- myFICO® Forums

- FICO Scoring and Other Credit Topics

- General Credit Topics

- 2011 Closed CC Account With Balance From Is Still ...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

2011 Closed CC Account With Balance From Is Still Showing on CR??

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2011 Closed CC Account With Balance From Is Still Showing on CR??

Aren't closed credit card accounts, even with a balance, supposed to drop off after 7-years? This was an individual credit card account, not a joint account.

The JP Morgan Chase Card was cancelled back in July, 2011 and the balance was never paid off (about $4k) due to divorce/separation.

Last payment made was in 2015 (paid it down from $7k to around $4k).

It will be 10-years soon since this account was closed. At what point in time will this drop off? I'm estimating it's having a 25-40pt impact to my score. Thank you for any insight.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Closed Credit Card Account With Balance From 7/2011 Is Still Showing on CR??

I forgot to mention, i tried disputing this with no change TWICE with each of the three reporting bureau's.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 2011 Closed CC Account With Balance From Is Still Showing on CR??

I think becuase the last activity was in 2015 when you made a payment thats why. Resets the clock I believe. It will come off in a couple of years. On your credit report there should be a DOFD as its known listed with a month and year. Look that up and then you will know when it comes off.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Closed Credit Card Account With Balance From 7/2011 Is Still Showing on CR??

It's typically 10 years, not 7. The 7-year timeline typically applies to derogatory items with the exception of CH 7 BK, for instance. That said, some closed accounts can sometimes fall off before 10 years, but there's instances of which they've remained beyond 10+ years. I had a couple of closed (in good standing) JPM Chase (legacy Bank One/First USA) CCs that were still on my CRs for 15 years, which actually helped in my case.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 2011 Closed CC Account With Balance From Is Still Showing on CR??

Exclusion from credt reports at 7 years applies to "adverse items of information" that have been reported to a CRA, as set forth in FCRA 605(a). Specific types of "adverse items of information" and their required exclusion periods are set forth in subsections 605(a)(1) - (a)(4), and include bankruptcies, civil judgments, tax liens, collections, and charge-offs.

Subsection 605(a)(5) then provides a catch-all exclusion of "any other sdverse item of information" after 7 years.

While the catch-all provision of subsection 605(a)(5) does not define closure of an account to be an included "adverse item of information" thta would thus require exclusion at 7 years, that would be your argument if you wished to make such an assertion. Typical "other adverse items of information" that are clearly recognized by either case law or CRA established preactice include reported monthly account delinquencies, repossessions, and forclosures.

To date, simply closing of an open credit card account is not per se recognized as being an adverse item of information within the clear meaning of FCRA 605(a)(5). While it might be possible to argue that closure by the credit grantor might be "adverse" if it has been stated as being done due to account delinquency, even if they have not reported delinquencies, other reasons for account closure, such as closed by the consumer, or closed by the credit grantor due to long periods of account non-use, would likely not be considered as an included adverse item of information.

You might wish, if the creditor has clearly stated that they closed the account due to delinquency status, as adverse, argue that the closure per se was an adverse item of information, and thus subject to exclusion at 7 years, I am not aware of any specific case law precedent that supports such a position.

Removal of accounts at approx ten years from account closure is not based upon any exclusion requirement of the FCRA. It is purely an internal housekeeping business decision of the CRAs.

With respect to the posted scenario, certainly any reporting of account delinquencies or reporting of the current account status as delinquent would be subject to exclusion at 7 years under recognized application of subsection 605(a)(5). but account closure per se is not so recognized.

What derogs are currently reporting on the account? What is privided as the current status?

If the current status is shown as delinquent, that might be basis for arguing 7 year exclusion rather than using the account closure as such basis.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Closed Credit Card Account With Balance From 7/2011 Is Still Showing on CR??

@ilsstp wrote:I forgot to mention, i tried disputing this with no change TWICE with each of the three reporting bureau's.

