- myFICO® Forums

- FICO Scoring and Other Credit Topics

- General Credit Topics

- Re: Credit Karma vs FICO

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Credit Karma vs FICO

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit Karma vs FICO

Since my file has been clean, my VS 3.0 scores are usually around 15 points lower than my FICO 8's.

With maxed out FICO 8's at 850, I can't seem to ever get my VS 3.0's above 836. I believe member T. Thumb reported similar numbers to mine with his VS 3.0's stalling out in the upper 830's as well.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit Karma vs FICO

So, when my FICO scores were in the low mid-600s 3 yrs ago, CKs TU & EQ scores vacillated as much 66 pts in favor of CK. But once my FICO scores reached high 700-low 800, CK scores seemed to align more accurately to within 3-7 pts of one another, but again still in favor of CK.

|| AmX Cash Magnet $40.5K || NFCU CashRewards $30K || Discover IT $24.7K || Macys $24.2K || NFCU CLOC $15K || NFCU Platinum $15K || CitiCostco $12.7K || Chase FU $12.7K || Apple Card $7K || BOA CashRewards $6K

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit Karma vs FICO

@Anonymous wrote:Since my file has been clean, my VS 3.0 scores are usually around 15 points lower than my FICO 8's.

With maxed out FICO 8's at 850, I can't seem to ever get my VS 3.0's above 836. I believe member T. Thumb reported similar numbers to mine with his VS 3.0's stalling out in the upper 830's as well.

Yup, I see the same thing - VS3 capped out at 834 for me on TU, and 837 on EQ and EX, I've never seen mine get higher than that.

(Unlike VS2, which was ridiculously easy to pin at 990....)

EQ9:847 TU9:847 EX9:839

EQ5:797 TU4:807 EX2:813 - 2021-06-06

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit Karma vs FICO

@Anonymous wrote:Since my file has been clean, my VS 3.0 scores are usually around 15 points lower than my FICO 8's.

With maxed out FICO 8's at 850, I can't seem to ever get my VS 3.0's above 836. I believe member T. Thumb reported similar numbers to mine with his VS 3.0's stalling out in the upper 830's as well.

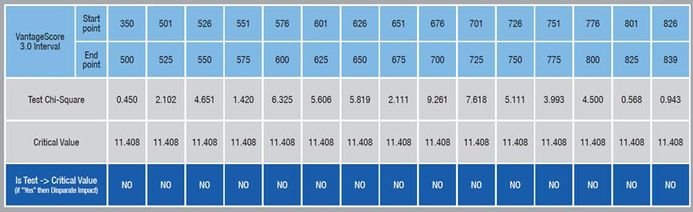

Highest reported VantageScore 3.0 I have seen reported is 839. That was mentioned in a VantageScore white paper study. It was much easier for me to achieve Fico 8 850s and Fico 9 850s than VantageScore 3.0 835s or even VantageScore 830s. Of course, VantageScore dings me significantly for not enough accounts.

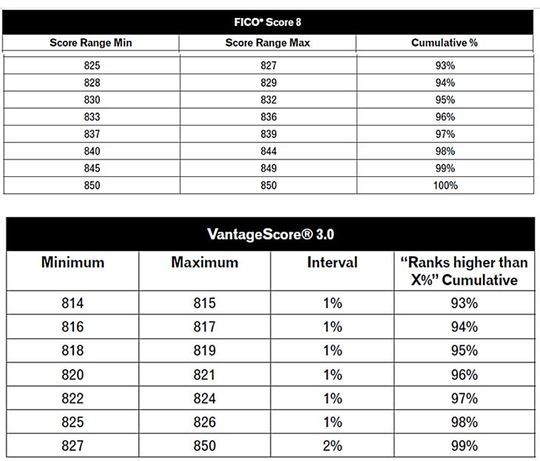

Below are a couple tables for percentile comparisons. From a percentile perspective, an 827 VS3 score would be on par with an 845 Fico 8 score.

The below table from a 2015 VantageScore white paper

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit Karma vs FICO

It looks rather like VS3 doesn't have a top-end buffer like FICO8 does.

