- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Credit in the News

- Re: Americans are suddenly defaulting on their cre...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Americans are suddenly defaulting on their credit cards

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Americans are suddenly defaulting on their credit cards

I think this article explains some other things, such as why Synchrony is so stubborn on giving out CLI's on my Amazon card (requiring at least 650 TU) and why my new Walmart card will probably have a low SL starting out. I actually didn't go into Ch 7 BK until 2014 though that was in large part the result of things that happened during '08-'10. Will have to take especial care from here on out (this is a good incentive to, among other things, pay down my secured card, transfer the balance when I can do it without jacking up util, and close it out to consolidate my portfolio).

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Americans are suddenly defaulting on their credit cards

@Thomas_Thumb wrote:

@gdale6 wrote:I have been letting balances rise and am hording the cash converted into metals. I have always had a plan should the economy start to go off its track.

Ok - it looks like you are targeting one of the five investments, metals, recommended in "The Death of Money" by James Rickards. Key point is it should be in physical form (coins or bullion). Industrial metals not included in the portfolio. The other four investments - per the book - are:

- Land (either undeveloped in a prime location or with agricultural potential). NOT land with structures.

- Fine art including the broader range of collectibles such as true classic cars. Low weight portable collectibles are best per James because they are portable.

- Alternative funds (natural resources, water, energy). Maybe a wind or solar energy farm. Perhaps a water desalination plant.

- Cash (this is needed and serves a needed purpose at least until a calamity occurs)

I'm not sold on what James Rickards advocates but, I do believe undeveloped and farm land has long lasting staying power regardless of money devaluation. Land can be leased to those that farm - no need to run a farming operation on it directly. By brother in law has a house on 64 acres of land on the edge of urbanization. He leases 40 areas to a farmer. He paid under $2000/acre 20 years ago and could get upwards of $20,000/acre today based on nearby land sales to developers. Nice low taxes due to farming.

Physical precious is what I purchase and in coin form. I have never invested in the paper markets for such.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Interesting...CC defaults up significantly

@Revelate wrote:Seems like MSN is late to the party as were talking about this back in April, FWIW I saw the increase in defaults starting in 11/2016 in my Lending Club account (I was soley in the 3 bottom tranches) though I wasn't smart enough to think this was a full market issue.

I'm not certain what the data suggests really as it's still well within historical norms as the average is like 5% historically looking at one of their other charts; though of course the spike is what they're looking at... that said based on my April / May LC results I suspect Q2 Synchrony isn't going to be much better.

