- myFICO® Forums

- FICO Scoring and Other Credit Topics

- General Credit Topics

- CK must think I can't manage things

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

CK must think I can't manage things

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

CK must think I can't manage things

I got an interesting email from CK about a new card, I recently opened. I found this hilarious as it seems they are just convinced I can't manage it and will need to be asking them for forgiveness. This sort of made me mad, but then I started laughing. I'm sure asking for a cap on your spending would be a fast way to get a creditor to slash your CL. Message below:

Looks like you have a new credit card. Congrats! Check out these tips from our credit insiders:

Name your payment date. Most issuers will let you set your due date to when it's easiest to pay.

Limit your spending. Ask your issuer to set a cap on your spending so you can keep your balances low.

Remove late fees. See if the issuer will waive the charge on a late payment.

Head over now to check out your brand-new account!

First Goal Score: 750+ Reached 3/2019

Next Goal all over 800

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: CK must think I can't manage things

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: CK must think I can't manage things

@SoCalifornia wrote:

CK just assumes everyone am an idiot.

Yeah, everyone not is so stoopid like they think

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: CK must think I can't manage things

If you recall who CK's targeted demographic is you'd understand why they are sending that to you. Most people who are well versed in credit don't touch CK except for the basic monitoring & alerts they provide. CK targets the ones new to credit or the uneducated in credit...with that in mind the emails make sense. Junk them if you don't like them :-)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: CK must think I can't manage things

CK says a lot of dumb things and the purpose for them is to make money off consumers, if they apply for credit cards on CKs website.

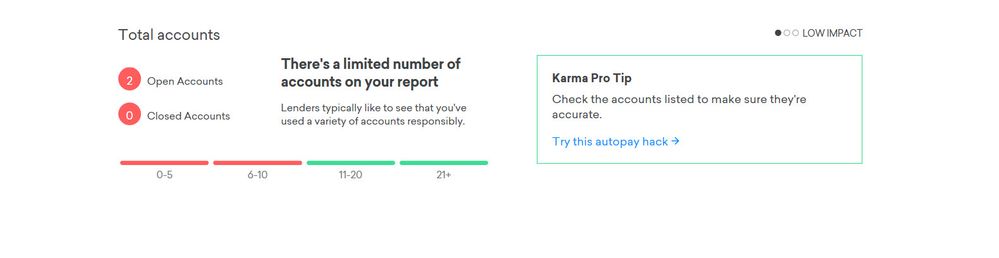

While some on the board may have these many cards, I find this appalling from the total accounts I should have by CKs standards. At the most back in 2008 I had 5 credit cards and 2 lines of credit....who really needs 11-20 cards or 21+ cards to be in the green?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: CK must think I can't manage things

I never received an email or alert for CK when I opened a new account. I wonder if this is something new as my last new account was reported 8/2018. Also I wonder if it has anything to do with one's current CC UTL at the time a new account is reported?

But as stated, I wouldn't worry about their suggestions or comments. Their algorithm is different. They hate UTL. I'm at 5% UTL on 1 card out of 9 (usually stay around 1-3%) and I lost 8 points on their score. Reason for change in score;

"Overall, you're doing a great job of keeping your balances low, but sometimes even a small increase can cause your score to go down. To maintain a healthy Credit Card Utilization, try to keep your total balances below 30% of your total credit limits."

Uh, I did that....

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: CK must think I can't manage things

@Trudy wrote:I never received an email or alert for CK when I opened a new account. I wonder if this is something new as my last new account was reported 8/2018. Also I wonder if it has anything to do with one's current CC UTL at the time a new account is reported?

But as stated, I wouldn't worry about their suggestions or comments. Their algorithm is different. They hate UTL. I'm at 5% UTL on 1 card out of 9 (usually stay around 1-3%) and I lost 8 points on their score. Reason for change in score;

"Overall, you're doing a great job of keeping your balances low, but sometimes even a small increase can cause your score to go down. To maintain a healthy Credit Card Utilization, try to keep your total balances below 30% of your total credit limits."

Uh, I did that....

It may be something new they are trying as this is the first such email I've gotten like this. I've had the account for quite a while before I found out the scores did not count for anything. I keep it and log in occasionally just as a way to see what is getting reported on those two CRAs. I learned the hard way not to pay any attention to your approval odds for this card is excellent.

