- myFICO® Forums

- FICO Scoring and Other Credit Topics

- General Credit Topics

- Re: EQ FICO Resilience Index Leaderboard - Februar...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

FICO Score Stress Indicators/Indexes

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

EQ FICO Resilience Index Leaderboard - February 27, 2021

EQ FICO Resilience Index

Leaderboard as of February 27, 2021 |

Breaking News |

YouTube link. That's a first!

|

General Information about this score |

This Resilience Index score is included with a myFICO subscription. It will be shown on the dashboard.

And as always - lower rating (higher number) doesn't mean that person has a bad credit profile in any way. This score is really sensitive to balance amounts and it doesn't matter if you have a 600 or 850. |

RECORD HOLDER |

| EQ FICO RESILIENCE INDEX |

Adkins | 80 |

MEMBER NAME | SCORES | RED | HIGH | DATE |

RESILIENT [1-44] | ||||

GOLD KEY WINNER |

| |||

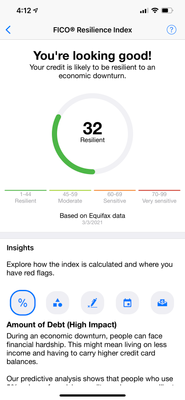

mrsgrits' DH | 32 | 0 | 32 | |

| LP007 | 34 | 0 | 34 | |

| CreditBones | 37 | 0 | 37 | |

juggernaut9* | 37 | 0 | 37 | |

Lulah* | 37 | 0 | 37 | |

| USDOD | 37 | 0 | 37 | |

THE BAT |

| |||

tacpoly [EQ 8 850] | 39 | 0 | 39 | |

JWD1980* | 40 | 0 | 40 | |

Throckmorton's Wife* | 40 | ? | 40 | |

| Tonya-E | 43 | 0 | 43 | |

| LaHossBoss SO | 44 | 0 | 44 | |

MODERATE [45-59] | ||||

| FireMedic1 | 45 | 2 | 45 | |

| PicoFico | 45 | 2 | 45 | |

| Bankrupt2019 | 46 | 2 | 46 | |

| EW800 | 46 | 2 | 46 | |

| sjt | 47 | 2 | 47 | |

| LaHossBoss* | 48 | 2 | 41 | |

| Thomas_Thumb | 48 | 2 | 48 | |

| jasonbourne84 | 49 | 2 | 49 | |

| Trudy | 49 | 2 | 49 | |

Chris865 [OP] | 52 | 2 | 52 | |

| angelwingz | 53 | 2 | 53 | |

| KLEXH25 | 53 | 2 | 53 | |

| Mr_Mojo_Risin | 54 | ? | 54 | |

| Credit4Growth | 54 | 2 | 54 | |

| Face_Value | 54 | 2 | 54 | |

| CassieCard | 56 | 2 | 53 | |

| CreditAggie | 56 | 2 | 56 | |

| Flyingifr | 56 | 2 | 56 | |

| joeyv1985 | 56 | 2 | 56 | |

| kilroy8 | 56 | ? | 56 | |

| TMB_ | 56 | 2 | 56 | |

| mrsgrits | 57 | 2 | 57 | |

| mgood | 58 | 2 | 55 | |

| sarge12 | 59 | 2 | 59 | |

SENSITIVE [60-69] | ||||

| coreysw12 | 61 | 2 | 60 | |

| CreditObsessedinFL | 61 | 2 | 56 | |

| NRB525 | 63 | 2 | 63 | |

| Remedios | 63 | 2 | 63 | |

Dogbert* | 64 | 2 | 64 | |

| OmarGB9 | 64 | 2 | 64 | |

| Birdman7 | 65 | 2 | 60 | |

| Revelate | 65 | 2 | 63 | |

| RehabbingANDBlabbing | 66 | 2 | 66 | |

| thornback | 66 | 2 | 66 | |

| Dumbee | 68 | 2 | 56 | |

| jayk1 | 69 | ? | 69 | |

VERY SENSITIVE [70-99] | ||||

K-in-Boston* | 70 | 3 | 70 | |

CreditCuriosity* | 72 | 3 | 72 | |

Dmessina666* | 72 | 3 | 72 | |

GApeachy | 72 | 3 | 72 | |

jasonbourne84's DH | 72 | 3 | 72 | |

Kenro* | 72 | ? | 72 | |

Brian_Earl_Spilner* | 78 | 3 | 72 | |

GOLDEN CHALICE WINNER AND |

|

| ||

Adkins | 80 | 3 | 80 |

* FORMER AWARD WINNERS * |

MEMBER NAME | AWARD | TROPHY | FOR | DATE |

Brian_Earl_Spilner | GOLDEN CHALICE |

| Lowest rating: 76 | |

Brian_Earl_Spilner | GOLDEN SWORD |

| Record Low Rating: 76 | |

CreditCuriosity | GOLDEN CHALICE |

| Lowest rating: 75 | |

Dmessina666 | GOLDEN CHALICE |

| Lowest rating: 78 | |

Dmessina666 | GOLDEN SWORD |

| Record Low Rating: 78 | |

Dogbert | GOLDEN CHALICE |

| Lowest rating: 76 | |

Dogbert | GOLDEN SWORD |

| Record Low Rating: 76 | |

juggernaut9 | GOLD KEY |

| Highest Rating: 37 | |

JWD1980 | GOLD KEY |

| Highest Rating: 40 | |

K-in-Boston | GOLDEN CHALICE |

| Lowest rating: 73 | |

Kenro | GOLDEN CHALICE |

| Lowest rating: 72 | |

Kenro | GOLDEN SWORD |

