- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Credit in the News

- Re: MyFICO Forums cited about maximum credit limit...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

MyFICO Forums cited about maximum credit limits on certain cards.

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: MyFICO Forums cited about maximum credit limits on certain cards.

@M_Smart007 wrote:Interesting read. No mention of The American Express Black card?

or even UBS !

My guesses, @M_Smart007, is that neither one of those were cards they could get referral fees on publicizing. AMEX Black is, of course, invitation only, and plus it has NPSL as well. And UBS seems to be a much smaller, niche player, at least in the US. I think they have cards for part of the services and conveniences for their HNW clients. They probably don't pay referral fees to advertise. I think the article was targeted towards the average reader of average income/assets in the US.

It appears to me that the information is very general in nature and incomplete. Like I found when I researched the topic a few years ago before I got on My Fico, the few articles like this out there are dealing with miscellaneous data points from places like My Fico since the lenders don't disclose credit limit statistics as far as I know. And when I came on My Fico, I learned that the articles I had read were not fully informed. For example, after my recent CLI on Discover to $51K, @NoMoreE46 asked me what the ceiling was on a Discover card. I knew I hadn't reached new territory but I dug up some data points for cards over $50K. While it's not commonplace, I found about ten credit limits between $51K and $76K, with two reported in the mid-70's. (Additional posts beyond the first one mention additional data points I uncovered.) Also, another member reported over $78K TCL on two Discover cards. So it's interesting that the author didn't bother to dig any of this data up himself and mention Discover as a potentially high-limit card. Those Discover cards are almost as high as the Chase Sapphire Reserve example he mentioned at $80K, and I know we have a couple of members reporting a little higher on that card or other premium Chase cards. He also didn't mention the possible $80K cap on a Navy Federal CU Flagship Rewards; that may the easiest card to get a high limit on for someone of more average means. And he also didn't mention the Barclay's Luxury card line, which apparently can grow quite high, even if it's not that popular with the My Fico crowd overall. Member: @Anonymous reported a SL of $150K on his luxury card with CLI to $300K.

Still, it's an interesting read, especially for someone who doesn't follow these trends on forums like My Fico!

Business Cards

Length of Credit > 40 years; Total Credit Limits >$898K

Top Lender TCL - Chase 156.4 - BofA 99.7 - AMEX 95.0 - CITI 94.5 - NFCU 80.0

AoOA > 30 years (Jun 1993); AoYA (Feb 2024)

* Hover cursor over cards to see name & CL, or press & hold on mobile app.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: MyFICO Forums cited about maximum credit limits on certain cards.

Although I'm not in you guys tax bracket @Aim_High , I've gotta be honest, I'm running out of ways to really make use of these cc's on the personal side. Now the business side? No problem, but with most of the crazy stuff out of the way at 53, I'm just making stuff up. Like swiping for used cars and tuition and other things. I can see it's gotta either move towards entertainment, or I've gotta put some thought into how I am moving forward. I'm definitely closing anything with less than a $10k limit with one exception. Case in point I literally bought a base layer from Cabelas and some groceries from Walmart so I didn't forget to use them. Assinine.

Now someone like @Anonymous is obviously having fun. I can't fathom that system he has running, but if it's sport, I get it. Do you. What would I even do with an $80k limit? Even @M_Smart007's, or @SouthJamaica , or @K-in-Boston's collections of cards would make me dizzy. I GOTTA think I'd lose track of something. I take my hat off to all you guys. Of course with limits that high I could see trimming down to 3 or 4 cards and tapping out with the "sport" angle. The Mrs and I have got a "few" personal projects left in us where we could mix it up and stay safe with those limits.

Remember that 19 year old a few years ago that had a $286k limit from UBS? That was crazy!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: MyFICO Forums cited about maximum credit limits on certain cards.

