- myFICO® Forums

- FICO Scoring and Other Credit Topics

- General Credit Topics

- Re: FICO Score Stress Indicators/Indexes

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

FICO Score Stress Indicators/Indexes

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Score Stress Indicators/Indexes

Honestly at this point it looks like a filler product to allow issuers deny people for valid reason. 800's accross board? But your resilience index is whopping 45! Sorry.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Score Stress Indicators/Indexes

@sarge12 wrote:

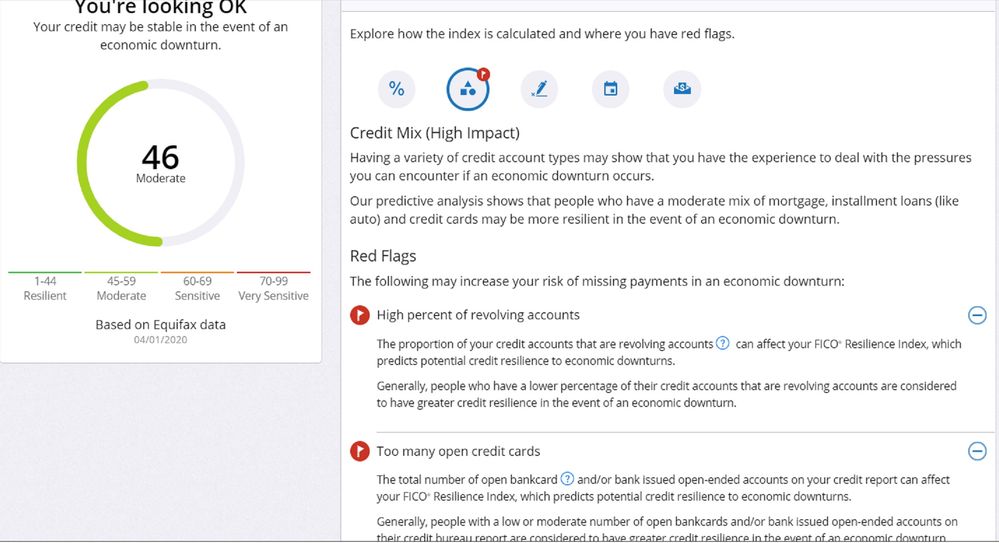

@sjt wrote:They are penalizing us for too many open credit cards and available credit. I think they are oversimplifying DP and I don't think it will be useful to lenders, as they already do a monthly SP on our files and if they see anything unusual they won't hesitate to AA our butts.

Income and savings are not on reports, so to lend credence you have to believe this....2 people with identical profiles showing on their credit report will be equally likely to have credit problems. So their theory is that even if one of them has 50,000 dollars in debt and 20 dollars in savings is equally resilient to someone with 50,000 dollars in debt and 50 million dollars in savings. That is BS, and even a minimum amount of common sense will tell you that is not the case. To some who are in 50,000 dollars debt that is their life savings, for others that is their bar tab with tips or a weekend trip to a resort. Many with a perfect credit history are 1 paycheck loss away from trouble all the time.

I agree. Credit scores only tell part of one's financial picture, which is why most banks look at more than a credit score when evaluating credit apps and their continued monitoring of accounts. Maybe the "resilience score" is an attempt to give a bigger picture. But for me, it only brings up shortfalls in the credit scoring system.

Barclays: Arrival+ WEMC

Capital One: Savor WEMC, Venture X Visa Infinite

Chase: Freedom U Visa Signature, CSR Visa Infinite

Citibank: AAdvantage Platinum WEMC

Elan/US Bank: Fidelity Visa Signature

Credit Union: Cash Back Visa Signature

FICO 08: Score decrease between 26-41 points after auto payoff (11.01.21) FICO as of 5.23, EX: 812 / EQ: 825 / TU: 815

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Score Stress Indicators/Indexes

@Anonymous wrote:

@Nostradamuz wrote:It is not a personal FICO score in the Equifax website, this is a FICO for business.

I think you're looking at a different product, which is quite easy to do on Equifax's website for business.

This is from the CEO of FICO:

"This is some really smart stuff that our guys came up with that helps us to differentiate among consumers and evaluate their credit. Within any particular FICO Score, they're that's at a point in time and a point in the economic cycle, and there are individuals who are more resilient and there are individuals who are less resilient."

