- myFICO® Forums

- FICO Scoring and Other Credit Topics

- General Credit Topics

- Re: Comenity Majors vs Comenity Minors/Credit Repo...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Comenity Majors vs Comenity Minors/Credit Report

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Comenity Majors vs Comenity Minors/Credit Report

Can you please explain to me what they are and what's the difference between them.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Comenity Majors vs Comenity Minors/Credit Report

No clue. FICO looks at any credit card account as a revovling line of credit. FICO doesnt care who the creditor is. The consumer does. Every revovling Credit Line vs. whats reported %-wise with the tweaks that EX, TU, and EQ have to come up with a FICO Score is reported on a credit report. Its the consumer who grades whats a major or minor.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Comenity Majors vs Comenity Minors/Credit Report

@AyaMai wrote:Can you please explain to me what they are and what's the difference between them.

I've never heard of those terms. Can you refer us to your source for that?

Total revolving limits 741200 (620700 reporting) FICO 8: EQ 703 TU 704 EX 687

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Comenity Majors vs Comenity Minors/Credit Report

@AyaMai wrote:Can you please explain to me what they are and what's the difference between them.

There is no difference as to the reporting aspect since a "major" or "minor" (as you reference it) are reported as revolving accounts. The only key difference is whether Comenity reports some of their V/MC/AX as bankcards.

Potentially, and depending on the state you live, insurance UW could play a role in your rates if they access reports and the ratio of retail (closed loop) accounts is proportionally higher than bank cards.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Comenity Majors vs Comenity Minors/Credit Report

@SouthJamaica wrote:

@AyaMai wrote:Can you please explain to me what they are and what's the difference between them.

I've never heard of those terms. Can you refer us to your source for that?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Comenity Majors vs Comenity Minors/Credit Report

@AyaMai wrote:

@SouthJamaica wrote:

@AyaMai wrote:Can you please explain to me what they are and what's the difference between them.

I've never heard of those terms. Can you refer us to your source for that?

Thank you very much for giving me the source of that distinction between "majors" and "minors". I'm sorry but I don't know what the distinction is.

Total revolving limits 741200 (620700 reporting) FICO 8: EQ 703 TU 704 EX 687

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Comenity Majors vs Comenity Minors/Credit Report

@SouthJamaica wrote:

@AyaMai wrote:

@SouthJamaica wrote:

@AyaMai wrote:Can you please explain to me what they are and what's the difference between them.

I've never heard of those terms. Can you refer us to your source for that?

Thank you very much for giving me the source of that distinction between "majors" and "minors". I'm sorry but I don't know what the distinction is.

I had recently read a PDF that had been widely circulated in the credit repair area. It had listed Comenity majors and Comenity minors and also which credit bureau's that the majors and minors had pulled from. It also said that the majors were any Visa/MasterCard/AMEX that Comenity issued that could be used everywhere. The minors were considered store and retailer credit cards issued by Comenity that could usually be used in only one place such as Lowe's, banana republic, the Lexus card, etc.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Comenity Majors vs Comenity Minors/Credit Report

@RealEstateGuy89 wrote:

@SouthJamaica wrote:

@AyaMai wrote:

@SouthJamaica wrote:

@AyaMai wrote:Can you please explain to me what they are and what's the difference between them.

I've never heard of those terms. Can you refer us to your source for that?

Thank you very much for giving me the source of that distinction between "majors" and "minors". I'm sorry but I don't know what the distinction is.

I had recently read a PDF that had been widely circulated in the credit repair area. It had listed Comenity majors and Comenity minors and also which credit bureau's that the majors and minors had pulled from. It also said that the majors were any Visa/MasterCard/AMEX that Comenity issued that could be used everywhere. The minors were considered store and retailer credit cards issued by Comenity that could usually be used in only one place such as Lowe's, banana republic, the Lexus card, etc.

OK well now that they've been defined for me, my answer to the question is:

It makes no difference, they would be treated the same in any FICO algorithm, with one possible minor exception -- if practicing AZEO (all zero but one) it's preferable not to use a store card as the card reporting a balance.

Total revolving limits 741200 (620700 reporting) FICO 8: EQ 703 TU 704 EX 687

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Comenity Majors vs Comenity Minors/Credit Report

@SouthJamaica wrote:

@RealEstateGuy89 wrote:

@SouthJamaica wrote:

@AyaMai wrote:

@SouthJamaica wrote:

@AyaMai wrote:Can you please explain to me what they are and what's the difference between them.

