- myFICO® Forums

- FICO Scoring and Other Credit Topics

- General Credit Topics

- Re: Family Doesn't Understand My Relationship With...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Family Doesn't Understand My Relationship With Credit

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- « Previous

-

- 1

- 2

- Next »

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Family Doesn't Understand My Relationship With Credit

I knew of some of the benefits such as miles and purchase protection, but it never dawned on me to charge something and then pay it off with the cash I would’ve used to buy it in order to increase rewards, for example. I’ve been doing that with my small CapOne QS lately but it’ll be a lot more effective once my Discover IT with a better line arrives today or tomorrow. Looking forward to that cash back match!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Family Doesn't Understand My Relationship With Credit

@wasCB14 wrote:

@Anonymous wrote:I currently have 7 credit cards, and live at home. My mom keeps telling me "I am going to wreck my credit for having so many cards" and "it is irrepsonsible to have more than a couple credit cards". I keep trying to explain that havings lots of cards is a good thing if you are responsible but she and no-one else seem to get it. Are we in a bubble on this forum, or are most people just not very credit savy?

I'm not an expert on FICO scoring, but is the value of a 5th, 6th, 7th revolving account significant if utilization is low?

I've not had family worried I would wreck my credit, but I have had family wonder how I keep track of it all.

Same here... I use a spreadsheet

Licensed Senior Mortgage Loan Officer in the states of Arizona & California

Specializing in VA, FHA, USDA & Conventional loans. My company is also licensed in 12 states, Arizona, Colorado, Nevada, California, Oregon, Washington, Utah,

Alaska, New Mexico, Texas, Illinois and Florida

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Family Doesn't Understand My Relationship With Credit

I've got quite a few friends who are scared of credit or assume what 'too many' cards can do to you. I've showeed a few friends my scores & they're amazed...most have helped me help them start rebuilding responsibly. Credit has an overwhelmingly negative social stigma for those who have no understanding of credit basics.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Family Doesn't Understand My Relationship With Credit

@wasCB14 wrote:

@Anonymous wrote:I currently have 7 credit cards, and live at home. My mom keeps telling me "I am going to wreck my credit for having so many cards" and "it is irrepsonsible to have more than a couple credit cards". I keep trying to explain that havings lots of cards is a good thing if you are responsible but she and no-one else seem to get it. Are we in a bubble on this forum, or are most people just not very credit savy?

I'm not an expert on FICO scoring, but is the value of a 5th, 6th, 7th revolving account significant if utilization is low?

I've not had family worried I would wreck my credit, but I have had family wonder how I keep track of it all.

There's a scoring advantage in being able to have (when you need it) one card showing a positive balance with many open accounts showing a $0 balance. The easiest way to have accounts with a zero balance that you can keep open for decades is credit cards. By "many" we don't mean dozens. Five total is fine in that sense. (Three may be enough.) And the phrase "when you need it" is important. Implementing AZEO (All Zero Except One) doesn't help you build credit over time -- it's just a nice trick to implement in the 40 days before an important credit app (like a car loan, mortgage, etc.).

There may be an advantage to more than five in making your profile thicker (which just means more accounts). A long term goal for anyone should be to eventually acquire seven open accounts and ten accounts total (open and closed together). A person with exactly four accounts (3 cards and one loan) would take a small hit compared with someone with ten because his profile was too "thin." And fewer than four accounts becomes more of a problem. (4 is better than 3 is better than 2 is better than only 1. A profile with only 1-2 accounts would be a significant scoring problem.)

More accounts in a profile also enables you to add more new accounts without it dinging your score -- less AAoA impact and a smaller percentage of your accounts being "new."

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Family Doesn't Understand My Relationship With Credit

The number of cards in and of itself does not impact the FICO score. The credit history of each or your credit acounts and how long you have had them is a different story. Also the credit limits in and of themselves has no impact on your score but your credit utilization does impact the FICO score. Credit limits to the extent that they impact your credit utilization is a part of the FICO score. I would suggest you stop apping for new credit for a while (at least a year). Remember apply only for the credit you need and not want.

