- myFICO® Forums

- FICO Scoring and Other Credit Topics

- General Credit Topics

- Amex "Key Factors Affecting Your Score"

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Amex "Key Factors Affecting Your Score"

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Amex "Key Factors Affecting Your Score"

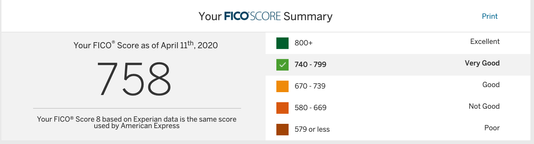

Hello - my score recently updated with Amex after recovering from some recent events. The "key factors affecting your score" have since been replaced from the old factors to the ones indicated below.

My oldest account is 3.5 years and newest is 6 months old (which is the Amex Delta Gold). I have 4 inquiries in the last 12 months. Would this really be a factor if I applied for an Amex Gold (which I plan to do a month from now). I was hoping after a score recovery, there would not be much left in the "key factors" section.

Do they just always have something to say even with decent scores?

Also, that looks like my FICO Bankcard 2 score as my FICO 8 is 764.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Amex "Key Factors Affecting Your Score"

Thanks for sharing the DP.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Amex "Key Factors Affecting Your Score"

@Anonymous wrote:... Do they just always have something to say even with decent scores?

Yes. ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Amex "Key Factors Affecting Your Score"

Reminds me of our Company's old auditor. You could literally have everything just how it's supposed to be, but he alwasy found something that was wrong or to "improve" on. lol

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Amex "Key Factors Affecting Your Score"

@Anonymous wrote:Reminds me of our Company's old auditor. You could literally have everything just how it's supposed to be, but he alwasy found something that was wrong or to "improve" on. lol

Tell me about it! I guess we will see in a month when I ask them to open their purse.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Amex "Key Factors Affecting Your Score"

What's even better is when CK is emailing you like crazy with kudos for doing so well, then when you log in it's a bunch of reasons why your score is low. So what was all that one in a million talk?

Somehow my score decreased by paying off $500 in balances, but they increased by $250. What..

reading their algo reasons gives me a headache.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Amex "Key Factors Affecting Your Score"

@Anonymous wrote:What's even better is when CK is emailing you like crazy with kudos for doing so well, then when you log in it's a bunch of reasons why your score is low. So what was all that one in a million talk?

Somehow my score decreased by paying off $500 in balances, but they increased by $250. What..

reading their algo reasons gives me a headache.

I've just never trusted CK. According to it, my approval odds for the Chase Sapphire Reserve are "Excellent" but for the Chase Sapphire Preferred are "fair".

I'm sure it's suppose to be the other way round. But oh well.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Amex "Key Factors Affecting Your Score"

@Anonymous wrote:Hello - my score recently updated with Amex after recovering from some recent events. The "key factors affecting your score" have since been replaced from the old factors to the ones indicated below.

My oldest account is 3.5 years and newest is 6 months old (which is the Amex Delta Gold). I have 4 inquiries in the last 12 months. Would this really be a factor if I applied for an Amex Gold (which I plan to do a month from now). I was hoping after a score recovery, there would not be much left in the "key factors" section.

Do they just always have something to say even with decent scores?

Also, that looks like my FICO Bankcard 2 score as my FICO 8 is 764.

Those reasons are negative reason codes provided by FICO not what Amex "thinks" of your profile. And yes, as long as your score is under 850 FICO provides reason codes.

These reason codes are listed in order with the #1 having the largest effect on your score.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Amex "Key Factors Affecting Your Score"

@dragontears wrote:

@Anonymous wrote:Hello - my score recently updated with Amex after recovering from some recent events. The "key factors affecting your score" have since been replaced from the old factors to the ones indicated below.

My oldest account is 3.5 years and newest is 6 months old (which is the Amex Delta Gold). I have 4 inquiries in the last 12 months. Would this really be a factor if I applied for an Amex Gold (which I plan to do a month from now). I was hoping after a score recovery, there would not be much left in the "key factors" section.

Do they just always have something to say even with decent scores?

Also, that looks like my FICO Bankcard 2 score as my FICO 8 is 764.

Those reasons are negative reason codes provided by FICO not what Amex "thinks" of your profile. And yes, as long as your score is under 850 FICO provides reason codes.

These reason codes are listed in order with the #1 having the largest effect on your score.

