- myFICO® Forums

- FICO Scoring and Other Credit Topics

- General Credit Topics

- Experian AAoA Confusion

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Experian AAoA Confusion

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Experian AAoA Confusion

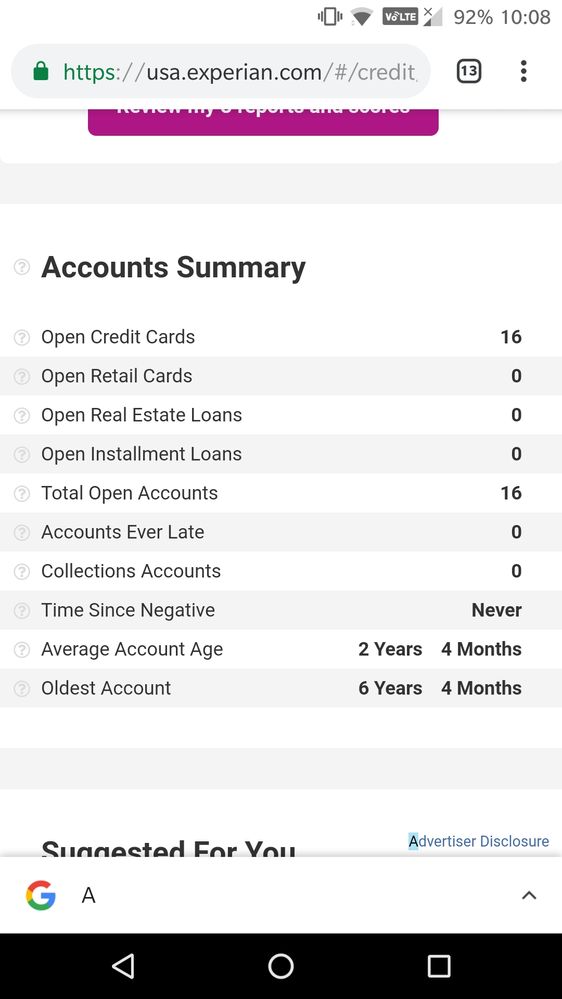

I have a subscription with Experian/Credit Check Total and I'm a little confused... When I log in, it brings up the summary page which shows that my AAoA is 1 year 11 months.

However, when I click on my actual Credit Report, it shows my AAoA as 2 years, 4 months. Why the different numbers? Is one showing the open accounts only, and the other calculating all accounts?

![Comenity – Express Next Store Card : $5,000 [AU]](https://i.imgur.com/Pmmb7kq.jpg)

Officially collection free as of 3/19/19!!

STARTING SCORES: 377 (11/2013) & 580 (3/2018)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Experian AAoA Confusion

I have this as well. Pretty sure (and someone confirm please) top one is your AAoA taking only into consideration your accounts where you are the primary account holder, the other also adds any cards where you are an authorized user as well which is why there is a discrepancy. I'm not too sure which one EX uses for pulls tbh. Hoping someone can answer that one for me, too.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Experian AAoA Confusion

First one is incorrect, second one is right

As BBS calls is, first one is "user interface fluff"

You can safely go by what's in "Credit Report" section. I've asked this same question while back. Second one is used for pulls

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Experian AAoA Confusion

It would depend when talking FICO 8/9 if the AU’s are being counted, but Remedios is right for things like FICO 2 the second one is correct.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Experian AAoA Confusion

Top one is identical to what Discover card shows after removing all AU accounts (they always do that)

It takes AU accounts out of consideration, but still counts closed accounts (non AU).

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Experian AAoA Confusion

Can someone explain how AAoA plays in this credit score? 12 years but average is 2? I assume they opened a card 2 years ago? Credit Scores look great

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Experian AAoA Confusion

@Anonymous wrote:Can someone explain how AAoA plays in this credit score? 12 years but average is 2? I assume they opened a card 2 years ago? Credit Scores look great

First number is the average age of ALL accounts listed on your report; this includes any closed account(s) still appearing/reporting. Second number is the age of the oldest account that is listed on your report. Having cards being older reduces the impact of new accounts reporting when applying for credit since it gives you a buffer so to speak. It's why some people have AUs added to give them that extra cushion and cross scoring thresholds for AoA.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Experian AAoA Confusion

@Anonymous wrote:Can someone explain how AAoA plays in this credit score? 12 years but average is 2? I assume they opened a card 2 years ago? Credit Scores look great

I can explain! ![]()

So my oldest account is Navient, which is a student loan I had from 12 years ago. I had literally nothing in between that loan and like March 2017? Everything you see in my signature has been opened in the past 2 years, most of them from late last year. That's why my AoOA and AAoA are so vastly different.

I've been working really hard on raising my scores, so thank you! ![]()

![Comenity – Express Next Store Card : $5,000 [AU]](https://i.imgur.com/Pmmb7kq.jpg)

Officially collection free as of 3/19/19!!

STARTING SCORES: 377 (11/2013) & 580 (3/2018)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Experian AAoA Confusion

That's odd, yours is 12 years but mines is 6 years and the AaoA is 2 years and 4 months? I thought yours would be older than mines. I wish I started at 18, but I started my credit card journey at 20 lol.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Experian AAoA Confusion

@TheBoondocks wrote:

That's odd, yours is 12 years but mines is 6 years and the AaoA is 2 years and 4 months? I thought yours would be older than mines. I wish I started at 18, but I started my credit card journey at 20 lol.

It all just comes down to adding the amount of time (in months) each account has been opened and dividing that by the amount of accounts. I've opened like 10 of my accounts in the past 6-8 months. I guess I got a little app happy lol. I wish I started at 18 as well. I didn't technically start my credit journey until last year, when I turned 32 ![]() My dad was always hounding me about how important credit is and how I should start right when I turn 18. Kicking myself for not listening to that wise advice.

My dad was always hounding me about how important credit is and how I should start right when I turn 18. Kicking myself for not listening to that wise advice.

![Comenity – Express Next Store Card : $5,000 [AU]](https://i.imgur.com/Pmmb7kq.jpg)

Officially collection free as of 3/19/19!!

STARTING SCORES: 377 (11/2013) & 580 (3/2018)