Q2, 2020 Earnings call transcript

This is a typical pretext often included before making a very dumb statement. Some of the stupidest things ever spoken by people has had equally ridiculous qualifiers. When someone like Thomas_Thumb who has had all 850 scores forever has an average resiliency index score then the creators of that score are not very smart in my opinion. That is perhaps what happens when people are not as smart as they think themselves to be. It appears to me that too many here and other forums have figured out what they are looking for so as to gain and maintain 800+ scores, so they had to add this into the mix to punish people for doing what increases fico 08 scores. Lenders and the creators of fico scores should celebrate rising credit score trends. The actions required to get those high scores make it extremely unlikely they will ever even make late payments, so why is that a problem? It might be that more of them always PIF which prevents lenders from receiving those outrageous interest charges from the high scoring cardholders.

EX fico08=809 07/16/23

EQ fico09=812 07/16/23

EX fico09=821 07/16/23

EQ fico bankcard08=832 07/16/23

TU Fico Bankcard 08=840 07/16/23

EQ NG1 fico=802 04/17/21

EQ Resilience index score=58 03/09/21

Unknown score from EX=784 used by Cap1 07/10/20

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Score Stress Indicators/Indexes

@EW800 wrote:

@Anonymous wrote:

@Anonymous wrote:

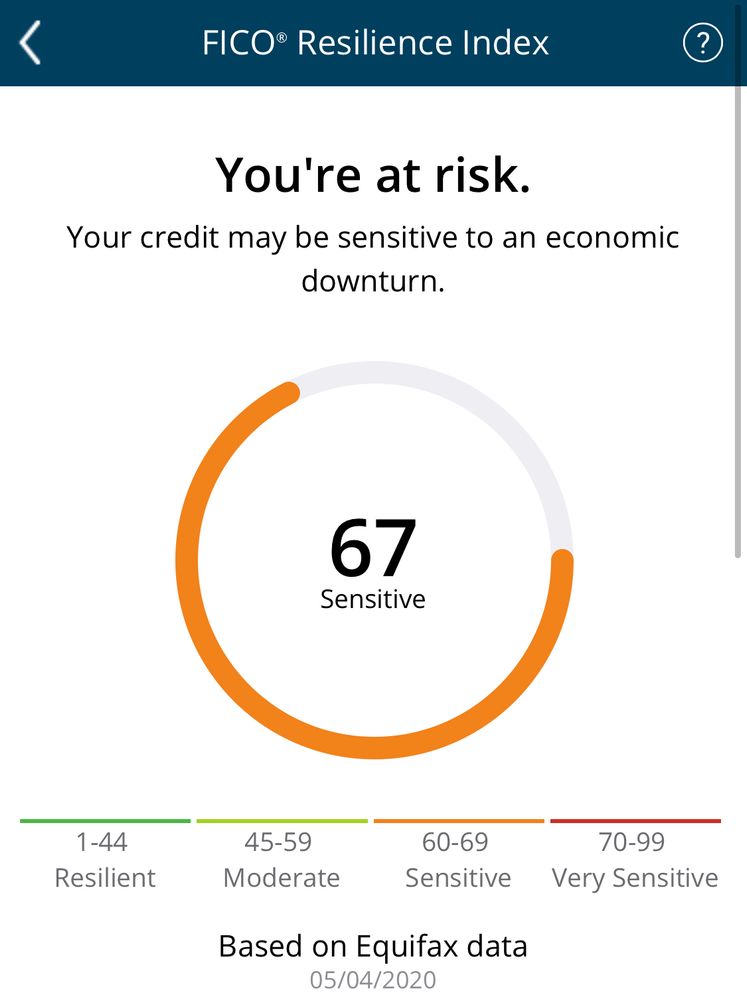

@EW800 wrote:My FICO Resilience Index Score is 46, which indicates "You're Looking OK", and about middle of the road on the pie chart. As a comparison to my FICO 8 and FICO 9 Scores, they are 850 across the board, which has been the case for about the last several months.

It appears that I have two red flags:

1) High Percent of Revolving Accounts. Well, I guess that would be accurate. I have about a dozen open revolving accounts, and just one open install account. I am not sure that I agree that this means I have less credit resilience in an economy downturn, but I guess FICO does not agree.

2) Too Many Open Credit Cards. I guess that is similar to above. I have about a dozen open credit card or store accounts. For the last several years, only one has ever shown with a balance at any given time. It appears that the fact that all but one are zero balance makes no difference, just the fact that I have several credit card accounts open.

Any idea if FCO is selling or giving this score/index number to any lenders?

@EW800 May I ask how many credit cards do you have open? And how many do you have both open and closed at Equifax? Because I'm quite surprised that I do not have that code myself having over 20 credit cards.

Do you have a lots of student loans or something? I know my # of SLs far outweighed my # of CC - def not as many as you. Just thinking out loud...

