- myFICO® Forums

- FICO Scoring and Other Credit Topics

- General Credit Topics

- Re: FICO Score Stress Indicators/Indexes

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

FICO Score Stress Indicators/Indexes

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Score Stress Indicators/Indexes

@sjt wrote:

@joeyv1985 wrote:

@Anonymous wrote:

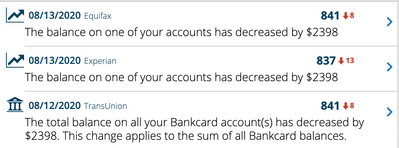

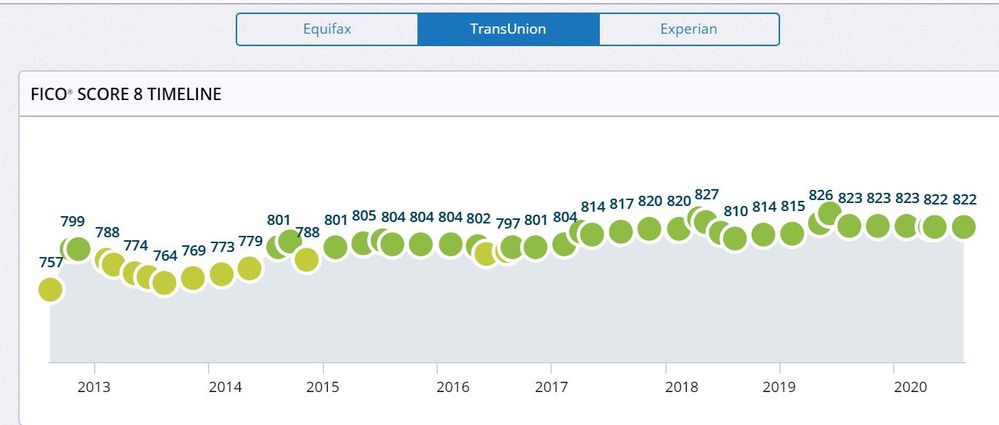

@tacpoly wrote:When all my cards reported 0, my Resilience Score improved from 56 with 2 flags last month to 43 with no flags this month, however, my FICO8 scores went down:

@tacpoly Thank you for sharing, that does make sense though because you reduced your monthly obligation to help the resiliency score, but AZ penalty on fico.

@joeyv1985 I will definitely be interested in hearing your results because that will not decrease your monthly auto obligation, but will decrease the total amount owed.

Agree. I'm torn on how long I should have this car loan open. I can pay it off now, but part of me wants to stretch this refi to at least the 1 year anniversary in Mid November for scoring purposes. No big purchases on the horizon so I don't mind a pullback in my score once I hit my target.

I'm sort of in the same situation, I have an auto loan which will be paid in about a year. I was thinking about paying it off but decided not too for score purposes and the interest I would save would not be significant.

But could that not be the real reason for this new score? I always wonder when I see something new added that actually influences people to change their credit decisions about paying debt down, could that not be the objective for this score?

EX fico08=809 07/16/23

EQ fico09=812 07/16/23

EX fico09=821 07/16/23

EQ fico bankcard08=832 07/16/23

TU Fico Bankcard 08=840 07/16/23

EQ NG1 fico=802 04/17/21

EQ Resilience index score=58 03/09/21

Unknown score from EX=784 used by Cap1 07/10/20

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Score Stress Indicators/Indexes

@sarge12 wrote:But could that not be the real reason for this new score? I always wonder when I see something new added that actually influences people to change their credit decisions about paying debt down, could that not be the objective for this score?

Well if I had a choice between a higher FICO vs a lower Resilience score, I'd choose the FICO.