As @FinStar mentioned, 10 years is the normal time for closed accounts to fall off. The disputes did no good because the accounts are correctly reported, although I suppose it never hurts to try.

AoOA: closed: 36 years, open: 25 years; AAoA: 11.8 years

Amex Gold, Amex Green, Amex Blue, Amex ED, Amex Delta Gold, Amex Hilton Surpass, BoA Platinum Plus, Chase Freedom Unlimited, Chase Amazon, Chase CSP, Chase United Explorer, Citi AA Plat, Sync Lowes, Sync JC Penney - total CL 145k

Loans: Chase car loan (35k/6yrs 0.9%)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 2011 Closed CC Account With Balance From Is Still Showing on CR??

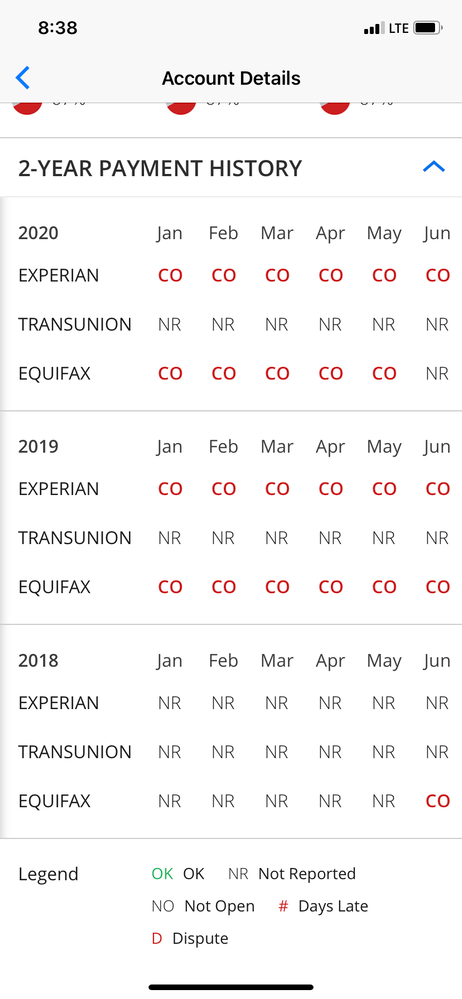

They are currently showing up as the balance being charged off and closed by creditor grantor request. What kills me is that this closed account wasn't even being reported to any of the 3 bureaus until I disputed them at 7-years back in mid 2018. All of sudden this account started showing up....maybe I shouldn't have disputed it at the 7-year mark back in 2018. Probably doesn't matter but this account was opened up in 2008 (Don't even remember the name) but the issuing card went under and was picked up by JPMC.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 2011 Closed CC Account With Balance From Is Still Showing on CR??

Well, was it CO'd? If so, when? That will determine first whether it's a derogatory account or not, and second, when it would fall off. If it did get charged off, it should've fallen off 7 years from DOFD (first late payment that lead to charge off). Meaning, if it was CO'd in 2011, it should've fallen off in 2018 on its own.

Last App: 1/10/2023

Penfed Gold Visa Card

Currently rebuilding as of 04/11/2019.

Starting FICO 8 Scores:

Current FICO 8 scores:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 2011 Closed CC Account With Balance From Is Still Showing on CR??

Once a creditor has reported a charge-off, they are then required under FCRA 623(a)(5) to separately and explicitly report the date of first delinquency to the CRA within 90 days. The DOFD is the date it first became delinquent, and thereafter has remained delinquent up to the time it was charged-off.

The CRA is then required to exclude any reference to a CO no later than 7 years plus 180 days after the reported DOFD. See FCRA 605(c). It is thus critical that you know the reported DOFD.

If the account, at time of exclusion of the repoted CO, remains delinquent, then it can no longer continue to make any report that includes a statment of currently delinquent status after 7 years.. Thus, the entire account would be excluded after 7 years if the debt was never paid, and not just the reference to the reported CO. See FCRA 605(a)(5), and the explanation of that policy provided on the Exp web site.