- myFICO® Forums

- Types of Credit

- Credit Cards

- Would You Apply for a Synchrony Card Today?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Would You Apply for a Synchrony Card Today?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Would You Apply for a Synchrony Card Today?

@Jordan23ww wrote:... They closed my account after 2 or 3 months of inactivity. Back then I bought so much stuff I didn't need to go to Sam's every single month. ... Found out about the card closure when the Sam's Cashier told me my card was declined.

+1. While I don't think I had a store card closed that quickly, this type of situation is one reason among several that I decided store cards weren't something with which I cared to bother any longer. For someone who shops frequently at a certain store and gets good savings there, the cards may be worthwhile but they do tend to be closed more quickly for inactivity than a regular bank card. Add in taking a hard pull, new account FICO penalties, and another card to manage and it starts to put into question their overall value.

I like some of the other suggestions about picking another more versatile card to open with a 0% intro APR instead of the store card.

Business Cards

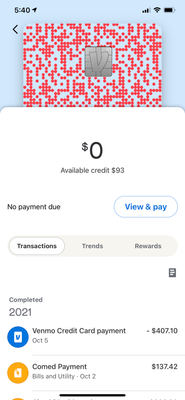

Length of Credit > 40 years; Total Credit Limits >$898K

Top Lender TCL - Chase 156.4 - BofA 99.7 - AMEX 95.0 - CITI 94.5 - NFCU 80.0

AoOA > 30 years (Jun 1993); AoYA (Feb 2024)

* Hover cursor over cards to see name & CL, or press & hold on mobile app.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Would You Apply for a Synchrony Card Today?

@Duriel wrote:I wouldn't make them the majority of my cards. I regret opening Venmo. It's been more trouble than it's worth so far.

How so?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Would You Apply for a Synchrony Card Today?

N E V E R

EVER EVER EVER

NEVER

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Would You Apply for a Synchrony Card Today?

@ridgebackpilot wrote:For background, I've never had any kind of card issued by Synchrony Bank. In general I don't like store cards and have none in my portfolio. But I need a couple of sets of new tires, and America's Tire (Discount Tire) is offering 0% interest on tire purchases if you open a Synchrony Car Care card. I got pre-qualified on their site and am considering applying.

But I've read about all the recent Synchrony card abrupt closures. I don't want that to happen to me! Would you recommend applying for a Synchrony card today? My use of the card would be pretty limited.

Although I, personally, wouldn't apply for a Sync card, in your situation, it makes sense to do it. I already have four Sync accounts--and worry every day (well, since returning to this forum a few months ago) that they'll all summarily be shut down without warning. But you're looking at your first--and if you keep it your ONLY--Sync card, so you should be okay. Buy your tires, pay your bill, see how it goes, but be very, very cautious going forward about opening any additional cards with them--and don't be shocked if this account gets closed one day out of the blue!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Would You Apply for a Synchrony Card Today?

@ridgebackpilot wrote:...But I've read about all the recent Synchrony card abrupt closures. I don't want that to happen to me!

And, this is my reason for regretting apping with them. I could always count on them for a CLI every 3 months. But, I stopped requesting CLI bc if they close or CLD, I don't want it to affect me too much. So, no, I would never app for a Synch card again.

There are also other reasons that I dislike Synch. Lose your card? Well, you're getting a new tradeline reported to the bureaus. Trigger a fraud alert with a purchase? Your balance is getting reported to the bureaus.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Would You Apply for a Synchrony Card Today?

@MrDisco99 wrote:

@Duriel wrote:I wouldn't make them the majority of my cards. I regret opening Venmo. It's been more trouble than it's worth so far.

How so?

My lowest limit ever (even beyond $700 kohls card when I was 18 or 19) and it reported so I thought I was safe to use it like a normal human being. I put my utilities on it and they reported again 7 days later. Almost maxed out.

Vantagescore 3 dropped me to poor credit for a few days then went back to normal mid 700? Hope nobody cares about that score. Ficos haven't budged outside of single digit new account drops. All still low-mid 700 depending on which model.

And I paid last Tuesday and available balance still hasn't updated. I didn't realize they were that slow. I can't imagine using the card as a daily driver. Balances aren't high for my income or in general. Other lenders just seem to be better, and sync has known me over a year.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Would You Apply for a Synchrony Card Today?

@ridgebackpilot @Syn is a prime lender, the cases I've seen of ppl getting their accounts closed is for having multiple cards and/or high exposure with very little use.

I only have one (PayPal credit), no problems.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Would You Apply for a Synchrony Card Today?

Sure if suits your needs. Lowes for example is a great card I have used for fenc financing and the likes. Most of their cards aren't my cup of Tea, but have the lowes which serves a purpose especially for the new house I am building now(fence and other odds and end will go on it). I wouldn't just have Sync though for utilization padding and the likes and try to get 100kish in credit with them. At 50k sync. exposure; use verizon card for monthly Verizon bill auto drafted and use lowes when needed use it every 5-6 months to keep alive for big projects.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Would You Apply for a Synchrony Card Today?

For tires, I wouldn't esp seeing as the use would be limited. For me personally, I would. I already prequalify for their Lowes card and seeing as my husband wants it but can't get it, it's something I would get for him to use.

Goal Cards:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Would You Apply for a Synchrony Card Today?

Probably not. I have two sync cards, and I feel like Synchrony is entropy in my life.