- myFICO® Forums

- Types of Credit

- Credit Cards

- best cash back cards combination for general spend...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

best cash back cards combination for general spending

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: best cash back cards combination for general spending

@Open123 wrote:

@KennyRS wrote:I literally charge an extremely small amount to my card each month. Each card that I have gets half of my cell phone bill about 30 each and I pay 28 and let 2 dollars report on each. lol But, one could really (if they wanted to get the biggest bang for the buck so to speak) only buy like a 1 or 2 dollar Amazon gift card on their card and let that report a balance each month. Easy, easy money with this card. Not life changing, but a good deal.. period.

This is what I had in mind, but wasn't certain a small charged paid would qualify as the "minimum" payment threshold for the bonus. If it does, I'll get this card just for the freebies per quarter & BofA checking bonus.

It absolutely does.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: best cash back cards combination for general spending

Whenever Themanwhocan (who is right about everything else!) posts this, I just think "that's wrong in any meaningful way". If I can get away with paying 1c, the percentage would be huge and even though in reality is has to be more than that you can have a big percentage. But it just doesn't scale. Without an unrealistic number of BBR cards, I cannot structure my transactions to take advantage of this. It really is best thought about as just $25 per quarter per card. What's needed is good scalable percentages (which is why I use Blue Cash!). So yes, a free $100 a year, but whether that is exciting/worth the effort depends on the person.

Ecactly... I have the 123 rewards & was about to sock-drawer it (and the BCE) and get a Sallie Mae for gas & groc @ 5% when I looked at the Balance Rewards card again and figured hell I can take an extra $120 a year for free so I had them convert the 123 over, and maybe now I find that I might can get two more cards and make that a free $360... sure why not!?!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: best cash back cards combination for general spending

@longtimelurker wrote:

@KennyRS wrote:

@Themanwhocan wrote:You are missing Bank of America Better Balance Rewards. Setup a small monthly bill to charge to that card, then setup auto pay in full... And get $25 every 3 months.

For example, if I Charged $46 a month to the card (my DSL bill), that would be over 18% cash back. And its possible to get multiple cards, someone here has 3 of them. You could charge $166 each month, and get 5% cash back. A good way to cover those bills that just don't have a corresponding credit card category.

I literally charge an extremely small amount to my card each month. Each card that I have gets half of my cell phone bill about 30 each and I pay 28 and let 2 dollars report on each. lol But, one could really (if they wanted to get the biggest bang for the buck so to speak) only buy like a 1 or 2 dollar Amazon gift card on their card and let that report a balance each month. Easy, easy money with this card. Not life changing, but a good deal.. period.

Whenever Themanwhocan (who is right about everything else!) posts this, I just think "that's wrong in any meaningful way". If I can get away with paying 1c, the percentage would be huge and even though in reality is has to be more than that you can have a big percentage. But it just doesn't scale. Without an unrealistic number of BBR cards, I cannot structure my transactions to take advantage of this. It really is best thought about as just $25 per quarter per card. What's needed is good scalable percentages (which is why I use Blue Cash!). So yes, a free $100 a year, but whether that is exciting/worth the effort depends on the person.

lol I agree. The blue cash is infinitely better with spend behind it. This is just a freebie, good freebie, but not life changing like uncapped 5% rewards with the right spend. (Still not LIFE CHANGING but pretty freaking good! LOL)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: best cash back cards combination for general spending

@KennyRS wrote:lol I agree. The blue cash is infinitely better with spend behind it. This is just a freebie, good freebie, but not life changing like uncapped 5% rewards with the right spend. (Still not LIFE CHANGING but pretty freaking good! LOL)

Right, call me frugal (or, cheap) and openly mercenary, but I'm taking the $30 per quarter freebie anyway, in addition to everything else! LOL

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: best cash back cards combination for general spending

@longtimelurker wrote:

@KennyRS wrote:

@Themanwhocan wrote:You are missing Bank of America Better Balance Rewards. Setup a small monthly bill to charge to that card, then setup auto pay in full... And get $25 every 3 months.

For example, if I Charged $46 a month to the card (my DSL bill), that would be over 18% cash back. And its possible to get multiple cards, someone here has 3 of them. You could charge $166 each month, and get 5% cash back. A good way to cover those bills that just don't have a corresponding credit card category.

I literally charge an extremely small amount to my card each month. Each card that I have gets half of my cell phone bill about 30 each and I pay 28 and let 2 dollars report on each. lol But, one could really (if they wanted to get the biggest bang for the buck so to speak) only buy like a 1 or 2 dollar Amazon gift card on their card and let that report a balance each month. Easy, easy money with this card. Not life changing, but a good deal.. period.

Whenever Themanwhocan (who is right about everything else!) posts this, I just think "that's wrong in any meaningful way". If I can get away with paying 1c, the percentage would be huge and even though in reality is has to be more than that you can have a big percentage. But it just doesn't scale. Without an unrealistic number of BBR cards, I cannot structure my transactions to take advantage of this. It really is best thought about as just $25 per quarter per card. What's needed is good scalable percentages (which is why I use Blue Cash!). So yes, a free $100 a year, but whether that is exciting/worth the effort depends on the person.