@805orbust wrote:Although I'm not in you guys tax bracket @Aim_High , I've gotta be honest, I'm running out of ways to really make use of these cc's on the personal side. Now the business side? No problem, but with most of the crazy stuff out of the way at 53, I'm just making stuff up. Like swiping for used cars and tuition and other things. I can see it's gotta either move towards entertainment, or I've gotta put some thought into how I am moving forward. I'm definitely closing anything with less than a $10k limit with one exception. Case in point I literally bought a base layer from Cabelas and some groceries from Walmart so I didn't forget to use them. Assinine.

Remember that 19 year old a few years ago that had a $286k limit from UBS? That was crazy!

I remember it well, @805orbust. Not just $286K but $286.5 ... LOL ![]() (UBS Visa Infinite - 20 years old Crazy Limit.)

(UBS Visa Infinite - 20 years old Crazy Limit.)

Your comments resonate with me. You may not be in my tax bracket, but I don't have spending habits like my current tax bracket either, and I plan to keep it that way. For one, I realize I'm in my prime earning years before retirement and I don't need "lifestyle creep" to make the transition more difficult. And I'm still accruing assets for the future. Part of my reason for pumping up my limits now is that I have legitimate high income if there are questions about what I report. Over the years, I've found that lenders tend to leave high but unused limits alone as long as cards aren't totally neglected, and as long as profile doesn't raise alarms. I know that in retirement, my limit purchasing power will shrink with inflation over the years. So pumping them up now makes it easier to keep plenty of available credit and provide utilization buffering for FICO scoring. Honestly, my total limits are waaaaayyyyy above my normal spending needs. But the other point you make about having to remember to use cards to avoid closure is something I'm also concerned about. I'm not one of the true rewards optimizers on the forum who enjoys juggling dozens of cards. I'd rather err towards simplicity to some degree. So I want to be able to close lower limit or less useful cards as I go to focus on the ones that contribute the most to my lineup. And contributions isn't all about rewards, necessarily. It's also about age of accounts, credit limits, APRs (purchase, plus BT, plus tendency of lender to offer deals), perks, payment network diversity, lender diversity, lender stability, customer service, fraud prevention, technology (app's or websites), and probably other things. I kind of agree with you that $10K would be my base limit. I closed my lower store cards and don't like the multiple small limit cards cluttering my profile (and mind!) When I came on My Fico a few years ago, my goal was to get ALL my cards to $25K or higher. I could do that now, with some consolidations or closures, but I've shifted. I'm focusing more on getting multiple cards into the $50K to $100K range with a few at $25K to $50K and perhaps one or two at $10K to $25K. One card that I'm willing to accept a lower limit on is my Bank of America Customized Cash Rewards. That's because I reached their total limit "cap" for most consumers of $99.9K and I'd prefer to have one super-sized limit on my Premium Rewards instead of dividing it more equally between the two cards.

I wouldn't enjoy @Anonymous's complicated system with 80 cards either. I'm trying to get a relatively high TCL with fewer cards and I've been slowly growing mine into that same general $600K to $750K range as @K-in-Boston, @SouthJamaica, and @UH_HUH. With my latest CLIs, I just reached $654.5K TCL. Now I don't know where he is on TCL but @M_Smart007 is probably in the same seven-figure range as some of our members like @coldfusion, @Anonymous, or @12njoy. Some of the largest CL players would of course be @FinStar and @Mahraja. In my case, I'm already way over what I really need or want to manage for the long-term. I'll continue to add some cards and limits for awhile but imagine I'll eventually downsize some cards to focus on a handful of the best. It's fun to get to those higher levels but it's all relative. It's more of a personal race more than a race betwen everyone on the forums. ![]() We all have such different credit profiles, financial profiles, and lifestyles that one TCL with one member may mean little when compared to another!

We all have such different credit profiles, financial profiles, and lifestyles that one TCL with one member may mean little when compared to another!

