- myFICO® Forums

- FICO Scoring and Other Credit Topics

- General Credit Topics

- Bank to cancel card for lack of usage - is it bett...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Bank to cancel card for lack of usage - is it better to cancel on my own for credit reporting?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- « Previous

- Next »

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Bank to cancel card for lack of usage - is it better to cancel on my own for credit reporting?

@FalconSteve wrote:

@Anonymous wrote:Whether it was young or if it was very old doesn't matter and wouldn't impact your scores any differently. Open accounts and closed accounts are factored into age of accounts the same way.

This varies by scoring method

On what score model or version are closed accounts not included in aging metrics?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Bank to cancel card for lack of usage - is it better to cancel on my own for credit reporting?

@olivia3636 wrote:I have 5 credit cards. I have intentionally been paying down cards/keeping utilization low in preperation for building the house. Below is my credit card mix/profile.

Navy Federal - $49k Limit - 28% utilization

Amex - $44k limit - 0% utilization

Chase - $27k Limit - 0% utilization

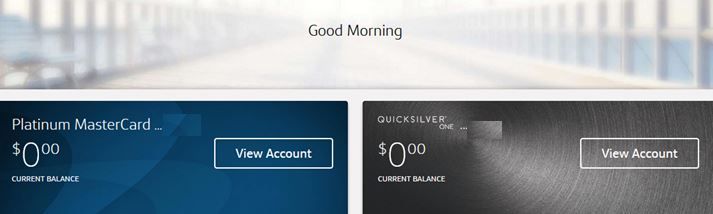

Capital One CC1 - $1,800 Limit - 0% utilization (oldest credit card)

Capital One CC2 - $6,500 Limit - 0% utilization - This is the card they are closing

With this setup I wouldn't even waste my time thinking about it, just move on. To me it almost appears to be a CLD, i mean why close the acount with the highest CL and not even give you the choice to keep it open? IMHO you're not missing out on anything by not having any Cap 1 cards in your profile.

Then again you mention you have been paying cards down so UT might have been an issue with them at some point, who knows. I'd be tempted to close it myself out of spite but it really isn't worth your time and effort.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Bank to cancel card for lack of usage - is it better to cancel on my own for credit reporting?

@FalconSteve wrote:

@Anonymous wrote:Whether it was young or if it was very old doesn't matter and wouldn't impact your scores any differently. Open accounts and closed accounts are factored into age of accounts the same way.

This varies by scoring method

I believe you are incorrect. If you can reference for me a Fico scoring model that doesn't include closed accounts I'd enjoy a link to it, as would others I'm sure.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Bank to cancel card for lack of usage - is it better to cancel on my own for credit reporting?

@Shooting-For-800 wrote:

@Slabenstein wrote:

@Physh1 wrote:Cap 1 combines accounts/limits...see if they are willing to move the $6500 over to the other card.

They stopped doing this a while ago, unfortunately.

Someone stated on this board recently that it is back ...

@Shooting-For-800 do you have the source, link or thread? IIRC, that feature hasn't been reinstated. You'd be seeing a lot of members flock to a mega thread if that were the case.

The unsecuring (or graduation) of Capital One cards has returned less than a month ago, as far as options that used to be available at some point with the issuer.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Bank to cancel card for lack of usage - is it better to cancel on my own for credit reporting?

@FinStar wrote:

@Shooting-For-800 wrote:

@Slabenstein wrote:

@Physh1 wrote:Cap 1 combines accounts/limits...see if they are willing to move the $6500 over to the other card.

They stopped doing this a while ago, unfortunately.

Someone stated on this board recently that it is back ...

@Shooting-For-800 do you have the source, link or thread? IIRC, that feature hasn't been reinstated. You'd be seeing a lot of members flock to a mega thread if that were the case.

The unsecuring (or graduation) of Capital One cards has returned less than a month ago, as far as options that used to be available at some point with the issuer.

