- myFICO® Forums

- FICO Scoring and Other Credit Topics

- General Credit Topics

- Re: FICO Score Stress Indicators/Indexes

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

FICO Score Stress Indicators/Indexes

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Score Stress Indicators/Indexes

Just pulled my report. It's still 51 and has the same two reasons.

Barclays: Arrival+ WEMC

Capital One: Savor WEMC, Venture X Visa Infinite

Chase: Freedom U Visa Signature, CSR Visa Infinite

Citibank: AAdvantage Platinum WEMC

Elan/US Bank: Fidelity Visa Signature

Credit Union: Cash Back Visa Signature

FICO 08: Score decrease between 26-41 points after auto payoff (11.01.21) FICO as of 5.23, EX: 812 / EQ: 825 / TU: 815

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Score Stress Indicators/Indexes

@sjt wrote:Just pulled my report. It's still 51 and has the same two reasons.

Man that is dead center in the moderate, so you can pick which group to shoot for. At 59, I have virtually no shot at being resilient, so I am shooting for sensetive. I need just 1 more point to reach that goal. As I said earlier, moderate is too good to be bad, and too bad to be good. Better to be sensetive, and once acheived you can bet I will be bragging about my sensetive status. Being sensetive to a downturn might also provide me with an excuse to start a go-fund-me if the economy really tanks. Don't you think we would want to help our sensetive friends through the hard times. In such a case I will post a link to the go-fund-me, but first I must actually acheive the sensetive status. Hopefully I will not have to acheive very sensetive status to use the go-fund-me option. Just in case someone gets offended, I have given to several very worthy causes via go-fund-me, which is a wonderful way to simplify helping someone really needing it. First time it was for Sailor Guntzler who at 7 years old was the sole survivor of a private plane crash that killed her Mother, Father, Sister, and Cousin. That brave child walked a few miles alone barefoot, and in the dark to get help. That was a very worthy cause, and example of the strength of the Human spirit. After hearing her story, and getting info about the go-fund-me site the community set up for her, I raced to the site to donate. I do of course joke about using the service, but it is wonderful way to help some who really needs it like Sailor Guntzler.

EX fico08=809 07/16/23

EQ fico09=812 07/16/23

EX fico09=821 07/16/23

EQ fico bankcard08=832 07/16/23

TU Fico Bankcard 08=840 07/16/23

EQ NG1 fico=802 04/17/21

EQ Resilience index score=58 03/09/21

Unknown score from EX=784 used by Cap1 07/10/20

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Score Stress Indicators/Indexes

By the way, I know it is off topic, but the Sailor Guntzler go-fund-me was active for a very short time administered by her family church. It garnered such worldwide support that they shut it down due to overacheiving their goal. She was adopted by her grown half sister, but they did not want her in the public spotlight, so I have seen no recent updates. I am thrilled I got my donation in before they shut it down. For a bit it remained for updates without accepting further help. Even then, they posted that shortly they wanted privacy for her to heal from such tragedy. Total class in how they handled that, and shut it down while donations were still pouring in. I hope this amazing child is well and happy, because I can't imagine such a horrible tragedy at 7 years old.

EX fico08=809 07/16/23

EQ fico09=812 07/16/23

EX fico09=821 07/16/23

EQ fico bankcard08=832 07/16/23

TU Fico Bankcard 08=840 07/16/23

EQ NG1 fico=802 04/17/21

EQ Resilience index score=58 03/09/21

Unknown score from EX=784 used by Cap1 07/10/20

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Score Stress Indicators/Indexes

@sarge12 wrote:

@sjt wrote:Just pulled my report. It's still 51 and has the same two reasons.

