if the cashback was limited on one card. Since the cashback on the chase Amazon card for use on Amazon is unlimited, whether one can get more than one is a moot point from a rewards perspective.

Sorry, we can't just exclude forum members, since the original question began with relative unpopularity of the JCB card, presumably on this forum. Even if it wasn't, the very premise of the question assumes users who assign high significance to rewards. For this population looking to maximize rewards, it's not at all unrealistic to have more than one of a given card if it can be obtained.

Again, you are using irrelevant assumptions. The popularity or unpopularity of JCB is only relevant to an individual's need, regardless of rewards. You seem to place an empahsis on that point yet not every individual is out chasing rewards, so that premise alone is insignificant (regardless if that counts members of this board or any others).

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Why is JCB Murakai not popular?

I think this card is a niche card. You have to live in the right area, have decent credit history, be ok with an online management system that is subpar, can live with a low limit and be ok with having an AF card.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Why is JCB Murakai not popular?

In the end, it's 1% more than the Fid Amex or Citi. So, it's an extra $100 for every $10K of general spending. In my view, for most, it's not worth the effort, HP, and new account.

For $10K of spending, one could cycle sign-up bonuses worth at least $1,500. Why would anyone jump though hoops with these guys for an extra $100?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Why is JCB Murakai not popular?

@FinStar wrote:Again, you are using irrelevant assumptions. The popularity or unpopularity of JCB is only relevant to an individual's need, regardless of rewards. You seem to place an empahsis on that point yet not every individual is out chasing rewards, so that premise alone is insignificant (regardless if that counts members of this board or any others).

No, in this discussion, that premise is the most significant. Because the sole premise to asking why the JCB card isn't popular IS its seemingly high rewards structure. Let me quote the OP:

Is there a catch or something that I don't see?

I see that 3% cash back, only a $35 AF(annual fee plus membership fee), only 13.9% APR, and a Discover card. To me, that seems better than Citi DC at 2%, CapOne QS at 1.5%. There has to be something that I'm not realizing, anyone have any thoughts on this card?

I personally think it looks a little ugly, but it seems like it does give a lot of cash back.

The question being asked in the OP here is, in essence, "Why isn't the JCB card popular despite its rewards structure?" (which specifically describes the rewards). For individuals who aren't out chasing rewards, it wouldn't make any sense to ask the question why it's not popular among them even though it has such great rewards!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Why is JCB Murakai not popular?

@Open123 wrote:In the end, it's 1% more than the Fid Amex or Citi. So, it's an extra $100 for every $10K of general spending. In my view, for most, it's not worth the effort, HP, and new account.

For $10K of spending, one could cycle sign-up bonuses worth at least $1,500. Why would anyone jump though hoops with these guys for an extra $100?

Another perspective is 3% is 50% more rewards than 2%.

Why is a 1.5% card worth the hassle and HP vs. a 1% .... why is a 2% card worth the hassle and HP vs. a 1.5%?

Sign up bonuses are finite. Only so many cards offer them & most issuers frown on churning. For me, I'd rather have a card I earn rewards on year over year vs. a one time $100 sign up bonus.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Why is JCB Murakai not popular?

@weehoo wrote:I had applied last year via snail mail. Even got a call from a nice lady and we went over my application after a 20 min phone call. Then got a denial letter a week after that stating to many recent inquiries. So far its the only card i wanted and still do not have.

Do you remember which CRAs they pulled?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Why is JCB Murakai not popular?

TU for CLI.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Why is JCB Murakai not popular?

@rlx01 wrote:

EX for app.

TU for CLI.

Thx for that ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Why is JCB Murakai not popular?

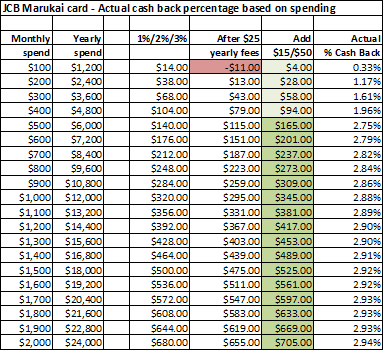

The Marukai Premium JCB card actually gives a $50 bonus if your yearly spend is at least $5K.

1% cash back on the first $1K: $20 less than 3% cash back

2% cash back on the next $2K: $20 less than 3% cash back

So if you spend over $5K every year, that $50 more than offsets the $40 difference due to lower cashback percentage for the first $3K spending, and the remaining $10 can offset the Marukai store membership fee.

To me, this is a flat 3% cashback card through and through with $25 annual fee.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Why is JCB Murakai not popular?

@longtimelurker wrote:

@yfan wrote:

@Kenny wrote:

@yfan wrote:Simple. Because the cashback is "up to" 3%, not flat 3%. It's 1% on spends up to $1K, 2% on spends between 1K and 3K and 3% above 3K.

I would respectfully disagree with this answer. To some people 3k is a single purchase. I would think the general reasons have all been listed by now that are more applicable/probable.

Right, but the question was why the card isn't popular, and I don't think you become popular by appealing to "some people". Even those who do drop 3K on one purchase on a regular basis may not want to lose out on the cashback on their first 3K. I'm not saying that the other reasons aren't valid. But as a California resident, this card is available to me, and this is THE reason I chose not to get it.

OK, but compared to what other card. On that first $3K a 1.5% card like QS would get $45, a 2% would get $60, this gets $50, and then you are earning 3% on all the rest. In addition the card gives you $10 if you spend $1000 a year, $50 if you spend more than $5000, and even the $10 makes up most of the $15 AF

$3K on a card per year is not "some people", probably quite a lot do this on cards that give less than 3%.

So while it may be your reason, I doubt if that is a lot of people's reason unless they all have less than $5k uncategorized spend.

If you can average about $500 non-category spend per month, then the card is worth it. IF you can obtain it.

TU-8: 804 EX-8: 805 EQ-8: 788 EX-98: 767 EQ-04: 752

TU-9 Bankcard: 837 EQ-9: 823 EX-9 Bankcard: 837

Total $443,800