- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Credit in the News

- Re: JPMorgan Chase to raise mortgage borrowing sta...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

JPMorgan Chase to raise mortgage borrowing standards

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: JPMorgan Chase to raise mortgage borrowing standards

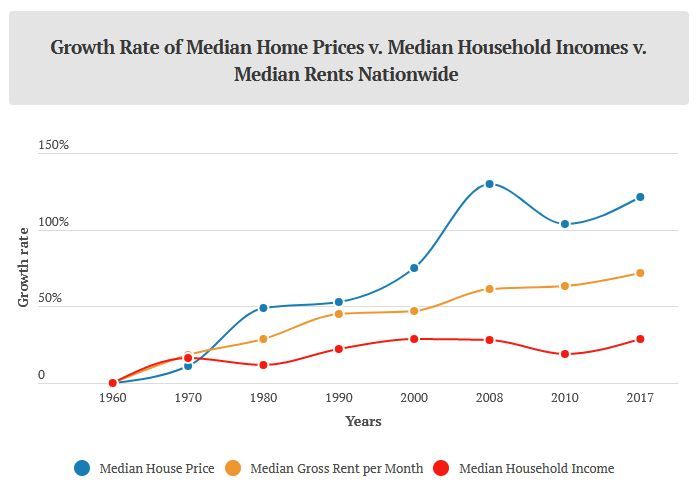

20% use to be the standard way back what 30-40 or so years plus back.. Most of the people don't have 20% to put down and if this requiriement was required there would be alot i mean alot of abandoned houses and the building/buying market for houses basically wouldnt exist IMO expect of course for those that can put 20% down on already over inflated housing market where houses are probably 10-20% overpriced, but soon to most likely come plummeting down depending on outcome of the economy starting to recover sooner than later or not.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: JPMorgan Chase to raise mortgage borrowing standards

@CreditCuriosity wrote:20% use to be the standard way back what 30-40 or so years plus back.. Most of the people don't have 20% to put down and if this requiriement was required there would be alot i mean alot of abandoned houses and the building/buying market for houses basically wouldnt exist IMO expect of course for those that can put 20% down on already already over inflated housing market where houses are probably 10-20% overpriced, but soon to most likely come plummeting down depending on outcome of the economy starting to recover sooner than later or not.

You basically hit the nail on the head. Homes are at the ridiculously inflated costs they are because people are buying 3x as much home as they can actually afford due to the ease of getting large mortgages with little or no down. If they can't afford 20% down, they can't afford the house, but the sellers would rather gouge buyers and leave them with the mess. If the crowds of people willing to mortgage themselves up to their eyeballs in competition for those overpriced homes all simply stepped back and said "we can't afford this", the developers and sellers gouging people would in turn have to back off their pricing or sit on empty stock, which costs them rather than the buyers. It would certainly disrupt things for a few years, but it's going to need to happen sooner or later to restore sanity to the housing market.

It's a demand-side economic market, so why buyers continue to let the supply-side call the shots and inflate the market is baffling. Or maybe it's just greed or FOMO or both.

Crap like HGTV hasn't helped, either. It's given many people the terrible idea that they can flip homes and make tons of profit in the process.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: JPMorgan Chase to raise mortgage borrowing standards

You both make great points. If houses weren't so inflated more people might be able to put 20% down, it's definitely no longer the American dream when 90% of them can't afford a house. And while I like those HGTV shows due to my construction background, I agree that they send a false messege to too many people. I also feel that Brokers/Investors are to blame for increased housing prices.

Most normal people just don't have the extra Money to put aside for that 20% down, at least not on $300-500K house. Heck, even $150K is going to be tough. With the cost of living it's just not doable anymore. Though I guess it's not too differrent then when houses were much cheaper but interest rates were astronomical compared to today's rates.

Chase is obviously a different type of FI compared to all the new found Lenders who think 5% down is just fine, since it's not much of a risk for them to resell the house when/if the current buyer defaults. I like Chase for teh most part, but i wouldn't have cinsidered them for a Mortgage simply because they want to run your credit before they even discuss loan types and amounts. etc.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: JPMorgan Chase to raise mortgage borrowing standards

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: JPMorgan Chase to raise mortgage borrowing standards

I live in Chicago where the only houses you will find under 250k are in high crime areas with few good paying jobs, struggling schools, terrible hospitals, minimum entertainment, and poor access to highways and trains.

If you leave the city for the suburbs and want a house less than 250k, you will have an hour and a half commute to work and if the conditions are not optimal, it will be two hours. You will also pay high property taxes and have minimal entertainment options. People are being forced to pay more than 250k essentially to live in a comfortable environment.

I don't really care about how banks like Chase feel because they've been ripping people off for the longest. Most Anericans have 3k to 7k in their savings accounts and make less than 60k a year. I would argue at least 80 percent of the people in the US couldn't truly afford to put down 40k on a 200k house. And if you want to live in a decent situation in a metro area, 60k on a 300k house.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: JPMorgan Chase to raise mortgage borrowing standards

Further thinking about this seeing other posts. Put this in perspective folks: Chase as a lender? Doesn't really matter to the majority of people who aren't living in high cost areas.

