- myFICO® Forums

- FICO Scoring and Other Credit Topics

- General Credit Topics

- Re: FICO Score Stress Indicators/Indexes

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

FICO Score Stress Indicators/Indexes

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Score Stress Indicators/Indexes

@Anonymous wrote:I was beginning to wonder if I was crazy as well because I did not see it on mobile either. I’ll be looking for it when I refresh.

I'm going to guess your score will be in the 63-66 range.

Reasons to include:

1) Sheer number of accounts.

2) Sleep deprivation!

Equifax says that up to 5 reasons can be shown. (See EQ links I posted earlier.)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Score Stress Indicators/Indexes

😂😂😂

If they included sleep deprivation, I think it would ding me a little harder, I think it would definitely be a higher score, LOL!! ☹️😉

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

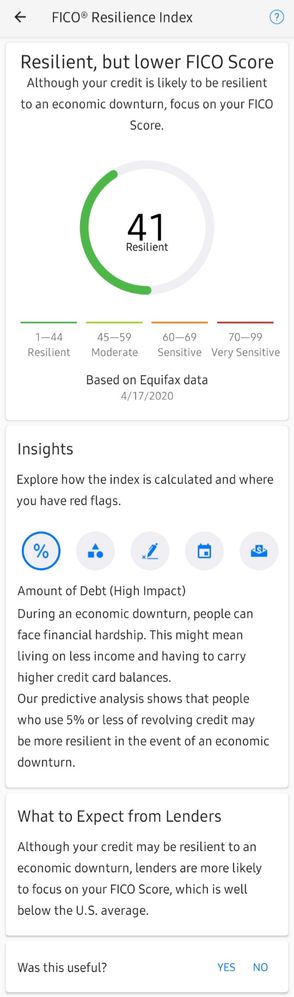

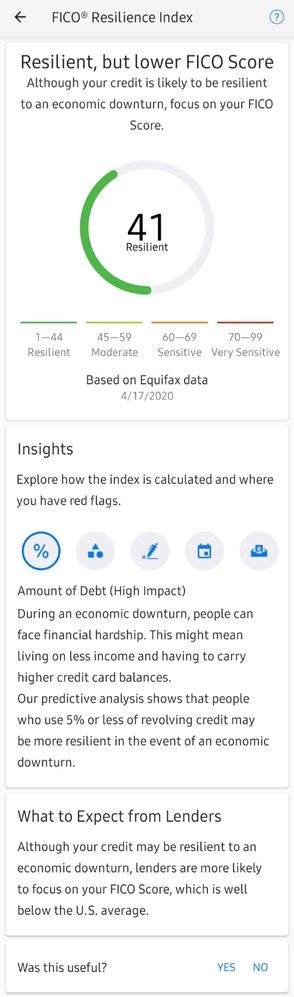

MyFICO Resilience Scoring

So I just got this new score regarding credit resiliency

I am guessing I am resilient because my scores are so bad nothing can make them worse? Lol joking aside, I guess I should be proud, but not too excited yet because it just may be more bad news in my credit world, and I need to investigate more.

I would love to hear what you all think and how this score reflects on your credit profile. Also, if anyone knows any more about this and if lenders really will be using something like this, I'd be curious to know. Likely this is new to us all.

Thanks!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: MyFICO Resilience Scoring

Congratulations! So far you are the only poster who has listed a score in the resilient rating category.

There is a thread on this subject over in General Credit Topics. Link pasted below:

It would be useful to learn more details about your profile such as:

1) Your average age of accounts (AAoA) and age of oldest account. An AAoA of 8 years or more is best.

2) Your total (aggregate) reported balance on all your credit cards. Not sure about thresholds on this but, under $1500 is likely ok. My aggregate balance was $1050 - no red flag (UT = 1%). One poster had a UT< 5% but a red flag (balance over $4k). Another poster with a red flag had a UT< 3% but a balance over $7k.

* The resilience score appears to consider aggregate balance in absolute $$ rather strongly (perhaps moreso than revolving utilization).

3) Your monthly payment obligations on all installment loans combined. Again, not sure about the threshold(s) on this. $1830/mo generated a red flag for me but, $1760/mo did not generate a flag for another poster.

4) Your total amount for outstanding loans.The resilience model does not appear to look at aggregate installment B/L ratio (utilization) but might look at aggregate balances in absolute $ terms.