| Record Low Rating: 72 | |

LaHossBoss | GOLD KEY |

| Highest rating: 41 | |

Lulah | GOLD KEY |

| Highest Rating: 37 | |

Throckmorton's Wife | GOLD KEY |

| Highest Rating: 40 |

All awards are from this game: Adventure (1980) (Atari 2600) Level 3 play through

The Bat is awarded for best EQ 8 score with lowest Resilience Index score. The bat can fly away with any award - even a dragon!

Meet the creator of the Resilience Index.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: EQ FICO Resilience Index Leaderboard - February 6, 2021

@Anonymous wrote:

@joeyv1985 wrote:

@Anonymous wrote:

@joeyv1985 wrote:

@Anonymous wrote:

@joeyv1985 wrote:Hello Cassie,

My monthly score came in and it's holding steady at 56 with 2 flags. My FICO 8 scores are the highest they've ever been, EQ 777/TU 797/EX 788. My car was PIF in December, but the balance still shows a balance akin to 1 payment. Compared with a balance of over $5K from the previous reporting period, I thought that would have dropped my score down to at least 54 or so. Maybe I need to pay more of my Mortgage principal to really make a dent in my Resilience score. Oh well.

@joeyv1985 I think it's more concerned with the amount of the payment and monthly obligation than it is the total amount still remaining due on the loan. I'll bet your resilience score goes down meaning better, when that car loan reports closed.

Hmmmm. Would it be a double edged sword t when the car loan shows closed on the report? Meaning car PIF thus dropping Resiliency Score however FICO's take a bit of hit because my credit mix loses one intallment loan, although I still have the mortgage.

@joeyv1985 if the car loan were your only loan, your analysis would be spot on. However because you have a mortgage you may not see much of a drop on your 8/9. Your aggregate loan utilization won't change much since there's only one payment remaining.

we know mortgage loans are tracked separately and satisfy a mix type, but I would definitely like to know the results of what happens, if you would be kind enough to report back. it will be interesting to know if the different loan utilizations are kept separate or if it's based on the combination. Do you have anything else reporting around that time? someone else may already know the answer.

You'll probably see an increase on your mortgage scores due to one less account with a balance, tho!

Edit: @joeyv1985 Closed loans still contribute to credit mix. The point change usually comes from the loan balance & utilization going to 0%.

Hello Birdman,

I'll be more than happy to report back my results a month from now. By then I can only assume, the Car loan will have reported Paid In Full and if there's a fallout, hopefully not, it won't be as catastrophic. As far as any new reporting is concerned, the only thing I can think of is an inquiry falling off. Between my 3B report in Jan and the one that just reported here in Feb, 3 inquiries fell off the report leaving me with 3. Of the 3 remaining, 1 more should fall off on my next 3B report in March which will leave me with just 2. The said inquiries were last year. Also, on the Feb 3B report, 2 CC's crossed the 1 year mark since I opened them. I should have another one reporting it's 1 year anniversary on the next report. Other than that, I can't think of anything else material enough to impact my scores. I'm currently in a gardening mode, so there's nothing pressing as far as new accounts are concerned. Just keeping my spending in check, aging my accounts and requesting a CL increase here and there.

