- myFICO® Forums

- FICO Scoring and Other Credit Topics

- General Credit Topics

- Re: FICO Score Stress Indicators/Indexes

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

FICO Score Stress Indicators/Indexes

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Score Stress Indicators/Indexes

@Anonymous

From Aug to Oct, for myself, I had a huge change from having an active installment loan to none.

Since I have SLs in rehab that will wrap up in Dec (which closed installment loans do not count for the resiliency score, but will once reinstated), I opted out of not getting another SSL. I figured, no need to take a new TL/AAoA hit just to bridge 3-5 months and it would even get paid down below 9% in that timeframe, so not really worth it, for me.

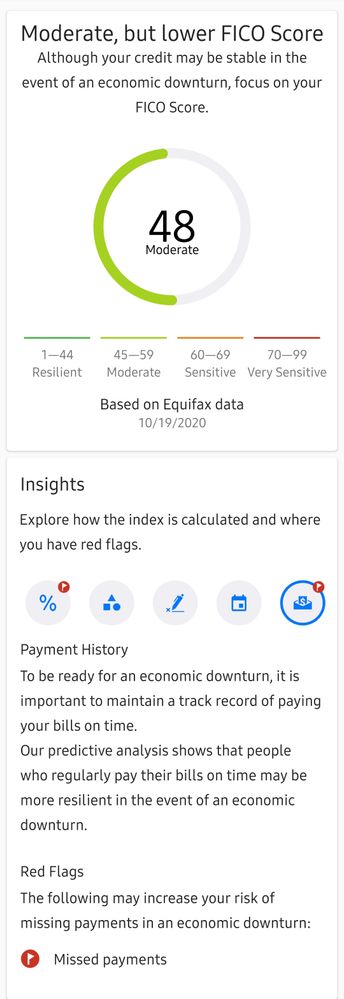

I went from having no flags to 2 flags and from "resilient" to "moderate":

Funny enough "missed payments" is now a flag. My last missed payments were over 3-4 years ago and during my time being rated "resilient", this was not a flag at all.

Now I have this flag crop up and I have no open and active installment loans and this was not a flag during my period of being "resilient" and while I had an open installment loan. I find it interesting that I am not being hit for "too many revolving accounts" or "credit mix".

So if you no longer have an open installment loan to rate, they consider your closed ones?

As you can see, my "resiliency score" went up (so my rating went down lol)

I am interested to see what changes in Dec-Feb when my SLs are rehabbed, active, and open.

One other note: my only CO on EQ aged off this month before the 3B pull and it made squat of difference in this score model or any other fico models lol

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Score Stress Indicators/Indexes

@Anonymous

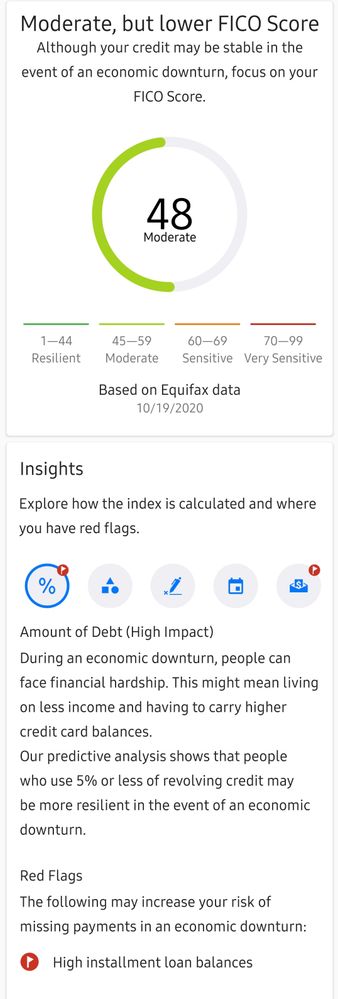

SO has had a roller-coaster ride with scores, new accounts, and baddies aging off.

