- myFICO® Forums

- FICO Scoring and Other Credit Topics

- General Credit Topics

- Re: FICO Score Stress Indicators/Indexes

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

FICO Score Stress Indicators/Indexes

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Score Stress Indicators/Indexes

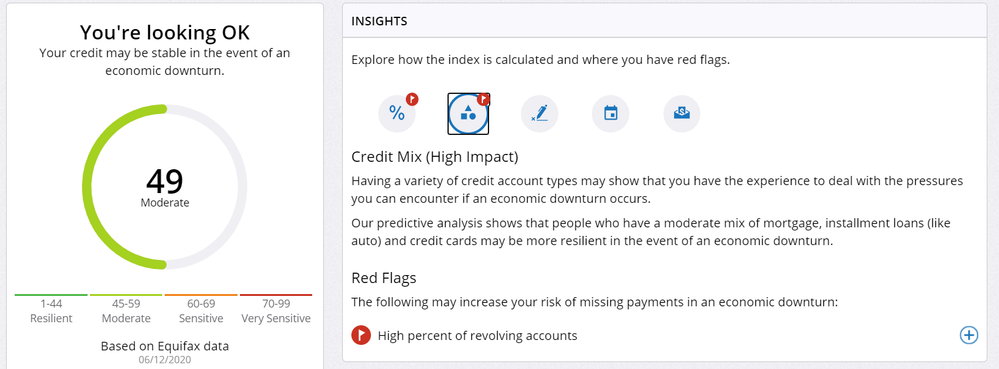

@Trudy wrote:Okay, my bad if I've missed something but I haven't followed this thread in a while. Was at 54, think it ticked up a bit the following month to 56 which is the last time I checked. But had to post as I pulled my report yesterday and just remembered to check this...my score is now 49.

...

I get more risky as I pay down my balances (well above the amount due)

Yet EQ loves me FICO score wise.

You got less risky! You were at 54 in the latest update to the Leaderboard here, and now at 49 which is better!

Because we're down the rabbit hole. lol

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Score Stress Indicators/Indexes

@Trudy wrote:Okay, my bad if I've missed something but I haven't followed this thread in a while. Was at 54, think it ticked up a bit the following month to 56 which is the last time I checked. But had to post as I pulled my report yesterday and just remembered to check this...my score is now 49.

As my # of accounts decreased:

---from 3 rev, 2 loans --> 1 rev, 2 loans

As my UTL decreased:

---AGG CC UTL from 4.64% --> 1.68%, Home UTL from 83.6% --> 81.3%, Auto from 11.48% --> 7.83%

I get more risky as I pay down my balances (well above the amount due)

Yet EQ loves me FICO score wise.

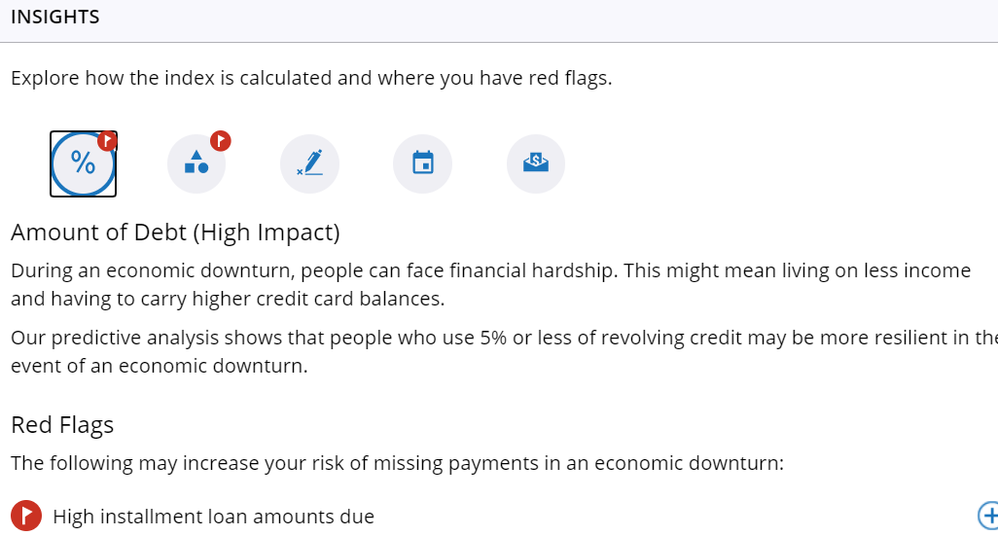

So both me and my SO have 1 active installment loan, each. A Self Lender loan. Mine has a $48/mo payment and his has a $150/mo payment. He did get the flag for high installment loan payment while I had no flags. I am guessing that since my monthly obligation is less, it is more favorable. Since his is more $ every month towards monetary obligations, he got stung for that.

From what I read on it, they are looking at economic downturn how well someone can keep up with their monthly obligations, say if you lost a job. The more monthly obligations owed, the less resilience. I am speaking in terms of installment debt right now.

Apparently if more than 75% of you TLs are revolvers, that also flags you and makes you risky in their eyes. No clue why!