EQ9:847 TU9:847 EX9:839

EQ5:797 TU4:807 EX2:813 - 2021-06-06

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit Karma vs FICO

@iv wrote:It looks rather like VS3 doesn't have a top-end buffer like FICO8 does.

And moreover, it's also possible that the "850" ceiling in V3 is fictitious, much as it is for the FICO models preceding FICO 8. (E.g. the EQ mortgage score has a true maximum of 818, etc.)

The 300 bottom end for the standard FICO models is also not entirely correct. I think TT has posted a white paper before which seems to clearly show that the lowest possible score for FICO 8 is something in the low to mid 300s -- but not 300.

I wonder whether BBS or iv might get a few extra points on V3 if their total utilization went from < 1% to something like 4.2%. I believe TT has conjectured that V3 has a sweet spot around there -- and that ultralow utilizations by comparison (e.g. 0.7%) have a small scoring penalty.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit Karma vs FICO

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit Karma vs FICO

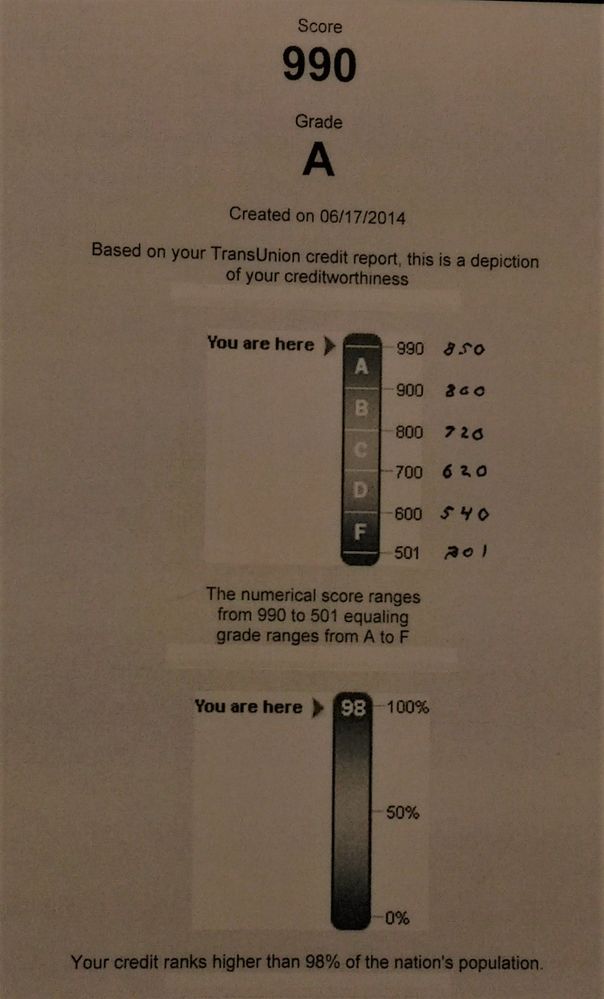

@iv wrote:(Unlike VS2, which was ridiculously easy to pin at 990....)

What source is there for a VS2 score? I've never seen one personally, but would be interested to see it for S&G's if it's possible.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit Karma vs FICO

@Anonymous wrote:I wonder whether BBS or iv might get a few extra points on V3 if their total utilization went from < 1% to something like 4.2%. I believe TT has conjectured that V3 has a sweet spot around there -- and that ultralow utilizations by comparison (e.g. 0.7%) have a small scoring penalty.

While my reported utilization usually sits at 1% aggregate, I have taken it as high as 5% at least once in the last 8 months and it's come in at 3% and 4% a couple of times as well just the way balances fell when I wasn't micromanaging them. I never saw any clear score shifts on my VS 3.0's (that I couldn't tell were from something else) so I'm not sure that those utilization changes mattered on my profile.

If I'm at 836 and the highest reported score is 839, it would be cool to know where I'm lacking that's causing the 3 point deficit. I always figured it had something to do with one of the age of accounts factors... perhaps AoYA for example, thinking that possibly an AoYA of 24 months was needed for maximum points or something (I'm at 20 months currently).