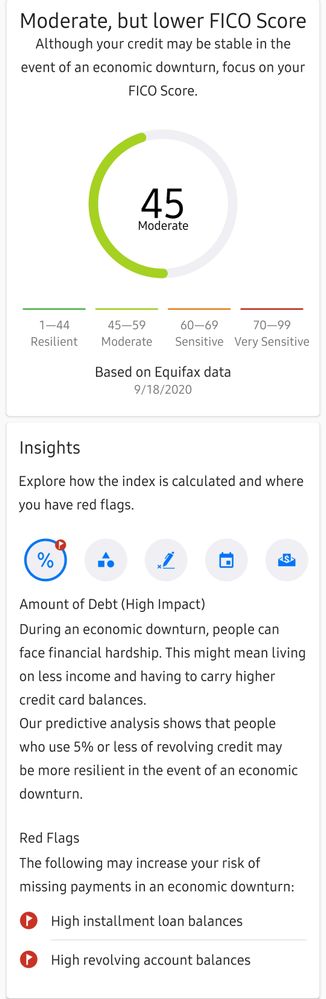

His score went down, but rating is still "moderate".

His previous flag of "too many AU accounts" (1 lol) has dropped and was replaced with "high revolving account balances", which is true. 62% revolving aggregate, 90% & 28% revolving individual, and 2% AU revolving individual util. He still has the same AU account reporting, so i guess they felt he did not deserve 3 flags? Makes no sense. Perhaps "moderate" ratings can't have 3 flags?

He is right on the cusp of "resilient", so I am very excited to see what paying down his util will do to this score.

I found it was interesting that the score went down. Only changes were a new charge card (care credit), disco was closed by grantor, and util went up. So this score decrease boggles my mind!

We have since paid down the util and I am about to do a 3B pull and get a new resiliency score tomorrow, but wanted to share September's score/reasons since there was a change in DPs.

I did not have the "high installment loan balances" flag while I had an open installment loan, so I am only guessing this is not because of his closed/defaulted SLs, but still from his Self Lender loan. It was at 52% util at the time of this 3B pull.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Score Stress Indicators/Indexes

@Anonymous: Wow, 2 great reports!

A lot of people that took out loans for that 'high amount' (whatever the $ value is) must have ended up in the 'bad' category. I guess open/closed didn't matter.

That's sort of like the CFA (Consumer Finance Account) reason statement explanation:

"The fact that you have a consumer finance company loan on your credit report means that you represent a higher risk to lenders than someone with no consumer finance loans. Even if this account is closed, it will still lower your FICO® Score."

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Score Stress Indicators/Indexes

@Anonymous wrote:@Anonymous

From Aug to Oct, for myself, I had a huge change from having an active installment loan to none.

Since I have SLs in rehab that will wrap up in Dec (which closed installment loans do not count for the resiliency score, but will once reinstated), I opted out of not getting another SSL. I figured, no need to take a new TL/AAoA hit just to bridge 3-5 months and it would even get paid down below 9% in that timeframe, so not really worth it, for me.

I went from having no flags to 2 flags and from "resilient" to "moderate":

Funny enough "missed payments" is now a flag. My last missed payments were over 3-4 years ago and during my time being rated "resilient", this was not a flag at all.

Now I have this flag crop up and I have no open and active installment loans and this was not a flag during my period of being "resilient" and while I had an open installment loan. I find it interesting that I am not being hit for "too many revolving accounts" or "credit mix".

So if you no longer have an open installment loan to rate, they consider your closed ones?

As you can see, my "resiliency score" went up (so my rating went down lol)

I am interested to see what changes in Dec-Feb when my SLs are rehabbed, active, and open.

One other note: my only CO on EQ aged off this month before the 3B pull and it made squat of difference in this score model or any other fico models lol

@Anonymous it would make sense for the score to get worse when you close your only open loan because you're a higher risk, because you're more likely to be approved for a loan, imo. But what do you mean you didn't get any points anywhere for your only chargeoff aging off?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Score Stress Indicators/Indexes

@Anonymous wrote:

@Anonymous wrote:@Anonymous

From Aug to Oct, for myself, I had a huge change from having an active installment loan to none.