I've never noticed the huge disparity between your business and personal cards until you mentioned that! ![]() You've got $135K on four business cards including $100K on two Chase INK cards! But then much lower limits on your personal cards. Is that by choice or is there such a huge volume of business transactions to drive up those limits?

You've got $135K on four business cards including $100K on two Chase INK cards! But then much lower limits on your personal cards. Is that by choice or is there such a huge volume of business transactions to drive up those limits?

Business Cards

Length of Credit > 40 years; Total Credit Limits >$898K

Top Lender TCL - Chase 156.4 - BofA 99.7 - AMEX 95.0 - CITI 94.5 - NFCU 80.0

AoOA > 30 years (Jun 1993); AoYA (Feb 2024)

* Hover cursor over cards to see name & CL, or press & hold on mobile app.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: MyFICO Forums cited about maximum credit limits on certain cards.

@Aim_High wrote:that same general $600K to $750K range as @K-in-Boston...

![]() Experian says $1,148,400 but there are at least 5 open revolving accounts missing from my EX report. I might have gone a little overboard with new accounts and CLI requests in the latter half of the 2010s. Way more than I need, but I'm not trying to double my revolving utilization either. LOL

Experian says $1,148,400 but there are at least 5 open revolving accounts missing from my EX report. I might have gone a little overboard with new accounts and CLI requests in the latter half of the 2010s. Way more than I need, but I'm not trying to double my revolving utilization either. LOL

Your assumption was definitely correct on the reason only certain cards were mentioned. For TPG it is, and always has been, about referral links. I used to really like the site before they closed the comment section off. Obviously anyone can understand much of the reasoning for that with a visit to the comment sections at DOC or Reddit, but one of the things that used to be great there is that articles would be corrected based on reader feedback (and DOC still does this).

Several of the posts linked in that article date back to 2014. We know that Amex will issue even 7-digit revolving credit lines pretty much regardless of the product. That one makes it seem like Delta Gold is the card to have if you want a high credit limit, while even in that same family of cards I'm certain there are some extremely large limit Delta Platinum and Delta Reserve cards floating around and those likely have a much larger average credit line than Delta Gold as those that would justify having those cards would skew towards generally having higher credit limits anyway. Citi, Chase, Bank of America, and many others will certainly also issue much larger credit lines.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: MyFICO Forums cited about maximum credit limits on certain cards.

@K-in-Boston wrote:

@Aim_High wrote:that same general $600K to $750K range as @K-in-Boston...

Experian says $1,148,400 but there are at least 5 open revolving accounts missing from my EX report. I might have gone a little overboard with new accounts and CLI requests in the latter half of the 2010s. Way more than I need, but I'm not trying to double my revolving utilization either. LOL

Your assumption was definitely correct on the reason only certain cards were mentioned. For TPG it is, and always has been, about referral links. I used to really like the site before they closed the comment section off. Obviously anyone can understand much of the reasoning for that with a visit to the comment sections at DOC or Reddit, but one of the things that used to be great there is that articles would be corrected based on reader feedback (and DOC still does this).

Several of the posts linked in that article date back to 2014. We know that Amex will issue even 7-digit revolving credit lines pretty much regardless of the product. That one makes it seem like Delta Gold is the card to have if you want a high credit limit, while even in that same family of cards I'm certain there are some extremely large limit Delta Platinum and Delta Reserve cards floating around and those likely have a much larger average credit line than Delta Gold as those that would justify having those cards would skew towards generally having higher credit limits anyway. Citi, Chase, Bank of America, and many others will certainly also issue much larger credit lines.

Well, congrats on breaking into the $1M club, @K-in-Boston! ![]() Are there a lot of cards or limits missing from your siggy? I had thought you were closer to the 3/4 M club. And the $1.1M is without five missing revolvers also?! What is the backstory on those missing cards? I've always thought targeting the largest lenders including Chase and Citi were important in building a large TCL but your cards with them seem fairly limited. Any thoughts on more cards with either? I know you do love your AMEX cards, though.

