- myFICO® Forums

- FICO Scoring and Other Credit Topics

- General Credit Topics

- Consumer Finance Accounts - List of Known Lenders

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Consumer Finance Accounts - List of Known Lenders

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Consumer Finance Accounts - List of Known Lenders

With inquiry binning, it's possible to take one on and receive no score drop. Whether binning is the same across all models, I'm not sure.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Consumer Finance Accounts - List of Known Lenders

It is a revolver right? If so, very weird; same happened to me on EQ...baffled.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Consumer Finance Accounts - List of Known Lenders

@Anonymous wrote:

Your AoYA was over 12 months and you didn't take a hit when the new account hit?

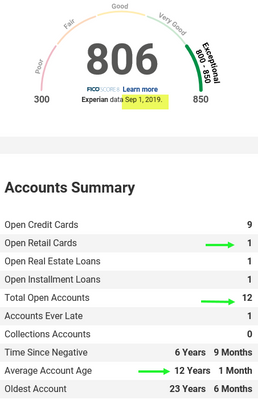

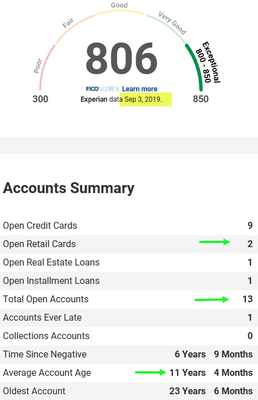

AoYA hit 1Y on 8/1/19. New account reported to EX on 9/3 and no change in any of my F8 scores with EX. My AAoA changed from 12Y1M as of 9/1/19 to 11Y4M on 9/3 when the account reported.

It is a revolver right? If so, very weird; same happened to me on EQ...baffled.Yes, it reported as a revolver. Not as a bankcard as noted earlier in the post but as a retail card.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Consumer Finance Accounts - List of Known Lenders

I would think it has something to do with the coding.

As an aside, what's your negative item from 6 years 9 months ago? I'm assuming a 30 day late, since a more severe negative would no doubt keep you out of the 800's.

Is it possible that the presence of a late payment could be impacting scorecard assignment and/or impact of an AoYA reduction?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Consumer Finance Accounts - List of Known Lenders

@Anonymous wrote:I would think it has something to do with the coding.

As an aside, what's your negative item from 6 years 9 months ago? 1 30D from 12/2012 (in sig)

Is it possible that the presence of a late payment could be impacting scorecard assignment and/or impact of an AoYA reduction? I guess it is possible. That would indicate the 30D is actually saving me from losing points, clearly hurting for gaining points. I want to say I had a discussion with Birdman7 about my 30D impacting my scorecard and his thoughts were no. I could be wrong, don't want to misquote. Could have been that the 30D does not put me in a dirty scorecard....

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Consumer Finance Accounts - List of Known Lenders

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Consumer Finance Accounts - List of Known Lenders

Nevertheless there are modifiers from my understanding for scorecards, so it is possible that 30 day late is acting as a modifier and in someway affecting score, as BBS implied. Strange.

It would be nice to figure it out, but we cant always figure out everything. Definitely be interested in hearing what more experienced members have to say.

Did Equifax and TransUnion respond as expected?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Consumer Finance Accounts - List of Known Lenders

As noted previously, I won't know what the other 2 bureaus have to say until I receive my 3B F8 report from EX on the 10th or an alert from MyFico. Heck, not sure if it's this post or another as we've had dialogue about some of the same topics in different post ![]() Had my 3B monthly report from MyFico on 9/2 which is clearly too soon for an update with the new acct for EQ and TU (EX showed the INQ though). All of my accounts have a report date between the 24th and 5th. Usually everything is updated by the 10th with EX, much later for TU and not sure about EQ. Not sure about the new acct or whether it will update with the balance before 10/3 since it didn't report as a new account with a balance on 9/3.

Had my 3B monthly report from MyFico on 9/2 which is clearly too soon for an update with the new acct for EQ and TU (EX showed the INQ though). All of my accounts have a report date between the 24th and 5th. Usually everything is updated by the 10th with EX, much later for TU and not sure about EQ. Not sure about the new acct or whether it will update with the balance before 10/3 since it didn't report as a new account with a balance on 9/3.

I've never been credit seeking and got into debt like many without knowing anything about credit in the past and not managing appropriately. So now that I refi'd my home and spent the $$$$$ on replacing all of my furniture due to need (one piece to go, don't plan on spending more than 2K, likely cash if that within the next month), I'm willing to test things as long as I don't incur more debt than needed as I don't see a need for any new apps and hopefully/prayerfully don't have an emergency need within the next few years or more.

Once the new bed balance reports on the new acct I"ll be at approximately 13K of 95K CL. The only balance that's incurring interest is $1959 on one card at 9% APR which I can pay down in 2 months or can take a less than $15 interest charge for testing purposes. Note the new acct will add to # of accts reporting a balance (see sig for total accts). Plan to have the 13K paid off in the next 8 - 12 months. I won't be a total guinea pig but willing to test some things that will help others and myself get a more definitive answer about specific situations...with similar profiles at least. Bring it on guru's ![]() I'll do what I can.

I'll do what I can.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Consumer Finance Accounts - List of Known Lenders

Equifax is not so easy. But CK updates it weekly. And MF will shoot you an alert whenever it feels like it.

As for testing purposes, we need before and after scores and negative reason codes can be helpful. It would be nice to have a 3B from August 31 and from September 1, so we could see the AoYA gains on all 28 algorithms.

Next, before and after reports from each bureau for the new account hitting would be helpful. Do you have Experian creditworks? It’s awesome you pulled the 3B on September 2. Do you have your EX scores from September 3? Either by 1B or via Experian credit works? If so, that would be great because it would give us your score changes for most algorithms, depending on source. (EX credit works leaves out version 9😔. )

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Consumer Finance Accounts - List of Known Lenders

What will be the individual utilization on this account? How many accounts with a balance do you currently have? And then we know you will have one more when this report correct?