Since I have SLs in rehab that will wrap up in Dec (which closed installment loans do not count for the resiliency score, but will once reinstated), I opted out of not getting another SSL. I figured, no need to take a new TL/AAoA hit just to bridge 3-5 months and it would even get paid down below 9% in that timeframe, so not really worth it, for me.

I went from having no flags to 2 flags and from "resilient" to "moderate":

Funny enough "missed payments" is now a flag. My last missed payments were over 3-4 years ago and during my time being rated "resilient", this was not a flag at all.

Now I have this flag crop up and I have no open and active installment loans and this was not a flag during my period of being "resilient" and while I had an open installment loan. I find it interesting that I am not being hit for "too many revolving accounts" or "credit mix".

So if you no longer have an open installment loan to rate, they consider your closed ones?

As you can see, my "resiliency score" went up (so my rating went down lol)

I am interested to see what changes in Dec-Feb when my SLs are rehabbed, active, and open.

One other note: my only CO on EQ aged off this month before the 3B pull and it made squat of difference in this score model or any other fico models lol

@Anonymous it would make sense for the score to get worse when you close your only open loan because you're a higher risk, because you're more likely to be approved for a loan, imo. But what do you mean you didn't get any points anywhere for your only chargeoff aging off?

I will double check again, but I am almost certain I got absolutely nothing for my only CO (paid) aging off EQ this month. It was only reporting to EQ. It was Cap One Auto, so an installment loan.

I am uncertain if the defaulted SLs come into play, which are about to age off while I finish the rehabs. So not sure if they are considered COs?

Regardless, I would have thought I would have received some sort of boost for that.

I knew my resiliency score would go up and rating down when the installment loan closed. My issues is I now have a flag for "installment loan balances too high" when this was not a flag previously and these are on closed installment loans (defaulted SLs). Which these technically have $0 balance since they were "transferred/assigned to govt" and the CAs reporting have the balance. So in my mind these are not installment loans, but CAs, as they are labeled/listed. Which makes no sense then.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Score Stress Indicators/Indexes

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Score Stress Indicators/Indexes

@Anonymous wrote:

Yeah I would’ve thought you’d have earned points, too. Do you have any collections present?

Yes, 4, all unpaid.

So I combed through myFico 3B pull for Sept and Oct and these are the changes in my EQ scores:

F8: 614 > 615 (+1)

F9: 653 > 653 (+/-0)

EQ5: 645 > 645 (+/-0)

A5: 650 > 659 (+9)

A8: 611 > 636 (+25)

A9: 641 > 641 (+/-0)

B8: 614 > 615 (+1)

B5: 659 > 659 (+/-0)

BS 9: 663 > 663 (+/-0)

So look like really only auto enhnaced scores improved, which makes sense a bit since it was an auto loan CO. I guess A8 really liked it. Mind you I previously had even higher scores than these when I had my installment loan <9% util reporting until it was paid off and closed. At least no scores went down.

There were no other reported changes to EQ, unless there were age factors. AoYA/R is now 7 months old and the other two aged to 8 months old, so I would think any age points would have been gained last month, if that is a thing on a dirty scorecard. AZEO and single bank revolver reporting 2% util, as usual. AAoA = 9yr and AoOA = 15yr 5mo. AAoA went down, I assume due to the removal of the CO. AAoA last month was 9yr 2mo.

Sorry to go off on a tangent in this thread.

@Anonymous :

While I am here, I can also update you on my SO's resiliency score.

I did my SO's 3B pull and funny enough: he is now magically resilient!!! score went down to 44 and he ranked up!

*AND* he no longer has "high installment loan balances" or "high revolving balances".

The second flag removal is vaild, but this does confirm one thing for me: If he supposedly now no longer has "high installment loan balances", then it is not including his defaulted SLs. Or maybe not? He now has 43% util reporting to EQ for his Self Lender loan.

So, is his being under 50% util on installment loan a "thing" for resiliency scoring *or* does being "resilient" mean having no flags whether true or not? He still has the same AU account that he previously had been flagged for....I guess only EQ and Fico know....

