- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Credit in the News

- Re: HSBC leaving US.

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

HSBC leaving US.

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: HSBC US sells retail banking, loans, and credit cards to Citizens Bank (RI)

They used to their own version of what CapOne called their "Blank Check" program for vehicle purchases. Because of HSBC I was able to buy my first 2 houses. Sucks they never gained any real tractions with on the auto lending side.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: HSBC US sells retail banking, loans, and credit cards to Citizens Bank (RI)

@Anonymous wrote:

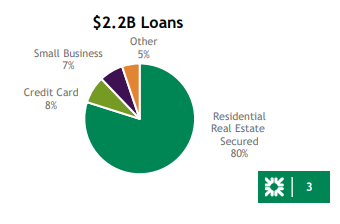

But if you look at the Citizens website, they provide a more detailed breakdown of that $2.2B. It sure looks like they're buying credit card accounts from HSBC.

2021-branch-acquisition-presentation-final.pdf (citizensbank.com)

Not sure if this means they're taking over the CC portfolio itself or in effect ownership of the existing debt and authority to collect it.

FICO 8 (EX) 846 (TU) 850 (EQ) 850

FICO 9 (EX) 850 (TU) 850 (EQ) 850

$1M+ club

Artist formerly known as the_old_curmudgeon who was formerly known as coldfusion

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: HSBC US sells retail banking, loans, and credit cards to Citizens Bank (RI)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: HSBC leaving US.

I hate to be "that guy", but I feel there are a lot of assumptions being made in this thread.

In my experience with HSBC, this isn't anything new. Back in the 2008/2009 period, HSBC sold off tons of Retail assets as well. One thing they've been consistent in overtime however is their reinforcement of continuing to do business with those clients deemed Premier status or above.

If you look through the press releases, yes, they are getting rid of a lot of branches, but they are intending on keeping a fair amount with the intention of using them instead as International Banking Centers (which is what Premier status or above gets you - Global banking benefits).

I've more recently noticed additional branches being built specifically on the West Coast, so I wouldn't be surprised if they are planning to still have a focus in those areas for wealthy enough clients (which also aligns with their shift more towards Asia).

The biggest callout I'd have is to not close all your accounts and run for the hills just yet, if you meet Premier status or above. You may need to worry otherwise. Although I'm still curious what that means for HSBC Direct accounts as HSBC just relaunched those recently.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: HSBC leaving US.

Slight correction: they're only keeping Premier accts with an avg daily balance of $75k or more. All the other Premier accts are gone. Only Jade and private banking customers are safe.

(edit: not trying to nitpick. Just pointing it out because my first thought was: I've got a Premier account, so this doesn't affect me. Nope.)

$75k is a lot to keep liquid in checking, even for customers with healthy incomes. That number seems designed to weed out high income customers who aren't wealthy. Which makes sense given their stated focus on cutting "mass market" banking services to focus on wealth management.

In any case, I'll wait until I get word from HSBC (and Citizens) about my accounts before doing anything. Even if HSBC cards get transferred to Citizens and rebranded, there's nothing stopping Citizens from creating new credit card programs to mimic the accounts they're buying. No sense in doing anything, now, before the details are announced.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: HSBC leaving US.

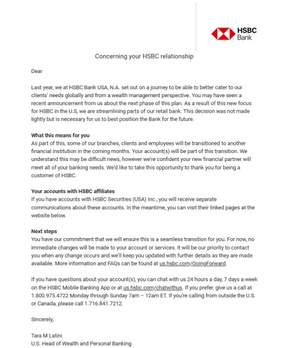

Email I received from HSBC late last night.

FICO 8 (EX) 846 (TU) 850 (EQ) 850

FICO 9 (EX) 850 (TU) 850 (EQ) 850

$1M+ club

Artist formerly known as the_old_curmudgeon who was formerly known as coldfusion

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: HSBC leaving US.

I also received a similar letter via email yesterday, but the language is slighlty different in that the letter does not mention my account being serviced by another financial institution in the future.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: HSBC leaving US.

Looks like my accounts will be moved between Dec 2021 and March 2022, and will end up with either Citizens or Cathay

i was thinking about closing them before i got this notice - but i think i may just leave them open and see how they end up

(i have a checking acct and CC and LOC)

Jan 25/2024 EX. 774 EQ. 751 TU 758

Inq. EX 2 EQ 3 TU 6 - - CC 2x24, 0x12

Amex BCP $35k - Apple GS $21k - BMW/Elan $19k - Cap1 QS $16.7k - Chase Amazon $13.6k - Chase Bonvoy Bountiful $10k - Chase United Club Infinite $26k - Citi CustomCash $3k - Citi DC $14.5k - CreditUnion1 $9k - DiscoverIT $31.5k - PayBoo - $15.6k - Penfed Gold - $19.3k - USB AltitudeGO -$19k- USBank Cash+ -$25k - PenFed LOC - $20k - USB LOC - $15k

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: HSBC leaving US.

@Ah-Chew228 wrote:I also received a similar letter via email yesterday, but the language is slighlty different in that the letter does not mention my account being serviced by another financial institution in the future.

By virtue of having a Premier Checking account you also have a significantly greater investment in them than I do and I'd previously spurned overtures to upgrade. No real suprise here that they would be interested in retaining you while transitioning me.

FICO 8 (EX) 846 (TU) 850 (EQ) 850

FICO 9 (EX) 850 (TU) 850 (EQ) 850

$1M+ club

Artist formerly known as the_old_curmudgeon who was formerly known as coldfusion

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: HSBC leaving US.

I'll hold off until early next year before deciding to leave HSBC. However, I opened the Chase Total Checking last week to take advantage of the $225 bonus.