@joeyv1985 if that is your youngest Revolver reaching one year, that will result in Scorecard reassignment on 8/9, probably giving you some points. I don't know what effect it will have on the resiliency score, but it will be interesting to find out, so that will be mixed in with the loan closing, so it will be hard to differentiate since it will be conflated, unfortunately.

nevertheless will look forward to your report, there's no telling what we may be able to learn!

Hello Birdman,

My auto loan finally reported paid in full and my Fico 8's, as expected, took a hit of anywhere between 8-19pts. Bummer. Howevever, the scores are still in the 770-780 range, so I'm not too worried. Any idea, how long before my scores start moving up from this event? Mortgate is still open and my credit utilization remains below 2%. My CU was roughly in that area when my auto loan reported.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: EQ FICO Resilience Index Leaderboard - February 6, 2021

@joeyv1985 wrote:

@Anonymous wrote:

@joeyv1985 wrote:

@Anonymous wrote:

@joeyv1985 wrote:

@Anonymous wrote:

@joeyv1985 wrote:Hello Cassie,

My monthly score came in and it's holding steady at 56 with 2 flags. My FICO 8 scores are the highest they've ever been, EQ 777/TU 797/EX 788. My car was PIF in December, but the balance still shows a balance akin to 1 payment. Compared with a balance of over $5K from the previous reporting period, I thought that would have dropped my score down to at least 54 or so. Maybe I need to pay more of my Mortgage principal to really make a dent in my Resilience score. Oh well.

@joeyv1985 I think it's more concerned with the amount of the payment and monthly obligation than it is the total amount still remaining due on the loan. I'll bet your resilience score goes down meaning better, when that car loan reports closed.

Hmmmm. Would it be a double edged sword t when the car loan shows closed on the report? Meaning car PIF thus dropping Resiliency Score however FICO's take a bit of hit because my credit mix loses one intallment loan, although I still have the mortgage.

@joeyv1985 if the car loan were your only loan, your analysis would be spot on. However because you have a mortgage you may not see much of a drop on your 8/9. Your aggregate loan utilization won't change much since there's only one payment remaining.

we know mortgage loans are tracked separately and satisfy a mix type, but I would definitely like to know the results of what happens, if you would be kind enough to report back. it will be interesting to know if the different loan utilizations are kept separate or if it's based on the combination. Do you have anything else reporting around that time? someone else may already know the answer.

You'll probably see an increase on your mortgage scores due to one less account with a balance, tho!

Edit: @joeyv1985 Closed loans still contribute to credit mix. The point change usually comes from the loan balance & utilization going to 0%.

Hello Birdman,

I'll be more than happy to report back my results a month from now. By then I can only assume, the Car loan will have reported Paid In Full and if there's a fallout, hopefully not, it won't be as catastrophic. As far as any new reporting is concerned, the only thing I can think of is an inquiry falling off. Between my 3B report in Jan and the one that just reported here in Feb, 3 inquiries fell off the report leaving me with 3. Of the 3 remaining, 1 more should fall off on my next 3B report in March which will leave me with just 2. The said inquiries were last year. Also, on the Feb 3B report, 2 CC's crossed the 1 year mark since I opened them. I should have another one reporting it's 1 year anniversary on the next report. Other than that, I can't think of anything else material enough to impact my scores. I'm currently in a gardening mode, so there's nothing pressing as far as new accounts are concerned. Just keeping my spending in check, aging my accounts and requesting a CL increase here and there.

@joeyv1985 if that is your youngest Revolver reaching one year, that will result in Scorecard reassignment on 8/9, probably giving you some points. I don't know what effect it will have on the resiliency score, but it will be interesting to find out, so that will be mixed in with the loan closing, so it will be hard to differentiate since it will be conflated, unfortunately.

nevertheless will look forward to your report, there's no telling what we may be able to learn!

Hello Birdman,

My auto loan finally reported paid in full and my Fico 8's, as expected, took a hit of anywhere between 8-19pts. Bummer. Howevever, the scores are still in the 770-780 range, so I'm not too worried. Any idea, how long before my scores start moving up from this event? Mortgate is still open and my credit utilization remains below 2%. My CU was roughly in that area when my auto loan reported.