Discover 09/90 19,000, JCPenney 10/2008 4,700 US Bank Cash 12,000 Citibank Custom Cash 5/2015 11,100 State Dept. FCU 15,000 06/2023 , 02/2024 Redstone FCU Signature VISA 10,000 Banking: Ally Bank Credit Unions: Lafayette FCU Fortera FCU State Department FCU Pelican CU

Pelican State CU Redstone FCU

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Family Doesn't Understand My Relationship With Credit

@AndySoCal wrote:The number of cards in and of itself does not impact the FICO score. The credit history of each or your credit acounts and how long you have had them is a different story. Also the credit limits in and of themselves has no impact on your score but your credit utilization does impact the FICO score. Credit limits to the extent that they impact your credit utilization is a part of the FICO score. I would suggest you stop apping for new credit for a while (at least a year). Remember apply only for the credit you need and not want.

Actually # of cards can impact score. Score potential is held back if the profile has to few revolving accounts and/or there are too few accounts with recent payment information.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Family Doesn't Understand My Relationship With Credit

As long as you understand using CC on basic everyday purchases.. bills, groceries, car payments - or if you need a toaster. Use them like a debit card. Don't buy a computer that's more than the budget you have planned just becuase you have a CC, and PIF.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Family Doesn't Understand My Relationship With Credit

@thomas_thumb

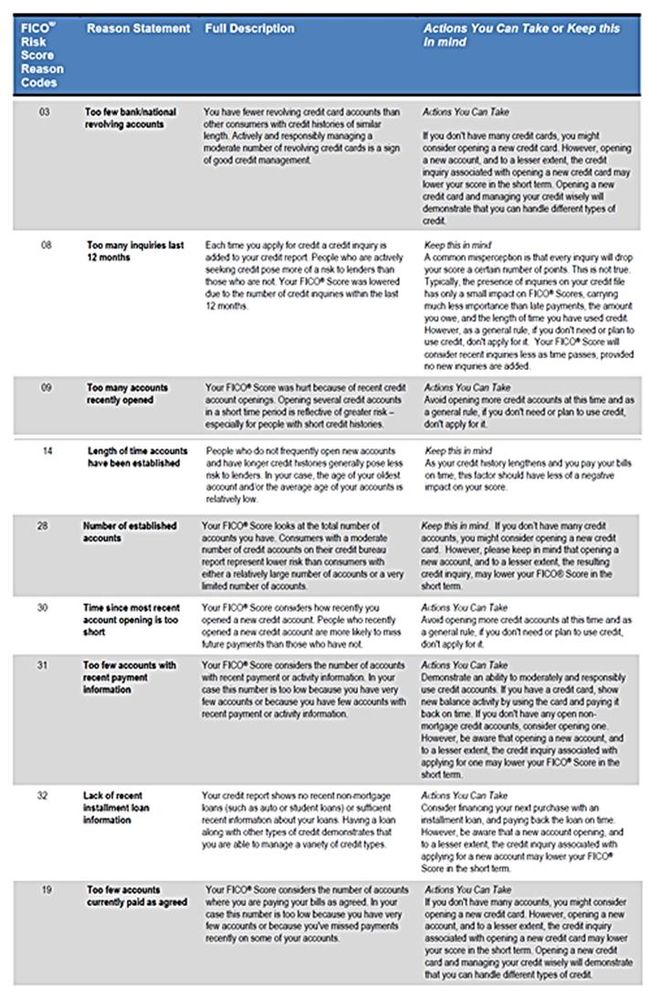

If you are referring to score reason 03 please read the what you can do for this reason. I get the same reason but for installment accounts because I do not have any.

Discover 09/90 19,000, JCPenney 10/2008 4,700 US Bank Cash 12,000 Citibank Custom Cash 5/2015 11,100 State Dept. FCU 15,000 06/2023 , 02/2024 Redstone FCU Signature VISA 10,000 Banking: Ally Bank Credit Unions: Lafayette FCU Fortera FCU State Department FCU Pelican CU

Pelican State CU Redstone FCU