- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Credit in the News

- Re: Building Credit - 29.99% interest rates

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Building Credit - 29.99% interest rates

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Building Credit - 29.99% interest rates

“The 30% threshold definitely seems to be an important psychological barrier,” Ted Rossman, industry analyst for CreditCards.com, said in the report. “These cards are issued by banks headquartered in Delaware, South Dakota and Connecticut — three states that do not have maximum credit card rates. So, they could charge more, but they’re choosing not to.”

-CNBCMoney

Is it just not having the credit to get a 0% interest rate card? Or Credit to support a 15% interest rate card? Or lack of knowledge that this is a bad interest rate?

Why is it so easy to sucker people in. And if it's happened to you no shame, but can you explain why?

FICO 8 scores 03/2022

EX-680

TU-732

EQ-749

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Building Credit - 29.99% interest rates

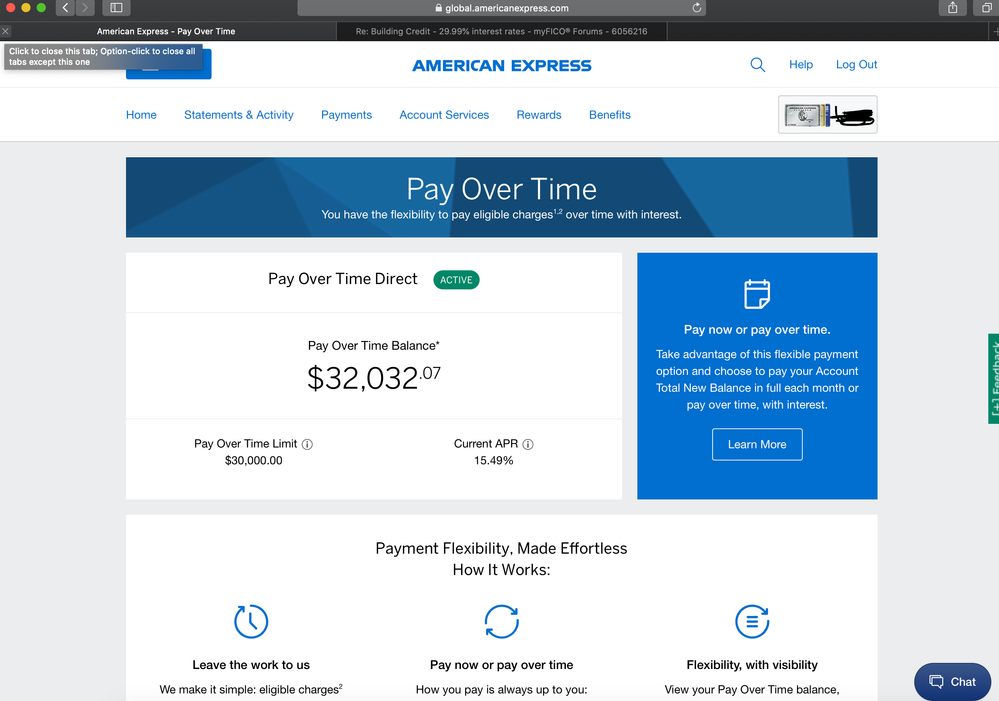

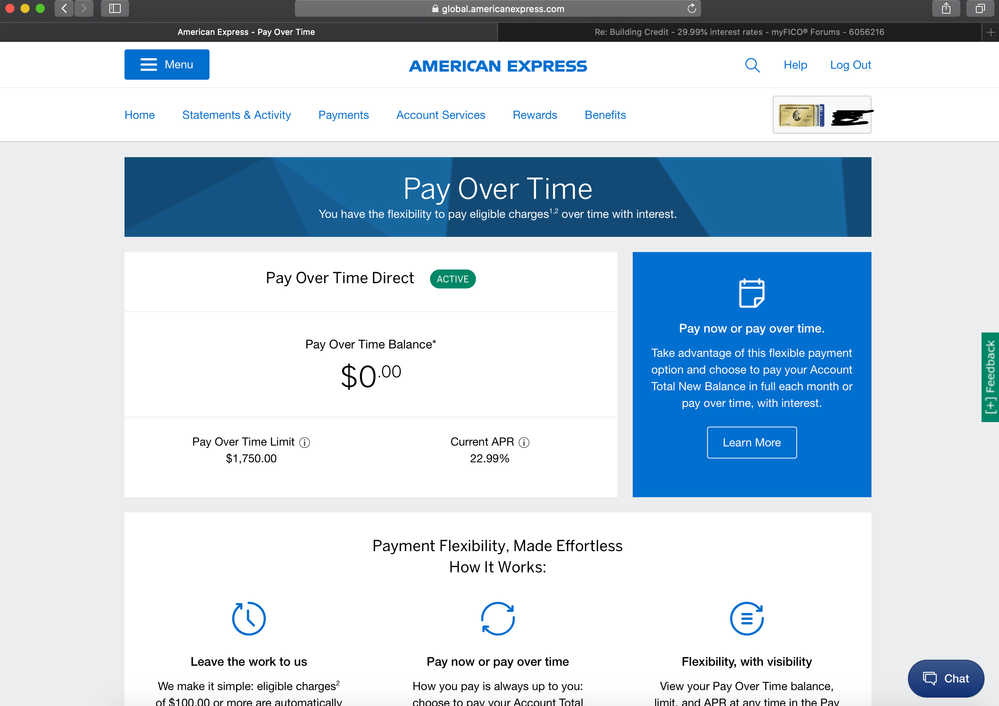

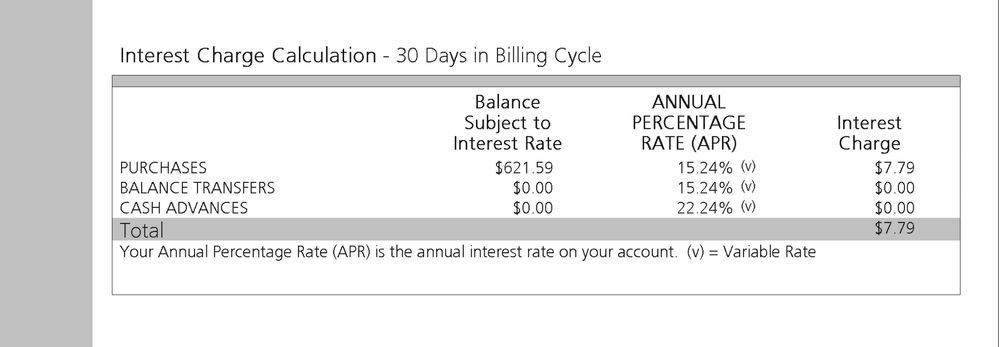

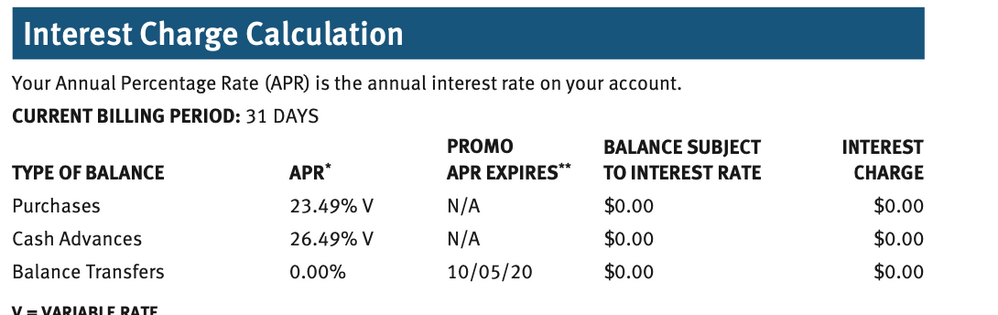

Could you please screenshot interest rates on your cards, this requires a proper context, and considering your credit age is in infancy, it would be a fun experiment

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Building Credit - 29.99% interest rates

I mean, you dont have to, you probably got as close to highest one on Amex cards, because no history, no ability to tell how you will behave over time.

If one is paying interest, diluting themselves into thinking there is a difference between 24.99% and 29.99% is just silly.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Building Credit - 29.99% interest rates