Man that is dead center in the moderate, so you can pick which group to shoot for. At 59, I have virtually no shot at being resilient, so I am shooting for sensetive. I need just 1 more point to reach that goal. As I said earlier, moderate is too good to be bad, and too bad to be good. Better to be sensetive, and once acheived you can bet I will be bragging about my sensetive status. Being sensetive to a downturn might also provide me with an excuse to start a go-fund-me if the economy really tanks. Don't you think we would want to help our sensetive friends through the hard times. In such a case I will post a link to the go-fund-me, but first I must actually acheive the sensetive status. Hopefully I will not have to acheive very sensetive status to use the go-fund-me option. Just in case someone gets offended, I have given to several very worthy causes via go-fund-me, which is a wonderful way to simplify helping someone really needing it. First time it was for Sailor Guntzler who at 7 years old was the sole survivor of a private plane crash that killed her Mother, Father, Sister, and Cousin. That brave child walked a few miles alone barefoot, and in the dark to get help. That was a very worthy cause, and example of the strength of the Human spirit. After hearing her story, and getting info about the go-fund-me site the community set up for her, I raced to the site to donate. I do of course joke about using the service, but it is wonderful way to help some who really needs it like Sailor Guntzler.

LOL! I bet if I get a new credit card, which would bring me down from 2 years AOYA to 0, I would be in that category.

Barclays: Arrival+ WEMC

Capital One: Savor WEMC, Venture X Visa Infinite

Chase: Freedom U Visa Signature, CSR Visa Infinite

Citibank: AAdvantage Platinum WEMC

Elan/US Bank: Fidelity Visa Signature

Credit Union: Cash Back Visa Signature

FICO 08: Score decrease between 26-41 points after auto payoff (11.01.21) FICO as of 5.23, EX: 812 / EQ: 825 / TU: 815

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Score Stress Indicators/Indexes

@sarge12 wrote:At 59, I have virtually no shot at being resilient, so I am shooting for sensitive. I need just 1 more point to reach that goal. As I said earlier, moderate is too good to be bad, and too bad to be good. Better to be sensitive, and once achieve you can bet I will be bragging about my sensitive status. Being sensitive to a downturn might also provide me with an excuse to start a go-fund-me if the economy really tanks. Don't you think we would want to help our sensitive friends through the hard times. In such a case I will post a link to the go-fund-me, but first I must actually achieve the sensitive status. Hopefully I will not have to achieve very sensitive status to use the go-fund-me option.

@sarge12... lol You really need to re-read the book and come back to the meetings.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Score Stress Indicators/Indexes

@Anonymous wrote:

@sarge12 wrote:At 59, I have virtually no shot at being resilient, so I am shooting for sensitive. I need just 1 more point to reach that goal. As I said earlier, moderate is too good to be bad, and too bad to be good. Better to be sensitive, and once achieve you can bet I will be bragging about my sensitive status. Being sensitive to a downturn might also provide me with an excuse to start a go-fund-me if the economy really tanks. Don't you think we would want to help our sensitive friends through the hard times. In such a case I will post a link to the go-fund-me, but first I must actually achieve the sensitive status. Hopefully I will not have to achieve very sensitive status to use the go-fund-me option.

@sarge12... lol You really need to re-read the book and come back to the meetings.

😂😂😂😂😂

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Score Stress Indicators/Indexes