I've never heard of those terms. Can you refer us to your source for that?

Thank you very much for giving me the source of that distinction between "majors" and "minors". I'm sorry but I don't know what the distinction is.

I had recently read a PDF that had been widely circulated in the credit repair area. It had listed Comenity majors and Comenity minors and also which credit bureau's that the majors and minors had pulled from. It also said that the majors were any Visa/MasterCard/AMEX that Comenity issued that could be used everywhere. The minors were considered store and retailer credit cards issued by Comenity that could usually be used in only one place such as Lowe's, banana republic, the Lexus card, etc.

OK well now that they've been defined for me, my answer to the question is:

It makes no difference, they would be treated the same in any FICO algorithm, with one possible minor exception -- if practicing AZEO (all zero but one) it's preferable not to use a store card as the card reporting a balance.

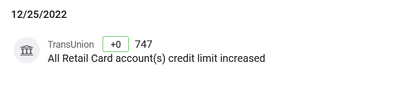

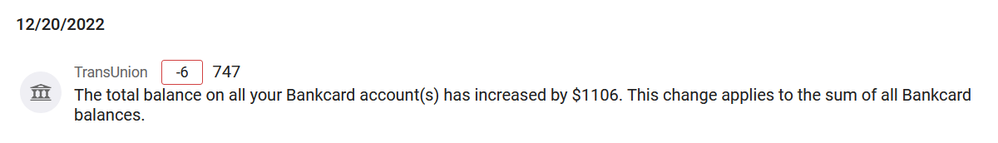

I've seen in the alerts on myFICO that TransUnion specifies bankcards or retail cards.

I don't know how, or if, that affects the score. And I haven't seen any such distinction from Equifax or Experian, and I just scrolled through several months of alerts looking for them. I think there are other places in the reports I've seen them listed seperately. I just dug up the alerts because that was fresh on my mind from looking at one this morning and I knew where to find it quickly.

To my way of thinking, I have two "store cards," only good at that store or on their website, no Visa or MC logo or anything like that. But for reasons I don't understant, my Kay Jewelers card from Genesis FS seems to be considered a "bankcard" while the Eddie Bauer card from Comenity Bank is considered a "store card."

Starting Score: EQ8 680, TU8 713, EX8 701

Starting Score: EQ8 680, TU8 713, EX8 701Current Score: EQ8 778, TU8 766, EX8 770 as of April 19

Goal Score: EQ8 780, TU8 780, EX8 780

Take the myFICO Fitness Challenge

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Comenity Majors vs Comenity Minors/Credit Report

@mgood wrote:

@SouthJamaica wrote:

@RealEstateGuy89 wrote:

@SouthJamaica wrote:

@AyaMai wrote:

@SouthJamaica wrote:

@AyaMai wrote:Can you please explain to me what they are and what's the difference between them.

I've never heard of those terms. Can you refer us to your source for that?

https://ficoforums.myfico.com/t5/General-Credit-Topics/Which-Report-Will-They-Pull-Part-2/td-p/63797...coreball

Thank you very much for giving me the source of that distinction between "majors" and "minors". I'm sorry but I don't know what the distinction is.

I had recently read a PDF that had been widely circulated in the credit repair area. It had listed Comenity majors and Comenity minors and also which credit bureau's that the majors and minors had pulled from. It also said that the majors were any Visa/MasterCard/AMEX that Comenity issued that could be used everywhere. The minors were considered store and retailer credit cards issued by Comenity that could usually be used in only one place such as Lowe's, banana republic, the Lexus card, etc.

OK well now that they've been defined for me, my answer to the question is:

It makes no difference, they would be treated the same in any FICO algorithm, with one possible minor exception -- if practicing AZEO (all zero but one) it's preferable not to use a store card as the card reporting a balance.

I've seen in the alerts on myFICO that TransUnion specifies bankcards or retail cards.

I don't know how, or if, that affects the score. And I haven't seen any such distinction from Equifax or Experian, and I just scrolled through several months of alerts looking for them. I think there are other places in the reports I've seen them listed seperately. I just dug up the alerts because that was fresh on my mind from looking at one this morning and I knew where to find it quickly.

To my way of thinking, I have two "store cards," only good at that store or on their website, no Visa or MC logo or anything like that. But for reasons I don't understant, my Kay Jewelers card from Genesis FS seems to be considered a "bankcard" while the Eddie Bauer card from Comenity Bank is considered a "store card."

Thank for the useful info.