@californiaboy935 wrote:“The 30% threshold definitely seems to be an important psychological barrier,” Ted Rossman, industry analyst for CreditCards.com, said in the report. “These cards are issued by banks headquartered in Delaware, South Dakota and Connecticut — three states that do not have maximum credit card rates. So, they could charge more, but they’re choosing not to.”

-CNBCMoney

Is it just not having the credit to get a 0% interest rate card? Or Credit to support a 15% interest rate card? Or lack of knowledge that this is a bad interest rate?

Why is it so easy to sucker people in. And if it's happened to you no shame, but can you explain why?

I can see this being moved from the Credit Cards forum, just FYI.

You have answered your own questions really. Regular people out there are not as well-versed about credit as many here are; therefore, when they have bad credit and have tried for a prime card only to be turned down, they apply for the First Premier, Credit One, Bank of Missouri et. al. card offers that come to their mailbox.

I believe a lot of people misunderstand secured credit cards and there is a psychological barrier to sending a bank $200-$500 to secure a good credit card because the above mentioned banks will offer them an "unsecured" card. Oddly enough, once those First Premier fees are tacked onto the card, the card holder might as well have sent $200 to Citibank, Capital One or Discover for a good secured card.

Provided the card has a grace period and the card holder never pays any interest, the interest rate is of no consequence.

I will not judge people that fall for these types of cards; and there are people that cannot get a secured card for one reason or another so these cards are their stepping stone. I will also not judge the banks for trying to make a buck. It is everybodies responsibility to understand what they are applying for and to make a decision that best suits them and their needs.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Building Credit - 29.99% interest rates

I've inserted the link to the article you were quoting, because when article is added, the title of your thread is somewhat misleading.