Barclays: Arrival+ WEMC

Capital One: Savor WEMC, Venture X Visa Infinite

Chase: Freedom U Visa Signature, CSR Visa Infinite

Citibank: AAdvantage Platinum WEMC

Elan/US Bank: Fidelity Visa Signature

Credit Union: Cash Back Visa Signature

FICO 08: Score decrease between 26-41 points after auto payoff (11.01.21) FICO as of 5.23, EX: 812 / EQ: 825 / TU: 815

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Score Stress Indicators/Indexes

@Anonymous

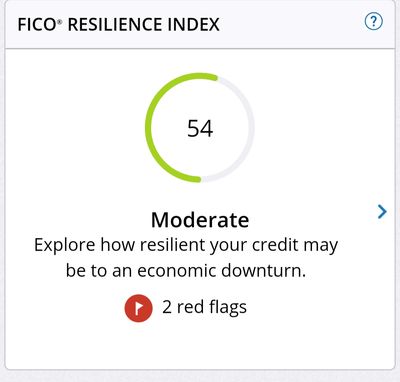

SO 3B pull resulted in an increase in resilency score (bad lol).

He went from 52 >>> 55

I assume this is because he added a new CC/revolver and lowered his AAoA further on EQ. His Self lender installment loan did hit 50% paid off, but I am not sure that is reflected yet on EQ or matters.

Same 2 red flags as last month:

Installment loan balances too high

Missed payments

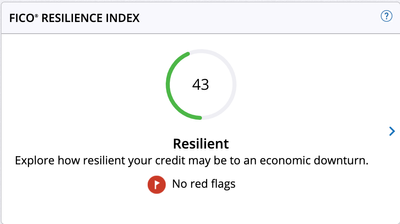

My resiliency score stayed the same this month:

43 >>> 43

no new changes in EQ report and still no flags

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Score Stress Indicators/Indexes

@sarge12 wrote:@sjt If you don't mind sharing 1) What is your amount of credit available, and is it too high, or too low 2) How many open revolving accounts do you have. Finally, 3) Have you or others shared enough data points to get an idea of what this index considers ideal for these data points. It would be nice to know what both need to be for maximizing all the data points. I do not know why, but somehow I think the very things that make my fico 08 scores easy to keep high, works against this score. Namely 20 or so credit cards, about 250k in limits, and very low utilization on all cards,except 1.

Current Report:

8 Open Revolvers with a total CL of $110,800. One card reporting a balance of $101, the rest reporting 0 balance.

1 Closed Account

FYI-4 Accounts that are not reporting. 2 are personal and 2 are business accounts. Will attempt to fix the non-reporting of the personal accounts.

1 Auto loan currently 29.6% utilization.

Clean file.

I do AZEO, so occasionally accounts so some account that are dormant until it reports a balance. I'm wondering if the reason I had a score of 47 was that a couple of my accounts were considered dormant.

Barclays: Arrival+ WEMC

Capital One: Savor WEMC, Venture X Visa Infinite

Chase: Freedom U Visa Signature, CSR Visa Infinite

Citibank: AAdvantage Platinum WEMC

Elan/US Bank: Fidelity Visa Signature

Credit Union: Cash Back Visa Signature

FICO 08: Score decrease between 26-41 points after auto payoff (11.01.21) FICO as of 5.23, EX: 812 / EQ: 825 / TU: 815

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Score Stress Indicators/Indexes

@sarge12 wrote:

@sjt wrote:

@joeyv1985 wrote:

@Anonymous wrote:

@tacpoly wrote:When all my cards reported 0, my Resilience Score improved from 56 with 2 flags last month to 43 with no flags this month, however, my FICO8 scores went down:

@tacpoly Thank you for sharing, that does make sense though because you reduced your monthly obligation to help the resiliency score, but AZ penalty on fico.

@joeyv1985 I will definitely be interested in hearing your results because that will not decrease your monthly auto obligation, but will decrease the total amount owed.

Agree. I'm torn on how long I should have this car loan open. I can pay it off now, but part of me wants to stretch this refi to at least the 1 year anniversary in Mid November for scoring purposes. No big purchases on the horizon so I don't mind a pullback in my score once I hit my target.

I'm sort of in the same situation, I have an auto loan which will be paid in about a year. I was thinking about paying it off but decided not too for score purposes and the interest I would save would not be significant.