Are there a lot of cards or limits missing from your siggy? I had thought you were closer to the 3/4 M club. And the $1.1M is without five missing revolvers also?! What is the backstory on those missing cards? I've always thought targeting the largest lenders including Chase and Citi were important in building a large TCL but your cards with them seem fairly limited. Any thoughts on more cards with either? I know you do love your AMEX cards, though.

I did not know that AMEX (or anyone) would issue seven-figure revolving lines. Wow. ![]() Can't fathom that! I have read many times about line of credit for HNW clients going into the mid six-figures in some rare cases. Amazing. Anything between $75K and $100K seems like a truly monster limit to me! But it is all relative to need, finances, and lifestyle.

Can't fathom that! I have read many times about line of credit for HNW clients going into the mid six-figures in some rare cases. Amazing. Anything between $75K and $100K seems like a truly monster limit to me! But it is all relative to need, finances, and lifestyle.

Yes, I am trying to increase my revolving utilization ratio but that's because I have usually had fairly low TCL relative to income most of my life, and also my TCLs have not kept pace with income in the past few years. Plus, as I have grown my limits, I'm seeing that cards at or above $50K are more in my reach than I had thought. I'm not ever going to be someone with a $250K limit, though!! ![]()

Business Cards

Length of Credit > 40 years; Total Credit Limits >$898K

Top Lender TCL - Chase 156.4 - BofA 99.7 - AMEX 95.0 - CITI 94.5 - NFCU 80.0

AoOA > 30 years (Jun 1993); AoYA (Feb 2024)

* Hover cursor over cards to see name & CL, or press & hold on mobile app.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: MyFICO Forums cited about maximum credit limits on certain cards.

Aside from 3 Amex business revolvers, after 5 years my NFCU CLOC has still never reported to any bureau and US Bank Cash+ is one that is missing solely from Experian. Right after I got the SUB on that card, I took advantage of a balance transfer offer and made heavy use of the limit. A week later, I got a call from their fraud department asking me about some charges I definitely didn't make. They reissued the card with a new number which created new entries on all 3 reports. The original entries on TU and EQ fell off, but stayed on EX with very high utilization and never being updated, definitely hurting my EX score for about 7 months with two new cards with heavy utilzation and one very heavy since it hadn't been updated with payments. I called a few times to get it taken care of, but they never fixed it. Finally did a CFPB complaint and it was taken care of immediately and I even got an apology letter. However, they didn't just take the original card off of my EX report, they took the replacement one too and it never appeared again.

For revolving credit, I have CLOCs, PLOCs, and a HELOC, as well as some very high limit AU cards (like a single BOA at $99,900) that are not in my signature. Since they're used for utilization (for better or worse), scoring (also for better or worse), and sometimes even lending decisions, I usually consider them as part of my TCL.

As for non-Amex lenders, I have around $50k on my own Chase cards. Didn't need more than about $5k on Freedom, and I moved a chunk of CSR's limit over to CFU when I opened it to take advantage of the intro offer then just never moved it back. I could probably boost that up by opening up Southwest and United cards, but I really don't have any interest at the moment. For Citi, I closed Premier after they nerfed the two reasons I had the card (travel portal multipler and gas earnings) and just my luck, they were no longer reallocating limits across cards. My sole Citi card is sock drawered and I just grab the easy SP CLI every 6 months on it.

I know Citi will issue 7 digit lines for sure as it came up in a conversation with a VC some years back when he and I were discussing his Centurion Card (first one I had seen in the wild at the time). When Pooka89 was actively posting here and was working in the Plat/Cent department, he confirmed the massive Amex revolving limits of some people he interacted with. As you said, probably relative for HNW people, and I am sure there are some BOA, Chase, and likely others floating around with insane limits particularly since the norm for a lot of people is to use only a couple of credit cards, and often those of their primary bank.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: MyFICO Forums cited about maximum credit limits on certain cards.