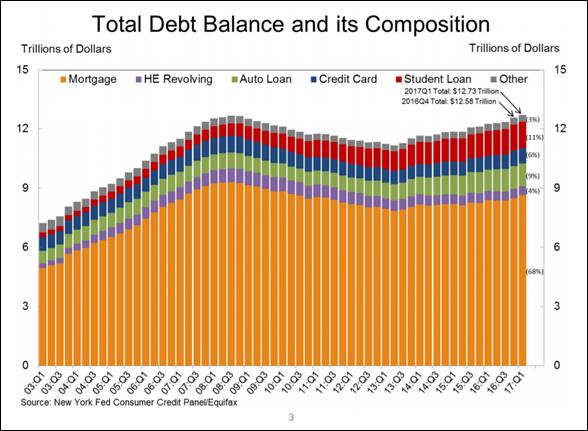

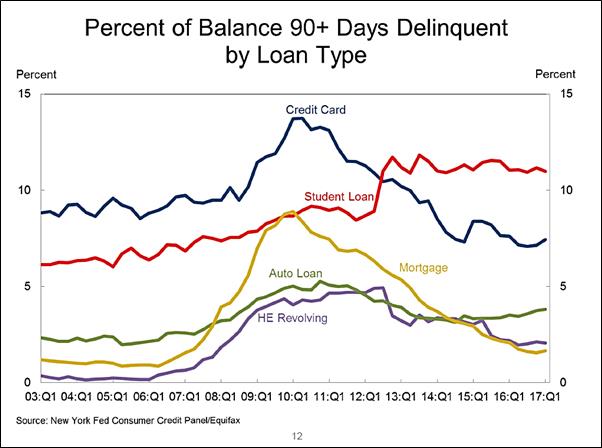

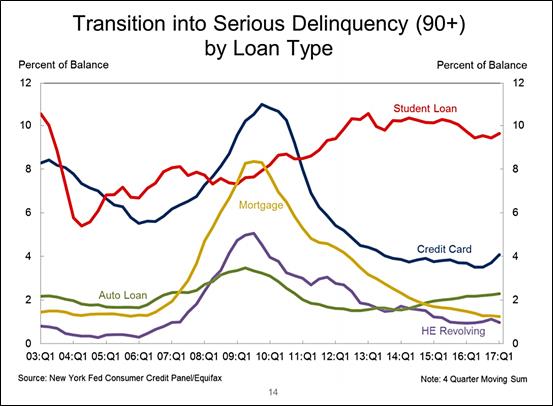

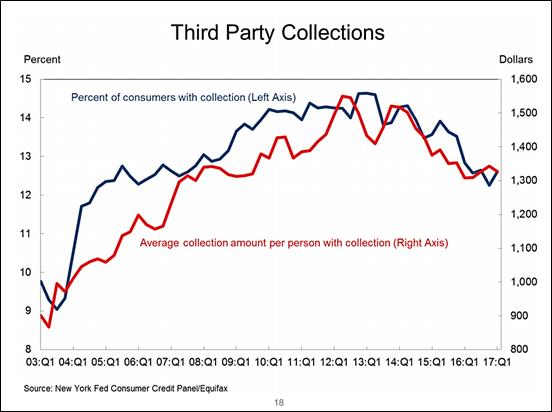

For those who like data - Below is a link to the most recent quarterly report on household debt and credit (May 2017) and a few graphs from the report:

https://www.newyorkfed.org/medialibrary/interactives/householdcredit/data/pdf/HHDC_2017Q1.pdf

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Americans are suddenly defaulting on their credit cards

You can only live a $75k lifestyle on $45k income for so long before it catches up to you.

I'm not repeating the financial mistakes I made in the past. However many people I know did not learn their lessons, simply because of their mentality....

Some of my favorite excuses are.......

Little man can't get ahead.

You will always have a car payment.

My employer is a tight was.

Comparing themselves to others....spending to impress.

The list could get long......

I'm not the 1%. Nowhere near it. But I've made choices and decisions so I don't have to participate in the next economic downturn.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Americans are suddenly defaulting on their credit cards

Interesting how Amex being so selective results in fewer defaults. Not shocking though. I hate to say this but for many Americans, credit cards are "Free money" I have so many friends who spend recklessly on dining and entertainment. 5 bucks here, 5 bucks there. it all adds up.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Americans are suddenly defaulting on their credit cards

What I find to be most troublesome are people on this forum that are at say 60% aggregate utilization on their credit cards and are in the CC forum asking for advice on which card to app for next, or "would I be approved if I applied for..." threads. These people can't even pay off the 60% utilization they have now in a reasonable amount of time (a couple of years?) yet they're perfectly willing to open the door to take on more debt. I feel like this is a major problem. The chances of this behavior ending well is slim to none.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Americans are suddenly defaulting on their credit cards

^^ Combine that with 70% of Americans living paycheck to paycheck.

How the heck are resturants and malls packed every weekend? Am I supposed to believe its the other 30%? hahahaha

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Americans are suddenly defaulting on their credit cards

@Anonymous wrote:What I find to be most troublesome are people on this forum that are at say 60% aggregate utilization on their credit cards and are in the CC forum asking for advice on which card to app for next, or "would I be approved if I applied for..." threads. These people can't even pay off the 60% utilization they have now in a reasonable amount of time (a couple of years?) yet they're perfectly willing to open the door to take on more debt. I feel like this is a major problem. The chances of this behavior ending well is slim to none.

@+ the cheering section pushing them on to ask for more and more CLI's w/o asking any info to determine if said person is already where they need to be... I am sure everyone doesn't need or qualify to have a 25k CL...just b/c someone has a 30k or so @ Lowes,etc.... doesn't mean we all need one...It's not for util. if you using 60+ %.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Americans are suddenly defaulting on their credit cards

I agree. Too often we preach greater limits, more cards, etc. (I'm guilty of this as well) when we should be preaching more about sound, healthy credit behavior.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Americans are suddenly defaulting on their credit cards

We make less than $100k a year. Every dollar coming in, is accounted for......right down to the latte from Starbucks. A real budget has given us so much freedom.

We get mocked by friends and some family because we don't drive the latest cars, have the biggest tv, etc. But what amuses me is when life happens to them, like a transmission going out in the car......to them it's a financial panic attack. To us it's a minor inconvenience. I also find it funny how many of them make a lot more than we do, but can't even cover something minor like battery or alternator.

Don't even get me started about job losses either.......

Sometimes it's not how much you make, but how you manage what you do make.