- myFICO® Forums

- FICO Scoring and Other Credit Topics

- General Credit Topics

- Re: FICO Score Stress Indicators/Indexes

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

FICO Score Stress Indicators/Indexes

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Score Stress Indicators/Indexes

@Anonymous wrote:@tacpoly: Last time, on 8-14-2020, you paid all cards to $0, which gave you EQ 846 and Resilience Index 43 with no flags.

Do you have a very low balance on 1 card this time?

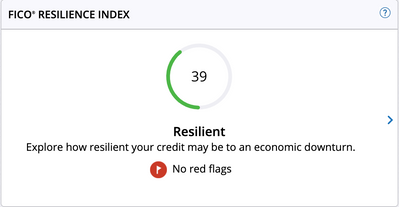

You have the absolute best overall rating of anyone so far: highest EQ 8 score (850) with lowest Resilience Index score (39).

You should get the bat award. Some people hate bats, though.

In the 40 year old videogame that all of these awards came from, the bat has the power to take away any other object - even a dragon!

One card has a reported balance of $372, according to my most recent credit report. I actually like bats! In fact, a stylized bat is on my personal stationery ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Score Stress Indicators/Indexes

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Score Stress Indicators/Indexes

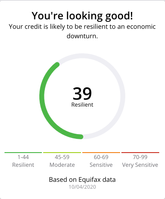

@tacpoly wrote:Incremental improvement to my Resilience score (from 43 to 39). No red flags and no changes to FICO8 scores: still 850's across the board.

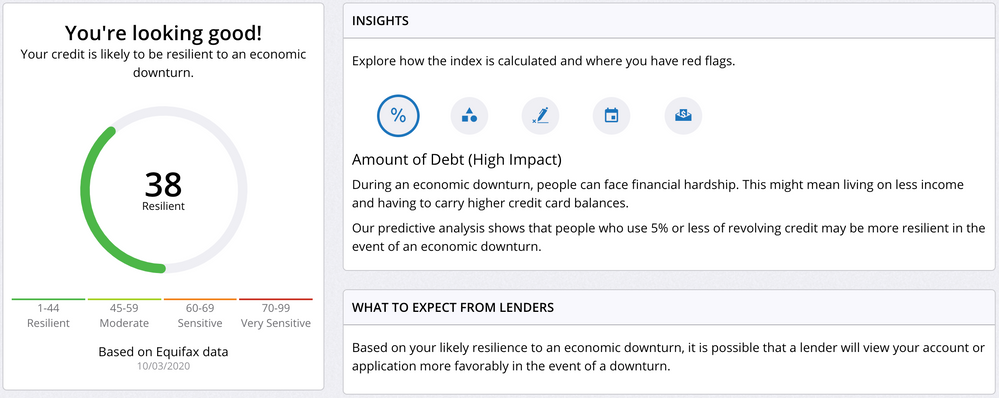

Wow! I don't have anywhere near 850 credit scores (CONGRATULATIONS!), but I do have a resiliency score of 38 with no red flags. Started out at a 54 with two red flags, then dropped to 41 and now it sits at 38. My member rank is too low for me to add the photo.

Update: I can add photos now!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Score Stress Indicators/Indexes

Pulled my 3B and I still have a 73 with a 818 EQ 8 as of the 4th. (None of my FICO 8 scores have changed by even a point in over 3 weeks; I think that is a new record for me.). Glad to see I am falling down (or up?) the leaderboard. All hail the new kings and/or queens.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Score Stress Indicators/Indexes

What's the highest score we've seen with a mortgage present? Also, what is the dollar value (monthly payment) of said mortgage? I'm wondering how significant that factor is with this score.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Score Stress Indicators/Indexes

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Score Stress Indicators/Indexes

@Anonymous wrote:

We have seen that the higher the payment obligation, the higher the score. But remember the score is reversed, so the higher the score, the worse off you are. You’ll have to go back and search through the thread, but the data is there.

Mortgage payment just for info is 1650 for me car payment is 1040 and student loan is 300/mo(ya still dragging these out as at 3% interest). Personal loan payment 300 and CC payment of approx 90/month(soon) to just pay off this month for dp's. Income can easily support above payments. Just DP's as house payment imho is fairly cheap, car payment is on higher side (mercedes) and student loan payment is pretty low along with my personal loan which will be paid on early next year well into that 3 year term..

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Score Stress Indicators/Indexes

@juggernaut9 wrote:

@tacpoly wrote:Incremental improvement to my Resilience score (from 43 to 39). No red flags and no changes to FICO8 scores: still 850's across the board.

Wow! I don't have anywhere near 850 credit scores (CONGRATULATIONS!), but I do have a resiliency score of 38 with no red flags. Started out at a 54 with two red flags, then dropped to 41 and now it sits at 38. My member rank is too low for me to add the photo.

@juggernaut9: That's ok about the photo - I'll update the board in a little bit with your name and score.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Score Stress Indicators/Indexes

@Anonymous wrote:What's the highest score we've seen with a mortgage present? Also, what is the dollar value (monthly payment) of said mortgage? I'm wondering how significant that factor is with this score.

@Anonymous: It might be @Thomas_Thumb , with a 48 and an open mortgage which is almost paid off. I think he said recently that his mortgage will be fully paid this month or November. There's only a few ahead of him that might have a mortgage.

@Anonymous's Wife might have the best score (40 Resilient + EQ8 829) with a mortgage, but I can't tell from the profile data posted.

Each name/score row has a link to what details they posted. It's on the far right, and won't show on mobile in normal portrait mode without scrolling horizontally.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Score Stress Indicators/Indexes

For open loans on my reports, I have mortgage refinanced 4.5 years ago and student loans refinanced a few months ago so both are high % but only about $2k a month. We bought at the bottom of the housing market and paid a decent chunk off before refinancing, so loan amounts really shouldn't matter. While the loan balance is high, the loan-to-value is only about 40%.

Not only is this score blind to income and therefore cannot determine DTI as a point of resiliency, but it's also blind to loan-to-value or outright ownership. If it's using raw dollar amounts, that's also quite subjective. I mean $2000 to the average citizen living in Boston, NYC, or San Francisco is quite different than $2000 for the average citizen living in say a rural area of the Gulf states.