- myFICO® Forums

- FICO Scoring and Other Credit Topics

- General Credit Topics

- Re: FICO Score Stress Indicators/Indexes

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

FICO Score Stress Indicators/Indexes

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Score Stress Indicators/Indexes

@Anonymous wrote:

@Anonymous wrote:I was beginning to wonder if I was crazy as well because I did not see it on mobile either. I’ll be looking for it when I refresh.

I'm going to guess your score will be in the 63-66 range.

Reasons to include:

1) Sheer number of accounts.

2) Sleep deprivation!

Equifax says that up to 5 reasons can be shown. (See EQ links I posted earlier.)

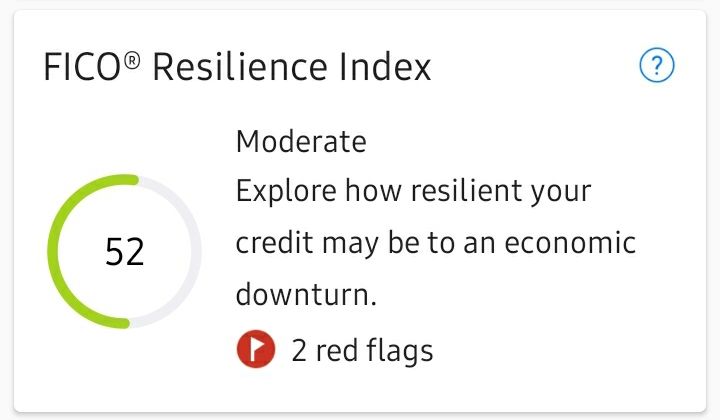

@Anonymous You are good! I'm at 64 with 2 flags: high installment balance and high percentage of revolvers!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Score Stress Indicators/Indexes

A question...is this something EQ decided to do on their own with a little help from FI, or is this FI product that EQ bought?

Either way, there is no way on the earth that this is objective risk assessment, more like a way to sell lenders additional product, and the best way to do that during times like these is to contribute to fear mongering.

If they sold a product without exaggerating the risk, no one would look twice. If you present it as "Omg omg omg look at all these people getting ready to rob you"..well, that's by far more convincing argument when attempting to emulate a shady used car dealer.

I had some lates 17 years ago because I was too lazy when it came to buying stamps and mailing checks.

I've been employed at the same place for a well over a decade, income in six figures, mortgage paid off, paid off auto loans, utilization typically ultra low, and yet, here I am slumming in the mid 60s because I let card report like it should and had no active loan...because I paid them off.

I understand that some aspects of scoring may not make sense on the surface or be counterintuitive at times, but this is just opportunistic behavior.

Gonna get off my soapbox now before I slip.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Score Stress Indicators/Indexes

@Remedios wrote:I've been employed at the same place for a well over a decade, income in six figures, mortgage paid off, paid off auto loans, utilization typically ultra low, and yet, here I am slumming in the mid 60s because I let card report like it should and had no active loan...because I paid them off.

Hey, you're probably still a much lower credit risk than many companies in the United States. Their debt levels were alarming well before this crisis.

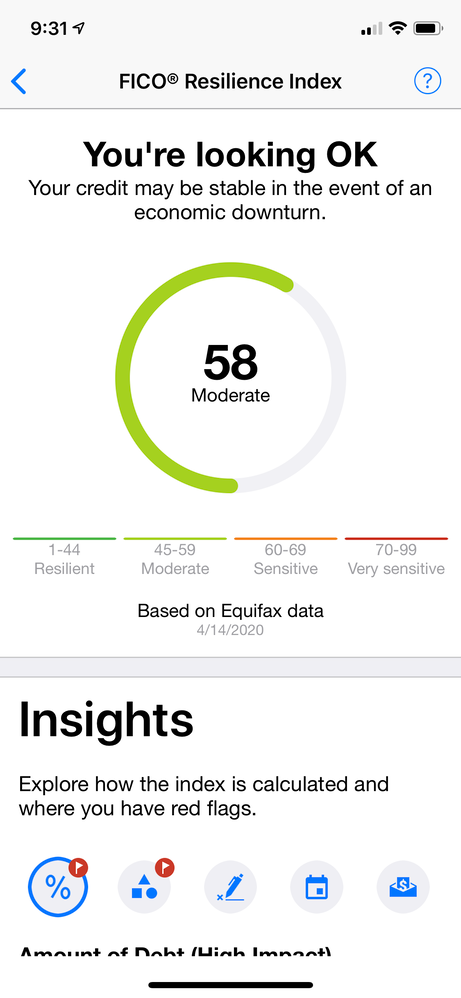

I looks like this score was a joint development. Equifax says in their product sheet that FICO ran the analysis on credit profile data around the time of the Great Recession. Maybe they only used Equifax collected profile data rather than the 3 CRA aggregate data. It does say that it's used in conjunction with a FICO score, which I assume to be EQ 8.

