- myFICO® Forums

- FICO Scoring and Other Credit Topics

- General Credit Topics

- Re: 7 yr old late payments / accounts still bad?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

7 yr old late payments / accounts still bad?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 7 yr old late payments / accounts still bad?

@Anonymous wrote:Wait, so you're saying that a late payment of 120 days that was last reported in 2013 is still having an impact on my score?

So, when the account is removed later this month, I can expect to see my score jump almost 50+ points?

Any delinquency on your report has an impact on your score. The severity may slightly diminish at the 2 year mark and onward. For the 90-120 lates, some feel the impact the entire 7 years. YEMV. Once all your delinquencies are removed is when you will see a score boost.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 7 yr old late payments / accounts still bad?

@Anonymous I dont think anyone can answer that question.

120 days late is a severe delinquency, and if that was your only and last one, there would be a significant gain.

However, without really knowing what that "fake" derog is (if it's even one), it's hard to tell.

If you lost points when it showed up, it's not neutral or positive.

120 days late is definitely affecting your score, and will continue to do so till it's off.

While we're at it, "no gains till last one falls off" is not an absolute truth.

There can be gains as various derogs fall off over time, but the biggest gain is realized once the last one is gone.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 7 yr old late payments / accounts still bad?

@Remedios wrote:@Anonymous I dont think anyone can answer that question.

120 days late is a severe delinquency, and if that was your only and last one, there would be a significant gain.

However, without really knowing what that "fake" derog is (if it's even one), it's hard to tell.

If you lost points when it showed up, it's not neutral or positive.

120 days late is definitely affecting your score, and will continue to do so till it's off.

While we're at it, "no gains till last one falls off" is not an absolute truth.

There can be gains as various derogs fall off over time, but the biggest gain is realized once the last one is gone.