5) Your percentage of accounts that are credit cards. Too high a percent (say over 75%) is a red flag. I had a red flag for 85% of my accounts being CCs. Not sure if the % is based on open accounts only or open + closed accounts. My guess is open only.

6) Your quantity of open and closed loans by type. This model wants to see more than one type of loan on file. Closed loans likely count but, nothing is stated specifically.

Side notes:

* Fico 98, Fico 04, Fico 8 and Fico 9 all consider # and/or % of cards with balances but, the EQ resilience score may not.

* Fico 8 puts a lot of emphasis on installment B/L but, the EQ resilience looks at payment obligations and/or outstanding balances in $ amounts only.

* Fico 98, Fico 04, Fico 8 and Fico 9 all put a lot of emphasis on revolving utilization. EQ resilience appears more focused toward aggregate balance in $.

* Late payments, collections and defaults are a big deal with Fico credit scores (these scores represents risk of a 90 day late payment) but, perhaps not as much with the resilience score assuming the lates & collections are paid. From what I can tell, the resilience score assesses ease of a given profile to weathering a job loss assuming nominal savings. If so, it makes sense that payment obligations in dollars are given priority.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: MyFICO Resilience Scoring

@Thomas_Thumb wrote:Congratulations! So far you are the only poster who has listed a score in the resilient rating category.

There is a thread on this subject over in General Credit Topics. Link pasted below:

It would be useful to learn more details about your profile such as:

1) Your average age of accounts (AAoA) and age of oldest account. An AAoA of 8 years or more is best.

2) Your total (aggregate) reported balance on all your credit cards. Not sure about thresholds on this but, under $1200 appears ok.

* The resilience score appears to consider aggregate balance in absolute $$ rather strongly (perhaps moreso than revolving utilization).

3) Your monthly payment obligations on all installment loans combined. Again, not sure about the threshold(s) on this. $1830/mo generated a red flag for me but, $1760/mo did not generate a flag for another poster.

4) Your total amount for outstanding loans.The resilience model does not appear to look at aggregate installment B/L ratio (utilization) but might look at aggregate balances in absolute $ terms.

5) Your percentage of accounts that are credit cards. Too high a percent (say over 75%) is a red flag. I had a red flag for 85% of my accounts being CCs. Not sure if the % is based on open accounts only or open + closed accounts. My guess is open only.

6) Your quantity of open and closed loans by type. This model wants to see more than one type of loan on file. Closed loans likely count but, nothing is stated specifically.

Thank you. I did not search that thread. I will check it out!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: MyFICO Resilience Scoring

OP do you have a mortgage or auto loan? Or only CC debt?

How much total debt?

Oct 2014 $46k on $127k 36% util EQ 722 TU 727 EX 727

April 2018 $18k on $344k 5% util EQ 806 TU 810 EX 812

Jan 2019 $7.6k on $360k EQ 832 TU 839 EX 831

March 2021 $33k on $312k EQ 796 TU 798 EX 801

May 2021 Paid all Installments and Mortgages, one new Mortgage EQ 761 TY 774 EX 777

April 2022 EQ=811 TU=807 EX=805 - TU VS 3.0 765

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Score Stress Indicators/Indexes

Proud to be improving my credit, but it did make me laugh that I am considered resilient, but with bad scores lol

* 14% Util

* $123456789 in SLs, some in rehab, all reporting defaulted

* 34% balance on Self Lender Installment Loan

* 6 CAs total, all unpaid

* 2 paid COs

* No mortgage

* 3/6 and 4/12 in new TLs

* Inq: 3/12; 3/24 EQ, 1/12; 2/24 TU, 1/12; 1/24 EX

* AoOA 18y 9m

* AAoA 9y 3m

* AoYA 0y 2m

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: MyFICO Resilience Scoring

@Anonymous wrote:

@Thomas_Thumb wrote:Congratulations! So far you are the only poster who has listed a score in the resilient rating category.

There is a thread on this subject over in General Credit Topics. Link pasted below:

It would be useful to learn more details about your profile such as:

1) Your average age of accounts (AAoA) and age of oldest account. An AAoA of 8 years or more is best.

2) Your total (aggregate) reported balance on all your credit cards. Not sure about thresholds on this but, under $1200 appears ok.

