- myFICO® Forums

- FICO Scoring and Other Credit Topics

- General Credit Topics

- Re: FICO Score Stress Indicators/Indexes

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

FICO Score Stress Indicators/Indexes

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Score Stress Indicators/Indexes

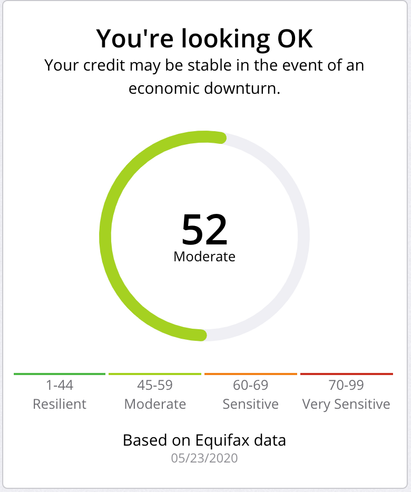

I guess as the originator of this wild and wonderful thread, I should report my rating and DP.

Insights:

- High installments loans

- High number of revolving accounts

Data Points:

- FICO 8, EQ 827

- < 1% utilization across $60k CL (8 cards)

- No bank card balances carried

- No mortgage

- 1 personal loan (PenFed)

- 1 truck loan

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Score Stress Indicators/Indexes

@Anonymous wrote:I guess as the originator of this wild and wonderful thread, I should report my rating and DP.

Yep. All your fault. haha

I'll update the board.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Score Stress Indicators/Indexes

EQ FICO Resilience Index - Leaderboard as of June 8, 2020

It's all rainbows, unicorns, comets, penguins, and...uh, chicken strips.

*Note about this score: Lower rating (higher number) doesn't mean that person has a bad credit profile in any way. We're in Equiland now...

Member Name | Score | Red Flags | Remarks |

| Throckmorton's Wife | 40 | ? | EQ 8: 829 |

| LaHossBoss | 41 | 0 | 1 CO - paid, due to drop off CR in next 2-3 months 5 CAs - 1 pfd CA was deleted this month and still waiting on 1 other pfd to delete, but it is still listed in it's entirety on this pull 1 installment loan - 25% bal/$48 mothly payment 3 CCs - at AZEO, <1% aggregate, 3% individual on non-zero bankcard with $10 payment due. 7 of 11 defaulted SLs and 2 of 5 CAs are reporting "affected by natural/declared disaster" I am at 75% CCs / 25% installment loans credit mix $58 in total monthly obligations reported for May 2020 AoOA 18y 5m | AAoA 9y 4m EQ 8: 605 | EQ 9: 671 | EQ 5: 641 |

| FireMedic1 | 45 | 2 | EQ 8: 740 | EQ 9: 827 |

| PicoFico | 45 | 2 | Rebuild start: 5/15/19 |

| EW800 | 46 | 2 | 850 FICO 8s and 9s |

| tacpoly | 46 | 2 | |

| Thomas_Thumb | 48 | 2 | Perfect credit profile. |

| Tonya-E | 48 | 2 | EQ 8: 849 |

| sjt | 51 | 2 | Was 52 then 47 now 51. 830+ all FICO 8s |

Chris865 [OP] | 52 | 2 | FLAGS: High installments loans, High number of revolving accounts |

| LaHossBoss SO | 52 | 2 | Unpaid CAs, SLs defaulted |

| angelwingz | 53 | 2 | EQ 8 770, AAoA 1yr 8mo, Recent account (4mo) |

| Trudy | 54 | 1 | EQ 8 850, EQ 9 850, EQ 5 817, AoOA 24y2m, AAOA 11y10mo |

| CassieCard | 55 | 2 | Was 53. EQ 8 734, EQ 9 739, EQ 5 727, AAoA 1yr2mo, AoOA 2yr5mo, Recent Accounts (2 @ 3mo), 4 cards with 4% on each one, 4% aggr. $587 to $1149 aggr balance with the same 4% aggr resulted in losing 2 points (53 to 55). Now homeless and shoplifting for fun and profit. |

| CreditObsessedinFL | 56 | 2 | Up from 58. One of the flags changed from 'age of revolving accounts' to 'number of revolving accounts' as recent account age passed 3mos. |

| TMB_ | 56 | 2 | EQ 8: 771 |

| sarge12 | 59 | 2 | Serving time in a women's prison. Got pardon. Still won't leave. FICO 8s 819+ |

| Brian_Earl_Spilner | 61 | 2 | Flags: Installment balances and Too many revolving accounts. Low utilization, $53 reporting. |

| NRB525 | 63 | 2 | All FICO 8's 800+. 6% EQ utilization. |

| Remedios | 63 | 2 | Was 67. EQ 8: 778. $1100/1% aggregate utilization. 1 card with a balance. An extremely high magnetic field around a couch has increased her resilience. |

| Revelate | 63 | 2 | EQ 8 826 and EQ 5 799. Putting it on his dating profile because it says 'Sensitive'. It's going to work. |

| Birdman7 | 64 | 2 | Sleeping. EQ 8 800, EQ 9 820, EQ 5 788. AoOA 25yr+ |

| RehabbingANDBlabbing | 66 | 2 | |

| Dumbee | 67 | ? | |

| Kenro | 72 | ? | High 700s across all FICO 8s. |

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Score Stress Indicators/Indexes