@Aim_High wrote:I did not know that AMEX (or anyone) would issue seven-figure revolving lines. Wow.

Can't fathom that! I have read many times about line of credit for HNW clients going into the mid six-figures in some rare cases. Amazing. Anything between $75K and $100K seems like a truly monster limit to me! But it is all relative to need, finances, and lifestyle.

This is why articles like this are meaningless. What does one person having a $1 million limit and another person having a $100,000 limit have to do with the person who has the $10,000 limit? Unless someone's playing the sad lottery daydream game where they're getting a card because they could theoretically one day have the same limit as someone whose profile is in an entirely different universe from theirs, there's no real-world scenario where what some other person has will affect what another person has.

Most HNW clients don't approach those 7-figure limits (and in many cases even 6-figure limits) because it's a liability. Whether you make 5 figures or 8 per year, the things you buy with a credit card remain somewhat static. Those 8-figure clients are staying at nicer hotels and booking nicer flights, but those are easily covered with a card with a high 5-figure or low 6-figure limit. Limits beyond that are mostly for show, and even then most HNW people aren't the least impressed with high credit limits.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: MyFICO Forums cited about maximum credit limits on certain cards.

@iced wrote:

@Aim_High wrote:I did not know that AMEX (or anyone) would issue seven-figure revolving lines. Wow.

Can't fathom that! I have read many times about line of credit for HNW clients going into the mid six-figures in some rare cases. Amazing. Anything between $75K and $100K seems like a truly monster limit to me! But it is all relative to need, finances, and lifestyle.

This is why articles like this are meaningless. What does one person having a $1 million limit and another person having a $100,000 limit have to do with the person who has the $10,000 limit? Unless someone's playing the sad lottery daydream game where they're getting a card because they could theoretically one day have the same limit as someone whose profile is in an entirely different universe from theirs, there's no real-world scenario where what some other person has will affect what another person has.

Most HNW clients don't approach those 7-figure limits (and in many cases even 6-figure limits) because it's a liability. Whether you make 5 figures or 8 per year, the things you buy with a credit card remain somewhat static. Those 8-figure clients are staying at nicer hotels and booking nicer flights, but those are easily covered with a card with a high 5-figure or low 6-figure limit. Limits beyond that are mostly for show, and even then most HNW people aren't the least impressed with high credit limits.

That's so true, @iced, and yes the limits and the needs are all relative. And even if the average person learns about higher limit options (which helps to protect utilization), many of them won't push their lenders like we do on My Fico to request higher limits. While it's not common for me, I just posted $30K in charges in one month and I don't make eight figures or even close to seven. Having limits in the upper five-to-lower-six figure range is helpful to protect individual account utilization for those exceptional situations. Still, it's interesting to see how "the other HALF (I mean 1%) lives." Lol There's a reason why the television show "Lifestyles of the Rich and Famous" among others has been so popular.

HNW consumers probably aren't just booking nicer flights. They may even own the jet and pay for the jet fuel, maybe even much more than a First Class ticket? Just the fuel costs of operating a Gulfstream G500 Business Jet are estimated at $400K to $800K per year. Meanwhile, us common folk are buying coach tickets or filling the tanks on our Cessna 172!

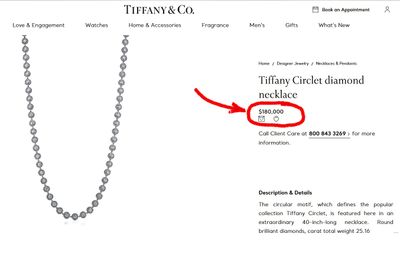

While if I made eight figures I might be able to "get by" with a paltry $100K card limit ![]() ... but when I went shopping for Valentines's Day

... but when I went shopping for Valentines's Day ![]() for DW, I wouldn't be able to buy her ... THIS > > (Unless maybe I had my AMEX Centurion card on me also!) So I suspect those high rollers have a true "need" for their limits at times!

for DW, I wouldn't be able to buy her ... THIS > > (Unless maybe I had my AMEX Centurion card on me also!) So I suspect those high rollers have a true "need" for their limits at times!