From the Equifax product sheet (direct PDF link):

Higher resilience customers tend to have:

- Fewer credit inquiries in the last year

- Fewer active accounts

- Lower total revolving balances

- More experience managing credit

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Score Stress Indicators/Indexes

I thought it was interesting that my SO had a couple red flags.

Here's a couple DPs:

* Apparently a red flag for being an AU on too many accounts, he only has 1 card of mine he is an AU on and that is just 1 too many for their liking!

* Installment loan(s) balances too high - interesting because it can't be the SLs, as he has half the amount in SLs compared to me. Only thing I can think of is his SSL. My payment is $48/mo, 34% util, $234 bal and his is $150, 91.7% util, $1534 bal. They may also be accounting for his 2 COs (1 Auto Loan and 1 Secured Installment?)

* Overall:

AAoA 8y 11m

AoOA 15y 10m

AoYA 1m

7 SLs defaulted, but all in rehab roughly $500/mo in standard repayment and 60k bal, all over 100% util

11 closed SLs

1 CO/Repo Auto Loan, unpaid & closed

1 CO Secured Installment, unpaid & closed

% of CC

Open Accounts Only 20%

Open & Closed Accounts 13%

1.5% util $12 reported bal on $800 revolving credit on 2 bank cards (one AU - the revolver w/ reported bal)

No mortgage

3 CAs, unpaid

1/12 & 1/24 inq EQ, TU, and EX

3/12 & 3/24 new accounts (including AU acct)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Score Stress Indicators/Indexes

@Anonymous wrote:

@Anonymous wrote:

@Anonymous wrote:I was beginning to wonder if I was crazy as well because I did not see it on mobile either. I’ll be looking for it when I refresh.

I'm going to guess your score will be in the 63-66 range.

Reasons to include:

1) Sheer number of accounts.

2) Sleep deprivation!

Equifax says that up to 5 reasons can be shown. (See EQ links I posted earlier.)

@Anonymous You are good! I'm at 64 with 2 flags: high installment balance and high percentage of revolvers!

Yes @Anonymous,

You are a guru, I finally got mine. The deferred student loans and % of balances of the student loans are my red flags.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Score Stress Indicators/Indexes

@Anonymous wrote:

@Remedios wrote:I've been employed at the same place for a well over a decade, income in six figures, mortgage paid off, paid off auto loans, utilization typically ultra low, and yet, here I am slumming in the mid 60s because I let card report like it should and had no active loan...because I paid them off.

Hey, you're probably still a much lower credit risk than many companies in the United States. Their debt levels were alarming well before this crisis.

I looks like this score was a joint development. Equifax says in their product sheet that FICO ran the analysis on credit profile data around the time of the Great Recession. Maybe they only used Equifax collected profile data rather than the 3 CRA aggregate data. It does say that it's used in conjunction with a FICO score, which I assume to be EQ 8.

From the Equifax product sheet (direct PDF link):

Higher resilience customers tend to have:

- Fewer credit inquiries in the last year

- Fewer active accounts

- Lower total revolving balances

- More experience managing credit

My inq are sparse now (didnt used to be that way), I've managed many accounts successfully, and if I can make sure 15 are paid on time, how is that more complex than one or two, unless that is a reference to available credit.

I'm unclear what an "active" account is. Is it any account that's open, or literal meaning *account showing signs of activity reflected as presence of balance*.

I'd bet my bum and left kidney that next time instead of bishing about me not having an open loan, it's going to bish about me having an open loan.

Now imagine a situation in which they started "resilience score if you live in hurricane prone areas"...wouldnt fly, there would be an outrage.

Perhaps next time Halley's comet passes near by, they can include that as a risk factor, because some may anticipate apocalypse and quit paying their bills in anticipation.

I guess it's a way to say "Our regular scoring models only work during rainbows and unicorn economy stages. Everything else sold separately"

I could reach 800 if I sit in the garden for six months, but I'm higher risk than someone with charge offs and open collections (no offense to the members im just trying to wrap my mind around this).

As soon as everything is reflected on EQ, I'll pull my reports and see what, if anything changed. My utilization will be rounded to 1%, maybe $2500 reporting, there will be a brand new, fully utilized loan with tiny payments $101.00 iirc.

Im assuming this score changes just like all others do with changes on CR.

I certainly wont be doing anything differently because of this, but I find it somewhat irksome.