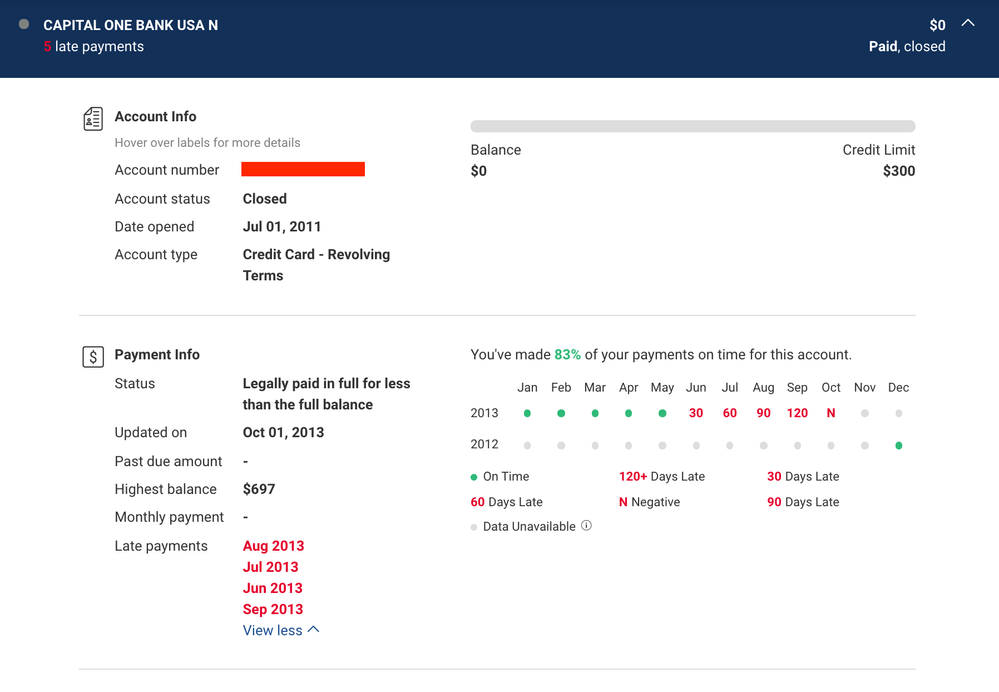

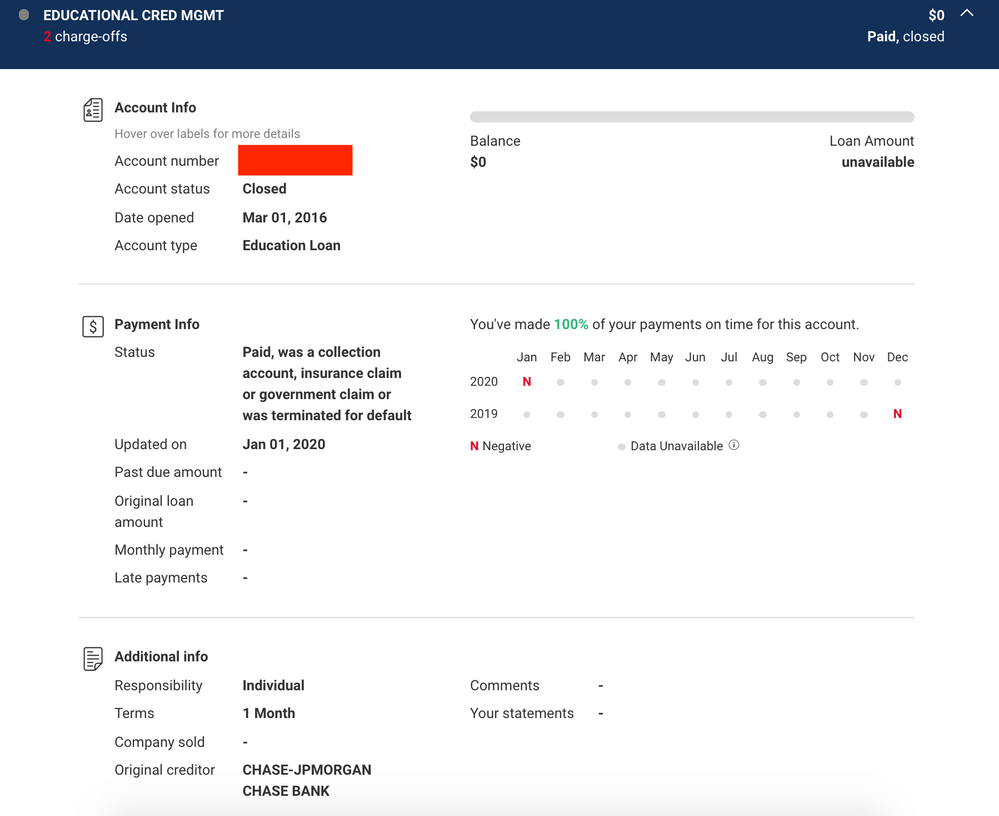

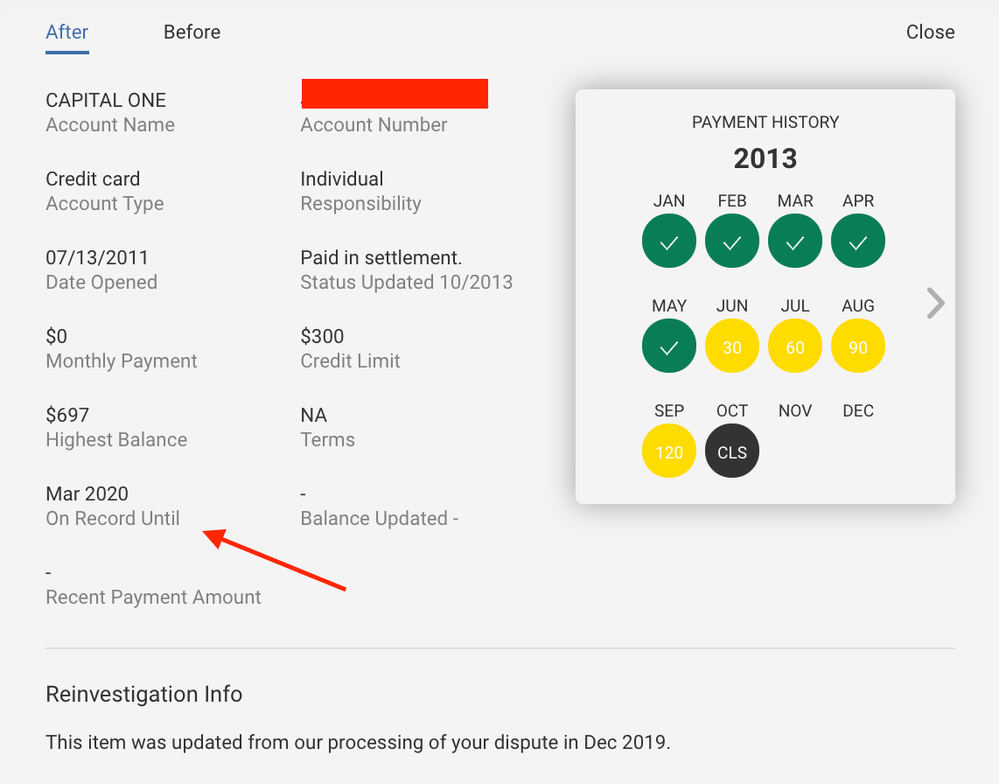

I am attaching some screenshots from my Experian report to demonstrate what I am talking about. The CapitalOne is from 2013 which is due to be deleted March 18th 2020 (according to an early exception note that states "on report till March 18, 2020"). The other is the "fake" late / derog or negative (I dont even know what to call it at this point). Its from an old ECMC loan. My final payment reported as a "N" item. I was told to dispute it and I did and it hit again in Jan. But its a closed paid account. They dont even report payments (I've been told by ECMC and you can see the weird "you've made 100% of payments" indicator). But I know this is somehow holding me back because my last "missed payment" indicator shows that it was 2 months ago. When I had paid off the loan, my score was 650 something. So I did not take a hit, but I know its not letting it go further either. Also, my TU report shows the account paid and closed and that score is 729, which is how I am coming to the conclusing that it is infact affecting my score.

So, that being said, if the CapitalOne falls off March 18th - does my score have a chance of moving up from 679? Even though the CapitalOne is 7 years old now? Or am I still at the mercy of this ECMC account and have to wait for that to fall off in the next 2 years too to see any significant movement?

PS: You can read about the ECMC saga here if you want

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 7 yr old late payments / accounts still bad?

I think you will see some gains, but probably not as much as you would without that other account.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 7 yr old late payments / accounts still bad?

@AllZero wrote:^ I don't have an answer for ECMC.

For Experian, I can't recall if they drop 1 deragatory at a time or if they do it as a string.

Can you clarify what you mean by "drop 1 derogatory". Is derogatory = payment / month? It is my understanding that the whole CapitalOne account is due to fall off March 18th 2020. What would be the string in this case?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 7 yr old late payments / accounts still bad?

