- myFICO® Forums

- FICO Scoring and Other Credit Topics

- General Credit Topics

- EQ FICO Resilience Index Leaderboard - Thursday, A...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

FICO Score Stress Indicators/Indexes

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: EQ FICO Resilience Index Leaderboard - Sunday, April 4, 2021

@Anonymous wrote:

@iv wrote:The concrete numbers provided are for EQ 8 Auto...

Oh and nice work @iv , plugging that formula in and generating the chart! That's very, very helpful!

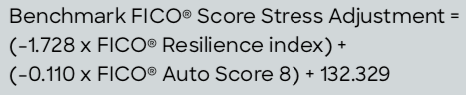

So... digging further into the "magic numbers" in that formula:

-0.110 x FICO Auto Score 8 is the easy one: that scales the 900 score range to a 1-99 range. (Or 27.5-99, with the floor at 250).

Which matches the range of the FRI score... (and you'll note that it's explict that the better your FICO 8 score, the more the penalty increases.)

-1.728 x FRI is less obvious (...although it appears to be -sqrt(e*log(3)), I'm not sure if that's meaningful, or accidental?)

But the combination of the two (without the magic fudge factor of 132.329) gives a range of -100.728 at the 1/900 ("best/best") end of the range, to -198.572 at the 99/250 ("worst/worst") end. Which is within rounding error of a 99-point spread, and likely part of the design.

With that in place for the best/best and worst/worst axis, the 1/250 ("best/worst") and 99/900 ("worst/best") axis ends up at -29.228 and -270.072 - which is a 2.4x wider spread. Probably also intentional - having a wider spread on the "mismatched" axis seems to make sense.

"Raw" offset ranges (without +132.329 factor):

| 250 | 900 | |

| 1 | -29.228 | -100.728 |

| 99 | -198.572 | -270.072 |

Now... those are all negative offsets (some fairly large!), and while they express the RANGE of variation FICO was aiming for, they don't hit the MAGNITUDE desired. Thus the +132.329 fudge factor - to adjust the "zero point" (where the offset formula has no effect). This adjusts the ranges so that a 44/500, a 38/600, a 32/700, a 25/800, and 19/900 has no net negative (or positive) effect.

The spread remains the same as the "raw" numbers, but now at the high (FICO 8 Auto) score end, you have about 1/5 with a positive offset, and 4/5 with a negative, while at the low end you have a 60/40 positive/negative split.

"Adjusted" offset ranges (with +132.329 factor):

| 250 | 900 | |

| 1 | 103.101 | 31.601 |

| 99 | -66.243 | -137.743 |

Based on all of that... anything worse than a 60 FRI is a negative across the board, regardless of score (with higher scores being penalized much more - the penalty gap between 250 and 900 is about 72 points). Meanwhile, any FRI better than 20 is a positive across the board (with lower scores getting boosted much more - same 72 point gap at the extremes). Between 20/900 and 60/250, the "zero point" for FRI follows a fairly smooth line every 15-20 points (see the chart in the prior post).

EQ9:847 TU9:847 EX9:839

EQ5:797 TU4:807 EX2:813 - 2021-06-06

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: EQ FICO Resilience Index Leaderboard - Sunday, April 4, 2021

@iv wrote:

@Anonymous wrote:

@iv wrote:The concrete numbers provided are for EQ 8 Auto...

Oh and nice work @iv , plugging that formula in and generating the chart! That's very, very helpful!

So... digging further into the "magic numbers" in that formula:

-0.110 x FICO Auto Score 8 is the easy one: that scales the 900 score range to a 1-99 range. (Or 27.5-99, with the floor at 250).

Which matches the range of the FRI score... (and you'll note that it's explict that the better your FICO 8 score, the more the penalty increases.)

-1.728 x FRI is less obvious (...although it appears to be -sqrt(e*log(3)), I'm not sure if that's meaningful, or accidental?)

But the combination of the two (without the magic fudge factor of 132.329) gives a range of -100.728 at the 1/900 ("best/best") end of the range, to -198.572 at the 99/250 ("worst/worst") end. Which is within rounding error of a 99-point spread, and likely part of the design.

With that in place for the best/best and worst/worst axis, the 1/250 ("best/worst") and 99/900 ("worst/best") axis ends up at -29.228 and -270.072 - which is a 2.4x wider spread. Probably also intentional - having a wider spread on the "mismatched" axis seems to make sense.

"Raw" offset ranges (without +132.329 factor):

250 900 1 -29.228 -100.728 99 -198.572 -270.072

Now... those are all negative offsets (some fairly large!), and while they express the RANGE of variation FICO was aiming for, they don't hit the MAGNITUDE desired. Thus the +132.329 fudge factor - to adjust the "zero point" (where the offset formula has no effect). This adjusts the ranges so that a 44/500, a 38/600, a 32/700, a 25/800, and 19/900 has no net negative (or positive) effect.

The spread remains the same as the "raw" numbers, but now at the high (FICO 8 Auto) score end, you have about 1/5 with a positive offset, and 4/5 with a negative, while at the low end you have a 60/40 positive/negative split.