If I sound extra salty, it's because I'm extra salty 😂

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Score Stress Indicators/Indexes

@Remedios wrote:

@Anonymous wrote:

@Remedios wrote:I've been employed at the same place for a well over a decade, income in six figures, mortgage paid off, paid off auto loans, utilization typically ultra low, and yet, here I am slumming in the mid 60s because I let card report like it should and had no active loan...because I paid them off.

Hey, you're probably still a much lower credit risk than many companies in the United States. Their debt levels were alarming well before this crisis.

I looks like this score was a joint development. Equifax says in their product sheet that FICO ran the analysis on credit profile data around the time of the Great Recession. Maybe they only used Equifax collected profile data rather than the 3 CRA aggregate data. It does say that it's used in conjunction with a FICO score, which I assume to be EQ 8.

From the Equifax product sheet (direct PDF link):

Higher resilience customers tend to have:

- Fewer credit inquiries in the last year

- Fewer active accounts

- Lower total revolving balances

- More experience managing credit

My inq are sparse now (didnt used to be that way), I've managed many accounts successfully, and if I can make sure 15 are paid on time, how is that more complex than one or two, unless that is a reference to available credit.

I'm unclear what an "active" account is. Is it any account that's open, or literal meaning *account showing signs of activity reflected as presence of balance*.

I'd bet my bum and left kidney that next time instead of bishing about me not having an open loan, it's going to bish about me having an open loan.

Now imagine a situation in which they started "resilience score if you live in hurricane prone areas"...wouldnt fly, there would be an outrage.

Perhaps next time Halley's comet passes near by, they can include that as a risk factor, because some may anticipate apocalypse and quit paying their bills in anticipation.

I guess it's a way to say "Our regular scoring models only work during rainbows and unicorn economy stages. Everything else sold separately"

I could reach 800 if I sit in the garden for six months, but I'm higher risk than someone with charge offs and open collections (no offense to the members im just trying to wrap my mind around this).

As soon as everything is reflected on EQ, I'll pull my reports and see what, if anything changed. My utilization will be rounded to 1%, maybe $2500 reporting, there will be a brand new, fully utilized loan with tiny payments $101.00 iirc.

Im assuming this score changes just like all others do with changes on CR.

I certainly wont be doing anything differently because of this, but I find it somewhat irksome.

If I sound extra salty, it's because I'm extra salty 😂

It clearly states:

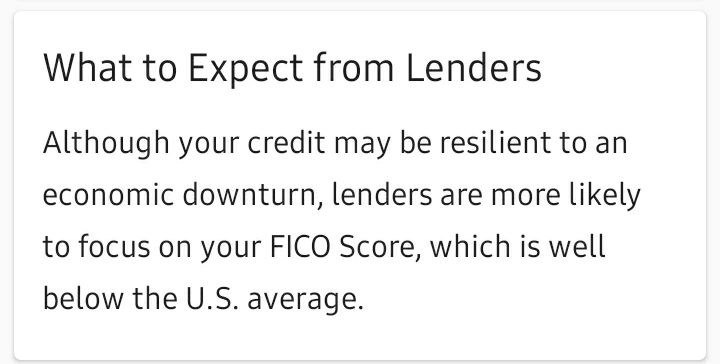

I will take the shot, it is clear it is me. So there is no need to be bitter about it, as they still will focus on your clearly better FICO scores than mine if we were both to seek credit, I assume it is a no-brainer.

From what I can gather is I have low CC to overall accounts ratio with low balances due across the board. I only have 3 CCs that were recently acquired while the last credit products I obtained were closer to a decade or more ago, so I clearly don't credit seek. If it hit the fan, I have next to nothing I owe and creditors can rest easy that I could keep up with my financial obligations, but I still have "bad credit". I assume my SLs may not be fugured into this equation because of who knows why...they can be deferred? Whatever, I am still a high risk according to FICO scoring, but have next to no debt otherwise if I had no money. I'm not hurt by it at all, but at least I know once my scores improve, my profile is at least somewhat appealing and "stable" according to this abstract and probably worthless calculation, but I am still happy in the midst of having crap credit that I am doing something "right".

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Score Stress Indicators/Indexes

@Remedios wrote:My inq are sparse now (didnt used to be that way), I've managed many accounts successfully, and if I can make sure 15 are paid on time, how is that more complex than one or two, unless that is a reference to available credit.

I'm unclear what an "active" account is. Is it any account that's open, or literal meaning *account showing signs of activity reflected as presence of balance*.

I'd bet my bum and left kidney that next time instead of bishing about me not having an open loan, it's going to bish about me having an open loan.

Now imagine a situation in which they started "resilience score if you live in hurricane prone areas"...wouldnt fly, there would be an outrage.

Perhaps next time Halley's comet passes near by, they can include that as a risk factor, because some may anticipate apocalypse and quit paying their bills in anticipation.

