- myFICO® Forums

- FICO Scoring and Other Credit Topics

- General Credit Topics

- 30 day late FICO reality

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

30 day late FICO reality

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 30 day late FICO reality

It should not take you 2-3 years to recover from a single 30 day late.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 30 day late FICO reality

Thank you all for your input. I appreciate the discussion specific to my case. Obviously, I understand that "The intent of FICO is to assess credit risk", which is why I was pointing out that a single 30 day late may yield an inaccurate risk assessment as expressed by the score(s). Assuming Fair Isaac's AI/algo is supposed to be getting better, then it should not, in 2018, be assigning my college frat boy son a higher score than my wife and I. That algorithmic result is absurd, so I'm not certain that "the intent of FICO is to assess credit risk".

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 30 day late FICO reality

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 30 day late FICO reality

Thanks, JVille. My wife isn't the "bill payer" per se. Obviously autopay would have prevented the issue and most of our payments are done via autopay and have been for years. My main point, however, is that the FICO score should accurately assess risk and there are inherent weaknesses due to the limitations of the input variables. I don't have a solution for assessing tens of millions of accounts more accurately, but I am aware of the "rules" and will be mis-assessed for a couple of years as a result of my negligence, not as a result of an increased risk.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 30 day late FICO reality

Well said and good luck!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 30 day late FICO reality

@rembomanThank you all for your input. I appreciate the discussion specific to my case. Obviously, I understand that "The intent of FICO is to assess credit risk", which is why I was pointing out that a single 30 day late may yield an inaccurate risk assessment as expressed by the score(s). Assuming Fair Isaac's AI/algo is supposed to be getting better, then it should not, in 2018, be assigning my college frat boy son a higher score than my wife and I. That algorithmic result is absurd, so I'm not certain that "the intent of FICO is to assess credit risk".

A recent 30 day late is very impactful and should be, as it could be leading up to further severe delinquencies. I'd be curious to see the percentage of 30 day lates to go to 60 days late, then 90 days, etc, as I'm sure a huge portion don't just stop at 30 days. And, I'm quite sure lenders know this and that the FICO algorithm in some way factors that in, which is why a 30 day late can be a crushing blow even though it's of the weakest severity.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 30 day late FICO reality

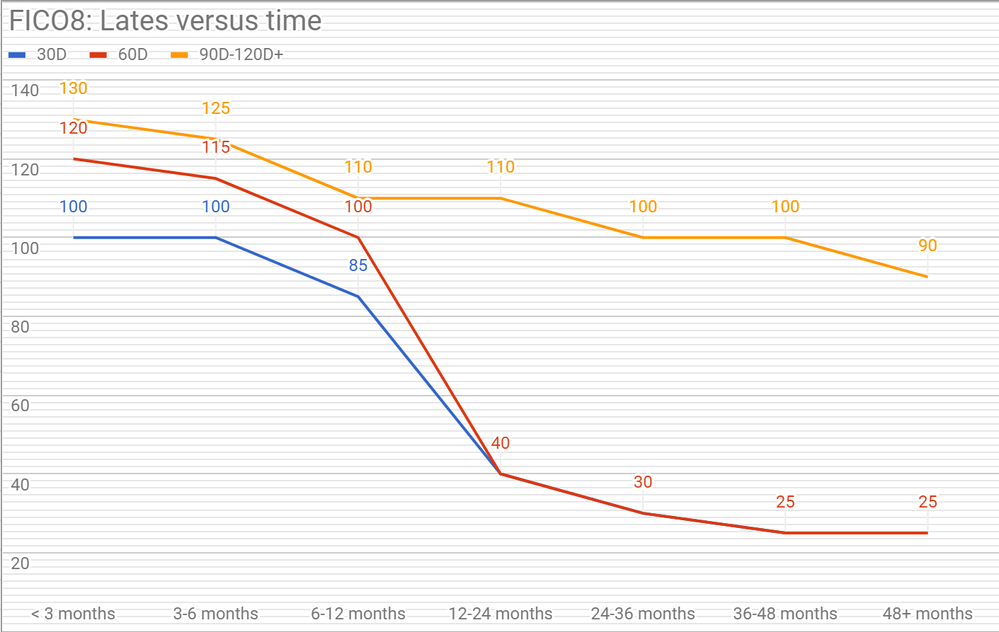

One 30 day late won't matter after 12 to 24 months.

In addition, this is a lesson to have autopay turned on for all accounts.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 30 day late FICO reality

A recent 30 day late is very impactful and should be, as it could be leading up to further severe delinquencies. I'd be curious to see the percentage of 30 day lates to go to 60 days late, then 90 days, etc, as I'm sure a huge portion don't just stop at 30 days. And, I'm quite sure lenders know this and that the FICO algorithm in some way factors that in, which is why a 30 day late can be a crushing blow even though it's of the weakest severity.

"very impactful", "huge portion", "crushing blow". Words don't really convey the math. It would also be "interesting" to see what percentage of single 30-day lates do not ever result in a credit default or any additional lates. Is this information available to Fair Isaac clients who use their service? If, say 25% do not ever have another "late", is their a common denominator or set of variables that can be factored into an improved scoring algorithm? Again, with AI constantly learning and reams of data available, it seems like the "outliers" should be fewer and fewer over time.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 30 day late FICO reality

I've seen that graph before and 40 points can be a 1-2 tier difference in rates. I don't know about you, but I like to negotiate from a position of strength, rather than coming in weak, making excuses as to why the risk score isn't really indicative of the reality. In any case, I'll be carrying zero debt other than mortgage. I'll be paying cash for a while, forsaking 0.9% auto financing in favor of immediate depreciation. When I need to co-sign for my son's apartment when he graduates from college next year and starts his own career, we'll see what happens. If need be, I'll just pay his 12 month lease in advance. I guess the bigger lesson is to make enough and save enough money over time to be able to pay cash for life's necessities.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 30 day late FICO reality

I have to agree with OP 100%! We found ourselves in this exact situation. Wife never late in her life (50's) and had charged $4 on sears account to get discount. Hadnt used sears card in years so auto pay wasnt set. She has health issues as well and totally forgot assuming based on the small amount. She intended to pay cash but cashier offered to pull up her card info to get her a discount. FICO was 850. To say missing a $4 payment is a true indicator that doom and gloom is on the horizon and now she is a credit risk is absurd! We have owned numerous homes, boat, RV .... no payments missed. So a basic review of someones credit report would show timely payments on all transactions including home and a missed $4 charge would clearly show an outlier. Now we don't have the income or cash reserve as OP, we are in good shape and have 6 figure income. To just rely on a credit score is fiscally irresponsible. I would assume most lenders would use this as an opportunity to raise your rate, which is why you should shop around. A repsonsible lender who actually evaluates your credit report will offer a rate truly reflective of your financial responsibility not just off anomaly.