@Anonymous sorry about my delayed response. No, I do not have any student loans, open or closed. I have about a dozen open CC accounts, however only one ever shows a balance, typically about $25 or so. I have one open auto loan, that has had just a $100 balance for the past six months or so. It is 0%, so I am just letting it sit there to take advantage of the open installment loan points. I have two closed auto loans and one closed second mortgage account, all with perfect history.

It appears that the Resilience Index does not like how many open credit cards I have, even though all but one are $0 balance.

I did go through very ugly times toward the end of the last "great recession" (2011) with a foreclosure and a credit card settlement, so perhaps I am getting spanked by the Resilience Index for that, even though all that stuff fell off all of my reports almost a year ago?? I am not real sure why my Resilience Index is not better than it is.

@EW800 that's crazy I've got over 20 credit cards and the same number of loans as you, yet I don't have that flag that's crazy.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Score Stress Indicators/Indexes

@sarge12 wrote:

@Anonymous wrote:

@sarge12 wrote:Many with a perfect credit history are 1 paycheck loss away from trouble all the time.

That is so true, and exactly why humans alone do not set the scorecards and factor weighting. What seems intuitive - high ability to pay, better job, longer history, higher score - may not be the case for as many people as we think, after regression over a few years of credit profile data.

This is from an article written by a guy who works in the information technology field:

"According to a Nielsen study, 25% of families making $150,000 a year or more are living paycheck-to-paycheck. One in three earning between $50,000 and $100,000 need their next paycheck to survive. For those earning less than $50,000, that percentage increases to half"

( Why people who earn a lot of money still can’t pay the bills )

I also work in a similar field as him (Industry 4.0) and have witnessed exactly what he writes about. That was written around 2 years ago, and I always seem to find newer ones, like this:

A Shocking Number of Higher Earners Still Live Paycheck to Paycheck (March 2020)

Also be aware that I am not talking about net worth, but liquid assets that are free and clear of being security for anyones debts. Many who people think are extremely wealthy actually are not when all assets and debts must be liquidated. Living beyond ones means exist in every income group, and many mega-jackpot lottery winners run through their millions quicker than even seems possible. Suddenly those who once wore clothes bought at wal-mart suddenly had to have a world renown fashion designers latest creations. The reason real wealth was originally no longer allowed on reports is due to being unfairly discriminatory for minorities. Being of modest means does not equate into being less responsible in paying debt. This index however is suppose to indicate the resiliance of a debtor to withstand an economic downturn or job loss.

In the case of a debtor with 20 dollars savings, their only source of revenue to pay their debts are often their paycheck. The debtor with 50 million dollars in liquid assets is not dependant on a paycheck as their only, or even main source of revenue. That 50 million bucks in cash provides a great deal of resilience. In my case, even though I have only about 400k in liquid assets, my personal wants combined with bad health, I can't imagine even using half of that before I leave this World. I have no spouse or children, but do help my Sister and her grown children a lot.

@sarge12 are you looking to adopt anyone? JK. Lol.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Score Stress Indicators/Indexes

@Anonymous wrote:

@Nostradamuz wrote:It is not a personal FICO score in the Equifax website, this is a FICO for business.

I think you're looking at a different product, which is quite easy to do on Equifax's website for business.

This is from the CEO of FICO:

"This is some really smart stuff that our guys came up with that helps us to differentiate among consumers and evaluate their credit. Within any particular FICO Score, they're that's at a point in time and a point in the economic cycle, and there are individuals who are more resilient and there are individuals who are less resilient."

Q2, 2020 Earnings call transcript

I noticed before it said the resilience score was for a particular score range.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Score Stress Indicators/Indexes

@Anonymous wrote:

@Anonymous wrote:

@Nostradamuz wrote:It is not a personal FICO score in the Equifax website, this is a FICO for business.

I think you're looking at a different product, which is quite easy to do on Equifax's website for business.

This is from the CEO of FICO:

"This is some really smart stuff that our guys came up with that helps us to differentiate among consumers and evaluate their credit. Within any particular FICO Score, they're that's at a point in time and a point in the economic cycle, and there are individuals who are more resilient and there are individuals who are less resilient."

Q2, 2020 Earnings call transcript

I noticed before it said the resilience score was for a particular score range.

That was just for example: (from myFICO) "Lenders can use this to help identify credit risk for people within a FICO Score range (680-700, for example) in the face of an economic downturn. Put another way in this example, the FICO Resilience Index answers the question, “Which consumers with FICO Scores between 680 and 700 may be more likely to be considered resilient in the event of an economic downturn?"

(From Equifax) "It answers questions like, “Which ‘680s’ are more likely to go bad when financial stress is exerted on a consumer population?” giving lenders a new tool to use and helping avoid taking large measures that impact more “resilient” consumers unnecessarily."