@FinStar Are you in fact saying that Cap1 is now unsecuring cards again? I have not seen that anywhere. I talked to a Rep about that maybe 2 or 3 months ago and they stated they were not doing that any time in the near future. Sounds good if this is now the near future.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Bank to cancel card for lack of usage - is it better to cancel on my own for credit reporting?

@Iusedtolurk wrote:

@FinStar wrote:

@Shooting-For-800 wrote:

@Slabenstein wrote:

@Physh1 wrote:Cap 1 combines accounts/limits...see if they are willing to move the $6500 over to the other card.

They stopped doing this a while ago, unfortunately.

Someone stated on this board recently that it is back ...

@Shooting-For-800 do you have the source, link or thread? IIRC, that feature hasn't been reinstated. You'd be seeing a lot of members flock to a mega thread if that were the case.

The unsecuring (or graduation) of Capital One cards has returned less than a month ago, as far as options that used to be available at some point with the issuer.

@FinStar Are you in fact saying that Cap1 is now unsecuring cards again? I have not seen that anywhere. I talked to a Rep about that maybe 2 or 3 months ago and they stated they were not doing that any time in the near future. Sounds good if this is now the near future.

Maybe the past 4-6 weeks. There is a thread about Cap One graduating with DPs of several members having their cards graduating from accounts many years old to the most recent opening date being like late 2019 (maybe 10/2019?)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Bank to cancel card for lack of usage - is it better to cancel on my own for credit reporting?

@Iusedtolurk wrote:

@FinStar wrote:

@Shooting-For-800 wrote:

@Slabenstein wrote:

@Physh1 wrote:Cap 1 combines accounts/limits...see if they are willing to move the $6500 over to the other card.

They stopped doing this a while ago, unfortunately.

Someone stated on this board recently that it is back ...

@Shooting-For-800 do you have the source, link or thread? IIRC, that feature hasn't been reinstated. You'd be seeing a lot of members flock to a mega thread if that were the case.

The unsecuring (or graduation) of Capital One cards has returned less than a month ago, as far as options that used to be available at some point with the issuer.

@FinStar Are you in fact saying that Cap1 is now unsecuring cards again? I have not seen that anywhere. I talked to a Rep about that maybe 2 or 3 months ago and they stated they were not doing that any time in the near future. Sounds good if this is now the near future.

It appears a variety of cardholders have reported it via the following link. It's not something that can be requested, though. But, it's a step in the right direction.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Bank to cancel card for lack of usage - is it better to cancel on my own for credit reporting?

@FinStar wrote:

@Iusedtolurk wrote:

@FinStar wrote:

@Shooting-For-800 wrote:

@Slabenstein wrote:

@Physh1 wrote:Cap 1 combines accounts/limits...see if they are willing to move the $6500 over to the other card.

They stopped doing this a while ago, unfortunately.

Someone stated on this board recently that it is back ...

@Shooting-For-800 do you have the source, link or thread? IIRC, that feature hasn't been reinstated. You'd be seeing a lot of members flock to a mega thread if that were the case.

The unsecuring (or graduation) of Capital One cards has returned less than a month ago, as far as options that used to be available at some point with the issuer.

@FinStar Are you in fact saying that Cap1 is now unsecuring cards again? I have not seen that anywhere. I talked to a Rep about that maybe 2 or 3 months ago and they stated they were not doing that any time in the near future. Sounds good if this is now the near future.

It appears a variety of cardholders have reported it via the following link. It's not something that can be requested, though. But, it's a step in the right direction.

Had no idea this was going on and experienced by quite a number of people. Thanks @FinStar for the link (quite a number of replies).

I usually always carry a small balance but I just happened to pay it down to zero for this upcoming statement (7% last statement) Plan to use and keep paying to zero for awhile. Mines will hit 3 years secured next month in FEB. soooo who knows.

Either way as I usually have balances on my accounts so zero balances look great!

CONGRATS to all who have went from secured to unsecured so far and hopefully one day in the future I will be one of those receiving Congrats.