Business Cards

Length of Credit > 40 years; Total Credit Limits >$898K

Top Lender TCL - Chase 156.4 - BofA 99.7 - AMEX 95.0 - CITI 94.5 - NFCU 80.0

AoOA > 30 years (Jun 1993); AoYA (Feb 2024)

* Hover cursor over cards to see name & CL, or press & hold on mobile app.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: MyFICO Forums cited about maximum credit limits on certain cards.

@Aim_High wrote:That's so true, @iced, and yes the limits and the needs are all relative. And even if the average person learns about higher limit options (which helps to protect utilization), many of them won't push their lenders like we do on My Fico to request higher limits. While it's not common for me, I just posted $30K in charges in one month and I don't make eight figures or even close to seven. Having limits in the upper five-to-lower-six figure range is helpful to protect individual account utilization for those exceptional situations. Still, it's interesting to see how "the other HALF (I mean 1%) lives." Lol There's a reason why the television show "Lifestyles of the Rich and Famous" among others has been so popular.

HNW consumers probably aren't just booking nicer flights. They may even own the jet and pay for the jet fuel, maybe even much more than a First Class ticket? Just the fuel costs of operating a Gulfstream G500 Business Jet are estimated at $400K to $800K per year. Meanwhile, us common folk are buying coach tickets or filling the tanks on our Cessna 172!

While if I made eight figures I might be able to "get by" with a paltry $100K card limit

... but when I went shopping for Valentines's Day

for DW, I wouldn't be able to buy her ... THIS > > (Unless maybe I had my AMEX Centurion card on me also!) So I suspect those high rollers have a true "need" for their limits at times!

Those who can afford this easily probably have a NPSL charge card for such things (one virtue of the old charge-style American Express cards) or they're not making the purchase via credit card.

I can also tell you that if you made 8 figures, you probably wouldn't be purchasing that for Valentine's. I sometimes think people really don't understand what the vast majority of the HNW/UHNW population buy. This is the type of thing that celebrities and "ballers" may buy, but they're all about the appearances so it makes sense. I guess in a way it also makes sense that this is what people think all wealthy people are like since the only real glimpses into such lives people get to see are through the wealthy celebrity types.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: MyFICO Forums cited about maximum credit limits on certain cards.

@Aim_High I agree with you wholeheartedly. As a matter of fact, not having really given it a ton of focused thought, I think m goals henceforth are similar to yours. I'm not crazy about the "R" word, so I think I'll always be "working" albeit in modified fashion. As for rewards, if I could have enough MR's and UR's that I never have to pay to fly ever, I'm happy, so no crazy thought required. The pandemic really snapped us out of lifestyle creep. Staring at the walls was great for resetting our behavior, even though I consider us to be pretty conservative spenders by nature (buy the Chevy or Toyota when you can afford the Cadillac or Lexus). I'm all about the flexibility for us in the coming years and being able to act on things quickly, plus I am a BIG believer that carrying cash is insane beyond $100-$300 or so except in unusual circumstances. It was good to read your thoughts as I've never given *much* thought to whats next. As for the business limits, the advice here really enabled me to build out our business credit picture for both companies with strategic precision. We run TONS of spend thru our business cc'ds. Now that I'm over the last 2 years of idiocy, I'll be going full force at evolving the personal credit picture. I've tended to do this in spurts as for some reason it seems its easiest to get credit when you don't need it. One of the wisest things I've heard said around here. ![]() You guys definitely inspire me. Not to mention spur me on to cook up new ideas on what to do with all this flexibility and buying power.

You guys definitely inspire me. Not to mention spur me on to cook up new ideas on what to do with all this flexibility and buying power.

@K-in-Boston congrats on the milestone.