- myFICO® Forums

- Types of Credit

- Credit Cards

- Re: tracking bce $6,000 grocery spend

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

tracking bce $6,000 grocery spend

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: tracking bce $6,000 grocery spend

Agreed^

I don't have a single store near me on that list. The whole "supermarket" thing is what's questionable, if it was an actual "grocery" category, then i think more merchants might code under the spend we're looking for.

I haven't ever dug too deep into what is actually earning what, i only know that Safeway codes for this category, or at least did once.

Because it's chore to go back further than teh most recent statement, I often don't. Plus I forgot how to see whuch merchant codes as what.

I did it a couple times, but recently haev been unable to find that feature.

This is one big reason I've held off on the BCP offer. I don't need two cards that do not code what I need them to.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: tracking bce $6,000 grocery spend

The whole grocery v supermarket thing was what kept me from apping earlier than I did, because I couldn't figure out if my usual grocery store would code as supermarket with Amex.

When I read that Aldi (which is similar) codes for supermarket, I took the chance (since there was a 300SUB, it made up for the AF if I was wrong), and I'm happy to report that Lidl report for the 6%, so I'm glad I have the card.

In addition, all of my Audible spend is coding at 6%/streaming, not just the recurring charges, so this card is pretty nice for me.

I do agree, though, that people need to pay attention and read the fine print to see if the card is actually beneficial to them before going for it.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: tracking bce $6,000 grocery spend

@bergrides wrote:

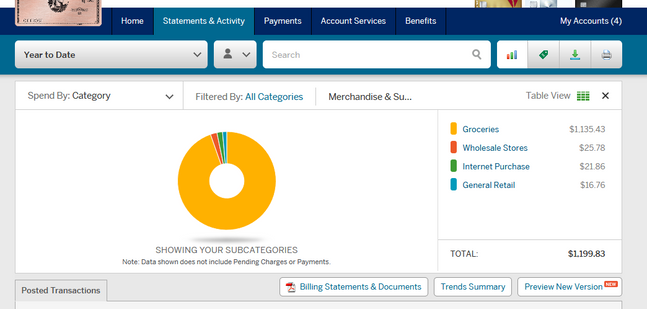

@Anonymous wrote:goto statement and activities

select year to date from drop down

click the merchanidise and supplies part of the pie

you should then see how much is grocery

(ps, shockingly, I am spending less on grocery than I thought, more reason that amex airline fee credit change may negatively impact its value for me)

FortifiedHM - This will show you everything in the Grocery classification, but that includes grocery items that do not count against the Grocery reward, and therefore don't go against the 6K limit. For instance mine shows the meat market and wine store I go to,which doesn't count.

Got to the graph, just don’t see how to shuw sub categories instead of just general categories. Unlies I have to go to my desktop instead of my iPad.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: tracking bce $6,000 grocery spend

@calyx wrote:The whole grocery v supermarket thing was what kept me from apping earlier than I did, because I couldn't figure out if my usual grocery store would code as supermarket with Amex.

When I read that Aldi (which is similar) codes for supermarket, I took the chance (since there was a 300SUB, it made up for the AF if I was wrong), and I'm happy to report that Lidl report for the 6%, so I'm glad I have the card.

In addition, all of my Audible spend is coding at 6%/streaming, not just the recurring charges, so this card is pretty nice for me.

I do agree, though, that people need to pay attention and read the fine print to see if the card is actually beneficial to them before going for it.

Before I apped for the card, I made sure the grocery stores I use were on the list, and the grocery store 6% has earned me over $282 in rewards in less than 8 months, making it worthwhile. I have 3 to 4 adults (4 when son is home from college) to grocery shop for, so I spend 400 - 800 at the grocery store a month, so I will run through the 6K. In the less than 8 months I have had the card, I have earned about $431 in rewards, so I made my AF back a while ago.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: tracking bce $6,000 grocery spend

@Anonymous wrote:

EDIT: The break even point on BCE/BCP is closer to the $3000 mark. That would be where you have covered the annual fee, and start to see a greater return using the BCP.

I feel like this is such an easy number to hit that the BCP should be worth it to almost everyone. I mean how could you not spend over 3k/year in groceries. Thats $250/month. Even if you are single with no kids

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: tracking bce $6,000 grocery spend

@Anonymous wrote:

@Anonymous wrote:

EDIT: The break even point on BCE/BCP is closer to the $3000 mark. That would be where you have covered the annual fee, and start to see a greater return using the BCP.

I feel like this is such an easy number to hit that the BCP should be worth it to almost everyone. I mean how could you not spend over 3k/year in groceries. Thats $250/month. Even if you are single with no kids

I do a lot of shopping at Costco (doesn’t take amex) and target (not coded as supermarket) do i have to see if the bcp is worth it. But i sm thinking if i buy amazon gc at a grocery store, andget 6% off of it, i t will make the bcp worth it, and don’t have to wait until I’m under 5/24 to get tge chase amazon prime visa.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: tracking bce $6,000 grocery spend

I assume you are aware some stores where you buy grocery doesn't count as grocery for amex (WMT, TGT)?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: tracking bce $6,000 grocery spend

@Anonymous wrote:I assume you are aware some stores where you buy grocery doesn't count as grocery for amex (WMT, TGT)?

Walmart and Target aren't grocery stores, they're discount stores/superstores that also sell groceries. It makes sense to not let someone go get 6% back on a new TV.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: tracking bce $6,000 grocery spend

I also get most groceries at Costco.

Has Amex been sending you any targeted upgrade offers? You don't need a spreadsheet to tell if the card is worth trying for a year if they're offering $250 or $150 and a waived 1st year AF.

I recently upgraded to BCP for $250/$1k spend. I'll try it for a year and see how merchants code.

*If you feel on the fence about it, maybe the thing to do is to wait for a nice upgrade offer.

Business use: Amex Bus. Plat., BBP, Lowes Amex AU, CFU AU

Perks: Delta Plat., United Explorer, IHG49, Hyatt, "Old SPG"

Mostly SD: Freedom Flex, Freedom, Arrival

Upgrade/Downgrade games: ED, BCE

SUB chasing: AA Platinum Select

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: tracking bce $6,000 grocery spend

For those of you that say you can easily burn through the 6k in supermarkets in just a few months, you may want to look at the Amex Gold card and do the math. It has a $250 annual fee, but it gives 4X points at supermarkets (assuming you are willing to go the points route instead of the cash back route) and it gives the 4X multiplier for up to $25k! Depending on your needs, the benefits of the gold might be better also. I plan to make the BCP my first Amex in a couple of months when my BK13 celebrates it's 5th birthday, but I might replace that with a gold next year if I see my grocery spend is high enough.