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit Karma vs FICO

@Anonymous wrote:

@iv wrote:(Unlike VS2, which was ridiculously easy to pin at 990....)

What source is there for a VS2 score? I've never seen one personally, but would be interested to see it for S&G's if it's possible.

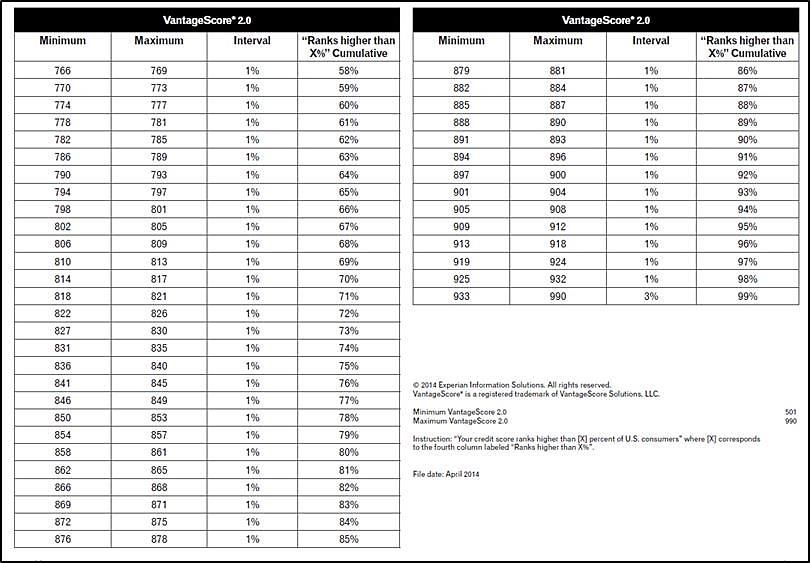

You won't find one these days. I used to get VS2 from Transunion but, like other sources they have migrated to VS3. As IV mentions, getting a 990 on VS2 was rather easy - 2% of the population achieved that score (score range 501 - 990). I have a distribution table on VS2 from Experian (pasted below).

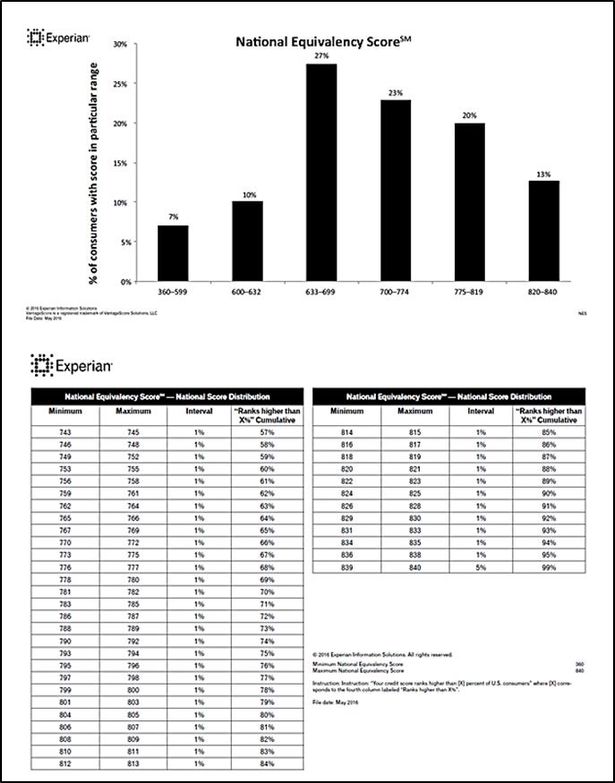

Another model that is relatively easy to achieve top score is Experian National Equivalency - available free thru credit.com. Score range 360 - 840. It looks like 4% get a perfeect score with this model. (distribution table directly below)

Knowing how my profile scores on various models has been a hobby for me. I almost signed up with PenFed to see what my Fico Next Gen score was but, found out it would be a hard pull. Canceled application prior to executing. One of the more obscure scores I found interesting is CreditXpert (score range 350 -850). I got my EQ/TU/EX scores for a small fee thru PrivacyGuard. They appear to approximate mortgage scores.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950