This has very little to do with credit building, and everything to do with store cards, which fall under "It is what it is".

Credit building and associated APRs are whole another animal.

That's why we should include links to articles and not a tiny quote that's completely off the mark.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Building Credit - 29.99% interest rates

@Remedios wrote:I've inserted the link to the article you were quoting, because when article is added, the title of your thread is somewhat misleading.

This has very little to do with credit building, and everything to do with store cards, which fall under "It is what it is".

Credit building and associated APRs are whole another animal.

That's why we should include links to articles and not a tiny quote that's completely off the mark.

Sorry wasnt trying to spread misinformation. Just looking for clear insight. Will be posting my interest rates on here ASAP. Stand by.

FICO 8 scores 03/2022

EX-680

TU-732

EQ-749

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Building Credit - 29.99% interest rates

@californiaboy935 wrote:

@Remedios wrote:I've inserted the link to the article you were quoting, because when article is added, the title of your thread is somewhat misleading.

This has very little to do with credit building, and everything to do with store cards, which fall under "It is what it is".

Credit building and associated APRs are whole another animal.

That's why we should include links to articles and not a tiny quote that's completely off the mark.

Sorry wasnt trying to spread misinformation. Just looking for clear insight. Will be posting my interest rates on here ASAP. Stand by.

There is no need.

Had the article actually talked about what the title says, it would be relevant, but that's not what the article is about.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Building Credit - 29.99% interest rates

When rebuilding or building credit the ability to obtain credit far outweighs the interest rates. My cards have interest rates of 27.24%, 24.71%, 21.49%. I don't ever carry a balance on any of them so the interest rates are irrelevant to me. However the responsible handling of these credit limits will lead to access to other credit lines with lower rates in the future.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Building Credit - 29.99% interest rates

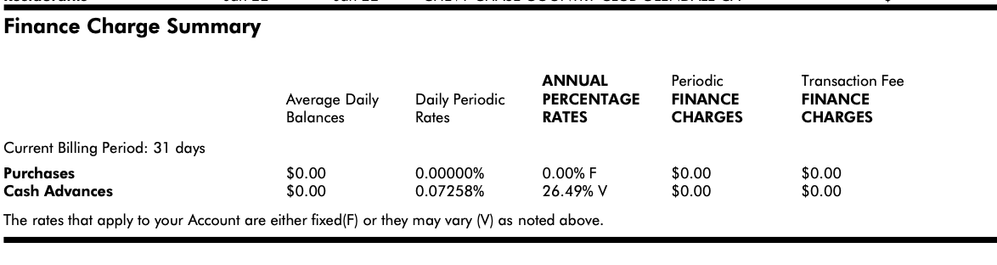

Here is my interest rates as of yet. I haven't encountered 29.99%. I would really like to know if they are okay for first timer... or just meh.

FICO 8 scores 03/2022

EX-680

TU-732

EQ-749

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Building Credit - 29.99% interest rates

@Anonymous wrote:

@californiaboy935 wrote:“The 30% threshold definitely seems to be an important psychological barrier,” Ted Rossman, industry analyst for CreditCards.com, said in the report. “These cards are issued by banks headquartered in Delaware, South Dakota and Connecticut — three states that do not have maximum credit card rates. So, they could charge more, but they’re choosing not to.”

-CNBCMoney

Is it just not having the credit to get a 0% interest rate card? Or Credit to support a 15% interest rate card? Or lack of knowledge that this is a bad interest rate?

Why is it so easy to sucker people in. And if it's happened to you no shame, but can you explain why?

I can see this being moved from the Credit Cards forum, just FYI.

You have answered your own questions really. Regular people out there are not as well-versed about credit as many here are; therefore, when they have bad credit and have tried for a prime card only to be turned down, they apply for the First Premier, Credit One, Bank of Missouri et. al. card offers that come to their mailbox.

I believe a lot of people misunderstand secured credit cards and there is a psychological barrier to sending a bank $200-$500 to secure a good credit card because the above mentioned banks will offer them an "unsecured" card. Oddly enough, once those First Premier fees are tacked onto the card, the card holder might as well have sent $200 to Citibank, Capital One or Discover for a good secured card.

Provided the card has a grace period and the card holder never pays any interest, the interest rate is of no consequence.

I will not judge people that fall for these types of cards; and there are people that cannot get a secured card for one reason or another so these cards are their stepping stone. I will also not judge the banks for trying to make a buck. It is everybodies responsibility to understand what they are applying for and to make a decision that best suits them and their needs.

Thank you for your response. I feel the same way. I think interest is dumb, but during these times many of our lowest income people have to rely on Credit Cards as their only form of "Income" and many have high interest rates such as this. I think that during COVID and marker downturn many of the most succeptable markets for these card issuers are hurting and banks take advantage of this.

FICO 8 scores 03/2022

EX-680

TU-732

EQ-749