- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Credit in the News

- Re: 5 Things ... When Your Credit Score Reaches 76...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

5 Things ... When Your Credit Score Reaches 760

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

5 Things ... When Your Credit Score Reaches 760

5 Things to Consider Doing When Your Credit Score Reaches 760

- Negotiate for Better Terms on Your Credit Cards

- Apply for a Better Credit Card

- Refinance Your Mortgage and Reduce Your Monthly Payment

- Pay Off Credit Card Debt Without Paying Interest

- Revisit Your Car Insurance Premiums

Your FICO credit scores are not just numbers, it’s a skill.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 5 Things ... When Your Credit Score Reaches 760

@Medic981 wrote:5 Things to Consider Doing When Your Credit Score Reaches 760

- Negotiate for Better Terms on Your Credit Cards

- Apply for a Better Credit Card

- Refinance Your Mortgage and Reduce Your Monthly Payment

- Pay Off Credit Card Debt Without Paying Interest

- Revisit Your Car Insurance Premiums

I have scores in the 730's across all 3 Cra's (primary reason for low scores is AAoA). I alwayse PIf on all CC acounts, so I never pay intrest. Since I alwayse PID, I really don't care what The APR is. I have had no problems getting the cards I need.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 5 Things ... When Your Credit Score Reaches 760

It can't hurt to negotiate better APR, just because you can PIF now doesn't mean forever. One day a person may need it for emergency, and a lower APR is nice to have in that instance.

And for those who can get better Auto rates, is a nice perk too. Paying a higher rate due to lower scores is almost like paying interest, when you shouldn't have to?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 5 Things ... When Your Credit Score Reaches 760

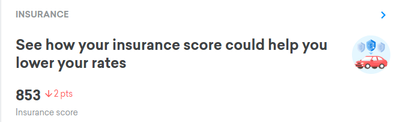

This is good information, thanks. But regarding rates my understanding is that insurance companies do not use your Fico scores to set your rates as seen in CK (below). And the insurance score has a much higher top # and tiers are different where my insurance score of 853 is not considered great. One of the gurus posted this information with ratings associated with insurance scores. I was going to do this until I read that post. I'll try to find it. Couldn't get a straight answer from my insurance as to the last time my score was checked and not sure I want to risk a change considering I was in an accident last year. Not my fault but since that's part of the risk factor I'm going to leave it be now as my rates are good. But I will be checking on APR. Re-fi'd home last year.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 5 Things ... When Your Credit Score Reaches 760

Here it is.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 5 Things ... When Your Credit Score Reaches 760

@Trudy wrote:And the insurance score has a much higher top # and tiers are different where my insurance score of 853 is not considered great.

This is direct from TransUnion: "Typical insurance scores range from 200 to 997; a good score is usually around 770 or higher. If your insurance score is low, that means that you’re potentially a higher insurance risk, and that you may end up paying a higher premium each month."

I also posted that back in April in the thread you linked to above. When I check my auto insurance score, Credit Karma says something to the effect of 'based on your profile you probably won't save much by switching car insurance'. I have an 820 TU Auto CBIS score on CK.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 5 Things ... When Your Credit Score Reaches 760

IMHO, Credit Score should even be considered for Ins. I've not been in an accident for years, yet get dinged due to a low score. It consistently hoves in the 740 range, and may have even been lower at the time I switched Insurance Company. I also do not know how often they check my score. That said I recently had my rate lowered for being accident/ticket free the past 6 years. Which is nice, as it's almost $100 savings over 6 months. Unfortunately I was involved in a hit and run a couple weeks back, so now I'm just waiting to see how that will affect my rate. lol

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 5 Things ... When Your Credit Score Reaches 760

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 5 Things ... When Your Credit Score Reaches 760

How does one negotiate their APR down? is this common?

im closing in on 760 and should be there within a month. 7 of 8 cards are over 22%

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content