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Score Stress Indicators/Indexes

@Anonymous wrote:

@Anonymous wrote:

Yeah I would’ve thought you’d have earned points, too. Do you have any collections present?Yes, 4, all unpaid.

So I combed through myFico 3B pull for Sept and Oct and these are the changes in my EQ scores:

F8: 614 > 615 (+1)

F9: 653 > 653 (+/-0)

EQ5: 645 > 645 (+/-0)

A5: 650 > 659 (+9)

A8: 611 > 636 (+25)

A9: 641 > 641 (+/-0)

B8: 614 > 615 (+1)

B5: 659 > 659 (+/-0)

BS 9: 663 > 663 (+/-0)

So look like really only auto enhnaced scores improved, which makes sense a bit since it was an auto loan CO. I guess A8 really liked it. Mind you I previously had even higher scores than these when I had my installment loan <9% util reporting until it was paid off and closed. At least no scores went down.

There were no other reported changes to EQ, unless there were age factors. AoYA/R is now 7 months old and the other two aged to 8 months old, so I would think any age points would have been gained last month, if that is a thing on a dirty scorecard. AZEO and single bank revolver reporting 2% util, as usual. AAoA = 9yr and AoOA = 15yr 5mo. AAoA went down, I assume due to the removal of the CO. AAoA last month was 9yr 2mo.

Sorry to go off on a tangent in this thread.

@Anonymous :

While I am here, I can also update you on my SO's resiliency score.

I did my SO's 3B pull and funny enough: he is now magically resilient!!! score went down to 44 and he ranked up!

*AND* he no longer has "high installment loan balances" or "high revolving balances".

The second flag removal is vaild, but this does confirm one thing for me: If he supposedly now no longer has "high installment loan balances", then it is not including his defaulted SLs. Or maybe not? He now has 43% util reporting to EQ for his Self Lender loan.

So, is his being under 50% util on installment loan a "thing" for resiliency scoring *or* does being "resilient" mean having no flags whether true or not? He still has the same AU account that he previously had been flagged for....I guess only EQ and Fico know....

@Anonymous I believe it's due to collections due to the PR card.

no, AoYRA is not a thing in dirty cards, I don't think % of revolvers with a bal is either. Utilization is weighted far less.

And, maybe resilience has different scorecards too, maybe that's why the flag isn't showing.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Score Stress Indicators/Indexes

EQ FICO Resilience Index Leaderboard as of October 26, 2020 |

Breaking News |

@Anonymous and SO trading places!

Welcome to the board, @CreditBones ! 46th member to share their score!

Dmessina666 reigns supreme with The Golden Chalice and The Golden Sword !!!

tacpoly wins The Bat award for scoring a 39 with an EQ 8 850!

Lulah is still sole possessor of the Gold Key with a score of 37 !

|

General Information about this score |

This Resilience Index score is included with a myFICO subscription. It will be shown on the dashboard.

And as always - lower rating (higher number) doesn't mean that person has a bad credit profile in any way. This score is really sensitive to balance amounts and it doesn't matter if you have a 600 or 850. |