Speaking of Vantage scores, before I found this place, I had used CK and they had my both TU and EQ at over 700, I was initially shocked to see my Ficos in the low 600's. I've been working hard this past year to improve my Ficos and through some good luck and the rest of my baddies aging off, I've picked them up a good bit. Now that I'm in the mid 7's on Fico, Vantage now has me in the high 6's to very low 7's

First Goal Score: 750+ Reached 3/2019

Next Goal all over 800

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: CK must think I can't manage things

I get that @dynamicvb

I too use them now for their reports and used them long ago not anything about the difference between V3 and Fico. It did help me tremendously on my rebuild. Mainly changing habits and understand some components of scoring (although different w/ V3). I had some old lates but mostly had high UTL. I focused on reducing my CC UTL and saw my V3 score rise from mid 600 to high 700's. Thrilling. I also found a collection on EQ that was not valid. Somewhere along the journey I learned the difference and pulled my Fico scores and was on a new journey. I too was shocked to find my Fico scores were lower. This forum was eye opening as l learned about many more components. With what I learned I was able to get that erroneous collection removed while previously I was just fighting with the collection company. No clue where my Fico scores were in comparison before 2016, but since I got on the Fico train my Fico scores have always been lower than vantage and still are. But the reports are valuable, particularly EQ since their reports and scores are harder to come by for free. I'm now only focused on Fico score changes.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: CK must think I can't manage things

@Anonymous wrote:While some on the board may have these many cards, I find this appalling from the total accounts I should have by CKs standards. At the most back in 2008 I had 5 credit cards and 2 lines of credit....who really needs 11-20 cards or 21+ cards to be in the green?

You're misinterpreting that scale. Thats referring to all types of accounts(mortgages, auto loans, credit cards, HELOCS....) both open and closed over time. They're certainly not implying that one should seek out 21 open credit cards.

If items didn't fall off of our reports after ten years, I would be sitting at 16 accounts.

@Anonymous wrote:....who really needs 11-20 cards or 21+ cards to be in the green?

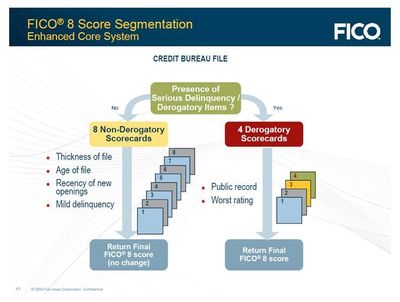

Considering that the number of accounts or "Thickness" is a factor in determining your FICO scorecard, I would say that it has more relevance to your score than with CK pushing card applications.

Rebuild Cards

Goal Cards

Loans

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: CK must think I can't manage things

@Anonymous wrote:

While some on the board may have these many cards, I find this appalling from the total accounts I should have by CKs standards. At the most back in 2008 I had 5 credit cards and 2 lines of credit....who really needs 11-20 cards or 21+ cards to be in the green?

It's not how many you should have, it's how many are required for no scoring penalty. Keep in mind the chart you show above with the pretty Christmas colors is just front-end fluff made by some human being that thought it looks good and would somehow benefit (perhaps manipulate) others. It's perfectly possible that the account ranges above have absolutely nothing to do with VS 3.0 scoring.

On to FICO scoring, which actually does matter, many people have theorized that a number of accounts on your credit report (open and closed) somewhere around 11+ may in fact be ideal. Could it be 8? 10? 12? Perhaps and no one really knows, as it's all proprietary information. The scoring difference we're talking though is extremely insignificant. For example, say perhaps 11 accounts is the threshold and someone moves from 10 to 11. They may pick up a couple of FICO points, something that's almost going to be impossible to see and actually likely 100% impossible because the adding of that 11th account with the inquiry and age of accounts reductions is the majority of the time going to overpower the slight score gain with a greater score loss, resulting in a net loss still.

The point is to not sweat number of accounts when you're talking something around 10 accounts. The only time number of accounts really matters is when you've got very few accounts and you're trying to move from a "thin" to a non-thin file for scorecard segmentation. Whatever number that is (3 or 4, maybe) is going to be significantly less than the 10+ you see suggested for squeezing out a few more FICO points at the top end.