Sure. I understand there is an automated back end of complex systems talking to each other that generate these generic outcomes.

Just unpleasant to see if you're trying to get approved for something.

That was all I was saying.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Amex "Key Factors Affecting Your Score"

@Anonymous wrote:

@dragontears wrote:

@Anonymous wrote:Hello - my score recently updated with Amex after recovering from some recent events. The "key factors affecting your score" have since been replaced from the old factors to the ones indicated below.

My oldest account is 3.5 years and newest is 6 months old (which is the Amex Delta Gold). I have 4 inquiries in the last 12 months. Would this really be a factor if I applied for an Amex Gold (which I plan to do a month from now). I was hoping after a score recovery, there would not be much left in the "key factors" section.

Do they just always have something to say even with decent scores?

Also, that looks like my FICO Bankcard 2 score as my FICO 8 is 764.

Those reasons are negative reason codes provided by FICO not what Amex "thinks" of your profile. And yes, as long as your score is under 850 FICO provides reason codes.

These reason codes are listed in order with the #1 having the largest effect on your score.

Sure. I understand there is an automated back end of complex systems talking to each other that generate these generic outcomes.

Just unpleasant to see if you're trying to get approved for something.

That was all I was saying.

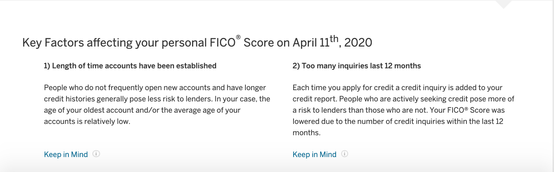

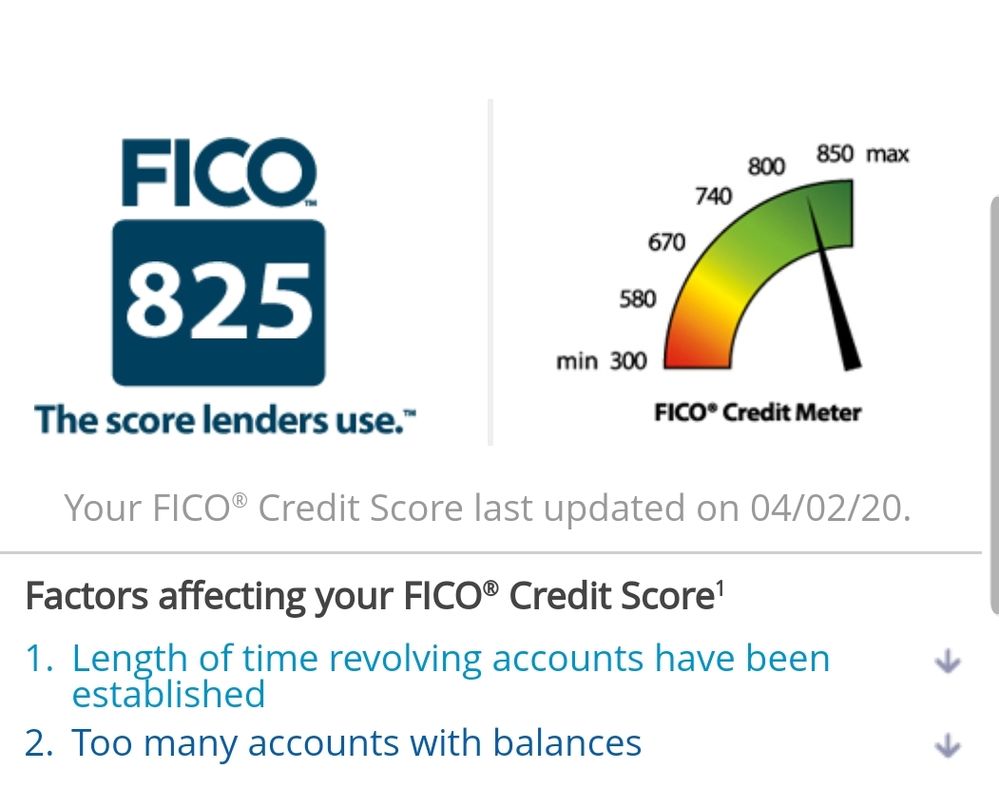

Get comfortable with seeing negative reason codes, they will be there even with a high score.

My most recent ones on TU