"Adjusted" offset ranges (with +132.329 factor):

250 900 1 103.101 31.601 99 -66.243 -137.743

Based on all of that... anything worse than a 60 FRI is a negative across the board, regardless of score (with higher scores being penalized much more - the penalty gap between 250 and 900 is about 72 points). Meanwhile, any FRI better than 20 is a positive across the board (with lower scores getting boosted much more - same 72 point gap at the extremes). Between 20/900 and 60/250, the "zero point" for FRI follows a fairly smooth line every 15-20 points (see the chart in the prior post).

Really nice, @iv !

Now that I see the pattern in your chart combined with some sort of link to Euler's number, plus the scaling, I'm thinking there's a sigmoid function in all of this. I need to look at some plots in R.

They only gave us information about FICO Auto 8, so I can only speculate about the coefficients used for FICO 8 Classic. It's clear that a dividing line similar to the one you found will exist there.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: EQ FICO Resilience Index Leaderboard - Sunday, April 4, 2021

@Anonymous wrote:Now that I see the pattern in your chart combined with some sort of link to Euler's number, plus the scaling, I'm thinking there's a sigmoid function in all of this. I need to look at some plots in R.

Maybe? But I'm not sure about that - I haven't drawn any fancy graphs from this yet, but just eyeballing the numbers, it looks pretty linear...

@Anonymous wrote:They only gave us information about FICO Auto 8, so I can only speculate about the coefficients used for FICO 8 Classic. It's clear that a dividing line similar to the one you found will exist there.

Yup. If I had to speculate on what the Classic variation for FRI looks like, I'd go with:

(-1.728 x FRI) + (-0.11647 x EQ 8 Classic) + 127

...or something very close to that.

(Chart the resulting numbers against the 300-850 range, and you'll see why.)

Important note for anyone who isn't just here to play with the math: unlike the formula from the FICO document discussed earlier, the one here is purely speculative. Don't use it for anything other than having fun with the current gedankenexperiment.

On a related note: just had the new $50k loan show up on the reports - and the FRI change was... nada. zlitch. zero. Still "52: Moderate", with exactly the same red flags as before. Disappointing! I figured it would move at least a little bit. (8/9 Classic unchanged, mortgage and some industry options wiggled slightly. Boring!)

EQ9:847 TU9:847 EX9:839

EQ5:797 TU4:807 EX2:813 - 2021-06-06

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: EQ FICO Resilience Index Leaderboard - Sunday, April 4, 2021

I pulled my 3B yesterday. Same score. 🤷 Balances are down across the board, but not enough yet evidently.

Last HP 08-07-2023

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

EQ FICO Resilience Index Leaderboard - Thursday, April 8, 2021

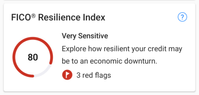

EQ FICO Resilience Index

Leaderboard as of Thursday, April 8, 2021 |

Breaking News |

@Adkins hangs on to the Golden Chalice and Golden Sword with a recently updated score of 80!

@CreditAggie to 57 with that excellent Citi Costco Visa card! @iv is back with a bang at 52, posting an excellent chart

|

General Information about this score |

This Resilience Index score is included with a myFICO subscription. It will be shown on the dashboard.

And as always - lower rating (higher number) doesn't mean that person has a bad credit profile in any way. This score is really sensitive to balance amounts and it doesn't matter if you have a 600 or 850. |

