- myFICO® Forums

- FICO Scoring and Other Credit Topics

- General Credit Topics

- Re: FICO Resilience Index?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

FICO Score Stress Indicators/Indexes

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Resilience Index?

The EQ Fico resilience score appears to put a lot of focus on monthly payment obligations for installment loans in absolute $$ amount without regard to current B/L ratio. Aggregate outstanding loan balance in absolute $$ is a primary scoring factor as well. I have a mortgage with a monthly payment of $1830. However, the B/L is under 5.4% and it will be paid off in October 2020. No other open loans.

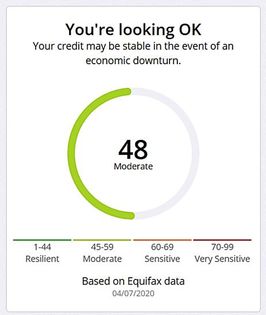

Credit mix appears to be an issue with my profile as well (85% of open accounts are credit/charge cards). My proflie is considered a moderate risk and scores 48 on the EQ Fico resilience index. That's quite a bit worse than I had expected but, at least it's considered stable ![]()

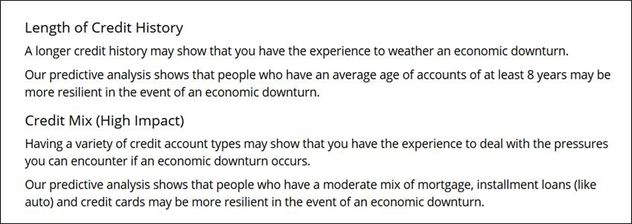

- Side notes: 1) A Fico resilience score reason statement mentions AAoA of 8 years as a benchmark. 2) Preferred credit mix includes a mortgage + another type of installment loan + revolving credit accounts.

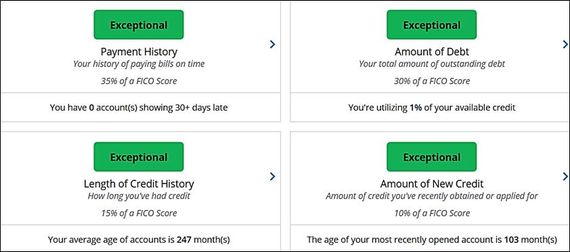

In typical Equifax style, my EQ Fico mortgage and EQ resilience scores are almost certainly being hurt by too many revolvers & charge cards with balances (5 of 6). Aggregate utilization is under 1% and individual card utilizations are all under 9%. That's EQ for you! [side note: my TU and EX mortgage scores were not hurt by 5 of 6 cards reporting balances.

Fico 8: .......EQ 850 TU 850 EX 850

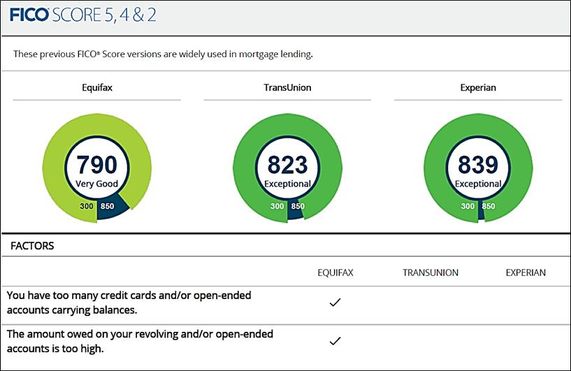

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Resilience Index?

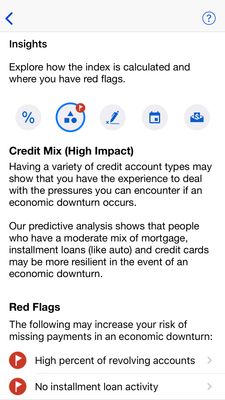

I was rated 53 on the resilience index with 2 red flags - 1) High percent of revolving accounts. [All of my accounts are CC's] 2) No installment loan activity. [Don't have any open]

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Score Stress Indicators/Indexes

I can't locate this new score/rating on Equifax or MyFICO and I pay for both...I am a skinny branch personality, SO maybe ignorance is bliss, but since I have paid subscriptions, where would this new "scary times" rating be found?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Score Stress Indicators/Indexes

@CreditobsessedinFL from the above, it appears to be included in the 3B from MF. I haven't updated yet to discover mine, though.

Looks like Equifax trying to make money off of the pandemic. Any opportunity to try to make another number to make some money!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Score Stress Indicators/Indexes

The YouTube link works, but it was very poorly put together. Missing punctuation, poor oration and also inaccuracies. It stated you have to have a score between 680-700 IIRC, but we know that’s not true from the above posts.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

MyFICO resilience score

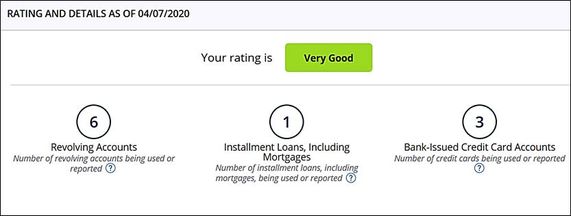

Has anyone else seen this? It says i have too many revolving accounts and not enough installment loans. Should I actually be conserned abot this?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: MyFICO resilience score

@Andypanda wrote:Has anyone else seen this? It says i have too many revolving accounts and not enough installment loans. Should I actually be conserned abot this?