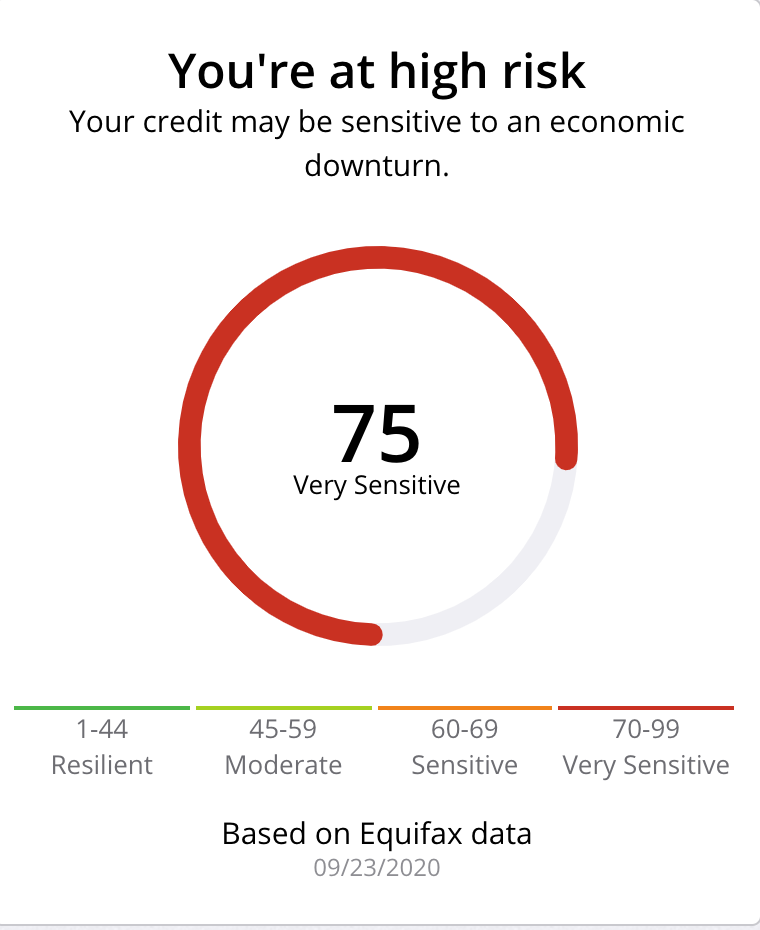

Man I think I take the risk at being the most risky, actually i might be runner up #2 it appear? Current EQ 08 is 768. Possibly cause i just bought a car about 4 months ago and also refinanced my house 6 months ago approximately so showing high installment balance. Also currently carrying 5k in CC debt along with a 6k installment loan initial balance 10.5k on 36 month term. 650k available credit approximately. I am going to default i tell you, not...

No baddies or high ultization ther then installment loans house/car as mentioned. Alot of inquiries though 11 on EQ in last year.

3 risk flags as can be seen. Reason 1 and 3 sure i can buy as mentioned.. Reason 2 hog wash as 4.3k on 18k CL other cards are all 0 max CL 61.5k

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Score Stress Indicators/Indexes

@CreditCuriosity wrote:Man I think I take the risk at being the most risky, actually i might be runner up #2 it appear? Current EQ 08 is 768. Possibly cause i just bought a car about 4 months ago and also refinanced my house 6 months ago approximately so showing high installment balance. Also currently carrying 5k in CC debt along with a 6k installment loan initial balance 10.5k on 36 month term. 650k available credit approximately. I am going to default i tell you, not...

No baddies or high ultization ther then installment loans house/car as mentioned. Alot of inquiries though 11 on EQ in last year.

3 risk flags as can be seen. Reason 1 and 3 sure i can buy as mentioned.. Reason 2 hog wash as 4.3k on 18k CL other cards are all 0 max CL 61.5k

@CreditCuriosity Outta curiosity (no pun intended) what is your highest individual utilization?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Score Stress Indicators/Indexes

@Anonymous on CC that would be 4200/18k = 23% utilization... On installment loans that is a different story as stated just refinanced my house and car so both of those are probably around 97-99% which i speculate is what is putting me at "risk".. I do have also a 1400 balance on NFCU at 50k cl so very low there and will just pay that off October so only one CC carry a balance and that is already down to 3950/18500(500 due to cli from them). will also apply a 400-500 payment on that this next cycle as well.. Hope that helps for some additional DPs. Tempted to pay off all my CC's at the BT was just to see if I could get a CLI off discover as charged on a 3% card and paid the 3% bt fee offer I had.. Have the cash, but figured i would float it as what is point of BT's if not to use them? Also to note MBFS allowed me to do 3 months of no payments as all car dealers did during start of pandemic so just paid the interest so didnt go over 100% utilization so really only 1 or 2 payments applied to principle of that loan which could be factoring into the stress level. No remarks on CR or anything they just extented the loan term 3 months I believe as part of the promo as I figured free money for 3 months...

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Score Stress Indicators/Indexes

@CreditCuriosity yeah it's definitely not utilization, it's got to be looking at the actual revolving balances for that flag. I wonder where the threshold is $5000? I wonder if it varies by scorecard etc. I wonder if this score even uses scorecards? Lol