@Revelate wrote:

@Brian_Earl_Spilner wrote:

@Anonymous wrote:

@Brian_Earl_Spilner wrote:I got a 61, yo. 2 red flags. Installment balances and credit mix for too many revolving accounts. They don't respect the YOLO.

You now have pretty low utilization now, right? I was thinking of the thread you started about paying down all of your cards.

Yeah, it kind of annoys me because even though all my balances updated, my score flags are for using too much revolving credit?

Wat?

I'm reporting $53 out of $16,800. It's going to go lower too because I just added $4300 in limits while the last of my balances are zeroing out.

Making a conjecture with very little available information I wonder if it's confusing (terminology wise) using with available credit.

Available credit doesn't necessarily mean stability and it's not lost on me that many in the higher scoring brackets (twilight zone Resilience) have larger tradelines and aggregate limits. If you are looking at a new algorithm don't some of the underpinnings need to change otherwise what value does it have?

Do people with high aggregate limits, when this variable is isolated, manifest more risk to lenders in the abscence of income information? Sort of QED style of course they do, bigger capability for losses and bankruptcy.

No debt = low chance for being overextended... I wonder what the average consumer credit limit is, I don't think I have seen that data. Maybe something to look for later.

@Anonymous hah even when your posts don't necessarily drive conversation directly (though rich deadbeat sort of did for this post) I almost always bark with laughter at your turn of phrase. Thank you!

Yeah I had wondered about available credit as well. And I'm just now catching up on this thread, so if it's been talked about since then I haven't got there yet.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Score Stress Indicators/Indexes

I can tell you based on the differences between my score and my wife's score that this is heavily weighting one or both of:

- recent credit (some combination of average age, newer accounts, remaining balance on installment loans)

- credit mix (installment vs revolving)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

FICO Score Stress Indicators/Indexes

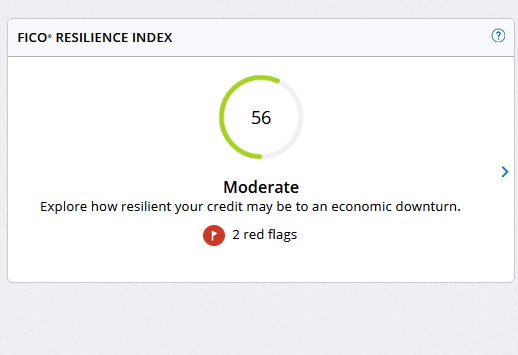

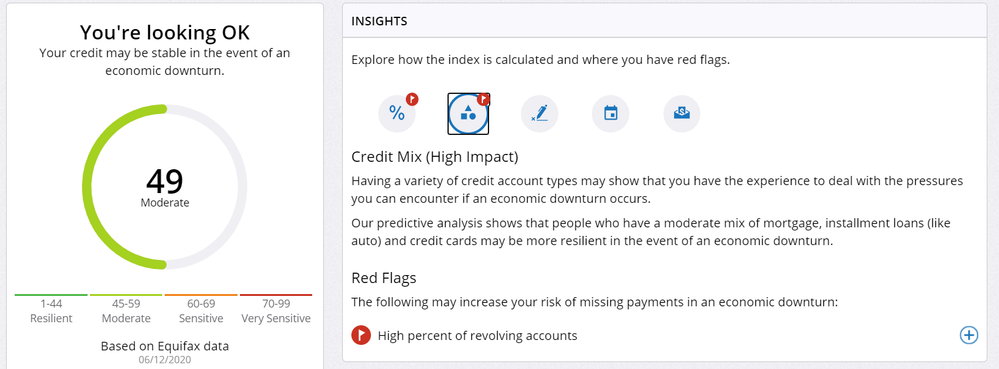

I have been railing for decades over the inherent unreliability of the "reasons" behind a FICO score, which I consider to be little more thana simple random number which has very little to do with reality. Now FICO has come up with the "FICO Resilience Index" - a sort of "stress test" of a FICO score. Here is mine.