I guess it's a way to say "Our regular scoring models only work during rainbows and unicorn economy stages. Everything else sold separately"

I could reach 800 if I sit in the garden for six months, but I'm higher risk than someone with charge offs and open collections (no offense to the members im just trying to wrap my mind around this).

As soon as everything is reflected on EQ, I'll pull my reports and see what, if anything changed. My utilization will be rounded to 1%, maybe $2500 reporting, there will be a brand new, fully utilized loan with tiny payments $101.00 iirc.

Im assuming this score changes just like all others do with changes on CR.

I certainly wont be doing anything differently because of this, but I find it somewhat irksome.

If I sound extra salty, it's because I'm extra salty 😂

lol Exceptional bishing. Comets, rainbows, and unicorns...haha

There must have been a relatively higher percentage of people with similar profile data to your current data, that ended up with derogatories at some future date after the Great Recession. I'm not sure of the timeframe they are using for this. Usually it's 2 years with credit risk modeling, but I would think most customers would want to know the risk well before that.

If FICO data analysis found that people who ate a lot of Nestle Chunky bars (co-worker has a problem lol) started missing payments somewhere down the line, then the first time we bought one would put us on a path toward their bad outcome and lower our FICO Chunky score a little bit.

"But I run 2 miles a day, great BMI, and still fit into my prom dress!" Doesn't matter. We're on the path to becoming degenerate Chunky addicts.

That's basically how it works.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Score Stress Indicators/Indexes

@Anonymous wrote:

@Remedios wrote:My inq are sparse now (didnt used to be that way), I've managed many accounts successfully, and if I can make sure 15 are paid on time, how is that more complex than one or two, unless that is a reference to available credit.

I'm unclear what an "active" account is. Is it any account that's open, or literal meaning *account showing signs of activity reflected as presence of balance*.

I'd bet my bum and left kidney that next time instead of bishing about me not having an open loan, it's going to bish about me having an open loan.

Now imagine a situation in which they started "resilience score if you live in hurricane prone areas"...wouldnt fly, there would be an outrage.

Perhaps next time Halley's comet passes near by, they can include that as a risk factor, because some may anticipate apocalypse and quit paying their bills in anticipation.

I guess it's a way to say "Our regular scoring models only work during rainbows and unicorn economy stages. Everything else sold separately"

I could reach 800 if I sit in the garden for six months, but I'm higher risk than someone with charge offs and open collections (no offense to the members im just trying to wrap my mind around this).

As soon as everything is reflected on EQ, I'll pull my reports and see what, if anything changed. My utilization will be rounded to 1%, maybe $2500 reporting, there will be a brand new, fully utilized loan with tiny payments $101.00 iirc.

Im assuming this score changes just like all others do with changes on CR.

I certainly wont be doing anything differently because of this, but I find it somewhat irksome.

If I sound extra salty, it's because I'm extra salty 😂

lol Exceptional bishing. Comets, rainbows, and unicorns...haha

There must have been a relatively higher percentage of people with similar profile data to your current data, that ended up with derogatories at some future date after the Great Recession. I'm not sure of the timeframe they are using for this. Usually it's 2 years with credit risk modeling, but I would think most customers would want to know the risk well before that.

If FICO data analysis found that people who ate a lot of Nestle Chunky bars (co-worker has a problem lol) started missing payments somewhere down the line, then the first time we bought one would put us on a path toward their bad outcome and lower our FICO Chunky score a little bit.

"But I run 2 miles a day, great BMI, and still fit into my prom dress!" Doesn't matter. We're on the path to becoming degenerate Chunky addicts.

That's basically how it works.

@Anonymous I think you're onto something.

I love Kinder Eggs, and if I were to choke on a toy, no one would be paying my bills.I should switch to plain milk chocolate before pulling my reports again.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Score Stress Indicators/Indexes

@Anonymous wrote:

Whatever, I am still a high risk according to FICO scoring, but have next to no debt otherwise if I had no money. I'm not hurt by it at all, but at least I know once my scores improve, my profile is at least somewhat appealing and "stable" according to this abstract and probably worthless calculation, but I am still happy in the midst of having crap credit that I am doing something "right"

You're here on this forum, so you're definitely on the 'doing something right' path.

Like I said earlier, the credit profile data they analyzed for this clearly showed that a lot of people in a similar situation as you were being pretty careful with their credit lines.

That's what it all comes down to - collect two years of profile data on millions, identify the ones that ended up with derogatories, then backtrack over all those profiles to the beginning of the dataset to identify common values. Better this way than "Oh, she has a charge-off, so automatically higher risk." There's going to be lots of nonintuitive results like this.

I think your 41 Resilient score makes a lot of sense.