- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Credit in the News

- Re: J.D. Power 2016 U.S. Credit Card Satisfaction ...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

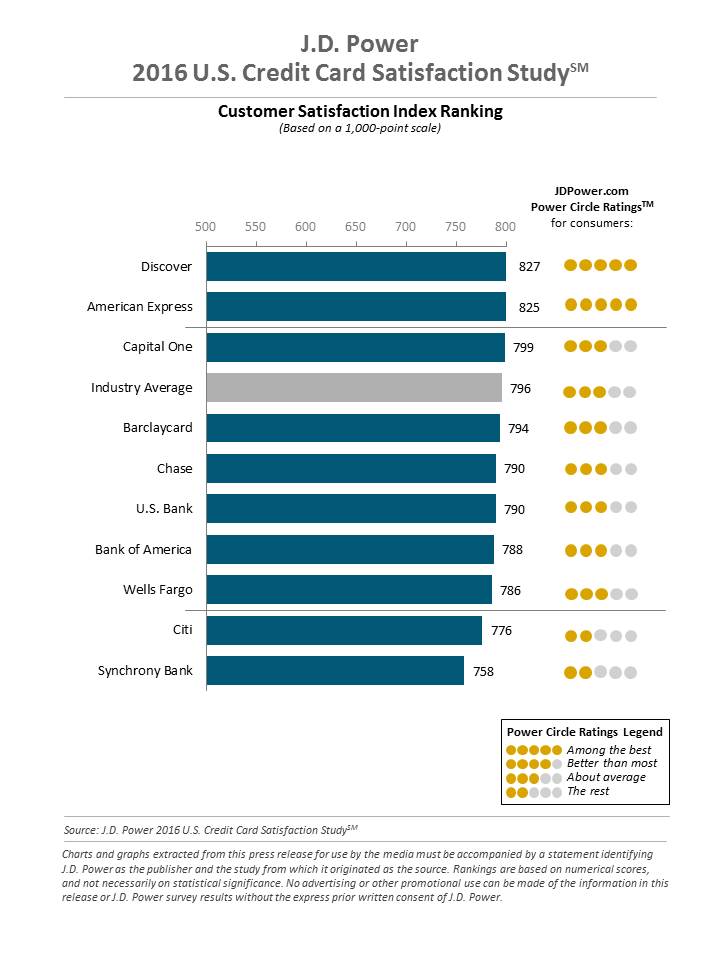

J.D. Power 2016 U.S. Credit Card Satisfaction Study results

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

J.D. Power 2016 U.S. Credit Card Satisfaction Study results

Discover ranks #1 with Amex closely behind. Full article here: http://www.jdpower.com/press-releases/2016-us-credit-card-satisfaction-study

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: J.D. Power 2016 U.S. Credit Card Satisfaction Study results

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: J.D. Power 2016 U.S. Credit Card Satisfaction Study results

Amex is still way up there, Surprising to me.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: J.D. Power 2016 U.S. Credit Card Satisfaction Study results

@elim wrote:Amex is still way up there, Surprising to me.

That and Cap-1 came in 3rd? I know a lot of folks on here love Cap-1 due to high SL/CL, but their CSR are awful and their APR's are very high compared to others, oh well at least Discover smoked AmEx again ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: J.D. Power 2016 U.S. Credit Card Satisfaction Study results

@pipeguy wrote:

@elim wrote:Amex is still way up there, Surprising to me.

That and Cap-1 came in 3rd? I know a lot of folks on here love Cap-1 due to high SL/CL, but their CSR are awful and their APR's are very high compared to others, oh well at least Discover smoked AmEx again

Looks like a good portion of the survey was satisfaction with the mobile app. Cap1 does have a fairly decent app. Happy to see Discover top out, I love their CS.

Browsing around the site from the survey, also found a mortgage lender satisfaction survey, Quicken loans won (ugh), but at least NFCU was number 2. http://www.jdpower.com/ratings/study/U.S.-Primary-Mortgage-Servicer-Satisfaction-Study/1302ENG

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: J.D. Power 2016 U.S. Credit Card Satisfaction Study results

My wife and I have the following cards:

AmEx BCE (hers, I'm AU)

Discover IT (mine)

Barclay Rewards (both)

Capital One QS (both)

In dealing with them via online chat or over the phone, we had nothing but excellent CS experiences thus far and hopfully to stay that way! (Personally? both Discover and AmEx are better!) ![]()

Cheers!

CAMailman

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: J.D. Power 2016 U.S. Credit Card Satisfaction Study results

I'm glad to see Discover up there. They have been so generous and good to me.

"Four more months until 2 inquires fall off."

My Journey Thread: Wolfeyy's Journey/Timeline thus far...

Goal: 780s across the board(Accomplished!) | Util: under 3%

5/27/17 - TU: 789 | EX: 785 | EQ: 798

Discover IT - $11,000 | Citi DC - $5,200 | PenFed Cash Rewards - $2,500 | Cap1 QS1 - $2,300 | Barclay Rewards - $1,500

Paypal Credit - $1,000

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: J.D. Power 2016 U.S. Credit Card Satisfaction Study results

I do not really understand Discover being at the top. They have the stingiest cl(to me) and only 1% rewards.

EX fico08=809 07/16/23

EQ fico09=812 07/16/23

EX fico09=821 07/16/23

EQ fico bankcard08=832 07/16/23

TU Fico Bankcard 08=840 07/16/23

EQ NG1 fico=802 04/17/21

EQ Resilience index score=58 03/09/21

Unknown score from EX=784 used by Cap1 07/10/20

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: J.D. Power 2016 U.S. Credit Card Satisfaction Study results

@sarge12 wrote:I do not really understand Discover being at the top. They have the stingiest cl(to me) and only 1% rewards.

I received a SL of $10k about 2 years ago, currently at $19k, but other than their credit limits, Discover constantly offers either 00% APR promotions for 12 months and/or regular balance transfers that can if you want go directly into your checking account at 12 months 00% (3% up front fee) OR 18 months at 4.99% - thats hard to beat. I also find their agents respinsive and helpful, not that I call often. Discover does have rotating 5% catagories bumped to 10% during the first year (not sure that promo is still going on)

AmEx I have my own dislike for (long story, not going into it) and Cap-1 really has nothing going for it other than high credit limits for a lot of "mid-graded good" scores say 680 to 720 - front line agents are robots, APR's are high as a rule, etc.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: J.D. Power 2016 U.S. Credit Card Satisfaction Study results

Cars or cards or anything else

EX819 1HP|TU797 1HP| EQ(Fico8 BankCard)841

EX819 1HP|TU797 1HP| EQ(Fico8 BankCard)841