They could have also asked, "Which consumers have FICO Scores between 750 and 850...".

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Score Stress Indicators/Indexes

@Anonymous wrote:

@sarge12 wrote:

@Anonymous wrote:

@sarge12 wrote:Many with a perfect credit history are 1 paycheck loss away from trouble all the time.

That is so true, and exactly why humans alone do not set the scorecards and factor weighting. What seems intuitive - high ability to pay, better job, longer history, higher score - may not be the case for as many people as we think, after regression over a few years of credit profile data.

This is from an article written by a guy who works in the information technology field:

"According to a Nielsen study, 25% of families making $150,000 a year or more are living paycheck-to-paycheck. One in three earning between $50,000 and $100,000 need their next paycheck to survive. For those earning less than $50,000, that percentage increases to half"

( Why people who earn a lot of money still can’t pay the bills )

I also work in a similar field as him (Industry 4.0) and have witnessed exactly what he writes about. That was written around 2 years ago, and I always seem to find newer ones, like this:

A Shocking Number of Higher Earners Still Live Paycheck to Paycheck (March 2020)

Also be aware that I am not talking about net worth, but liquid assets that are free and clear of being security for anyones debts. Many who people think are extremely wealthy actually are not when all assets and debts must be liquidated. Living beyond ones means exist in every income group, and many mega-jackpot lottery winners run through their millions quicker than even seems possible. Suddenly those who once wore clothes bought at wal-mart suddenly had to have a world renown fashion designers latest creations. The reason real wealth was originally no longer allowed on reports is due to being unfairly discriminatory for minorities. Being of modest means does not equate into being less responsible in paying debt. This index however is suppose to indicate the resiliance of a debtor to withstand an economic downturn or job loss.

In the case of a debtor with 20 dollars savings, their only source of revenue to pay their debts are often their paycheck. The debtor with 50 million dollars in liquid assets is not dependant on a paycheck as their only, or even main source of revenue. That 50 million bucks in cash provides a great deal of resilience. In my case, even though I have only about 400k in liquid assets, my personal wants combined with bad health, I can't imagine even using half of that before I leave this World. I have no spouse or children, but do help my Sister and her grown children a lot.

@sarge12 are you looking to adopt anyone? JK. Lol.

Sorry, but with a resliency index score of 59, I am barely able to care for myself my friend. Look for a more reseliant adoptive parent. According to fico, I will almost certainly fall into financial ruin if the economy does not improve. Never mind that I am drawing Social Security and have almost 20 times my debt in savings. It does not matter that I could live on SSDI alone. Fico has spoken, so I am not very resilient, I must live with that. Perhaps we can start a support group for those of us that are now learning of our lack of resilience for the first time! We should at least try, there must be help for us somewhere. I just feel so defeated after realizing I have spent all these years blissfully unaware of my lack of resilience, but now I know.

EX fico08=809 07/16/23

EQ fico09=812 07/16/23

EX fico09=821 07/16/23

EQ fico bankcard08=832 07/16/23

TU Fico Bankcard 08=840 07/16/23

EQ NG1 fico=802 04/17/21

EQ Resilience index score=58 03/09/21

Unknown score from EX=784 used by Cap1 07/10/20

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Score Stress Indicators/Indexes

@sarge12 wrote:

@Anonymous wrote:

@sarge12 wrote:

In my case, even though I have only about 400k in liquid assets, my personal wants combined with bad health, I can't imagine even using half of that before I leave this World. I have no spouse or children, but do help my Sister and her grown children a lot.@sarge12 are you looking to adopt anyone? JK. Lol.

Sorry, but with a resliency index score of 59, I am barely able to care for myself my friend. Look for a more reseliant adoptive parent. According to fico, I will almost certainly fall into financial ruin if the economy does not improve. Never mind that I am drawing Social Security and have almost 20 times my debt in savings. It does not matter that I could live on SSDI alone. Fico has spoken, so I am not very resilient, I must live with that. Perhaps we can start a support group for those of us that are now learning of our lack of resilience for the first time! We should at least try, there must be help for us somewhere. I just feel so defeated after realizing I have spent all these years blissfully unaware of my lack of resilience, but now I know.

LOL. You and Remedios are really good at this!

It reminds me of the time Russ Hanneman, of Silicon Valley fame (invented internet radio), made a bad 200 million dollar investment, which meant he was no longer a billionaire with only 986 million left. He had to sell his McLaren and drive a Maserati instead. He was also forced to fly privately in a rented(!) Cessna Citation Ultra.

Hear him tell his story. Don't click if easily offended...he swears a lot. I mean, who wouldn't in that position, right?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Score Stress Indicators/Indexes