I think there was a discussion here. FICO Score Stress Indicators/Indexes

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Score Stress Indicators/Indexes

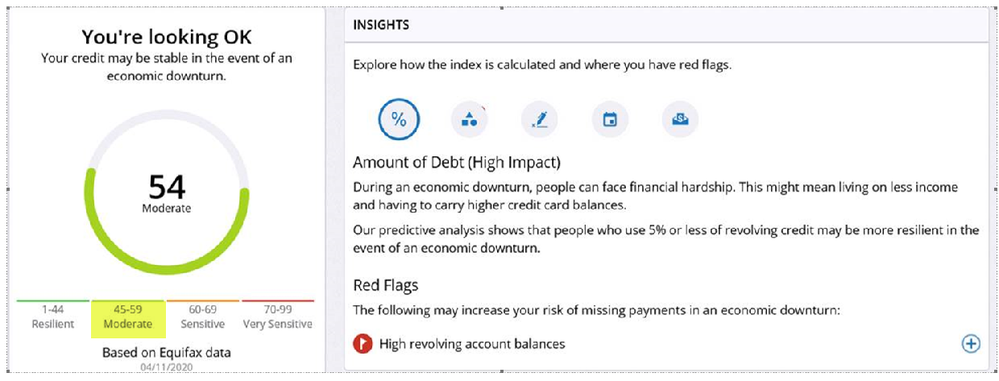

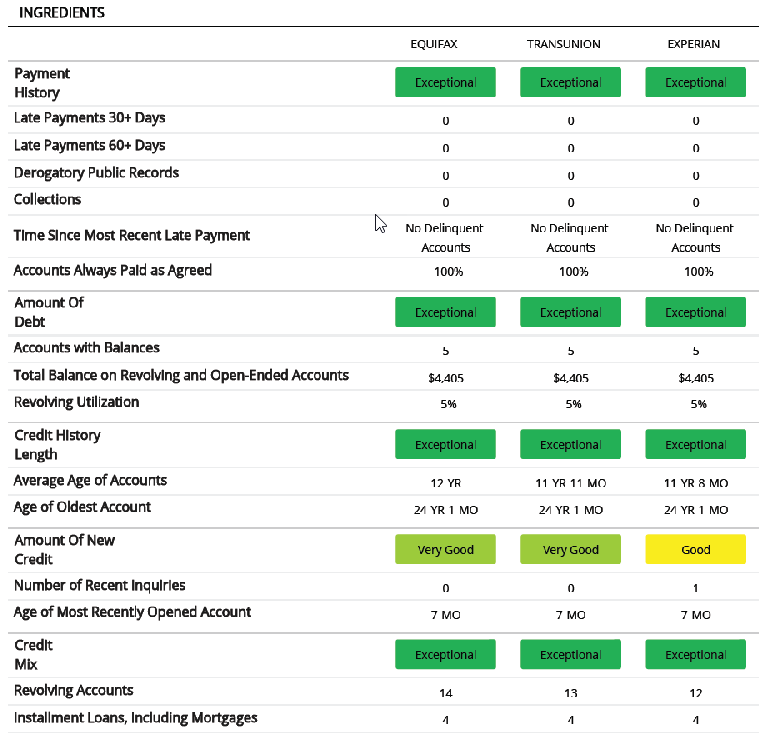

Equifax is my highest in every score. According to this I'm a Moderate risk with 1 flag; Revolving Balances.

Actually 4.64% AGG revolving UTL. Rounded up on MyFICO printscreen below.

From my 4/11 report

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Score Stress Indicators/Indexes

It certainly appears the resilience index looks at absolute dollar values in addition to the 5% for aggregate revolving utilization. After all, your red flag statement mentions "high revolving account balances". The $4400 aggregate balance must be considered high.

My total revolving balance was just over $1000 with overall utilization under 1%. It was not flagged as high. Perhaps an aggregate revolving threshold exists somewhere in the $1500 to $3000 range. There is likely an additional threshold at some higher level as well, say $10k.

My summary statements allude to the existance of aggregate installment loan balance threshold based on "high installment loan amounts due". This must relate to total monthly payment obligation or remaining aggregate balance on loans. I suspect the former since it is the installment payment that is "due". If that's true, then there must be a total payments due threshold below $1800. Otherwise there must be a total balance threshold at or below $12.5k.

Looking at your EQ accounts, you have 14 revolvers out of 18 accounts (77.7%) and no red flag with corresponding negative comment. I was flagged for too high a percentage of revolvers at 85.7%. My guess is an accounts ratio threshold for revolvers/total exists at 80%.

P.S. Your circle chart is different from the others posted (rotated 90 degrees). Fico updated the graphics?

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Score Stress Indicators/Indexes

Thanks @Birdman7, it isn't in my 3/5 3B report and it says I be eligible for another 3B report on 4/17, so perhaps I will be able to view it there. I wasn't able to find it on my regular Equifax report either. I will check again on 4/17.