@joeyv1985 what is your mortgage B/L at? That's interesting, depending on the mortgage B/L. Well from my viewpoint, you were receiving extra points, bonus points if you will, for having your only non-mortgage loan in optimal utilization range. You won't get those points again until you're in that scenario again. I am assuming that was your only non-mortgage loan and that you only have one mortgage?

but your scores are great and will continue to increase with age anyway, so they will still increase, it just won't be from that particular reason.

what effect did it have on the resiliency score?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: EQ FICO Resilience Index Leaderboard - February 6, 2021

@Anonymous wrote:

@joeyv1985 wrote:

@Anonymous wrote:

@joeyv1985 wrote:

@Anonymous wrote:

@joeyv1985 wrote:

@Anonymous wrote:

@joeyv1985 wrote:Hello Cassie,

My monthly score came in and it's holding steady at 56 with 2 flags. My FICO 8 scores are the highest they've ever been, EQ 777/TU 797/EX 788. My car was PIF in December, but the balance still shows a balance akin to 1 payment. Compared with a balance of over $5K from the previous reporting period, I thought that would have dropped my score down to at least 54 or so. Maybe I need to pay more of my Mortgage principal to really make a dent in my Resilience score. Oh well.

@joeyv1985 I think it's more concerned with the amount of the payment and monthly obligation than it is the total amount still remaining due on the loan. I'll bet your resilience score goes down meaning better, when that car loan reports closed.

Hmmmm. Would it be a double edged sword t when the car loan shows closed on the report? Meaning car PIF thus dropping Resiliency Score however FICO's take a bit of hit because my credit mix loses one intallment loan, although I still have the mortgage.

@joeyv1985 if the car loan were your only loan, your analysis would be spot on. However because you have a mortgage you may not see much of a drop on your 8/9. Your aggregate loan utilization won't change much since there's only one payment remaining.

we know mortgage loans are tracked separately and satisfy a mix type, but I would definitely like to know the results of what happens, if you would be kind enough to report back. it will be interesting to know if the different loan utilizations are kept separate or if it's based on the combination. Do you have anything else reporting around that time? someone else may already know the answer.

You'll probably see an increase on your mortgage scores due to one less account with a balance, tho!

Edit: @joeyv1985 Closed loans still contribute to credit mix. The point change usually comes from the loan balance & utilization going to 0%.

Hello Birdman,

I'll be more than happy to report back my results a month from now. By then I can only assume, the Car loan will have reported Paid In Full and if there's a fallout, hopefully not, it won't be as catastrophic. As far as any new reporting is concerned, the only thing I can think of is an inquiry falling off. Between my 3B report in Jan and the one that just reported here in Feb, 3 inquiries fell off the report leaving me with 3. Of the 3 remaining, 1 more should fall off on my next 3B report in March which will leave me with just 2. The said inquiries were last year. Also, on the Feb 3B report, 2 CC's crossed the 1 year mark since I opened them. I should have another one reporting it's 1 year anniversary on the next report. Other than that, I can't think of anything else material enough to impact my scores. I'm currently in a gardening mode, so there's nothing pressing as far as new accounts are concerned. Just keeping my spending in check, aging my accounts and requesting a CL increase here and there.

@joeyv1985 if that is your youngest Revolver reaching one year, that will result in Scorecard reassignment on 8/9, probably giving you some points. I don't know what effect it will have on the resiliency score, but it will be interesting to find out, so that will be mixed in with the loan closing, so it will be hard to differentiate since it will be conflated, unfortunately.

nevertheless will look forward to your report, there's no telling what we may be able to learn!

Hello Birdman,

My auto loan finally reported paid in full and my Fico 8's, as expected, took a hit of anywhere between 8-19pts. Bummer. Howevever, the scores are still in the 770-780 range, so I'm not too worried. Any idea, how long before my scores start moving up from this event? Mortgate is still open and my credit utilization remains below 2%. My CU was roughly in that area when my auto loan reported.

@joeyv1985 what is your mortgage B/L at? That's interesting, depending on the mortgage B/L. Well from my viewpoint, you were receiving extra points, bonus points if you will, for having your only non-mortgage loan in optimal utilization range. You won't get those points again until you're in that scenario again. I am assuming that was your only non-mortgage loan and that you only have one mortgage?

but your scores are great and will continue to increase with age anyway, so they will still increase, it just won't be from that particular reason.

what effect did it have on the resiliency score?

Hello Birdman,

Couple of things, my resiliency score doesn't report until 3/13, so when that happens, I'll let you know. As far as my mortgage is concerned, I took out the loan in May of 2019, so I've barely made a dent on the balance. I've probably paid about 4% of the balance. However, since the car loan is out of the way and I have no major bills to pay other than utilities and revolving credit, I plan on paying chunks of my mortgage balance as the year progresses. Hope this helps.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: EQ FICO Resilience Index Leaderboard - February 6, 2021

This is interesting. I know the two are not tied to each other, but I wish my FICO scores would increase as my resiliency score decreases.

