- myFICO® Forums

- FICO Scoring and Other Credit Topics

- General Credit Topics

- Re: Credit Karma Faco scores

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Credit Karma Faco scores

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Credit Karma Faco scores

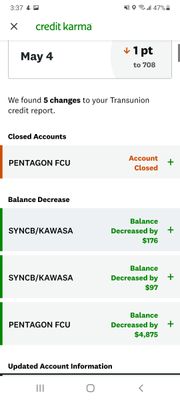

Can anyone explain why my faco scores dropped by one point after paying off the remainder of my auto loan and a bit on my other 2 loans (5k+total)? Is that 168$ balance from my charge card really that big of a deal or am I missing something else?

TU didn't even report the balance on the charge card so I'm thinking that had nothing to do with it... could be wrong though.

Discover it cashback: $10900

Citi DC: $13000

WF Propel: closed 2k

Amex BCED: $3000

Amex Gold: $NPSL

Amex Plat: NPSL

Cap1 QS: $3200

Cap1 VX $50k

VS CC: $2900

Kohls: $3000

Synchrony car care: $3000

citi best buy visa: $8500

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit Karma Faco scores

Don't get too hung up on the Faco scores. Mine just dropped 66 points for paying a card down from 31% utilization to 8%.

B&H Payboo Card $15,000 | Amazon Prime Card $10,000 | PC Richard Card $15,000 | Target RedCard $2,000 | Walmart Store Card $1,400 | Shell Gas Card $1,200 | Overstock Store Card $7,000 | Kohl's Store Card $3,000

Spring Cleaning:

C̶a̶p̶i̶t̶a̶l̶ ̶O̶n̶e̶ ̶Q̶u̶i̶c̶k̶S̶i̶l̶v̶e̶r̶ ̶$̶1̶,̶0̶0̶0̶ | C̶r̶e̶d̶i̶t̶ ̶O̶n̶e̶ ̶V̶i̶s̶a̶ ̶$̶1̶,̶2̶0̶0̶ | M̶e̶r̶r̶i̶c̶k̶ ̶B̶a̶n̶k̶ ̶$̶2̶,̶7̶0̶0̶ | M̶a̶r̶v̶e̶l̶ ̶M̶a̶s̶t̶e̶r̶c̶a̶r̶d̶ ̶$̶1̶,̶̶2̶0̶0̶ | C̶o̶m̶e̶n̶i̶t̶y̶ ̶M̶a̶s̶t̶e̶r̶C̶a̶r̶d̶ ̶$̶1̶,̶1̶8̶0̶

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit Karma Faco scores

The Credit Karma random number generator seems to be functioning perfectly fine. ![]()

But seriously though, who knows... lol The volatility of VantageScore (especially the 3.0 model that CK uses) is so ridiculous it is almost impossible to determine how they calculate scores. My CK is always around 50 points less than what my actual FICO scores are. From what I have experienced, and read, CK scores discount closed accounts, so I would imagine the decrease resulted from paying off the loan..

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit Karma Faco scores

@Anonymous wrote:The Credit Karma random number generator seems to be functioning perfectly fine.

But seriously though, who knows... lol The volatility of VantageScore (especially the 3.0 model that CK uses) is so ridiculous it is almost impossible to determine how they calculate scores. My CK is always around 50 points less than what my actual FICO scores are. From what I have experienced, and read, CK scores discount closed accounts, so I would imagine the decrease resulted from paying off the loan..

Lol are the scores on experian any better or still estimates? Like if I buy the 3 beaureau report thing? Ironically for me, when my scores were lower, my actual scores were around 30-50 less than CK now if experian is anything to go by, they're about 20-30 more.

Discover it cashback: $10900

Citi DC: $13000

WF Propel: closed 2k

Amex BCED: $3000

Amex Gold: $NPSL

Amex Plat: NPSL

Cap1 QS: $3200

Cap1 VX $50k

VS CC: $2900

Kohls: $3000

Synchrony car care: $3000

citi best buy visa: $8500

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit Karma Faco scores

@micvite wrote:

@Anonymous wrote:The Credit Karma random number generator seems to be functioning perfectly fine.

But seriously though, who knows... lol The volatility of VantageScore (especially the 3.0 model that CK uses) is so ridiculous it is almost impossible to determine how they calculate scores. My CK is always around 50 points less than what my actual FICO scores are. From what I have experienced, and read, CK scores discount closed accounts, so I would imagine the decrease resulted from paying off the loan..

Lol are the scores on experian any better or still estimates? Like if I buy the 3 beaureau report thing? Ironically for me, when my scores were lower, my actual scores were around 30-50 less than CK now if experian is anything to go by, they're about 20-30 more.