@Remedios wrote:I think you will see some gains, but probably not as much as you would without that other account.

Which is what I was suspecting. Even though those CapitalOne late payments are bad, they are now 7 years aged. My TU and EQ scores are 729 and 710 respectively and they also have the CapitalOne account on them. So its this ECMC nonsense that is holding me back for Experian.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 7 yr old late payments / accounts still bad?

If it was charged off, whole account poofs

If it's a string, 30, 60, 90 etc, but without account being charged off, there are two ways these get removed

One way is that all delinquencies are removed when first one reaches 7 years

The other way is each one drops off at 7 years, meaning one falls off each month.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 7 yr old late payments / accounts still bad?

@Anonymous wrote:

@AllZero wrote:^ I don't have an answer for ECMC.

For Experian, I can't recall if they drop 1 deragatory at a time or if they do it as a string.

Can you clarify what you mean by "drop 1 derogatory". Is derogatory = payment / month? It is my understanding that the whole CapitalOne account is due to fall off March 18th 2020. What would be the string in this case?

This may give you some insight.

https://ficoforums.myfico.com/t5/Understanding-FICO-Scoring/Aging-Delinquencies/m-p/5829291

String, e.g. 30, 60, 90, and 120 all together vs one removal per month.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 7 yr old late payments / accounts still bad?

The account was charged off after the last 120 day late in 2013. I called in December to get it deleted and they said the earliest they could move it was March 2020. Which is now. That is what the dispute shows too. I called again to see what the exact date would be and they said "March 18th, 2020".

Not sure what "on record till" means. But I just assumed the whole account would be removed.