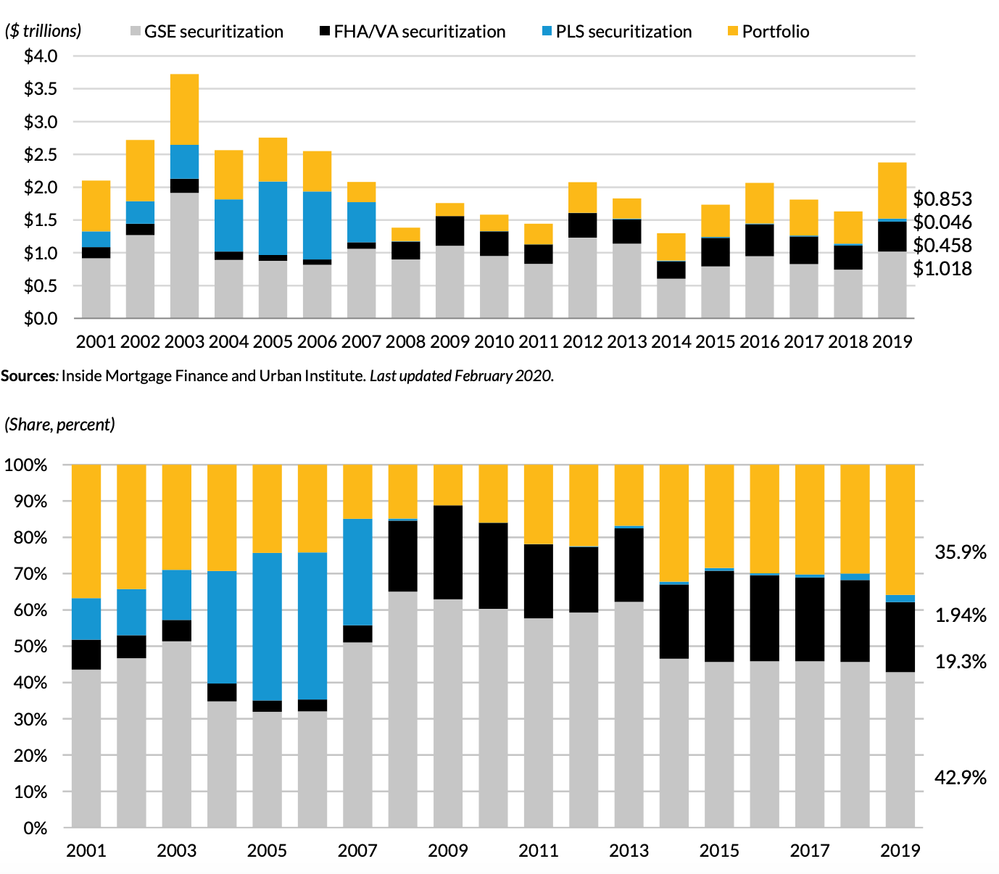

If the GSE's move to 20% then yeah, this whole housing market is going pear shaped and you can expect a 2007 like mortgage price collapse. But that hasn't happened yet. Freddie isn't clawing back my 5% down conventional Houston mortgage,

I'm curious and I have a plausible reason to reach out to Chase anyway regarding a possible mortgage (if I do just pick up my dad's place in Austin, needs work but I can swing that cost and renting it wouldn't be hard I don't think). Of course if we do see prices collapse that just makes that plan even cheaper.

Actually I'm looking at Fannie's site and other than updates to ARM originations they've done zip zero other than tightening up the documentation requirements.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: JPMorgan Chase to raise mortgage borrowing standards

Was curious and found this totally awesome mortgage stats site / report.

https://www.urban.org/sites/default/files/publication/101766/february20chartbook202020.pdf

But I'll insert the salient picture: Chase moving to 20% on some of it's loan products is probably only portfolio and that, meh. Affects my LA condo, maybe as the 1.3M prices fall and that'll put downward pressure everywhere (or maybe more people who are looking to buy might pick up my ~450kish condo which is well below conforming limit lines. FHA/VA movement on underwriting hurts, but the agencies haven't moved and until they do, ain't skeerd.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: JPMorgan Chase to raise mortgage borrowing standards

@Revelate wrote:Was curious and found this totally awesome mortgage stats site / report.

https://www.urban.org/sites/default/files/publication/101766/february20chartbook202020.pdf

But I'll insert the salient picture: Chase moving to 20% on some of it's loan products is probably only portfolio and that, meh. Affects my LA condo, maybe as the 1.3M prices fall and that'll put downward pressure everywhere (or maybe more people who are looking to buy might pick up my ~450kish condo which is well below conforming limit lines. FHA/VA movement on underwriting hurts, but the agencies haven't moved and until they do, ain't skeerd.

The "new" mortgage lending standards are similar to what Chase had during the Great Recession, although IIRC >20% down is required for a portfolio loan.

For anyone looking for a mortgage, ask Citi what rates they'll give if you move a good amount (usually over $1M) of cash/securities to them. They're usually very accommodating.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: JPMorgan Chase to raise mortgage borrowing standards

Renewed my pre-qual with Chase this morning. They approved in under an hour, so while the requirements may be higher, I don't think the actual review process is any more stringent.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: JPMorgan Chase to raise mortgage borrowing standards

@iced wrote:Renewed my pre-qual with Chase this morning. They approved in under an hour, so while the requirements may be higher, I don't think the actual review process is any more stringent.

Did you get a chance to see their tier sheets in terms of what loan products required what LTV?

Chase wasn't close to competitive when I originally talked to them on the Houston place (conventional loan) but if I pick up my dad's place depending on whether it's fixed up yet or not, might be a jumbo ergo portfolio loan.