@Anonymous

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: EQ FICO Resilience Index Leaderboard - February 6, 2021

@juggernaut9 wrote:This is interesting. I know the two are not tied to each other, but I wish my FICO scores would increase as my resiliency score decreases.

@Anonymous

Nice!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: EQ FICO Resilience Index Leaderboard - February 6, 2021

@Anonymous

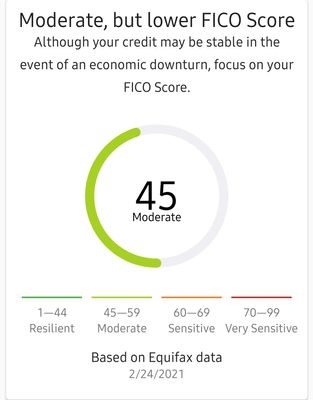

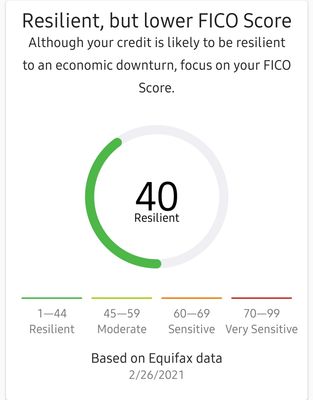

For Feb 3B pull, I am back down to 45, *almost* resilient again lol

My 2 flags are "high installment loan balances" and "missed payments"

For SO, he is down to 40, with no flags this time. I am convinced they do not give flags, just like with 800+ scores they do not give negative reason codes (correct me if I am wrong). Because as soon as me or my SO are outside the "resilient" range, we get 2 flags, with no changes in installment loan balances or number of missed payments. In fact, now both have gone *down* significantly (number of missed payments and installment loan balances - for the time being lol)!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: EQ FICO Resilience Index Leaderboard - February 6, 2021

@juggernaut9 wrote:This is interesting. I know the two are not tied to each other, but I wish my FICO scores would increase as my resiliency score decreases.

@Anonymous

Looks like we might have a new leader! You are certainly resilient lol.

NFCU Cash Rewards 16K CL

Citi Custom Cash 7.5K CL

AODFCU Visa Sig 5K CL

Discover IT 2.5K CL

Capital One QS 3600 CL

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: EQ FICO Resilience Index Leaderboard - February 6, 2021

@Anonymous wrote:@Anonymous

For Feb 3B pull, I am back down to 45, *almost* resilient again lol

My 2 flags are "high installment loan balances" and "missed payments"

For SO, he is down to 40, with no flags this time. I am convinced they do not give flags, just like with 800+ scores they do not give negative reason codes (correct me if I am wrong). Because as soon as me or my SO are outside the "resilient" range, we get 2 flags, with no changes in installment loan balances or number of missed payments. In fact, now both have gone *down* significantly (number of missed payments and installment loan balances - for the time being lol)!

Me: 2/2021

SO: 2/2021

You and SO are looking really good!

I'm trying to get to the 40's! Lol

NFCU Cash Rewards 16K CL

Citi Custom Cash 7.5K CL

AODFCU Visa Sig 5K CL

Discover IT 2.5K CL

Capital One QS 3600 CL

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

EQ FICO Resilience Index Leaderboard - March 3, 2021

EQ FICO Resilience Index

Leaderboard as of March 3, 2021 |

Breaking News |

New Gold Key Winner! @juggernaut9 with a 32 ! 2nd time winning the Gold Key!

|

General Information about this score |

This Resilience Index score is included with a myFICO subscription. It will be shown on the dashboard.

And as always - lower rating (higher number) doesn't mean that person has a bad credit profile in any way. This score is really sensitive to balance amounts and it doesn't matter if you have a 600 or 850. |