RECORD HOLDER |

| EQ FICO RESILIENCE INDEX |

Adkins | 80 |

MEMBER NAME | SCORES | RED | HIGH | DATE |

RESILIENT [1-44] | ||||

GOLD KEY WINNERS |

| |||

juggernaut9* | 32 | 0 | 32 | |

mrsgrits' DH | 32 | 0 | 32 | |

| LP007 | 34 | 0 | 34 | |

| CreditBones | 37 | 0 | 37 | |

Lulah* | 37 | 0 | 37 | |

| USDOD | 37 | 0 | 37 | |

THE BAT |

| |||

tacpoly [EQ 8 850] | 39 | 0 | 39 | |

JWD1980* | 40 | 0 | 40 | |

| LaHossBoss SO | 40 | 0 | 40 | |

Throckmorton's Wife* | 40 | ? | 40 | |

| Tonya-E | 43 | 0 | 43 | |

MODERATE [45-59] | ||||

| FiresOut | 45 | 2 | 45 | |

| LaHossBoss* | 45 | 2 | 41 | |

| PicoFico | 45 | 2 | 45 | |

| Bankrupt2019 | 46 | 2 | 46 | |

| EW800 | 46 | 2 | 46 | |

| sjt | 47 | 2 | 47 | |

| Thomas_Thumb | 48 | 2 | 48 | |

| jasonbourne84 | 49 | 2 | 49 | |

| nwa479 | 49 | 2 | 49 | |

| Trudy | 49 | 2 | 49 | |

| iv | 52 | 2 | 52 | |

| angelwingz | 53 | 2 | 53 | |

| CassieCard | 53 | 2 | 53 | |

| KLEXH25 | 53 | 2 | 53 | |

| Credit4Growth | 54 | 2 | 54 | |

| Face_Value | 54 | 2 | 54 | |

| Flyingifr | 56 | 2 | 56 | |

| kilroy8 | 56 | ? | 56 | |

| mgood | 56 | 2 | 55 | |

| TMB_ | 56 | 2 | 56 | |

| CreditAggie | 57 | 2 | 56 | |

| mrsgrits | 57 | 2 | 57 | |

| Mr_Mojo_Risin | 58 | 2 | 54 | |

| sarge12 | 58 | 2 | 58 | |

Chris865 [OP] | 59 | 2 | 52 | |

SENSITIVE [60-69] | ||||

| joeyv1985 | 60 | 2 | 56 | |

| coreysw12 | 61 | 2 | 60 | |

| CreditObsessedinFL | 61 | 2 | 56 | |

| NRB525 | 63 | 2 | 63 | |

| Remedios | 63 | 2 | 63 | |

Dogbert* | 64 | 2 | 64 | |

| OmarGB9 | 64 | 2 | 64 | |

| SecretAzure | 64 | 2 | 64 | |

| Birdman7 | 65 | 2 | 60 | |

| Revelate | 65 | 2 | 63 | |

| RehabbingANDBlabbing | 66 | 2 | 66 | |

| thornback | 66 | 2 | 66 | |

CreditCuriosity* | 68 | 3 | 68 | |

| Dumbee | 68 | 2 | 56 | |

| jayk1 | 69 | ? | 69 | |

VERY SENSITIVE [70-99] | ||||

K-in-Boston* | 70 | 3 | 70 | |

Dmessina666* | 72 | 3 | 72 | |

GApeachy | 72 | 3 | 72 | |

jasonbourne84's DH | 72 | 3 | 72 | |

Kenro* | 72 | ? | 72 | |

Brian_Earl_Spilner* | 78 | 3 | 72 | |

GOLDEN CHALICE WINNER AND |

|

| ||

Adkins | 80 | 3 | 80 |

* FORMER AWARD WINNERS * |

MEMBER NAME | AWARD | TROPHY | FOR | DATE |

Brian_Earl_Spilner | GOLDEN CHALICE |

| Lowest rating: 76 | |

Brian_Earl_Spilner | GOLDEN SWORD |

| Record Low Rating: 76 | |

CreditCuriosity | GOLDEN CHALICE |

| Lowest rating: 75 | |

Dmessina666 | GOLDEN CHALICE |

| Lowest rating: 78 | |

Dmessina666 | GOLDEN SWORD |

| Record Low Rating: 78 | |

Dogbert | GOLDEN CHALICE |

| Lowest rating: 76 | |

Dogbert | GOLDEN SWORD |

| Record Low Rating: 76 | |

juggernaut9 | GOLD KEY |

| Highest Rating: 37 | |

JWD1980 | GOLD KEY |

| Highest Rating: 40 | |

K-in-Boston | GOLDEN CHALICE |

| Lowest rating: 73 | |

Kenro | GOLDEN CHALICE |

| Lowest rating: 72 | |

Kenro | GOLDEN SWORD |

| Record Low Rating: 72 | |

LaHossBoss | GOLD KEY |

| Highest rating: 41 | |

Lulah | GOLD KEY |

| Highest Rating: 37 | |

Throckmorton's Wife | GOLD KEY |

| Highest Rating: 40 |

All awards are from this game: Adventure (1980) (Atari 2600) Level 3 play through

The Bat is awarded for best EQ 8 score with lowest Resilience Index score. The bat can fly away with any award - even a dragon!

Meet the creator of the Resilience Index.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: EQ FICO Resilience Index Leaderboard - Thursday, April 8, 2021

Slight change again this month. No major changes, just paying down SL.

Take the myFICO Fitness Challenge

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: EQ FICO Resilience Index Leaderboard - Thursday, April 8, 2021

@Tonya-E wrote:Slight change again this month. No major changes, just paying down SL.

42 is pretty solid! I'm trying to make my way there, keep fluctuating between 54-58. Pesky score! 😅

NFCU Cash Rewards 16K CL

Citi Custom Cash 7.5K CL

AODFCU Visa Sig 5K CL

Discover IT 2.5K CL

Capital One QS 3600 CL

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Score Stress Indicators/Indexes

I think Average Age of Revolving Accounts (AAoRA, yeah it's a thing alright) helped me this month with this score, because I can't explain it any other way. Unless my total credit limit being raised by $9,500 this month had something to do with it. Who knows how they segment this thing.

At 4-of-4 with $1807 in aggregate balance (6%), I had an EQ FRI of 56.

This time I'm at 4-of-4 with $1999 in aggregate balance (5%), and I get a EQ FRI of 54?(AAoRA = 1yr9mo, nothing else is a multiple of 3 either.)