RECORD HOLDER |

| |

Dmessina666 | 78 |

MEMBER NAME | SCORES | RED | HIGH | DATE |

RESILIENT [1-44] | ||||

GOLD KEY WINNER |

| |||

Lulah | 37 | 0 | 37 | |

juggernaut9 | 38 | 0 | 38 | |

THE BAT |

| |||

tacpoly [EQ 8 850] | 39 | 0 | 39 | |

JWD1980 | 40 | 0 | 40 | |

Throckmorton's Wife* | 40 | ? | 40 | |

| LaHossBoss SO | 44 | 0 | 44 | |

MODERATE [45-59] | ||||

| FireMedic1 | 45 | 2 | 45 | |

| PicoFico | 45 | 2 | 45 | |

| EW800 | 46 | 2 | 46 | |

| LP007 | 47 | 2 | 47 | |

| Tonya-E | 47 | 2 | 47 | |

| LaHossBoss* | 48 | 2 | 41 | |

| Thomas_Thumb | 48 | 2 | 48 | |

| jasonbourne84 | 49 | 2 | 49 | |

| Trudy | 49 | 2 | 49 | |

| BLM11 | 51 | 2 | 51 | |

| sjt | 51 | 2 | 47 | |

Chris865 [OP] | 52 | 2 | 52 | |

| angelwingz | 53 | 2 | 53 | |

| KLEXH25 | 53 | 2 | 53 | |

| Credit4Growth | 54 | 2 | 54 | |

| Face_Value | 54 | 2 | 54 | |

| CassieCard | 55 | 2 | 53 | |

| Flyingifr | 56 | 2 | 56 | |

| kilroy8 | 56 | ? | 56 | |

| TMB_ | 56 | 2 | 56 | |

| joeyv1985 | 58 | 2 | 58 | |

| sarge12 | 59 | 2 | 59 | |

SENSITIVE [60-69] | ||||

| coreysw12 | 60 | 2 | 60 | |

| CreditObsessedinFL | 60 | 2 | 56 | |

| NRB525 | 63 | 2 | 63 | |

| Remedios | 63 | 2 | 63 | |

| Birdman7 | 64 | 2 | 60 | |

Dogbert* | 64 | 2 | 64 | |

| OmarGB9 | 64 | 2 | 64 | |

| Revelate | 65 | 2 | 63 | |

| RehabbingANDBlabbing | 66 | 2 | 66 | |

| Dumbee | 68 | 2 | 56 | |

| jayk1 | 69 | ? | 69 | |

VERY SENSITIVE [70-99] | ||||

CreditCuriosity* | 72 | 3 | 72 | |

jasonbourne84's DH | 72 | 3 | 72 | |

Kenro* | 72 | ? | 72 | |

K-in-Boston* | 73 | 3 | 72 | |

GApeachy | 74 | 3 | 73 | |

Brian_Earl_Spilner* | 76 | 3 | 76 | |

GOLDEN CHALICE WINNER AND |

|

| ||

Dmessina666 | 78 | 3 | 78 |

* FORMER AWARD WINNERS * |

MEMBER NAME | AWARD | TROPHY | FOR | DATE |

Brian_Earl_Spilner | GOLDEN CHALICE |

| Lowest rating: 76 | |

Brian_Earl_Spilner | GOLDEN SWORD |

| Record Low Rating: 76 | |

CreditCuriosity | GOLDEN CHALICE |

| Lowest rating: 75 | |

Dogbert | GOLDEN CHALICE |

| Lowest rating: 76 | |

Dogbert | GOLDEN SWORD |

| Record Low Rating: 76 | |

JWD1980 | GOLD KEY |

| Highest Rating: 40 | |

K-in-Boston | GOLDEN CHALICE |

| Lowest rating: 73 | |

Kenro | GOLDEN CHALICE |

| Lowest rating: 72 | |

Kenro | GOLDEN SWORD |

| Record Low Rating: 72 | |

LaHossBoss | GOLD KEY |

| Highest rating: 41 | |

Throckmorton's Wife | GOLD KEY |

| Highest Rating: 40 |

All awards are from this game: Adventure (1980) (Atari 2600) Level 3 play through

The Bat is awarded for best EQ 8 score with lowest Resilience Index score. The bat can fly away with any award - even a dragon!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Score Stress Indicators/Indexes

@Anonymous wrote:His previous flag of "too many AU accounts" (1 lol) has dropped and was replaced with "high revolving account balances", which is true. 62% revolving aggregate, 90% & 28% revolving individual, and 2% AU revolving individual util. He still has the same AU account reporting [...]

Your SO has 3 CC (1 AU, and 2 own CC), correct?

This means that even at 1 AU CC out of 3 CC (33%) the "High % of AU accts" red flag 🚩 would still be triggered in the RI.

• In Oct 1, I was at 60% (3 AU out of 5 CC).

• Currently, I am at 43% (3 AU out of 7 CC).

• In November I should be at 33% (2 AU out of 6), because DW is closing a CC where I am AU.

But still then, at 33% I may still have that red flag 🚩

Darn it! 😣