RECORD HOLDER |

| EQ FICO RESILIENCE INDEX |

Adkins | 80 |

MEMBER NAME | SCORES | RED | HIGH | DATE |

RESILIENT [1-44] | ||||

GOLD KEY WINNERS |

| |||

juggernaut9* | 32 | 0 | 32 | |

mrsgrits' DH | 32 | 0 | 32 | |

| LP007 | 34 | 0 | 34 | |

| CreditBones | 37 | 0 | 37 | |

Lulah* | 37 | 0 | 37 | |

| USDOD | 37 | 0 | 37 | |

THE BAT |

| |||

tacpoly [EQ 8 850] | 39 | 0 | 39 | |

JWD1980* | 40 | 0 | 40 | |

| LaHossBoss SO | 40 | 0 | 40 | |

Throckmorton's Wife* | 40 | ? | 40 | |

| Tonya-E | 43 | 0 | 43 | |

MODERATE [45-59] | ||||

| FireMedic1 | 45 | 2 | 45 | |

| LaHossBoss* | 45 | 2 | 41 | |

| PicoFico | 45 | 2 | 45 | |

| Bankrupt2019 | 46 | 2 | 46 | |

| EW800 | 46 | 2 | 46 | |

| sjt | 47 | 2 | 47 | |

| Thomas_Thumb | 48 | 2 | 48 | |

| jasonbourne84 | 49 | 2 | 49 | |

| Trudy | 49 | 2 | 49 | |

Chris865 [OP] | 52 | 2 | 52 | |

| angelwingz | 53 | 2 | 53 | |

| KLEXH25 | 53 | 2 | 53 | |

| Mr_Mojo_Risin | 54 | ? | 54 | |

| Credit4Growth | 54 | 2 | 54 | |

| Face_Value | 54 | 2 | 54 | |

| CassieCard | 56 | 2 | 53 | |

| CreditAggie | 56 | 2 | 56 | |

| Flyingifr | 56 | 2 | 56 | |

| joeyv1985 | 56 | 2 | 56 | |

| kilroy8 | 56 | ? | 56 | |

| TMB_ | 56 | 2 | 56 | |

| mrsgrits | 57 | 2 | 57 | |

| mgood | 58 | 2 | 55 | |

| sarge12 | 59 | 2 | 59 | |

SENSITIVE [60-69] | ||||

| coreysw12 | 61 | 2 | 60 | |

| CreditObsessedinFL | 61 | 2 | 56 | |

| NRB525 | 63 | 2 | 63 | |

| Remedios | 63 | 2 | 63 | |

Dogbert* | 64 | 2 | 64 | |

| OmarGB9 | 64 | 2 | 64 | |

| Birdman7 | 65 | 2 | 60 | |

| Revelate | 65 | 2 | 63 | |

| RehabbingANDBlabbing | 66 | 2 | 66 | |

| thornback | 66 | 2 | 66 | |

| Dumbee | 68 | 2 | 56 | |

| jayk1 | 69 | ? | 69 | |

VERY SENSITIVE [70-99] | ||||

K-in-Boston* | 70 | 3 | 70 | |

CreditCuriosity* | 72 | 3 | 72 | |

Dmessina666* | 72 | 3 | 72 | |

GApeachy | 72 | 3 | 72 | |

jasonbourne84's DH | 72 | 3 | 72 | |

Kenro* | 72 | ? | 72 | |

Brian_Earl_Spilner* | 78 | 3 | 72 | |

GOLDEN CHALICE WINNER AND |

|

| ||

Adkins | 80 | 3 | 80 |

* FORMER AWARD WINNERS * |

MEMBER NAME | AWARD | TROPHY | FOR | DATE |

Brian_Earl_Spilner | GOLDEN CHALICE |

| Lowest rating: 76 | |

Brian_Earl_Spilner | GOLDEN SWORD |

| Record Low Rating: 76 | |

CreditCuriosity | GOLDEN CHALICE |

| Lowest rating: 75 | |

Dmessina666 | GOLDEN CHALICE |

| Lowest rating: 78 | |

Dmessina666 | GOLDEN SWORD |

| Record Low Rating: 78 | |

Dogbert | GOLDEN CHALICE |

| Lowest rating: 76 | |

Dogbert | GOLDEN SWORD |

| Record Low Rating: 76 | |

juggernaut9 | GOLD KEY |

| Highest Rating: 37 | |

JWD1980 | GOLD KEY |

| Highest Rating: 40 | |

K-in-Boston | GOLDEN CHALICE |

| Lowest rating: 73 | |

Kenro | GOLDEN CHALICE |

| Lowest rating: 72 | |

Kenro | GOLDEN SWORD |

| Record Low Rating: 72 | |

LaHossBoss | GOLD KEY |

| Highest rating: 41 | |

Lulah | GOLD KEY |

| Highest Rating: 37 | |

Throckmorton's Wife | GOLD KEY |

| Highest Rating: 40 |

All awards are from this game: Adventure (1980) (Atari 2600) Level 3 play through

The Bat is awarded for best EQ 8 score with lowest Resilience Index score. The bat can fly away with any award - even a dragon!

Meet the creator of the Resilience Index.