* The resilience score appears to consider aggregate balance in absolute $$ rather strongly (perhaps moreso than revolving utilization).

3) Your monthly payment obligations on all installment loans combined. Again, not sure about the threshold(s) on this. $1830/mo generated a red flag for me but, $1760/mo did not generate a flag for another poster.

4) Your total amount for outstanding loans.The resilience model does not appear to look at aggregate installment B/L ratio (utilization) but might look at aggregate balances in absolute $ terms.

5) Your percentage of accounts that are credit cards. Too high a percent (say over 75%) is a red flag. I had a red flag for 85% of my accounts being CCs. Not sure if the % is based on open accounts only or open + closed accounts. My guess is open only.

6) Your quantity of open and closed loans by type. This model wants to see more than one type of loan on file. Closed loans likely count but, nothing is stated specifically.

Thank you. I did not search that thread. I will check it out!

I will post this info in the main thread

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Score Stress Indicators/Indexes

It would be useful to learn more details about your profile such as:

1) Your average age of accounts (AAoA) and age of oldest account. An AAoA of 8 years or more is best.

* AAoA 9y 3m

* AoOA 18y 9m

2) Your total (aggregate) reported balance on all your credit cards. Not sure about thresholds on this but, under $1500 is likely ok. My aggregate balance was $1050 - no red flag (UT = 1%). One poster had a UT< 5% but a red flag (balance over $4k). Another poster with a red flag had a UT< 3% but a balance over $7k.

* The resilience score appears to consider aggregate balance in absolute $$ rather strongly (perhaps moreso than revolving utilization).

* $223 total reported balance across revolvers (14% util of $1550 total revolving credit)

* 2 of 3 revolvers are store cards. My 1 bank card has $12 reported balance (4% util of $300 credit limit - not secured card)

3) Your monthly payment obligations on all installment loans combined. Again, not sure about the threshold(s) on this. $1830/mo generated a red flag for me but, $1760/mo did not generate a flag for another poster.

* Good question. All SLs are defaulted (some in rehab). Roughly $1k/mo at standard repayment.

* $48/mo for SSL installment loan

4) Your total amount for outstanding loans.The resilience model does not appear to look at aggregate installment B/L ratio (utilization) but might look at aggregate balances in absolute $ terms.

* $114k in SLs (all well over 100% util on every single one)

* $234 reported bal on SSL (34% util)

5) Your percentage of accounts that are credit cards. Too high a percent (say over 75%) is a red flag. I had a red flag for 85% of my accounts being CCs. Not sure if the % is based on open accounts only or open + closed accounts. My guess is open only.

* Open only accounts: 20%

* Open & Closed accounts: 15.6%

6) Your quantity of open and closed loans by type. This model wants to see more than one type of loan on file. Closed loans likely count but, nothing is stated specifically.

* 23 SLs: 11 open, 12 closed

* 1 SSL, open

* 1 PL, closed

* 1 Auto loan, closed

Side notes:

* Fico 98, Fico 04, Fico 8 and Fico 9 all consider # and/or % of cards with balances but, the EQ resilience score may not.

* Fico 8 puts a lot of emphasis on installment B/L but, the EQ resilience looks at payment obligations and/or outstanding balances in $ amounts only.

* Fico 98, Fico 04, Fico 8 and Fico 9 put a lot of emphasis on revolving utilization. EQ resilience appears more focused toward aggregate balance in $.

* Late payments and collections are a big deal with Fico credit scores (which reflect risk of a 90 day late payment) but, perhaps not as much with the resilience score given they have been paid. From what I can tell, the resilience score assesses ease of a given profile to weathering a job loss assuming nominal savings. If so, it makes sense that payment obligations in dollars are given priority.

* other info, regarding baddies, etc., in my post above this one.

I hope this helps you figure out what they are looking for!

I have zero red flags

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Score Stress Indicators/Indexes

@Anonymous wrote:Proud to be improving my credit, but it did make me laugh that I am considered resilient, but with bad scores lol

That's a very interesting report, @Anonymous !

From FICO: "We looked for patterns in consumers' profiles who ended up missing or making payments in the Great Recession."

It looks like there was a rather large percentage of people with derogatories who at least didn't do more damage to their credit profile, around the time of the Great Recession.

I'm going to guess that a lot of people with your profile were paying closer attention to making payments on time.