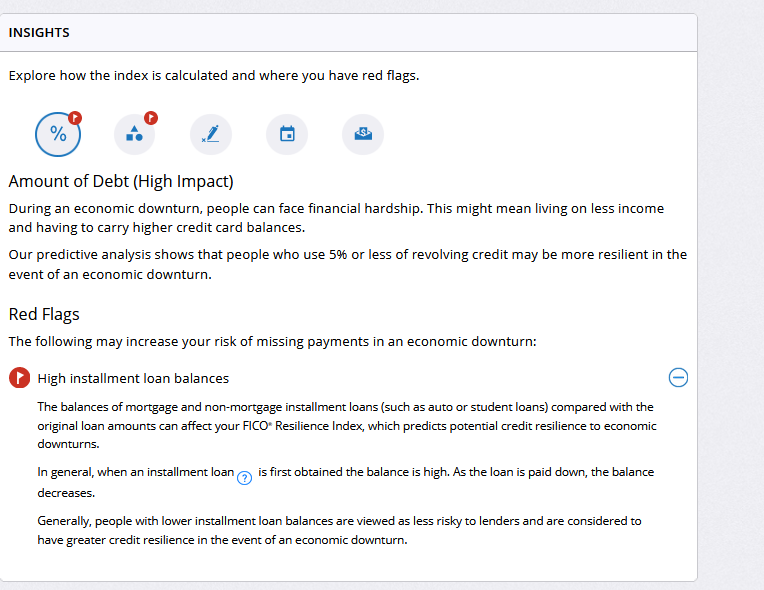

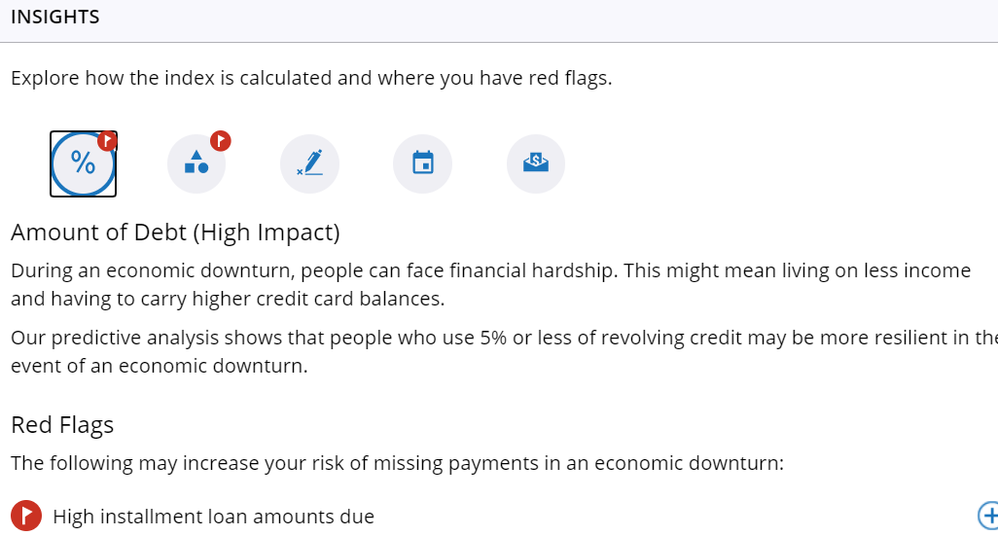

Now - let's look at the reasons for my high score (and therefore low resilience): First, let's look at how my Installment Loans affect my Resilience:

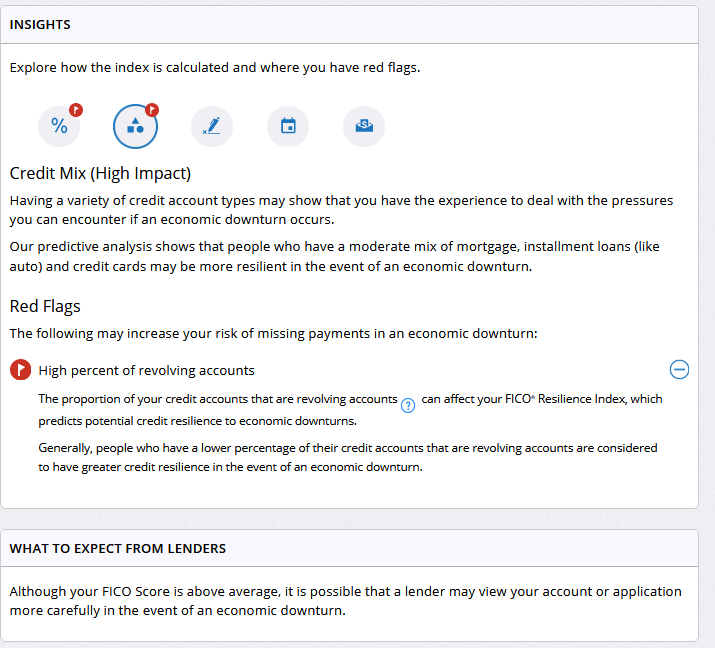

Pretty scary, right? Except for the fact that at the time this score was created BOTH MY INSTALLMENT LOANS HAD ALREADY BEEN PAID OFF AND A $0 BALANCE REPORTED!!!! So, to FICO, a balance of $0 in Installment Loans is a scary thing. Now let's look at the Credit Card side:

Notice - it does not address the BALANCE owed on Credit cards, just the fact that a high percentage of my remaining debt capacity is eaten up by credit cards. With the payoff of the installment loans all the remaining debt capacity I have is in credit cards, with a cumulative Util of less than 2%. The new score admits that my FICO score is "above average" but still docks me for not having any installment loans. In the two details, please read the sentences that start with "Generally....." - they are identical - so that in the Installment Loan section they are telling me that my Credit Resilience will be better if I have low balances in my Installment Loans, and in the Credit Card section NOT having enough in Installment Loans (hence the "lower percentage of their credit accounts that are revolving accounts" makes me a better credit resilience. BUT.... the fact that I am nearly debt free ($0 owed in Installment loans and Credit Card Util of less than 2%) somehow makes me more suceptible to missing payments in an economic downturn than, say, a person who owes $100,000 on a mortgage.

This new score appears to be just one more example of FICO-babble designed to confuse us further.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Score Stress Indicators/Indexes

@Anonymous wrote:This new score appears to be just one more example of FICO-babble designed to confuse us further.

Welcome to this crazy world:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Score Stress Indicators/Indexes

@Anonymous wrote:I have been railing for decades over the inherent unreliability of the "reasons" behind a FICO score, which I consider to be little more thana simple random number which has very little to do with reality. Now FICO has come up with the "FICO Resilience Index" - a sort of "stress test" of a FICO score. Here is mine.

Now - let's look at the reasons for my high score (and therefore low resilience): First, let's look at how my Installment Loans affect my Resilience:

Pretty scary, right? Except for the fact that at the time this score was created BOTH MY INSTALLMENT LOANS HAD ALREADY BEEN PAID OFF AND A $0 BALANCE REPORTED!!!! So, to FICO, a balance of $0 in Installment Loans is a scary thing. Now let's look at the Credit Card side:

Notice - it does not address the BALANCE owed on Credit cards, just the fact that a high percentage of my remaining debt capacity is eaten up by credit cards. With the payoff of the installment loans all the remaining debt capacity I have is in credit cards, with a cumulative Util of less than 2%. The new score admits that my FICO score is "above average" but still docks me for not having any installment loans. In the two details, please read the sentences that start with "Generally....." - they are identical - so that in the Installment Loan section they are telling me that my Credit Resilience will be better if I have low balances in my Installment Loans, and in the Credit Card section NOT having enough in Installment Loans (hence the "lower percentage of their credit accounts that are revolving accounts" makes me a better credit resilience. BUT.... the fact that I am nearly debt free ($0 owed in Installment loans and Credit Card Util of less than 2%) somehow makes me more suceptible to missing payments in an economic downturn than, say, a person who owes $100,000 on a mortgage.

This new score appears to be just one more example of FICO-babble designed to confuse us further.

I think the whole resilience score thing is a joke really. But IMHO they are not looking for a $100,000 mortgage, but rather loans with a very low B/L, just like you get the extra points for the SSL strategy once you get down to 9%. So unless it was $1 million mortgage to start with..., but then it seems like it penalizes you if the payments are too large.

And I think there's simply looking at the percentage of credit cards you have, as you said the more debt capacity you have. I guess they look at it as more likely to occur if the ability is there.

So they want nearly paid off loan(s)(with low payments) and a low ratio of cards to loans, it appears. I think 75% has been discussed as a possible threshold. 3:1. I think the majority of us here are all going to get that red flag.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Score Stress Indicators/Indexes

Joke, yes.

Opportunism, oh heck yes!

I mean, when's the next launch window for data collected in 2008 with very little similarities to 2019???

Wait for Small Pox? Magnetic poles shifting? Intelligent toasters taking over Wall Street?

Bubonic plague wouldn't work, because it's curable, but they could use data from 1620 because PANDEMIC!!!!

Make a buck when you can.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Score Stress Indicators/Indexes

Okay, my bad if I've missed something but I haven't followed this thread in a while. Was at 54, think it ticked up a bit the following month to 56 which is the last time I checked. But had to post as I pulled my report yesterday and just remembered to check this...my score is now 49.

As my # of accounts decreased:

---from 3 rev, 2 loans --> 1 rev, 2 loans

As my UTL decreased:

---AGG CC UTL from 4.64% --> 1.68%, Home UTL from 83.6% --> 81.3%, Auto from 11.48% --> 7.83%

I get more risky as I pay down my balances (well above the amount due) ![]() Yet EQ loves me FICO score wise.

Yet EQ loves me FICO score wise. ![]()