Its all in how you look at it, I guess. I don't carry loose change around anymore. I haven't for at least a few years. But, when I see a dime on the sidewalk, I still stop and pick it up. Because you know what, thats free money.

I still don't know what i should do with these dang dimes though. Its too much of a hassle to carry em around in case I might want to buy something extremely inexpensive.

Lucky dimes? Bah!

TU-8: 804 EX-8: 805 EQ-8: 788 EX-98: 767 EQ-04: 752

TU-9 Bankcard: 837 EQ-9: 823 EX-9 Bankcard: 837

Total $443,800

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: best cash back cards combination for general spending

@longtimelurker wrote:

@Themanwhocan wrote:

@longtimelurker wrote:Why not the Quicksilver? That earns 1.5% everywhere else, which isn't covered by having multiple cards.

Covered by the Fidelity Amex at 2%, as well as by multiple Better Balance Rewards cards at 5% or better.

Um no. So just had a total of $10K charge at a place that doesn't take Amex. Quicksilver gives me $150 back on this, how does the BBR cover this (in a reasonable way!)

If you are spending that much on non-category spending at places that don't accept Amex, AND if you really wanted the best credit card to use (and if you could ignore the fact that we're talking relatively small amounts of additional cash back)... Then you might want the Fidelity VISA card instead of the CapitalOne Quicksilver card.

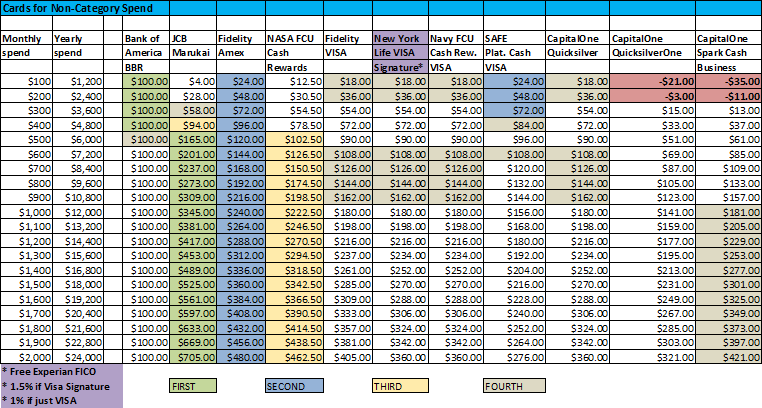

BUT...Actually... I just made a new chart, and just felt like posting it ![]() So...

So...

TU-8: 804 EX-8: 805 EQ-8: 788 EX-98: 767 EQ-04: 752

TU-9 Bankcard: 837 EQ-9: 823 EX-9 Bankcard: 837

Total $443,800

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: best cash back cards combination for general spending

All other cards may look better but in actual usage can't pare to the BC.

AMEX 12/2013 ---BCP $12,000 === BC $23,000 ----- 04/2014

CHASE SLATE $5,700 === 12/2013

BoA 123 $6000 === 12/2013

Barclay Rewards $1500 == 12/2013

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: best cash back cards combination for general spending

@Fico2Go wrote:

After comparing all the cards on the market, albeit 2%, 3%, 4%, 5%, 6% .the only one I know that has consistently payout $209 to $400 in Cashback each and every month for me is the AMEX blue cash.

All other cards may look better but in actual usage can't pare to the BC.

That is mathematically impossible if you are using the right cards you can do way better. Although like everyone has said it really depends on what your personal spend is on.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: best cash back cards combination for general spending

@kawaiiguy wrote:

@Fico2Go wrote:

After comparing all the cards on the market, albeit 2%, 3%, 4%, 5%, 6% .the only one I know that has consistently payout $209 to $400 in Cashback each and every month for me is the AMEX blue cash.

All other cards may look better but in actual usage can't pare to the BC.That is mathematically impossible if you are using the right cards you can do way better. Although like everyone has said it really depends on what your personal spend is on.

For me I think it really depends how much work do you want to put into it. You may be able to maximize cash back but at what cost, continually having to goto Walmart to liquidate GC or whatever?

EX Fico 804 11/16/16 Fako 800 Credit.com 11/16/16

EQ SW bank enhanced 11/16/16 839 CK fako 822 11/16/16

TU Fico discover 10/19/16 814 Fako 819 Creditkarma 11/16/16

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: best cash back cards combination for general spending

@mongstradamus wrote:

@kawaiiguy wrote:

@Fico2Go wrote:

After comparing all the cards on the market, albeit 2%, 3%, 4%, 5%, 6% .the only one I know that has consistently payout $209 to $400 in Cashback each and every month for me is the AMEX blue cash.

All other cards may look better but in actual usage can't pare to the BC.That is mathematically impossible if you are using the right cards you can do way better. Although like everyone has said it really depends on what your personal spend is on.

For me I think it really depends how much work do you want to put into it. You may be able to maximize cash back but at what cost, continually having to goto Walmart to liquidate GC or whatever?

Not sure why it is mathematically impossible, AFAIK 5% uncapped is the highest there is (which "translates" to a min of 4% outside the bonus categories). And I agree it depends how much work you put into it, though perhaps the question is how much work you NEED to put into to it, which depends very much on geography and how the needed stores fit in with your daily habits. For some, it is very little extra work.