Edit: when the score goes *down* you become *less* risky! You improved!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Score Stress Indicators/Indexes

@Anonymous wrote:You got less risky! You were at 54 in the latest update to the Leaderboard here, and now at 49 which is better!

Because we're down the rabbit hole. lol

Dang, this thing is so far off my radar I forgot whether high is good or bad ![]() Had to go back to my dashboard to remind myself how this even works.

Had to go back to my dashboard to remind myself how this even works.

Thanks for the reminder CC.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Score Stress Indicators/Indexes

@Anonymous wrote:Apparently if more than 75% of you TLs are revolvers, that also flags you and makes you risky in their eyes. No clue why!

Edit: when the score goes *down* you become *less* risky! You improved!

It's all about what we have in common with the people who ended up defaulting shortly after the Great Recession. Many of them were high income earners in the financial industry, so income alone isn't going to be a great predictor.

I can guess that a high number of revolvers meant more temptation to go to Vegas, start therapy shopping due to nervous breakdown, etc, etc., and enough people did that to make it statistically significant.

Are you going to have another Resilience Index update this month?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Score Stress Indicators/Indexes

My Resiliency Score ticked higher (less resilient)

2 red flags

- high revolving account balances - approx 25k of charges recently posted. All to be PIF. It will be interesting to see if there are anymore changes.

- high percent of revolving accounts

Transunion went down 6 points, but Fico 8 scores otherwise stable.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Score Stress Indicators/Indexes

@tacpoly wrote:My Resiliency Score ticked higher (less resilient)

2 red flags

- high revolving account balances - approx 25k of charges recently posted. All to be PIF. It will be interesting to see if there are anymore changes.

- high percent of revolving accounts

I'm surprised the 25K in balances only caused a single point loss. I wouldn't expect it to do much to a profile like yours anyway.

I lost 2pts (53 to 55) just going above $1000 to $1214. This month it will come back down to $775 and I'll most likely get that back. Maybe even more with 3/4 cards reporting a balance vs. 4/4 last time.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Score Stress Indicators/Indexes

@Revelate wrote:Random contribution cause I was curious: for reference every single one of my EQ FICO scores are at the highest they've ever been which is a little surprising to me... 826 EQ FICO 8 / 799 EQ FICO 5, totally gold plated on this bureau even with complaints of crappy installment utilization and a CFA.

Score: 63 - I'm Sensitive! Thinking this should totally go on the dating profile instead of an 800 FICO.

- High installment loan amounts due

- $1818/mo mortgage

- $869/mo auto loan

- High Revolving Balances

- 1/18 accounts with balances

- $3366/$25000

Interesting that Experian has my updated credit card balance, and Equifax has my updated mortgage balance not that that either matter for stuff that I'm tracking right now though I realized with how delayed this new mortgage was I'm in striking distance just by throwing some cash at the auto loan of 66% installment loan utilization.

Speaking of which, I have a second mortgage landing in a few months, I may just see if I can beat Remedios' score

.

This score sort of seems like snake oil anyway even if probably all the bureaus are selling it now: employment type, asset declaration, none of that is on a credit report and those seem like more valuable datapoints than anything on it in terms of what happens when things go pear shaped.

Huh, well random additional snapshot, I thought I was going to fall further down the scorecard but didn't move much.

Not pretty format but for this algorithm it gets about what it deserves TBH, Pink = new sorry was supposed to be working 6 minutes ago, fail Rev fail... especially after sleeping something like 19/24 of the last hours. Strangely my resilience score seems about as or maybe more resilient as my mainline FICOs.

Same reason codes, the order swapped though if that means anything Revolving is now above Installment.

Resillience Score 63 -> 65

EQ FICO 8 826 -> 808

EQ FICO 5 799 -> 779

- High Revolving Balances

- 1/18 accounts with balances -> 3/19

- $3366/$25000 -> $8569/$25000

- $965/$10000

- $51/$8500

- High installment loan amounts due

- $1818/mo mortgage

- $869/mo auto loan

- $2288/mo mortgage

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Score Stress Indicators/Indexes

@Anonymous

I did my 3B pull on 6/17/2020 and my score went up, ack!

I am now at 44, still in the okie dokie category.

Still no red flags.

I am sure I know the reason as to my score increase.

My AAoA and AoOA went down several years due to my oldest TL falling off my EQ CR.

AAoA:

5/18/2020: 9yr 4 mo

6/18/2020: 8yr 11mo

AoOA:

5/18/2020: 18yr 5mo

6/18/2020: 15yr 1mo

That is the only major change, so I am certain that is the culprit.

I can't remember if they rank highest for AAoA: 9yrs or 10yrs? I guess I will find out next month when my AAoA increases to 9yrs!

Anyone recall off the top of their heads what the higjest they rank for AoOA? 18, 19, or 20yrs?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Score Stress Indicators/Indexes

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Score Stress Indicators/Indexes

@Anonymous wrote:

@AnonymousSo what’s your new score?

Oops! It like deleted half of my post lol

I will edit it now!