Experian provides real FICO scores. The 3 bureau report from them will provide FICO 8 scores for all 3 bureaus and will provide F2, F3, Bankcard 2, Bankcard 8, Auto 2, and Auto 8 for Experian. I believe they usually run a special where you can sign up for a trial for $1, which makes it a cheap way to get accurate scores.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit Karma Faco scores

Experian is definitely a good one to sign up with... even their "free" level gives you a true fico 8 score (as opposed to the Vantage scores reported by EQ and TUs free services. It also sends you alerts when you get inquiries or other changes hit your credit report.

EQ free level is handy because you can see your soft pulls -- to see who is checking you out for potential credit offers.

Frankly, having a free account on all three is a good idea if for no other reason than to keep your credit reports frozen. Just my humble opinion!

06/15/2019:

03/02/2021:

04/06/2021:

05/28/2021:

Lesson Learned: DON'T POKE THE BEAR!!! THE BEAR WILL WIN!!!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit Karma Faco scores

@Anonymous wrote:

@micvite wrote:

@Anonymous wrote:The Credit Karma random number generator seems to be functioning perfectly fine.

But seriously though, who knows... lol The volatility of VantageScore (especially the 3.0 model that CK uses) is so ridiculous it is almost impossible to determine how they calculate scores. My CK is always around 50 points less than what my actual FICO scores are. From what I have experienced, and read, CK scores discount closed accounts, so I would imagine the decrease resulted from paying off the loan..

Lol are the scores on experian any better or still estimates? Like if I buy the 3 beaureau report thing? Ironically for me, when my scores were lower, my actual scores were around 30-50 less than CK now if experian is anything to go by, they're about 20-30 more.

Experian provides real FICO scores. The 3 bureau report from them will provide FICO 8 scores for all 3 bureaus and will provide F2, F3, Bankcard 2, Bankcard 8, Auto 2, and Auto 8 for Experian. I believe they usually run a special where you can sign up for a trial for $1, which makes it a cheap way to get accurate scores.

I usually just pay the 19$ or whatever when I'm trying to buy something to check my scores accurately real quick then cancel the next month. Just double checking to make sure I'm getting my moneys worth lol

Discover it cashback: $10900

Citi DC: $13000

WF Propel: closed 2k

Amex BCED: $3000

Amex Gold: $NPSL

Amex Plat: NPSL

Cap1 QS: $3200

Cap1 VX $50k

VS CC: $2900

Kohls: $3000

Synchrony car care: $3000

citi best buy visa: $8500

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit Karma Faco scores

@rostrow416 wrote:Don't get too hung up on the Faco scores. Mine just dropped 66 points for paying a card down from 31% utilization to 8%.

Alright... riddle me this: my experian just dropped 22 points after this loan got reported as paid off... where is the logic the fairness? Should I have just left like a nominal balance on there?🤣🤣. I was 755 now I'm 734🥲🥲🥲

Discover it cashback: $10900

Citi DC: $13000

WF Propel: closed 2k

Amex BCED: $3000

Amex Gold: $NPSL

Amex Plat: NPSL

Cap1 QS: $3200

Cap1 VX $50k

VS CC: $2900

Kohls: $3000

Synchrony car care: $3000

citi best buy visa: $8500

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit Karma Faco scores

@micvite wrote:

@rostrow416 wrote:Don't get too hung up on the Faco scores. Mine just dropped 66 points for paying a card down from 31% utilization to 8%.

Alright... riddle me this: my experian just dropped 22 points after this loan got reported as paid off... where is the logic the fairness? Should I have just left like a nominal balance on there?🤣🤣. I was 755 now I'm 734🥲🥲🥲

If it was your only installment loan, you lost the installment loan bonus from having it. You can easily gain those points back if you open another loan, though initially you'll take a small hit for the new account and HP.

Last App: 1/10/2023

Penfed Gold Visa Card

Currently rebuilding as of 04/11/2019.

Starting FICO 8 Scores:

Current FICO 8 scores:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit Karma Faco scores

@OmarGB9 wrote:

@micvite wrote:

@rostrow416 wrote:Don't get too hung up on the Faco scores. Mine just dropped 66 points for paying a card down from 31% utilization to 8%.

Alright... riddle me this: my experian just dropped 22 points after this loan got reported as paid off... where is the logic the fairness? Should I have just left like a nominal balance on there?🤣🤣. I was 755 now I'm 734🥲🥲🥲

If it was your only installment loan, you lost the installment loan bonus from having it. You can easily gain those points back if you open another loan, though initially you'll take a small hit for the new account and HP.

Funny thing, I opened up an SSL with PenFed last month, this week it showed up on my reports and whadday know; they are all showing a modest bump in scores (like between 4 and 9 points).