But could that not be the real reason for this new score? I always wonder when I see something new added that actually influences people to change their credit decisions about paying debt down, could that not be the objective for this score?

The real reason, according to the CEO of FICO, is to better evaluate those profiles that are borderline acceptable:

"And the traditional way of dealing with downturns, and we see it today is that lenders raise their lending thresholds. They raise their cutoffs. And while obviously, that's the prudent thing to do, we'd love for that to be a little more sophisticated and surgical and be able to evaluate some of the individuals below those cutoffs with more precision. And that's really what FICO Resiliency Index does." - William J. Lansing, CEO FICO, on earnings call transcript (Source)

Probably because the market is saturated at the 700+ level? Subprime lending seems to be all the rage these days, so it kind of makes sense.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: EQ FICO Resilience Index

EQ FICO Resilience Index Leaderboard as of August 18, 2020 |

Breaking News |

K-in-Boston STILL holds The Golden Chalice! even though Kenro also has a 72. Because 3 FLAGS beats a question mark!

Dogbert is still KEEPER of The Golden Sword! for having the lowest/highest/worst/best score ever!

Welcome new Gold Key Winner JWD1980 to the board with a score of 40!

tacpoly makes an impressive move from 56 Moderate to 43 Resilient!

FICO issued a press release about this score and it triggered a flurry of articles in the mainstream press. The Washington Post published an article about this 'new score'. Plenty more articles on Google here. Lots of article authors are wondering if/when consumers will be able to obtain their score. lol The first score was submitted to this thread on March 29, 2020.

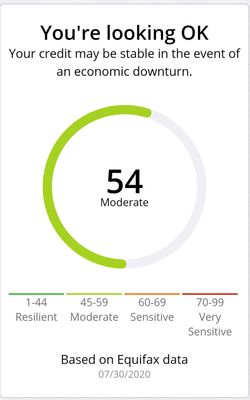

This Resilience Index score is included with a myFICO subscription. It will be shown on the dashboard.

And as always - lower rating (higher number) doesn't mean that person has a bad credit profile in any way. This score is really sensitive to balance amounts and it doesn't matter if you have a 600 or 850. |

RECORD HOLDER |

| |

Dogbert | 76 |

MEMBER NAME | SCORES | RED | HIGH | DATE |

RESILIENT [1-44] | ||||

GOLD KEY WINNERS |

| |||

JWD1980 | 40 | 0 | 40 | |

Throckmorton's Wife | 40 | ? | 40 | |

| LaHossBoss* | 43 | 0 | 41 | |

| tacpoly | 43 | 0 | 43 | |

MODERATE [45-59] | ||||

| FireMedic1 | 45 | 2 | 45 | |

| PicoFico | 45 | 2 | 45 | |

| EW800 | 46 | 2 | 46 | |

| Thomas_Thumb | 48 | 2 | 48 | |

| Tonya-E | 47 | 2 | 47 | |

| Trudy | 49 | 2 | 49 | |

| sjt | 51 | 2 | 47 | |

Chris865 [OP] | 52 | 2 | 52 | |

| angelwingz | 53 | 2 | 53 | |

| KLEXH25 | 53 | 2 | 53 | |

| CassieCard | 55 | 2 | 53 | |

| LaHossBoss SO | 55 | 2 | 52 | |

| Dumbee | 56 | 2 | 56 | |

| Flyingifr | 56 | 2 | 56 | |

| kilroy8 | 56 | ? | 56 | |

| TMB_ | 56 | 2 | 56 | |

| CreditObsessedinFL | 58 | 2 | 56 | |

| sarge12 | 59 | 2 | 59 | |

SENSITIVE [60-69] | ||||

| Birdman7 | 60 | 2 | 60 | |

| Brian_Earl_Spilner | 61 | 2 | 61 | |

| NRB525 | 63 | 2 | 63 | |

| Remedios | 63 | 2 | 63 | |

KEEPER OF THE GOLDEN SWORD |

| |||

Dogbert* | 64 | 2 | 64 | |

| joeyv1985 | 65 | 2 | 64 | |

| Revelate | 65 | 2 | 63 | |

| RehabbingANDBlabbing | 66 | 2 | 66 | |

VERY SENSITIVE [70-99] | ||||

Kenro* | 72 | ? | 72 | |

GOLDEN CHALICE WINNER |

| |||

K-in-Boston | 72 | 3 | 72 |

* FORMER AWARD WINNERS * |

MEMBER NAME | AWARD | TROPHY | FOR | DATE |

Dogbert | GOLDEN CHALICE |

| Lowest rating: 76 | |

Kenro | GOLDEN CHALICE |

| Lowest rating: 72 | |

Kenro | GOLDEN SWORD |

| Record Low Rating: 72 | |

LaHossBoss | GOLD KEY |

| Highest rating: 41 |

All awards are from this game: Adventure (1980) (Atari 2600) Level 1 play through

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Score Stress Indicators/Indexes

@sjt wrote:

@sarge12 wrote:@sjt If you don't mind sharing 1) What is your amount of credit available, and is it too high, or too low 2) How many open revolving accounts do you have. Finally, 3) Have you or others shared enough data points to get an idea of what this index considers ideal for these data points. It would be nice to know what both need to be for maximizing all the data points. I do not know why, but somehow I think the very things that make my fico 08 scores easy to keep high, works against this score. Namely 20 or so credit cards, about 250k in limits, and very low utilization on all cards,except 1.

Current Report:

8 Open Revolvers with a total CL of $110,800. One card reporting a balance of $101, the rest reporting 0 balance.1 Closed Account

FYI-4 Accounts that are not reporting. 2 are personal and 2 are business accounts. Will attempt to fix the non-reporting of the personal accounts.

1 Auto loan currently 29.6% utilization.

Clean file.

I do AZEO, so occasionally accounts so some account that are dormant until it reports a balance. I'm wondering if the reason I had a score of 47 was that a couple of my accounts were considered dormant.

Thanks, mine was 59 and my reports are squeaky clean. I have about 20 open revolvers, 240,000 in credit limits. This score does not like too many revolvers and high revolving limits it appears. I suspected that, but it is exactly that reason my utilization is so easy. I always PIF. I may never be resilient. I would have a point party if it was 47. My fico 08 scores are rock steady though.

EX fico08=809 07/16/23

EQ fico09=812 07/16/23

EX fico09=821 07/16/23

EQ fico bankcard08=832 07/16/23

TU Fico Bankcard 08=840 07/16/23

EQ NG1 fico=802 04/17/21

EQ Resilience index score=58 03/09/21

Unknown score from EX=784 used by Cap1 07/10/20

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Score Stress Indicators/Indexes

@sarge12 wrote:Thanks, mine was 59 and my reports are squeaky clean. I have about 20 open revolvers, 240,000 in credit limits. This score does not like too many revolvers and high revolving limits it appears. I suspected that, but it is exactly that reason my utilization is so easy. I always PIF. I may never be resilient. I would have a point party if it was 47. My fico 08 scores are rock steady though.

I agree, this "scoring model" does not like a lot of revolvers and large amounts of available credit. The thing is, banks and lenders, already have internal controls in place that flag any type of risk behavior for customers with our credit profiles, like flagging large purchases, increased balances, not PIF, etc. So this scoring system is useless. If anything, it points out flaws in the current scoring methods.

Barclays: Arrival+ WEMC

Capital One: Savor WEMC, Venture X Visa Infinite

Chase: Freedom U Visa Signature, CSR Visa Infinite

Citibank: AAdvantage Platinum WEMC

Elan/US Bank: Fidelity Visa Signature

Credit Union: Cash Back Visa Signature

FICO 08: Score decrease between 26-41 points after auto payoff (11.01.21) FICO as of 5.23, EX: 812 / EQ: 825 / TU: 815

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Score Stress Indicators/Indexes

So, I currently have 9 open revolvers and 10 open loans... and 2 flags (High percent of revolving accounts; Missed payments)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Score Stress Indicators/Indexes

I had the same score and number of flags since June 19th of this year, of course.